Street Calls of the Week

- Retail sales, Fed speakers, Q4 earnings will be in focus this week.

- Goldman Sachs is a buy with strong earnings on deck.

- Morgan Stanley is a sell amid weak profit and sales growth.

- Looking for more actionable trade ideas to navigate the current market volatility? Members of InvestingPro get exclusive ideas and guidance to navigate any climate. Learn More »

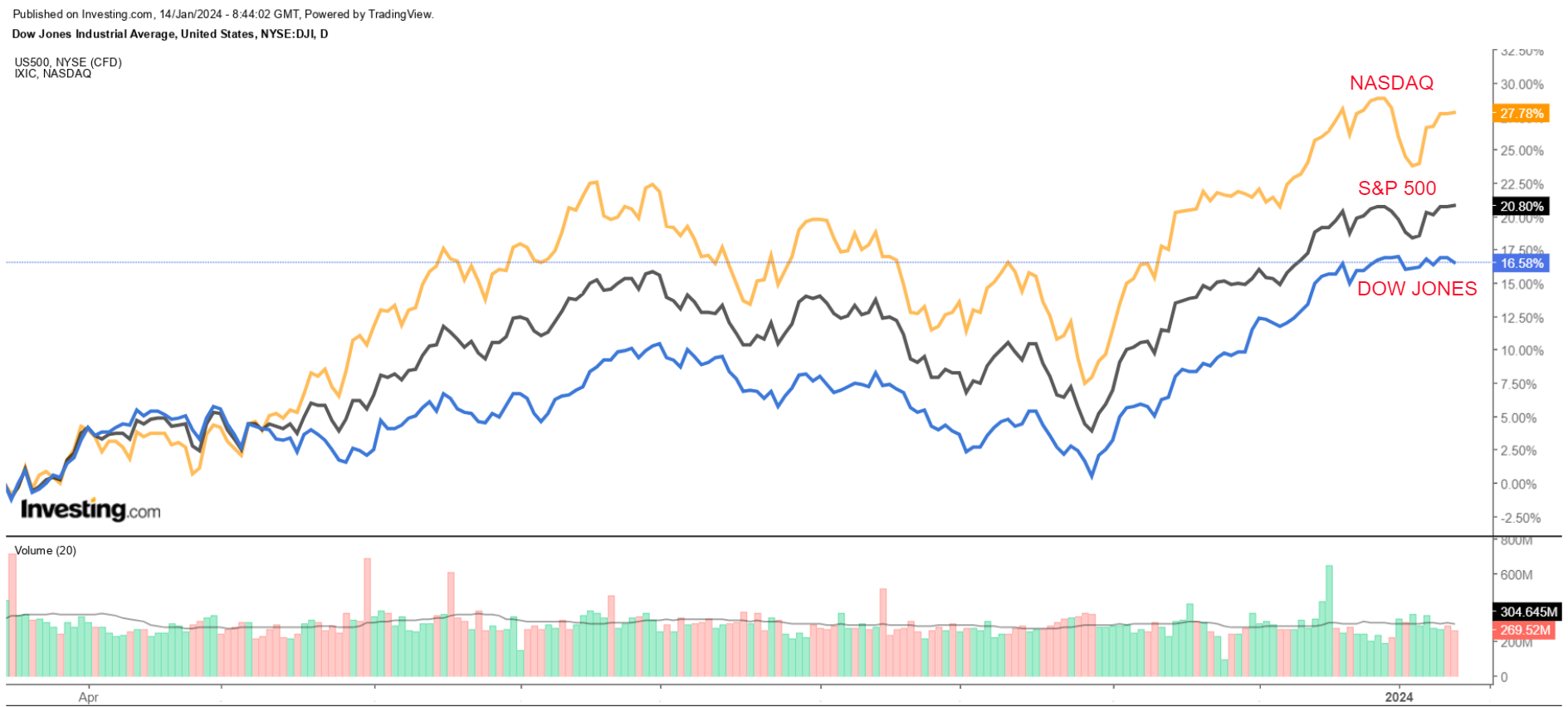

U.S. stocks ended little changed on Friday as investors digested the first batch of fourth-quarter earnings and continued to assess the Federal Reserve’s rate plans for the months ahead.

