SoFi stock falls after announcing $1.5B public offering of common stock

- 10-bagger stocks are hard to spot.

- Over the past years, there have been several 10 and 100-baggers that are still maintaining their gains.

- Using InvestingPro tools, let's try and identify three 10-baggers that have the potential to rally even higher.

The great Peter Lynch coined the term "10-bagger" in his book "One Up On Wall Street," referring to stocks that multiplied their price by 10. A "100-bagger" refers to stocks that multiply their price by 100. Of course, it's every investor's dream, but it's not easy to achieve. In some cases, many stocks will never reach that level.

In other cases, it may take years and years of holding onto a stock with hope, like it was with Bank of New York Mellon (NYSE:BK), which was stagnant for five years moving between the $76-$81 range for that period, or American Express (NYSE:AXP), which was stagnant for seven years ($85-$92).

Some famous 100-bagger stocks and the time it took them to achieve this feat are:

- Berkshire Hathaway (NYSE:BRKa) 19 years

- Kansas City Southern (NYSE:KSU) 18.2 years

- Altria (NYSE:MO) 24,2 years

- Walmart (NYSE:WMT) 12.5 years

And these 100 baggers got there in a very short time:

According to Christopher Mayer's book "100 Baggers: Stocks that Return 100-to-1 and How to Find Them," around 50% of stocks that multiplied their price by 100 took at least 15 years, with a maximum of 30 years and an average of 26 years.

One example of a big winner is Monster Beverage (NASDAQ:MNST), which not only became a 100-bagger (in 9.5 years) but also multiplied its price by 720. However, this was not easy to achieve, as the stock went through a -20% drop in just three months and a -32% drop in another period of 65 days.

Let's take a look at some "10x10" stocks, which are ones that multiplied their share price by 10 in the last 10 years. Appreciating by 1,000% is a significant achievement, as the S&P 500 (NYSE:SPY) only had a return of +212% over the same period.

We will use the InvestingPro tools to identify three stocks that have become 10-baggers and still have some room to rise.

