IonQ CRO Alameddine Rima sells $4.6m in shares

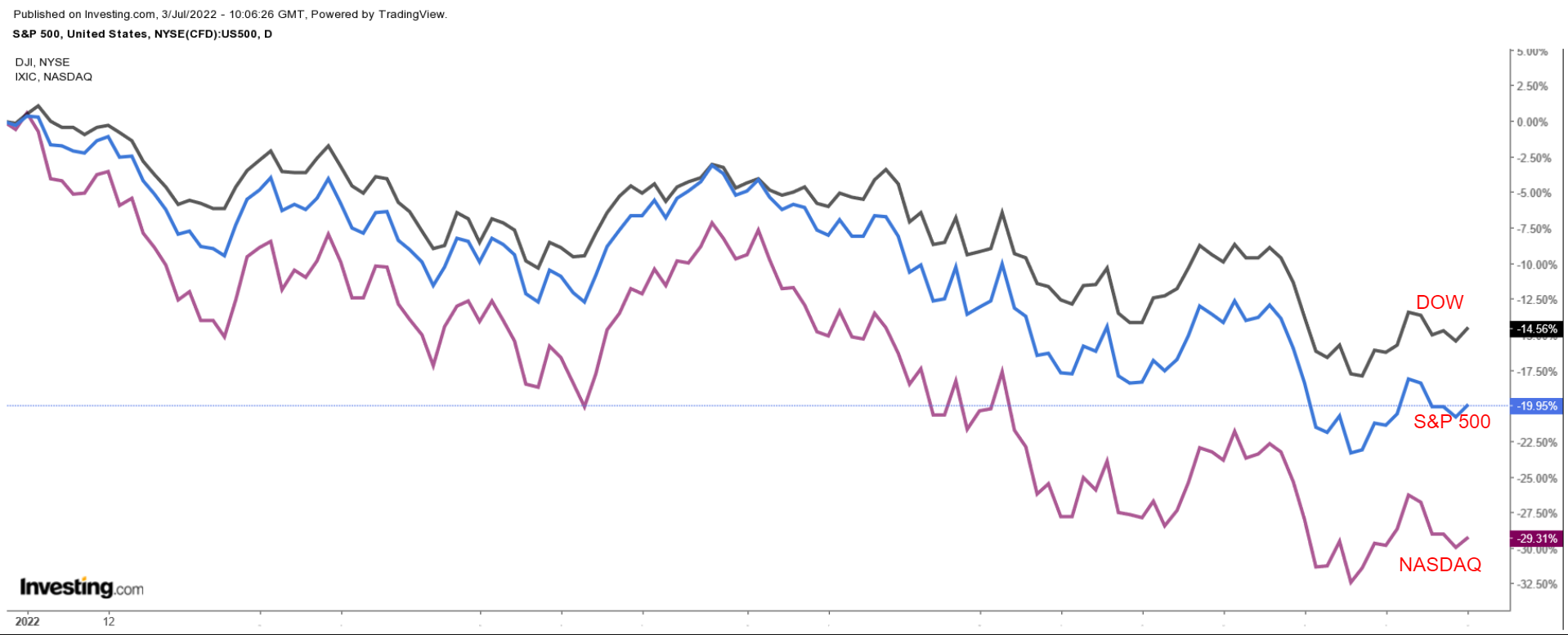

- Uncertainty hovers over the markets as the second half kicks off in earnest.

- Occidental Petroleum got a boost from another Warren Buffett buy.

- Carnival Cruises is facing increasing pressure as the travel rebound slows

- If you’re interested in upgrading your search for new investing ideas, check out InvestingPro+

Stocks on Wall Street edged higher on Friday, but the major U.S. indices still suffered their fourth losing week in five amid mounting fears of a recession.

The blue-chip Dow Jones Industrial Average fell 1.3% for the week, the benchmark S&P 500 declined 2.2%, while the technology-heavy Nasdaq Composite sank 4.1%.

The big event for markets in the holiday-shortened week ahead will be Friday’s U.S. employment report, which is expected to show solid job gains but a slowing from May’s strong growth.

U.S. stock markets will be closed on Monday for the Fourth of July Independence Day holiday.

The four-day week ahead will also feature the release of the minutes from the Federal Reserve’s most recent policy meeting, due on Wednesday.

Regardless of which direction the market goes, below we highlight one stock likely to be in demand and another which could see further downside.

Remember though, our timeframe is just for the upcoming week.

