China’s Xi speaks with Trump by phone, discusses Taiwan and bilateral ties

A chart-driven look at what’s going on with Gold (+Silver +Mining Stocks)

Learnings and conclusions from this session:

-

Gold has peaked short-term, but remains in an uptrend.

-

Key tailwinds are still in force (e.g. central bank buying, (geo)politics).

-

Yet valuations are getting extreme expensive, sentiment consensus bullish.

-

Silver looks to be better placed given relative value vs gold, macro tailwinds.

-

Meanwhile miners see fat profits (but also rich valuations).

Overall, while there are significant tailwinds still in play, strong technicals, and historical analogs suggesting room-to-run —with gold valuations stretched, price peaking in the short-term, and consensus bullish sentiment, it’s more of a neutral outlook vs clearly bullish back at the start of the year. Silver looks better placed, while miners see high profits but also high valuations.

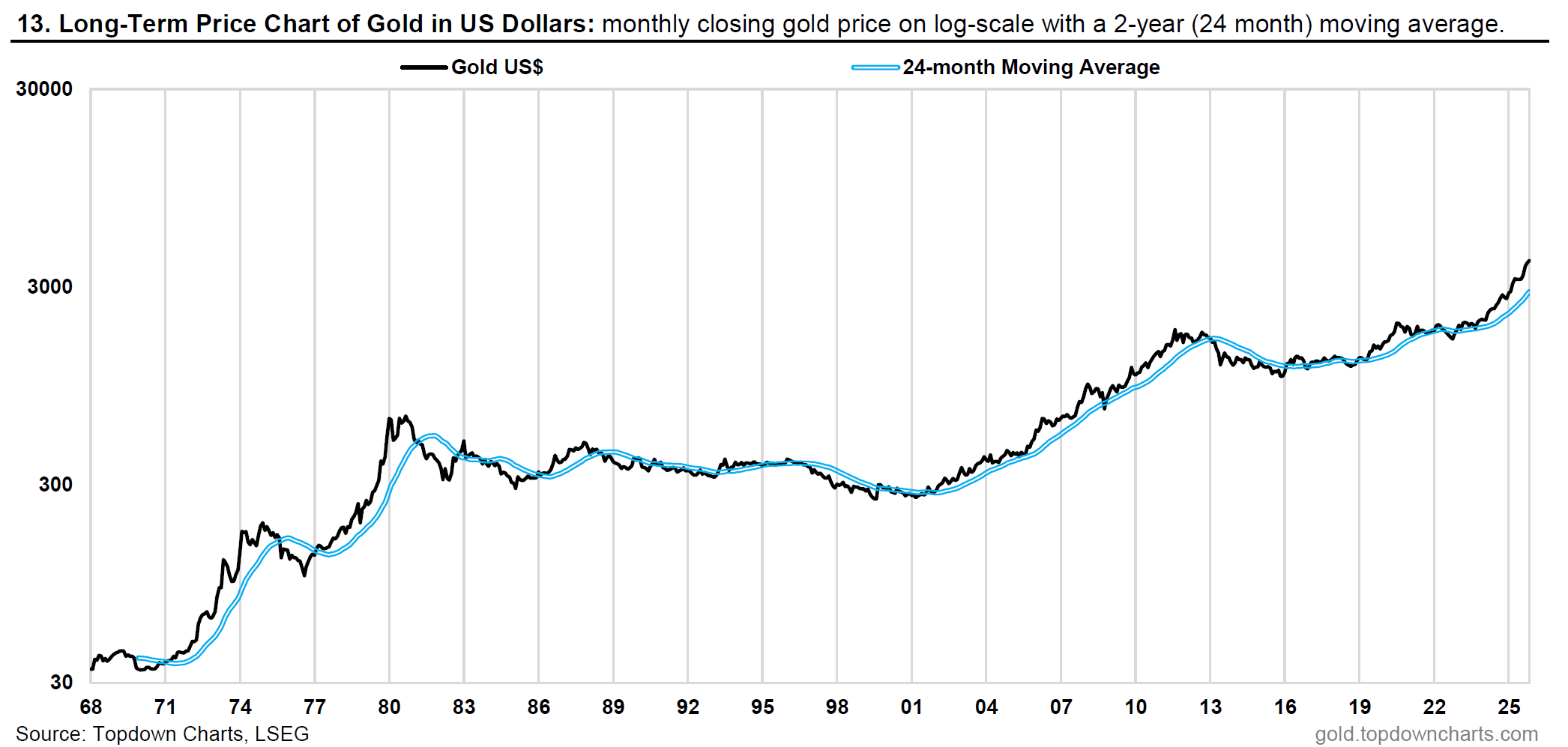

1. Gold Price in Perspective

On the daily charts gold peaked about a month ago and has been in consolidation mode since. But zooming out to the long-term monthly chart, a couple of things standout.