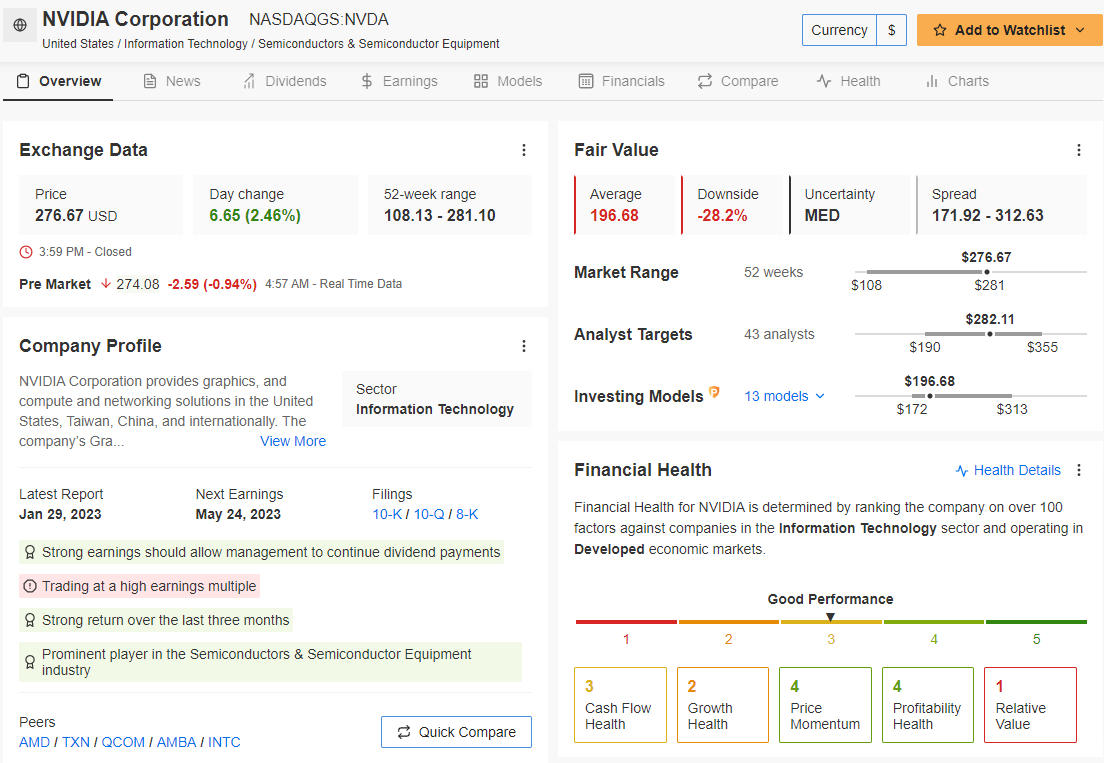

1. NVIDIA

Founded on 5 April 1993, NVIDIA (NASDAQ:NVDA) is a software company that develops graphics processing units (GPUs) and application programming interfaces (APIs). The company is a global leader in artificial intelligence hardware and software.

It reports quarterly results on 24 May and is expected to report earnings per share (EPS) of $0.91.

Source: InvestingPro

Over the last 10 years, it has gained +1,000%. Its all-time returns are 8,833%.

It is maintaining its upward trend and faces resistance at $286.95. Breaking this would give it a chance to continue its uptrend.

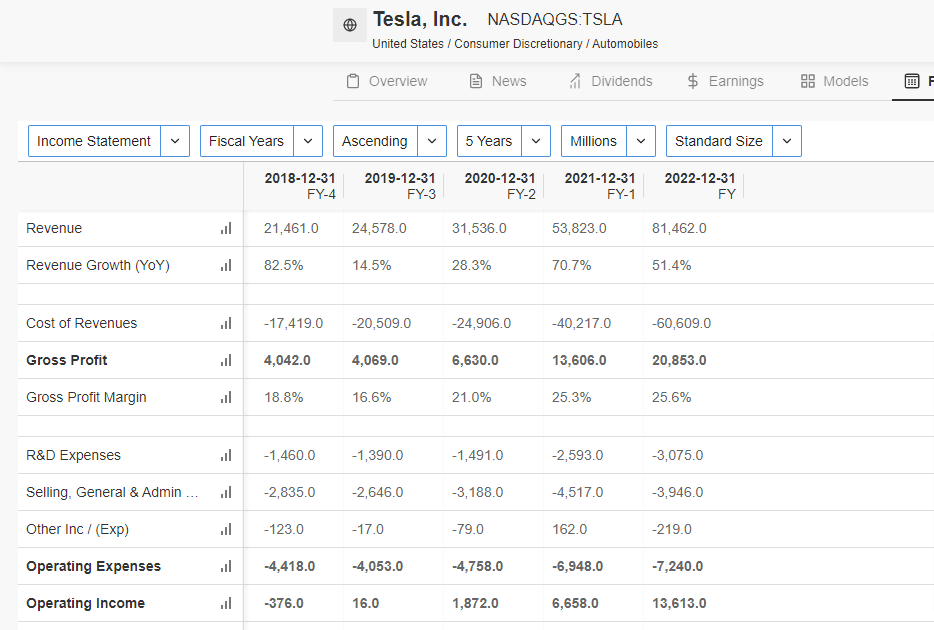

2. Tesla

Tesla (NASDAQ:TSLA), a US-based company headquartered in Austin, Texas, and led by Elon Musk, is involved in the design, production, and sale of electric vehicles, powertrain components for electric vehicles, solar roofs, and home batteries.

It was established in July 2003 with the name Tesla Motors, paying homage to the renowned inventor and electrical engineer Nikola Tesla. Elon Musk, who initially invested $6.5 million in the company, continues to serve as the chairman.

Source: InvestingPro

The stock is close to the resistance level at $214.24, and the 200-day moving average is nearby. Breaking through this level on the first attempt might be challenging, but it will be a bullish sign if it happens.

