ION expands ETF trading capabilities with Tradeweb integration

- REITs are shifting from dividends to growth-focused strategies.

- Lower interest rates are boosting profitability and appeal amid economic uncertainty.

- Investing in REITs now could unlock significant portfolio growth potential.

- Looking for actionable trade ideas to navigate the current market volatility? Unlock access to InvestingPro’s AI-selected stock winners for under $9 a month!

After long years of underperformance, REITs may be back in vogue.

The sector has shown strong momentum since mid-year, coinciding with the market adjusting of its mid-term interest rate expectations.

For those unfamiliar, REITs (real estate investment trusts) are companies that own, manage, or finance income-generating properties across various sectors. To qualify as REITs, these firms must meet specific requirements and are often traded on major stock exchanges.

From an investor's perspective, REITs offer real estate income without the need for direct property management, providing diversification, potentially higher returns, and reduced investment risk. Investments can be made through stock listings or ETFs.

Given their high sensitivity to interest rates, many investors are finding REITs offer a better risk-return proposition amid the Fed's rate cut cycle compared to other, more extended sectors like technology and utilities.

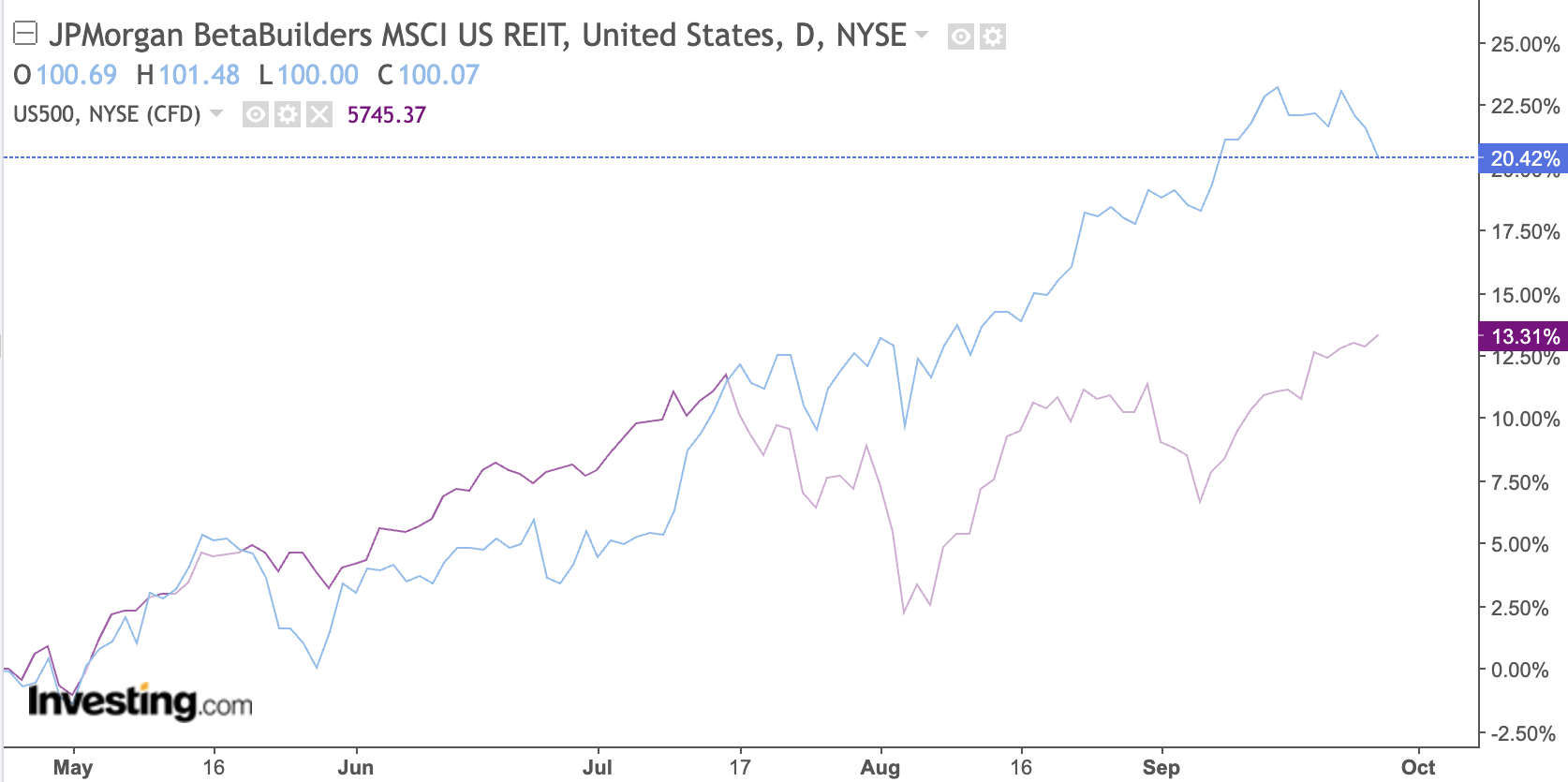

As a result, the MSCI US REIT ETF (NYSE:BBRE) (blue) has outperformed the broader S&P 500 (purple) since May this year, with particularly strong performance since July. See the chart below:

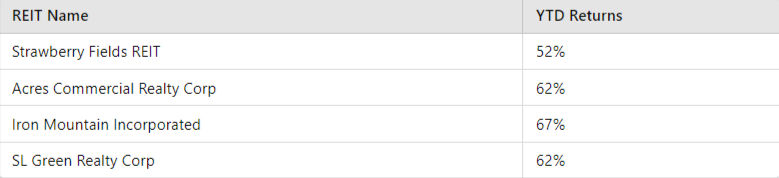

In terms of stocks, several names like Strawberry Fields Reit (NYSE:STRW), Acres Commercial Realty Corp (NYSE:ACR), Iron Mountain Incorporated (NYSE:IRM) and SL Green Realty Corp (NYSE:SLG) have been also pulverizing the broader market. Just take a look at their YTD returns below:

While past performance is no guarantee of future returns, the broader rebound in the sector aludes to an improving proposition. Below, we’ll consider three reasons why this might be a great time to invest in these assets, ahead of a crucial turning point for the sector.

1. Refinancing Boom

Lower rates allow REITs to refinance properties at cheaper costs or acquire new assets more affordably than in the last two years. This sets the stage for improved funds from operations (FFO), providing a solid foundation for future growth.

While a good share of that may already be priced in, the growing probability of yet another 50 bps cut by the Fed in November will likely lead to further upside for the sector.

Against this backdrop, there can be distinct advantages of investing in real estate stocks compared to the more volatile technology sector.

Christine Mastandrea, COO of Whitestone REIT, highlights how this can be a great opportunity for investors.

“The industry can be a great way for investors to grow the value of their portfolios while diversifying and protecting against potential course corrections in tech,” she explains.

With the Federal Reserve lowering interest rates and signaling further cuts in 2025, Mastandrea sees this as a prime time to invest in REITs.

“Lower rates decrease borrowing costs and boost profitability,” she notes, allowing REITs to quickly adjust pricing and attract more investors across sectors like multifamily, retail, hotels, logistics, and emerging classes like data centers and cold storage.

She also observes a shift in REIT marketing.

“Previously, high dividends came at the expense of operations, but now REITs position themselves as safety nets during volatility,” she states, balancing attractive dividends with lower debt and greater profit potential.

Mastandrea also notes the generational spending trends driving economic growth.

“Millennials, along with Gen Z and Gen Alpha, are fueling economic expansion for the next 20 years, much like their boomer parents,” she says. “Since real estate underpins the economy, as it grows, so do commercial real estate values.”

2. Business Model Shifting From Value to Growth

Adding fuel to this potential run, REITs are also entering a new chapter - one where growth, not only dividends, takes center stage.

Once known for their reliable payouts, real estate investment trusts are now shifting gears, prioritizing organic expansion and reducing debt, a strategy that mirrors the playbook of tech companies.

"In the past, REITs prioritized paying the highest dividends in order to attract investor interest. This often was at the expense of their own operations, as it meant less of their capital was being used to lower their debt levels or reinvested in their properties to grow profit," explains Christine Mastandrea, COO at Whitestone REIT (NYSE:WSR).

This marks a major departure from the old model, where dividends often came at the expense of reinvestment or debt reduction.

"We have seen a shift in that REITs are really marketing themselves as safety nets, especially in periods of volatility, thereby allowing them to still be attractive investment options but with lower debt levels and greater profit potential," adds Mastandrea.

Investors are taking notice. They're no longer viewing REITs as mere passive income machines but as dynamic vehicles capable of driving performance by reinvesting cash instead of doling out higher dividends.

The message is clear: stronger cash flow and long-term growth outweigh immediate increases in payouts.

3. Low-Volatility, Safety Amid Economic Slowdown

Moreover, in a potential recession, REITs offer both safety and value, having already weathered challenges since 2022. Their resilience in tough economic conditions positions them as reliable investments during market slowdowns.

Edward B. Pitoniak, CEO of VICI Properties (NYSE:VICI), highlights the dual benefits of REITs for both traders and long-term investors.

"If you’re a trader, REITs can be interesting," he says, noting their appeal as short-term opportunities.

However, Pitoniak emphasizes their even greater potential for investors focused on the long game.

"REITs play a critical role in ensuring your stock portfolio has significant compounding potential," he explains.

Unlike many other investments, REITs offer a twofold return: a dividend yield that often exceeds inflation, and earnings growth that may outpace inflation as well. This combination, Pitoniak says, is central to generating strong total returns.

“The key components are the dividend yield and the capitalization of earnings growth, which the market assigns to the REIT.”

“Investors should focus on REITs that provide a real return—one that outpaces inflation—and let those returns compound over time, boosting overall portfolio performance,” he adds.

Pitoniak’s comments underscore that REITs aren't just about passive income; they can actively enhance both the income and growth aspects of a diversified portfolio.

Bottom Line

REITs are entering a transformative phase, shifting focus from dividends to growth. With recent interest rate cuts paving the way for strategic acquisitions and refinancing, these instruments appear poised to unlock significant earnings potential.

Moreover, in an uncertain economic climate, they offer a unique blend of stability and growth, appealing to investors seeking value. As generational spending trends drive economic expansion, now is the perfect time to embrace REITs as dynamic assets that can enhance your portfolio's performance, offering a compounding effect over the long-term.

***

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk is at the investor's own risk. We also do not provide any investment advisory services. We will never contact you to offer investment or advisory services.