First, it’s clearly still in an uptrend (price above moving average, moving average upward sloping). Second, if you look at the early-70’s + late-70’s + early-00’s big breakouts, it still looks kind of “early” in the process.

Source: Monthly Gold Market Chartbook

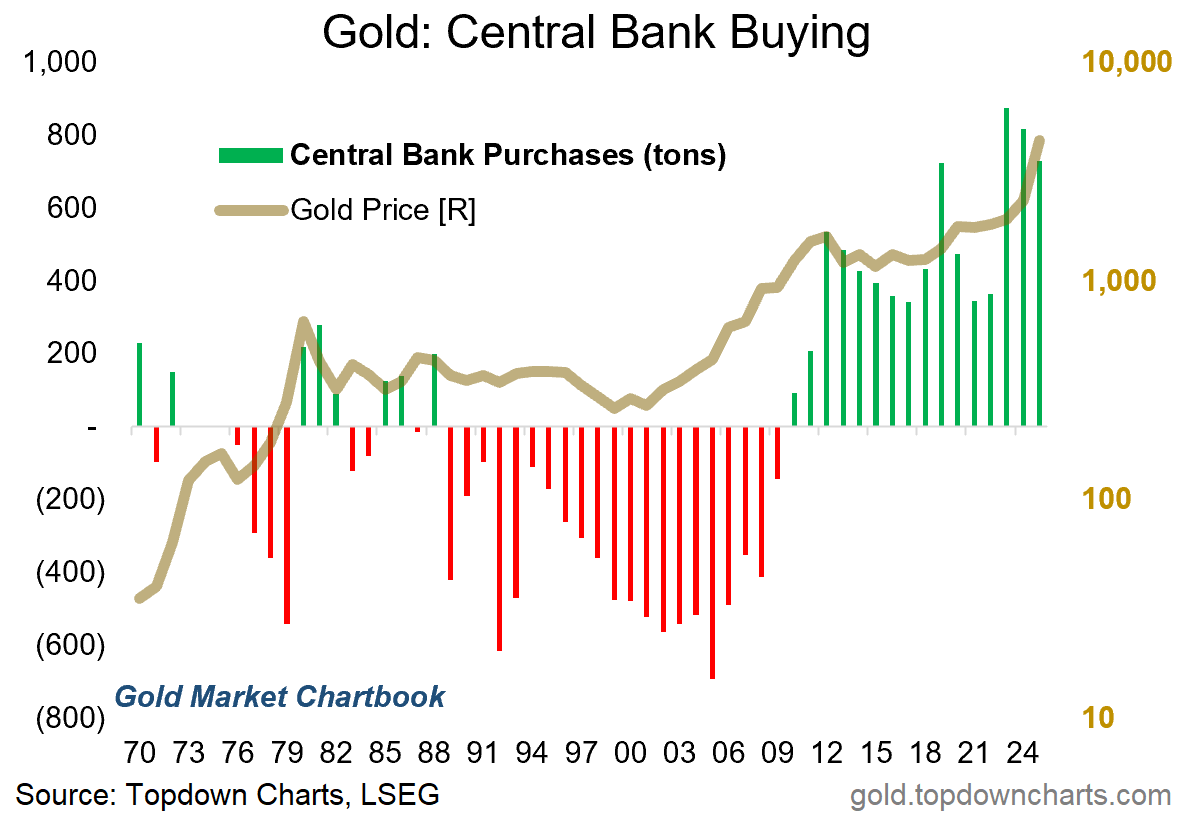

2. The Great Bank Buy-up

Meanwhile, a lot of the drivers of the current bull market in gold still seem to be in place. We’re still seeing significant central bank buying (and word is that the actual numbers are higher than that reported), geopolitics is also still an issue (the precautionary reserves diversification aspect is unlikely to abate any time soon, and a number of hot spots are liable to flare up at any moment).

The other aspect is political risk remains an issue in the USA (+USD heading into bear market mode) and the fiscal situation is not at all inspiring. Add to that the prospect of inflation resurgence… or even the opposite; a deflation scare prompting more QE and policy easing, and there’s a litany of macro narratives that one can reach to in espousing a bullish gold outlook.