Despite Friday’s downbeat performance, all three major averages posted weekly gains. The blue-chip Dow Jones Industrial Average added 0.3%, the benchmark S&P 500 inched up 1.8%, and the tech-heavy Nasdaq Composite jumped 3.1%.

For the S&P 500, it was its best weekly performance since mid-December, while the Nasdaq posted its biggest weekly gain since early November.

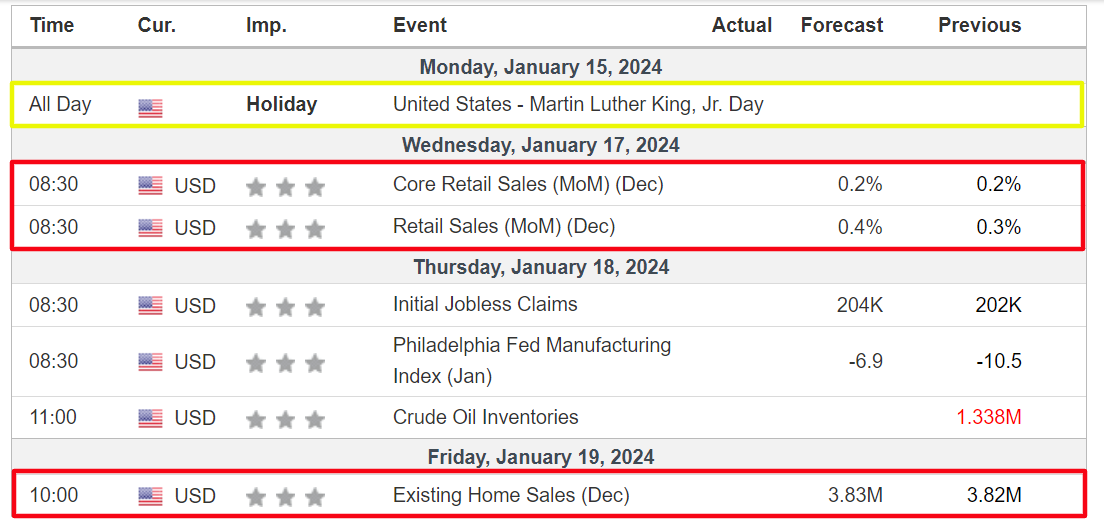

The holiday-shortened week ahead - which will see U.S. stock markets closed on Monday for the Martin Luther King Day holiday - is expected to be another busy one as Q4 earnings shift into high gear.

Reports this week are expected from notable names like Goldman Sachs, Morgan Stanley, PNC Financial (NYSE:PNC), Charles Schwab (NYSE:SCHW), and Interactive Brokers (NASDAQ:IBKR).

In addition to earnings, retail sales, housing data, and the Philadelphia Fed manufacturing survey are the highlights of the economic calendar.

Those releases will be accompanied by a heavy slate of Fed FOMC speakers, with the likes of district governors Christopher Waller and Michelle Bowman as well as New York Fed President John Williams set to make public appearances.

As of Sunday morning, financial markets see an 80% chance of a 25-basis point rate cut in March, according to the Investing.com Fed Monitor Tool.

Regardless of which direction the market goes, below I highlight one stock likely to be in demand and another which could see fresh downside.

Remember though, my timeframe is just for the week ahead, Monday, January 15 - Friday, January 19.

Stock To Buy: Goldman Sachs

I believe shares of Goldman Sachs will outperform this week as the Wall Street powerhouse’s latest financial results will likely top consensus forecasts thanks to an improvement in both its key investment banking unit and wealth management services business as well as a resurgence in deal-making and IPO activity.

Goldman’s financial results for the fourth quarter are due ahead of the opening bell on Tuesday at 7:30AM ET and are expected to show a return to profit growth following multiple quarters of declining earnings.

Market participants expect a possible implied move of around 3% in either direction in GS shares after the update drops. The stock declined 4% after its last earnings report in mid-October.

As seen above, Wall Street sees Goldman Sachs earning $4.27 per share in the final three months of 2023, increasing 28.6% from EPS of $3.32 in the year-ago period.

Meanwhile, revenue is anticipated to rise 3.4% year-over-year to $10.95 billion, reflecting solid growth in investment banking and fixed income trading revenue.

