Infosys, Wipro decline despite upbeat Q2 earnings; margin concerns weigh

- Dividend-paying stocks have become more important for retirement portfolios when inflation is high, and bond prices are falling

- Large companies that have a long history of paying dividends can weather an inflationary environment better than other asset classes

- Companies with strong cash flows that consistently grow dividends by 5% to 10% every year are generally suitable for a long-term portfolio

If your goal as an investor is building a solid income stream for your retirement years, you should look for stocks worth holding over the long run, focusing on their income-generating capabilities.

As inflation runs near a four-decade high and the bond market tumbles, income-producing or dividend-paying stocks become even more critical for your retirement portfolio.

According to S&P Dow Jones Indices and Bureau of Economic Analysis data, cited by the Wall Street Journal, dividends as a share of personal income climbed to 7.3% in the first quarter of this year from 3.2% in the first quarter of 1980. Interest income as a share of personal income declined to 9.2% from 16.2% over the same period.

Large companies with a history of paying dividends each year can benefit from an inflationary environment like the one we’re facing now. The products and services these companies produce are so essential that consumers are generally willing to pay higher prices.

Buying stocks of such companies is a great way to protect your long-term purchasing power when the prices of goods and services increase. A portfolio of stocks with strong cash flows that consistently grow dividends by 5% to 10% every year is the type of company I find suitable for a long-term retirement portfolio.

Keeping these benefits in mind, I’ve picked the following three stocks that could offer growth and regular income for your retirement portfolio.

1. McDonald’s

For health-conscious investors, McDonald’s Corporation (NYSE:MCD) may not be the right place to go, but the global fast-food chain is the kind of company that ticks almost all the boxes you should look for in a company add to your retirement portfolio.

The Chicago-based giant has a solid track record of consistently growing payouts. Since it started paying dividends in 1976, the company has raised its payout yearly. In addition, McDonald’s has a strong balance sheet, and its prospects for earnings-per-share growth are strong, especially in the post-pandemic environment when restaurants are open.

Source: InvestingPro

After struggling through the pandemic, the company rapidly regained sales momentum. In July this year, MCD reported better-than-expected earnings and revenue, helped by price increases and value offerings, and the popularity of digital tools like the mobile app and delivery.

MCD pays a quarterly dividend of $1.38 per share. That translates to an annual dividend yield of 2.14% at the current stock price. With a manageable payout ratio of about 70%, the company is in an excellent position to continue delivering dividend growth.

2. Lowe’s

Investing in home-improvement stocks may not look too exciting when interest rates rise and consumers want to cut back on their discretionary spending. However, that uncertainty, in my view, opens a window of opportunity to buy some quality stocks from this area.

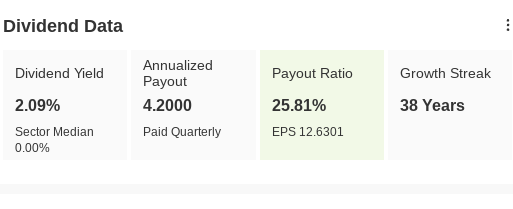

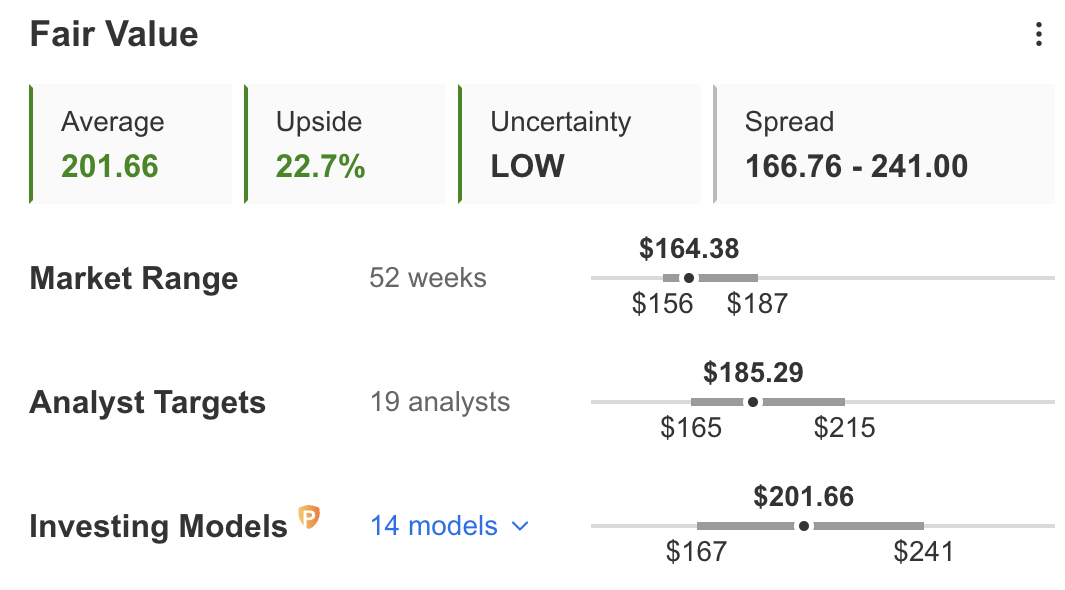

The number 2 home-improvement retailer in the U.S., Lowe’s Companies (NYSE:LOW), is one such name due to the strength of its dividend program and the company’s ability to consistently outperform. With 38 years of dividend hikes, Lowe’s is a reliable dividend stock that has endured many recessions and market downturns.

Source: InvestingPro

Even in this uncertain housing market, Lowe’s reported earnings last month that beat expectations while reporting strong momentum in July and August. The Mooresville, North Carolina-based giant is optimistic about the outlook for home renovators despite the cooling U.S. housing market as aging properties and higher real estate prices will likely fuel its sales growth.

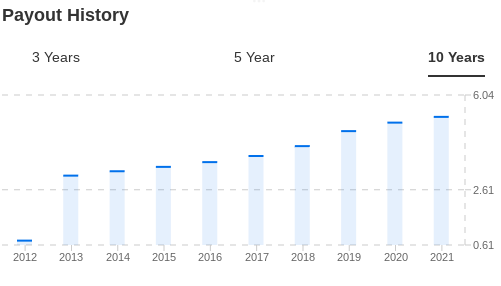

Lowe’s pays $1.05 a share quarterly dividend, which translates into a 2.09% annual yield. Its annual dividend has grown 19% per year over the past ten years, showing the robust performance that a few companies can match.

With its dividend payout ratio to be just 26%, the retailer has enough room to grow its payouts after sparing cash for debt payments and share buybacks.

3. Johnson & Johnson

The global pharmaceutical giant Johnson & Johnson (NYSE:JNJ) is the kind of company retirees should consider adding to their portfolios.

Regarding consistently growing dividends, only a handful of companies have done better than Johnson & Johnson. It has increased its quarterly dividend every year for 58 consecutive years.

This remarkable performance puts Johnson & Johnson among an elite group dubbed Dividend Kings, companies with at least five decades of annual dividend hikes. JNJ pays $1.13 a share quarterly with an annual yield of 2.75%.

JNJ has grown its payout by about 7% each year during the past ten years. The performance demonstrates the underlying strength of its products, diversified business platform, and the management’s strong desire to reward its investor base.

Source: InvestingPro

Disclosure: The writer is long JNJ and LOW.