Source: GoldNuggets Digest — The Gold Bull Market

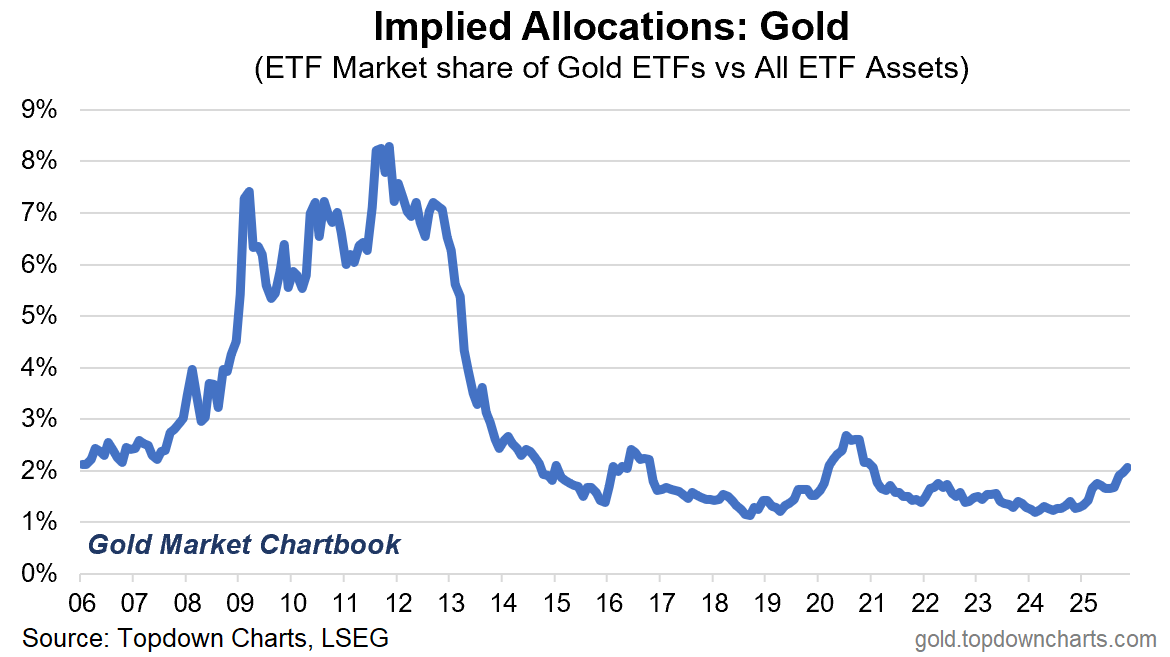

3. Retail Participation

Yet, retail has not really been on board for this bull. Going off ETF market implied allocations, retail investors are still running relatively light allocations to gold (still below the 2020 high, and a fraction of where it got to in the late stages of the 2000’s bull). You could argue that there is room to run on this front, but at the same time it seems tech and crypto have claimed greater mind and wallet share. On that front, maybe it takes more downside in tech and crypto to trigger a bit of rotation into things like gold.