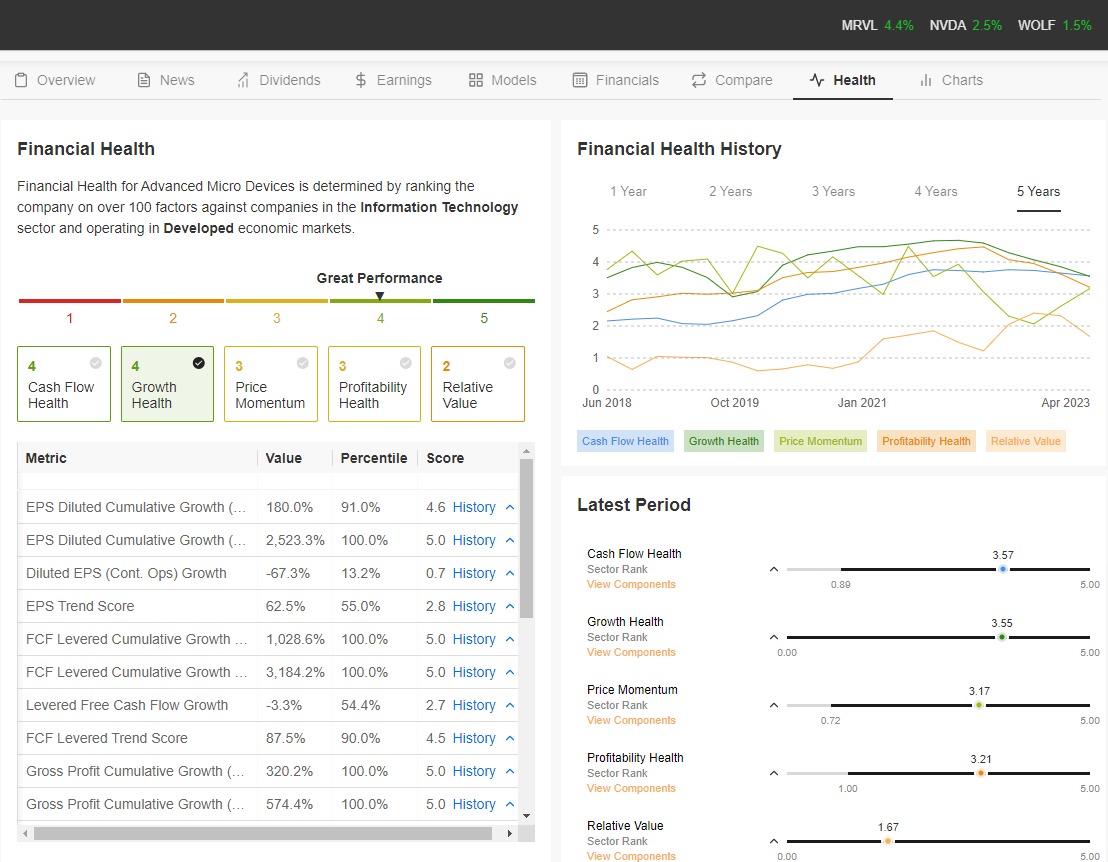

3. Advanced Micro Devices

Source: InvestingPro

Advanced Micro Devices (NASDAQ:AMD) reports quarterly results on 2 May, and EPS is expected to be $0.56.

Over the past 10 years, the stock has returned +1,000%. Its all-time returns are +3,700%. It remains within its bullish channel and above its 200-day moving average. $108.59 is its next target this year.

Aside from the three stocks, there are others as well:

- Plug Power (NASDAQ:PLUG)

- Enphase Energy (NASDAQ:ENPH)

- DexCom (NASDAQ:DXCM)

- Axon Enterprise (NASDAQ:AXON)

- Texas Pacific Land (NYSE:TPL)

- Monolithic Power Systems (NASDAQ:MPWR)

- Broadcom (NASDAQ:AVGO)

- Repligen Corporation (NASDAQ:RGEN)

- Fortinet (NASDAQ:FTNT)

- MSCI (NYSE:MSCI)

- Lam Research (NASDAQ:LRCX)

- Netflix (NASDAQ:NFLX)

- Apple (NASDAQ:AAPL)

- Microsoft (NASDAQ:MSFT)

This analysis was done using InvestingPro tools.

Disclosure: The author does not own any of the securities mentioned.