FOMC minutes; Delta, PepsiCo to report; gold retreats - what’s moving markets

- Fed could cut rates as early as next week.

- Small caps may be among the biggest beneficiaries.

- In this piece, we’ll explore how to spot the best small-cap stocks to buy to profit from a post-Fed rally.

- InvestingPro gives investors all the tools needed to maximize gains ahead of potential Fed rate cuts

The market now largely expects that the Fed will cut rates next week, with some even debating whether the central bank could deliver a larger 50-basis-point cut instead of the usual 25. This makes it the right time to position in stocks that stand to gain the most from a lower-rate environment.

This is all the more true as investors expect the central bank not to stop there, with further rate cuts anticipated between now and the end of 2025.

Yet small-cap stocks are often cited as obvious bets in the event of a rate cut. Smaller companies are more likely than larger ones to have variable-rate debt, which makes their margins more sensitive to compression when interest rates rise. For the same reason, they benefit more when rates fall.

While the S&P 500, Nasdaq and Dow Jones indices have just set new record highs, the Russell 2000 small-cap index is still a long way from its November 2024 highs, so the Fed rate cut expected next week could signal the start of an explosive year-end for small caps.

So, using the Investing.com screener, we went in search of the best opportunities among US small caps. Specifically, we looked for stocks meeting the following criteria:

- Capitalization between $300 million and $2 billion

- Potential upside of more than 20% according to analysts

- Average volume over 3 months that’s greater than 1 million

*Note that these three filters are available free of charge to all registered Investing.com users. Click here to access this screener search.

With these parameters, we were able to identify just over 100 opportunities. Below, you’ll find the top 10 stocks with the greatest potential, according to analysts:

While these stocks show impressive potential according to analysts, many of them display a worrying overall health score and/or growth health score. What’s more, other measures have shown us that some of them are currently highly overvalued.

We therefore decided to add the following criteria to our search:

- Bullish potential of over 20% according to InvestingPro Fair Value

- Overall health score greater than 2.5/5

- Growth health score greater than 2.5/5

Fair Value calculates an intelligent average of several recognized valuation models for each stock on the market. Meanwhile, the overall health score is based on several key financial metrics and peer comparisons to assess a company’s financial health. Finally, the Growth Health Score is one of its sub-components.

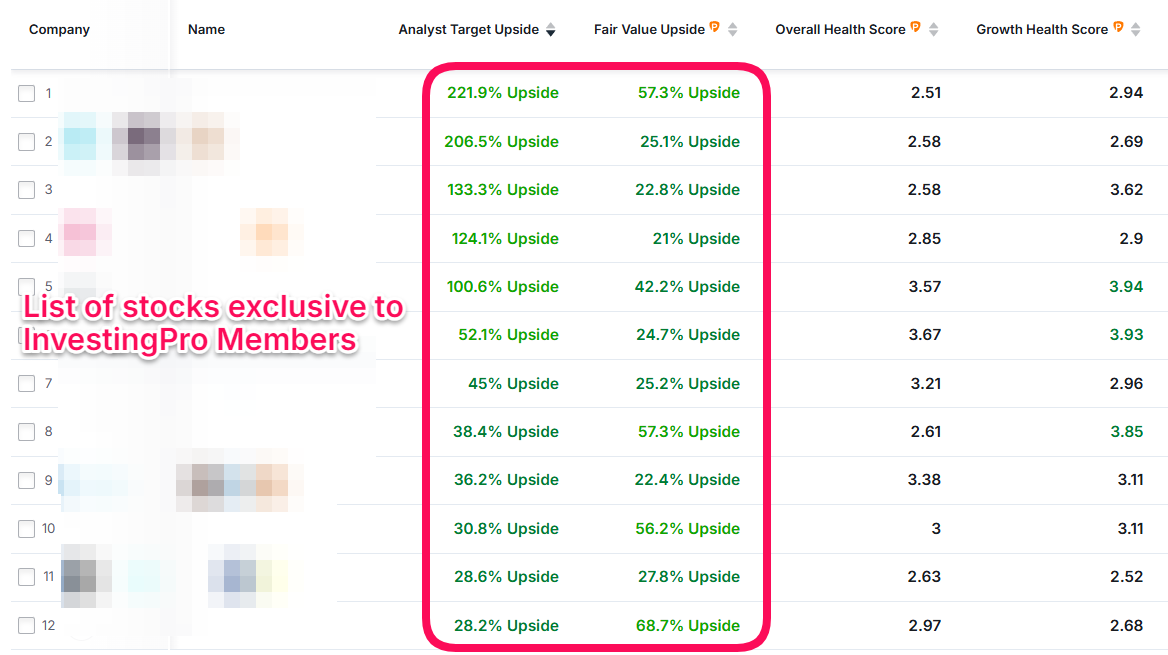

After adding these criteria, the stock list has been reduced to 12 opportunities:

Note that these stocks have a potential upside of +28.2% to +221.9% according to analysts, and +21% to +68.7% according to Fair Value. In addition to being popular with professionals, these small caps are also undervalued from the perspective of valuation models, boasting reassuring financial metrics.

ATTENTION: Unlike the initial search filters, these new criteria added later are reserved for InvestingPro members with a Pro+ plan.

- InvestingPro, Pro plan members can upgrade to the Pro+ plan here.

- If you are an existing InvestingPro (Pro+) member, click here to access this screener search.

If you haven’t already subscribed to InvestingPro, you can do so using the button below:

*Are you an iOS user? Use this link instead to subscribe.