Source: GoldNuggets Digest — Consolidation Mode

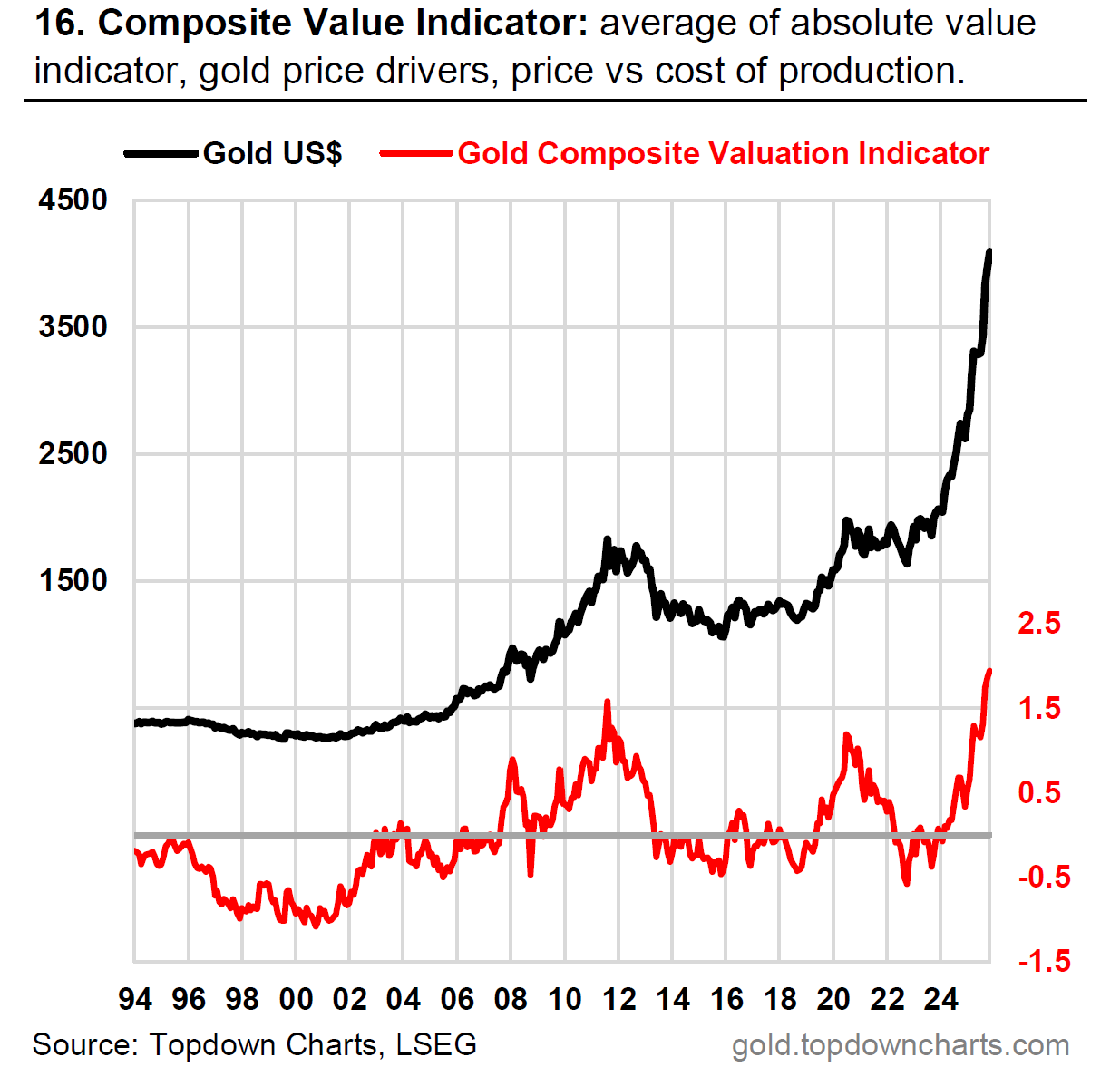

4. Gold Valuation Indicator

On the bearish side of things, my composite gold valuation indicator has reached extreme overvalued levels. This makes it harder to have a strong view — yes there are significant macro tailwinds, yes it’s still in an uptrend, but when valuation indicators reach extremes like this the best case is typically a significant period of consolidation and the worst case is a correction or major cycle peak.

So while I was quite optimistic on gold earlier this year, right now I’d say the easy answer is neutral.

Source: GoldNuggets Digest — Valuations in Focus [Methodology & Inputs] (← see that post for the thinking and method behind the valuation indicator)