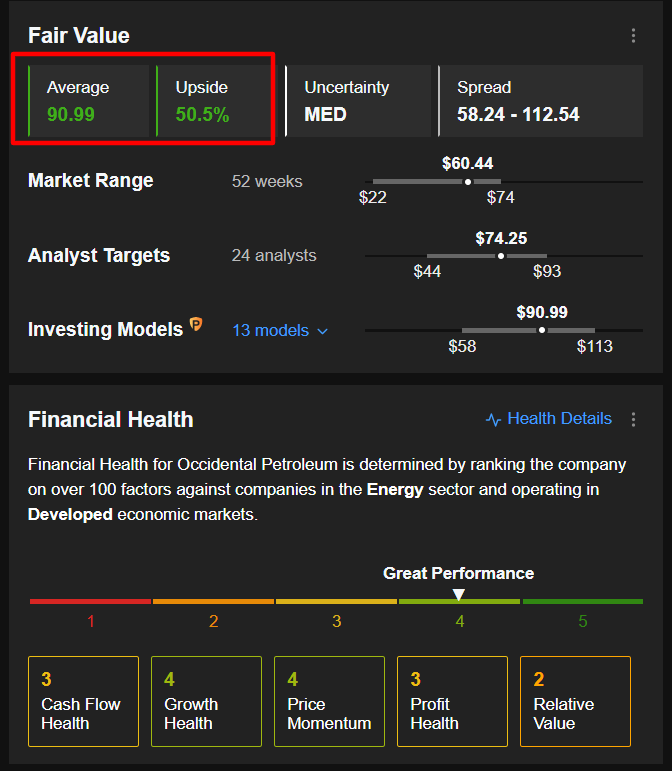

Stock To Buy: Occidental Petroleum

Shares of Occidental Petroleum (NYSE:OXY), which have enjoyed one of their best starts to a year in history, could see further gains in the week ahead, following promising news that Warren Buffett’s Berkshire Hathaway (NYSE:BRKa) has amassed a significant stake in the thriving energy company.

According to a Friday night filing with the U.S. Securities and Exchange Commission, Berkshire said it purchased 9.9 million shares of Occidental, which it bought between June 29 and July 1, for roughly $582 million.

Berkshire is OXY's largest shareholder with 163.4 million shares worth about $9.9 billion - equaling a 17.4% stake in the oil-and-gas producer.

The Omaha, Nebraska-based conglomerate also owns warrants to buy another 83.9 million Occidental shares for $5 billion.

Buffett’s large position has prompted speculation that Berkshire might eventually acquire all of Occidental.

OXY stock closed Friday’s session at $60.44, not far from a recent 52-week peak of $74.04 touched in late May, which was the highest level since November 2018.

At current valuations, the Houston, Texas-based energy firm - which has outperformed other notable names in the booming sector, such as ExxonMobil (NYSE:XOM), Chevron (NYSE:CVX), ConocoPhillips (NYSE:COP), EOG Resources (NYSE:EOG), and Pioneer Natural Resources (NYSE:PXD) - has a market cap of $56.6 billion.

Despite the broader market slump, OXY’s stock has been one of the year’s top performers, soaring by a whopping 108% in 2022 thanks to a potent combination of surging energy prices and improving energy market fundamentals.

Investors have also been encouraged by Occidental’s ongoing effort to reduce its debt and return more cash to shareholders in the form of higher dividend payouts and share buybacks.

Not surprisingly, the quantitative models in InvestingPro point to roughly 50% upside in OXY stock over the next 12 months, bringing it closer to its fair value of $90.99/share.

Stock To Dump: Carnival

Carnival (NYSE:CCL), which has seen its shares rapidly collapse to a series of new 52-week lows in recent sessions, is forecast to suffer another challenging week amid the ongoing impact of several headwinds plaguing the struggling cruise line operator.

CCL stock sank to $8.10 on Thursday to reach its lowest level since April 2020, when the Covid-19 health crisis kicked into high gear and led to a total shutdown of the global tourism industry.

Shares staged a mild rebound on Friday to close at $8.82, earning the Doral, Florida-based cruise giant a market cap of $9.9 billion.

Year-to-date, Carnival’s stock has lost more than half its value, slumping by an astonishing 56% in 2022 to significantly underperform the broader market.

Even more alarming, shares are 72% below their post-pandemic peak of $31.52 touched in June 2021. Before the pandemic hit, CCL was trading at around $50 in January 2020.

Carnival - and other once-high-flying reopening plays such as airlines and hotels, which rallied in tandem last year - has seen its recovery falter as investors fret that a potential recession could curb consumer demand for cruises.

Indeed, recent economic data has indicated that Americans are cutting back spending on discretionary items as they divert more spending into basic needs and services amid the current environment.

Another negative catalyst impacting the money-losing cruise line operator is its massive debt load - which has ballooned to a staggering $36 billion - and the growing risk that it might need to raise more capital to pay down its soaring interest expenses.

The company warned in its Q2 earnings report on June 24 that high fuel prices, elevated inflation, as well as ongoing Covid-related restrictions, were having a “material impact” on its business.

Taking that into consideration, shares of the world’s largest cruise liner look like a risky investment in the days ahead, given its gloomy outlook for weak demand and rising costs.

***

Looking to get up to speed on your next idea? With InvestingPro+ you can find

-

Any company’s financials for the last 10 years

-

Financial health scores for profitability, growth, and more

-

A fair value calculated from dozens of financial models

-

Quick comparison to the company’s peers

-

Fundamental and performance charts

And a lot more. Get all the key data fast so you can make an informed decision, with InvestingPro+. Learn More »