It should be noted that Goldman is seen as the most reliant on investment banking and trading revenue among its big bank peers on Wall Street.

Looking ahead, I believe Goldman Sachs CEO David Solomon will strike a somewhat upbeat tone for the months ahead as the financial services firm benefits from a recovery in global deal-making, merger activity, and IPO underwriting.

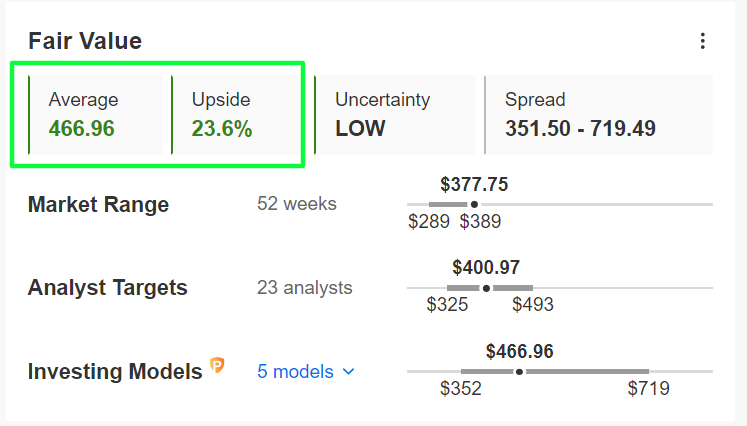

GS stock ended Friday’s session at $377.75, not far from a recent 52-week peak of $389.47 reached on January 5. At current levels, the New York-based investment banking behemoth has a valuation of $129.7 billion.

Shares are down 2.1% so far in 2024 after scoring an annual gain of 12.3% in 2023.

It its worth mentioning that Goldman Sachs appears to be extremely undervalued heading into its earnings print according to a number of valuation models on InvestingPro, which point to potential upside of 23.6% from the current market value to about $467/share.