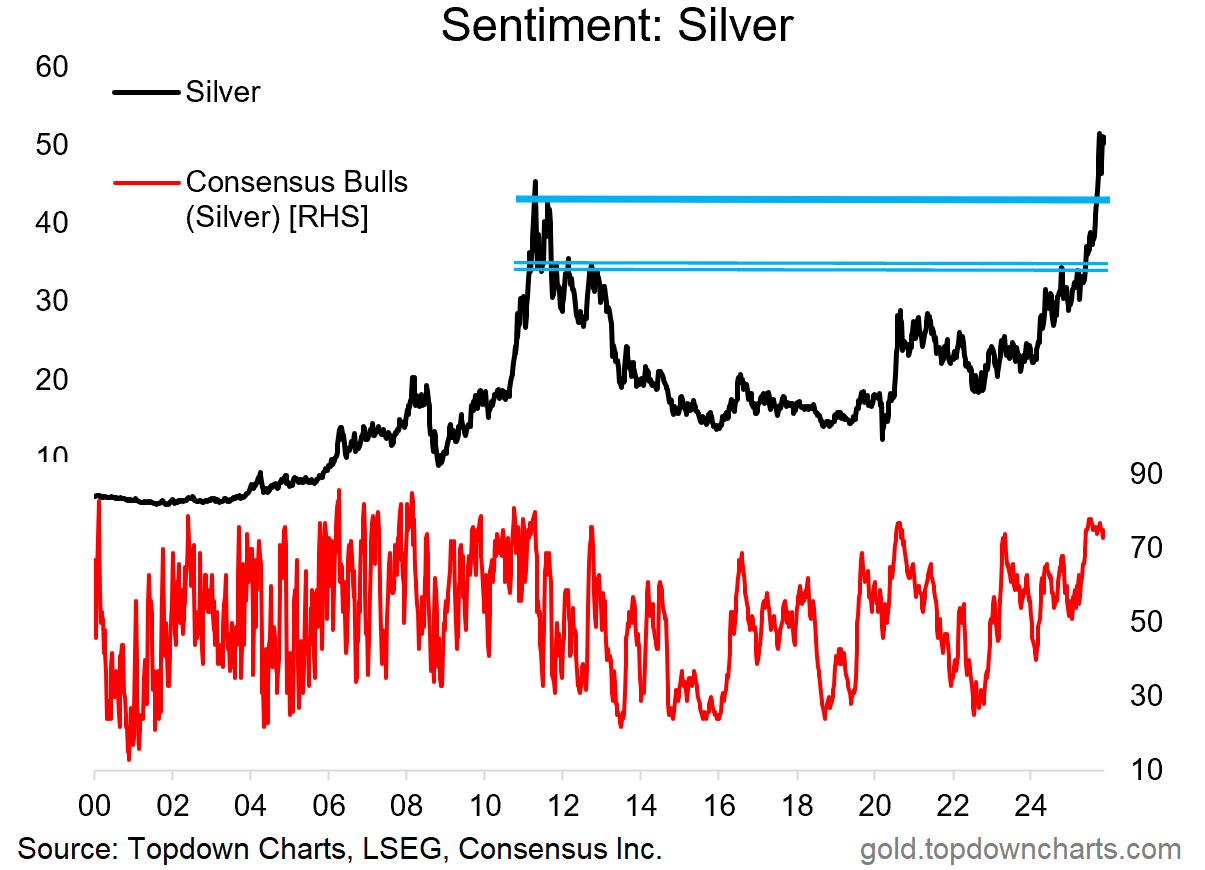

5. Silver Surge

Over to the other big precious metal, Silver has also been making some very interesting moves — breaking out through several key levels and cracking the US$50 mark. But like gold, it also seems to have run into a bit of resistance… and sell-side sentiment is perhaps uncomfortably consensus bullish. So it does make you wonder alongside gold as to whether we need a bit of a healthy pullback or period of digestion to clear the path higher.

Source: GoldNuggets Digest — Silver Star

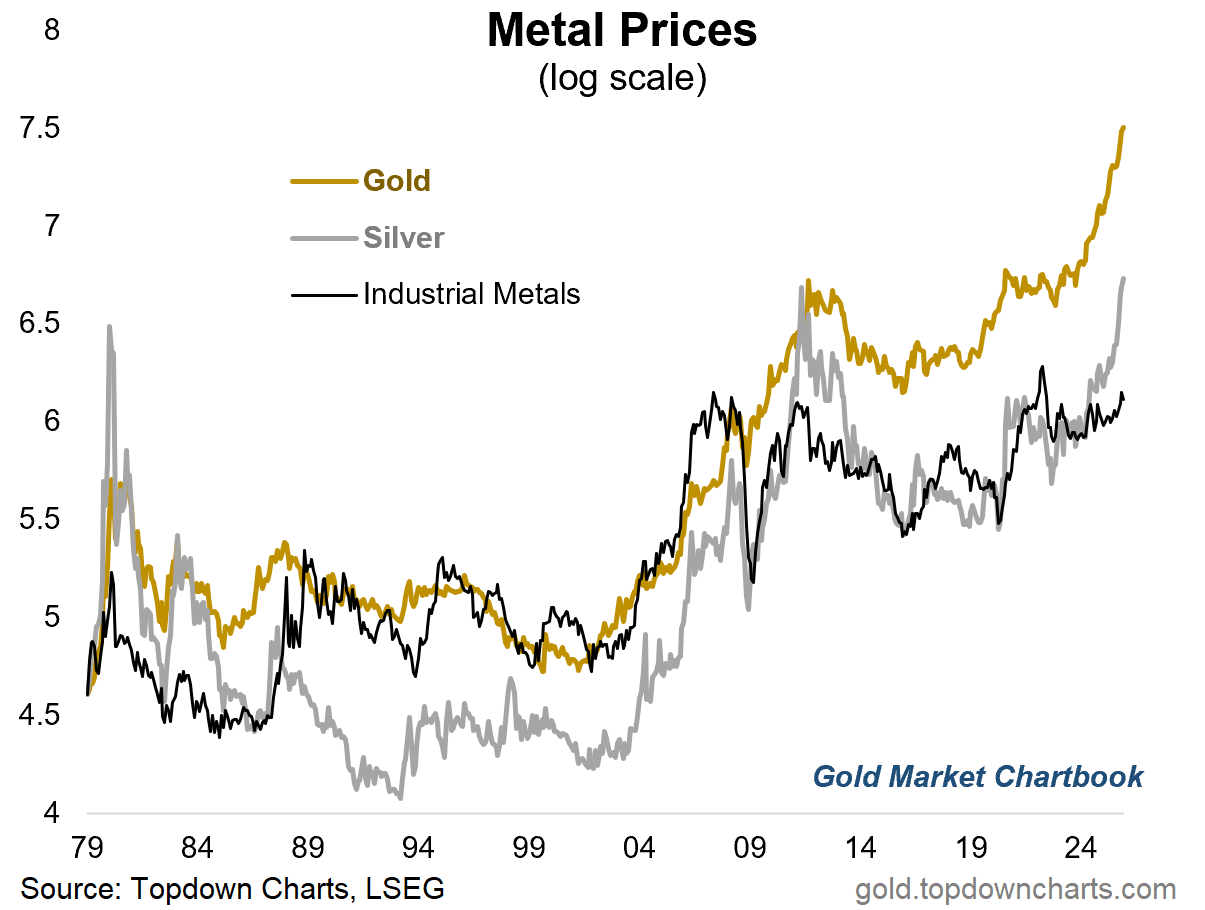

6. Metal Price Procession

One interesting thought on this is the transition in leadership from monetary metals to industrial metals. Silver sits across the two camps; partly a precious metal, and partly an industrial metal. The prospect of catch-up for silver (and industrial metals) is top of mind for me.

Source: GoldNuggets Digest — Trends, Cycles, Metals

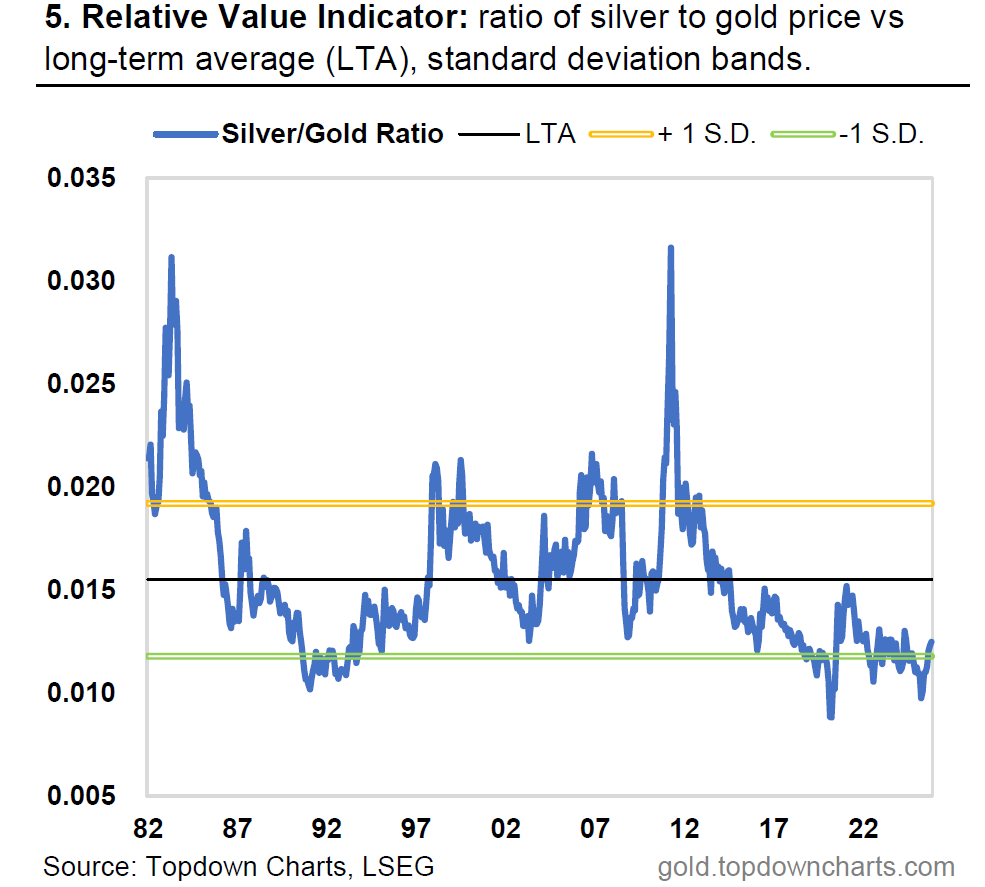

7. Silver vs Gold — Relative Value

Silver is also turning up relative to gold from “cheap” levels. I’ve outlined my bullish global growth thesis for 2026 elsewhere, and I’d say if we do see that come online that will be bullish for silver vs gold (and industrial metals), and it could just be the thing to give silver a second wind.