Stock to Sell: Morgan Stanley

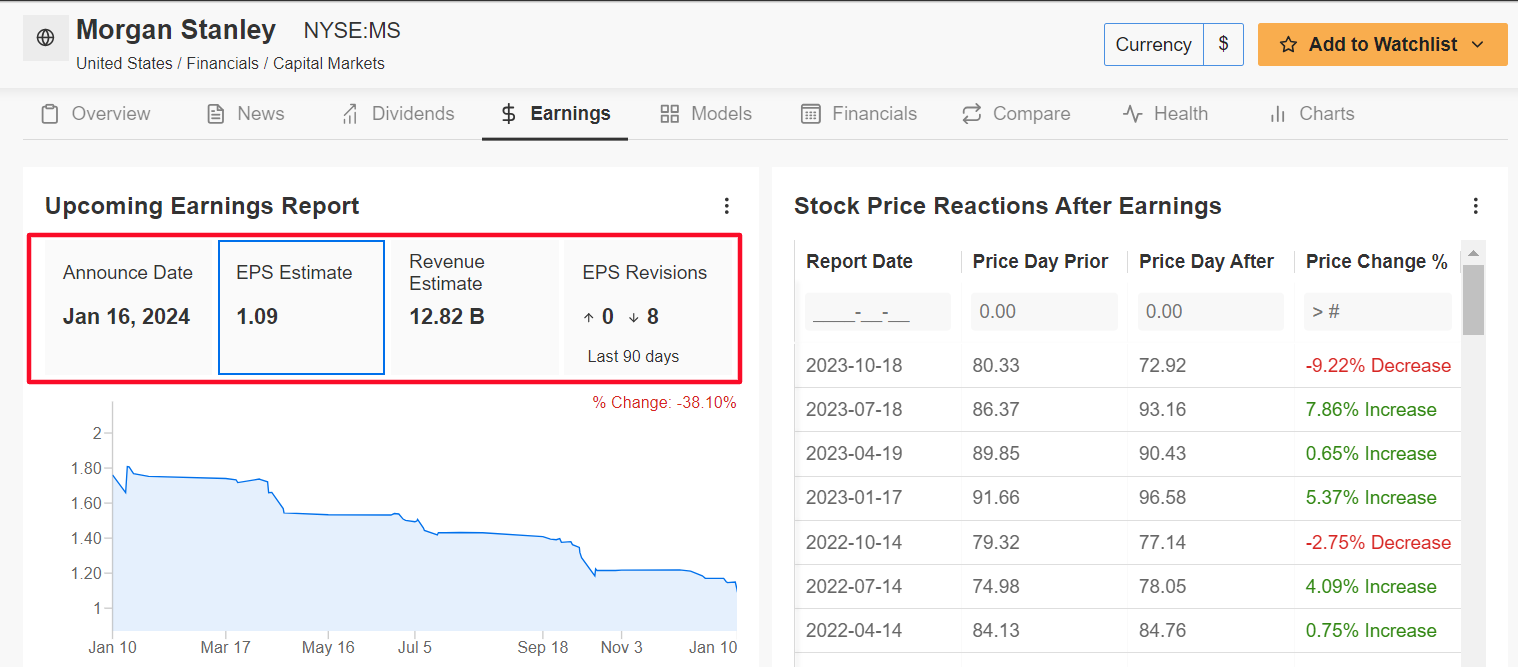

Staying in the financials sector, I foresee a weak performance for Morgan Stanley’s stock in the week ahead, as the investment banking giant’s fourth quarter earnings will probably underwhelm investors amid a weak performance across its key business segments.

Morgan Stanley’s Q4 update is scheduled to come out before the opening bell on Tuesday at 7:30AM ET.

As per the options market, traders are pricing in a move of about 4% in either direction for MS stock following the release. Shares suffered an earnings-day decline of 9.2% after the company’s third-quarter report came out in mid-October.

Underscoring several near-term headwinds Morgan Stanley faces, all eight analysts surveyed by InvestingPro cut their EPS estimates in the three months leading up to the print to reflect a drop of 38.1% from their initial profit forecasts.

Consensus calls for the New York-based financial services firm to report earnings per share of $1.09 for the fourth quarter, falling 16.8% from a profit of $1.31 a share in the year-ago period.

Meanwhile, revenue is forecast to inch up 1% year-over-year to $12.82 billion amid a disappointing performance in its all-important wealth management and investment banking divisions.

As such, I believe Morgan Stanley’s new CEO Ted Pick, who replaced outgoing chief James Gorman earlier this month, will show caution about forecasting net income growth for the coming months as the bank struggles amid a mixed business environment.

MS stock closed at $89.70 on Friday, earning the Wall Street giant a market cap of $147.2 billion.

Shares have gotten off to a downbeat start to the new year, falling 3.8% in the first two weeks of 2024 after ending 2023 with a gain of 9.7%.

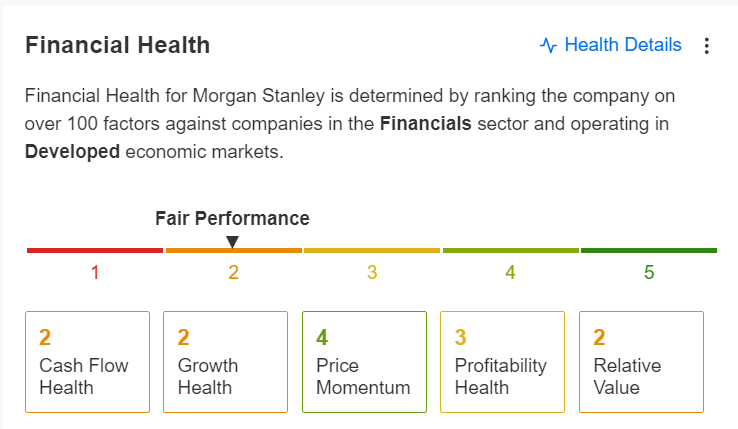

It should be noted that Morgan Stanley currently has a below average InvestingPro ‘Financial Health’ score of 2 out of 5 due to concerns over growth prospects, and free cash flow.

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. As with any investment, it's crucial to research extensively before making any decisions.

InvestingPro empowers investors to make informed decisions by providing a comprehensive analysis of undervalued stocks with the potential for significant upside in the market.

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR S&P 500 ETF (SPY), and the Invesco QQQ Trust ETF (QQQ). I am also long on the Technology Select Sector SPDR ETF (NYSE:XLK).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.