Source: Monthly Gold Market Chartbook

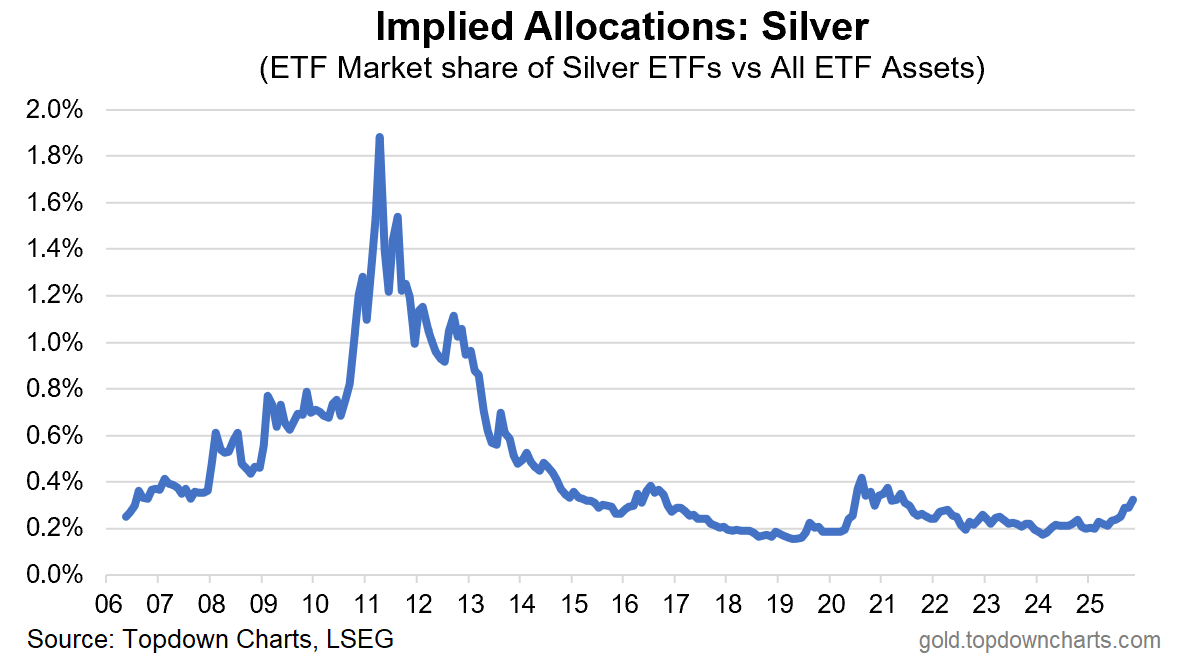

8. Silver Allocations

Another point is investor allocations to silver look pretty low vs history, but are steadily turning up. For something that has potential dual-tailwinds (monetary and macro) I’d say this looks early; room to run.

Source: Topdown Charts

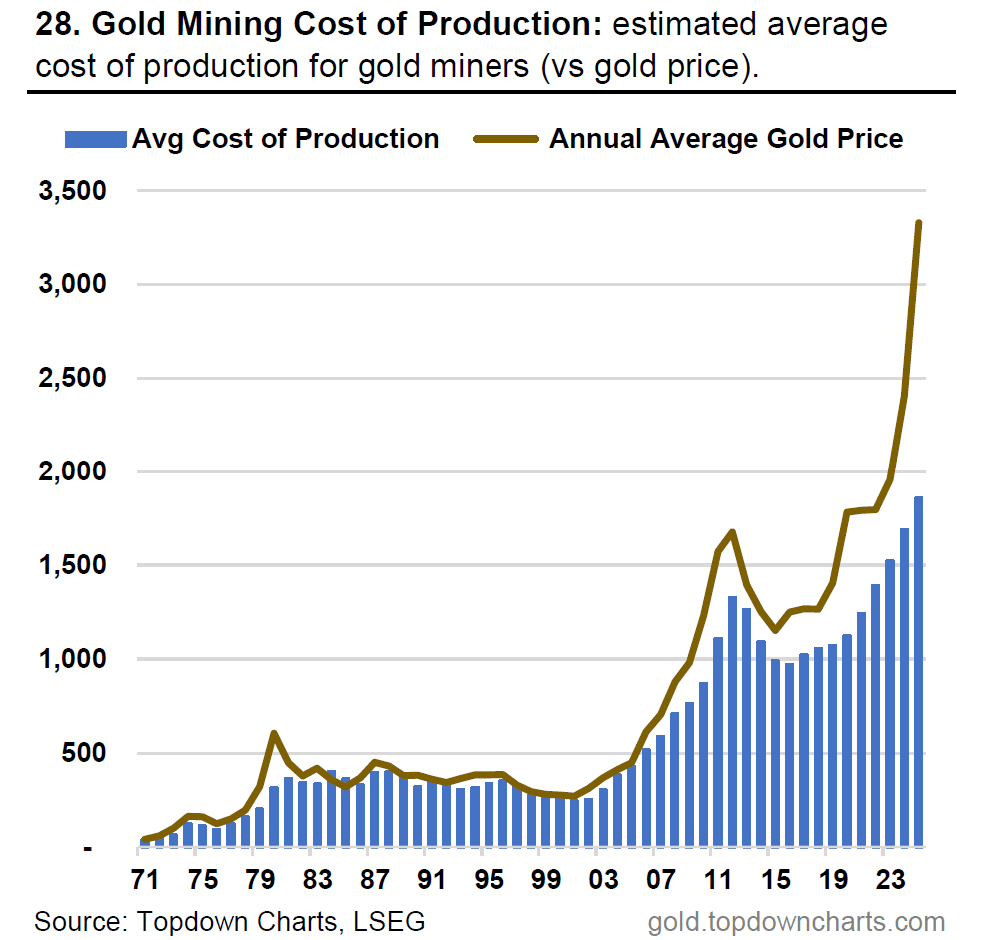

9. Gold Miners — Profit Time!

Lastly, on gold miners, we are seeing a rapidly widening gap between the annual average gold price and the average cost of production. On the upside, this (should) mean larger profits for gold miners, but also likely larger capex to bring new supply online.

Source: Monthly Gold Market Chartbook

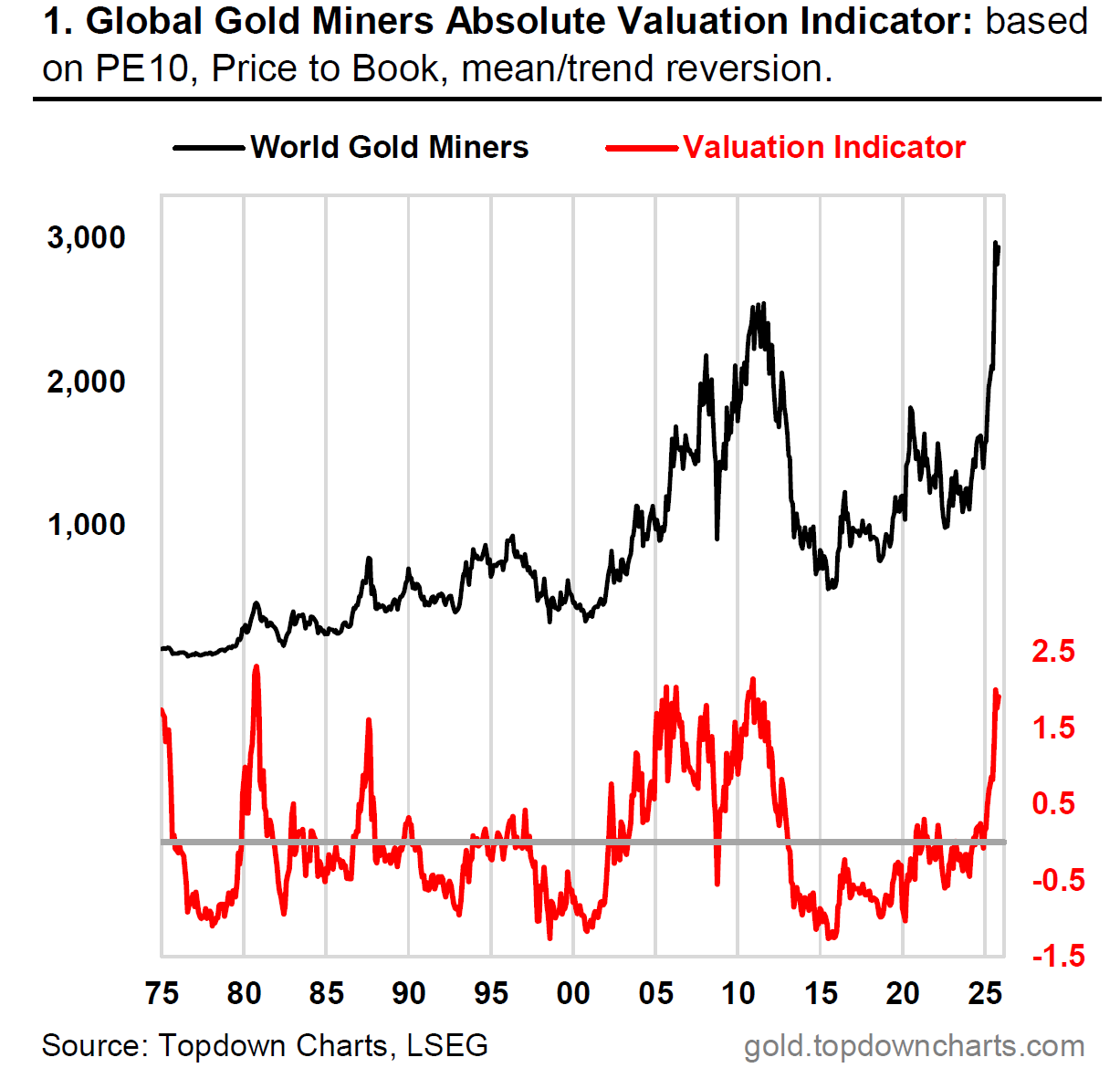

10. Gold Miner Valuations

But with gold miners up almost 3x off the 2022 lows, it does make you wonder if this is already in the price to some extent.

It is possible to see valuations become justified as widening margins work their way through to better-reported financials, but a key ingredient here is that the gold price needs to ideally stay elevated if not head higher to support a further push higher in mining stocks.

So much like the view on gold itself, we’re in risky territory and it’s not as clear-cut a bullish outlook as it was earlier this year. So to sum it all up, basically I’d say: neutral gold, neutral miners, and constructive on silver (and industrial metals).

Source: Monthly Pack