Six Flags stock rises after appointing John Reilly as new CEO

- Wall Street’s Q3 earnings season is gathering momentum.

- Using the InvestingPro, I identified several names set to enjoy robust earnings growth.

- Here are three stocks worth owning ahead of their quarterly reports in the coming weeks.

- Looking for more actionable trade ideas? Unlock access to InvestingPro for less than $8 a month!

As the third-quarter earnings season heats up, some standout companies are set to deliver explosive triple-digit profit growth.

Using the InvestingPro Stock Screener, I identified Robinhood Markets (NASDAQ:HOOD), On Holding (NYSE:ONON), and DraftKings (NASDAQ:DKNG) as three names that are all forecast to post impressive earnings results, thanks to a combination of favorable business conditions, strategic initiatives, and robust market demand.

Source: InvestingPro

Here’s a closer look at what’s driving the anticipated earnings surge for these three companies, each of which has seen significant upward revisions in profit forecasts and boasts strong financial health, according to exclusive data from InvestingPro.

1. Robinhood

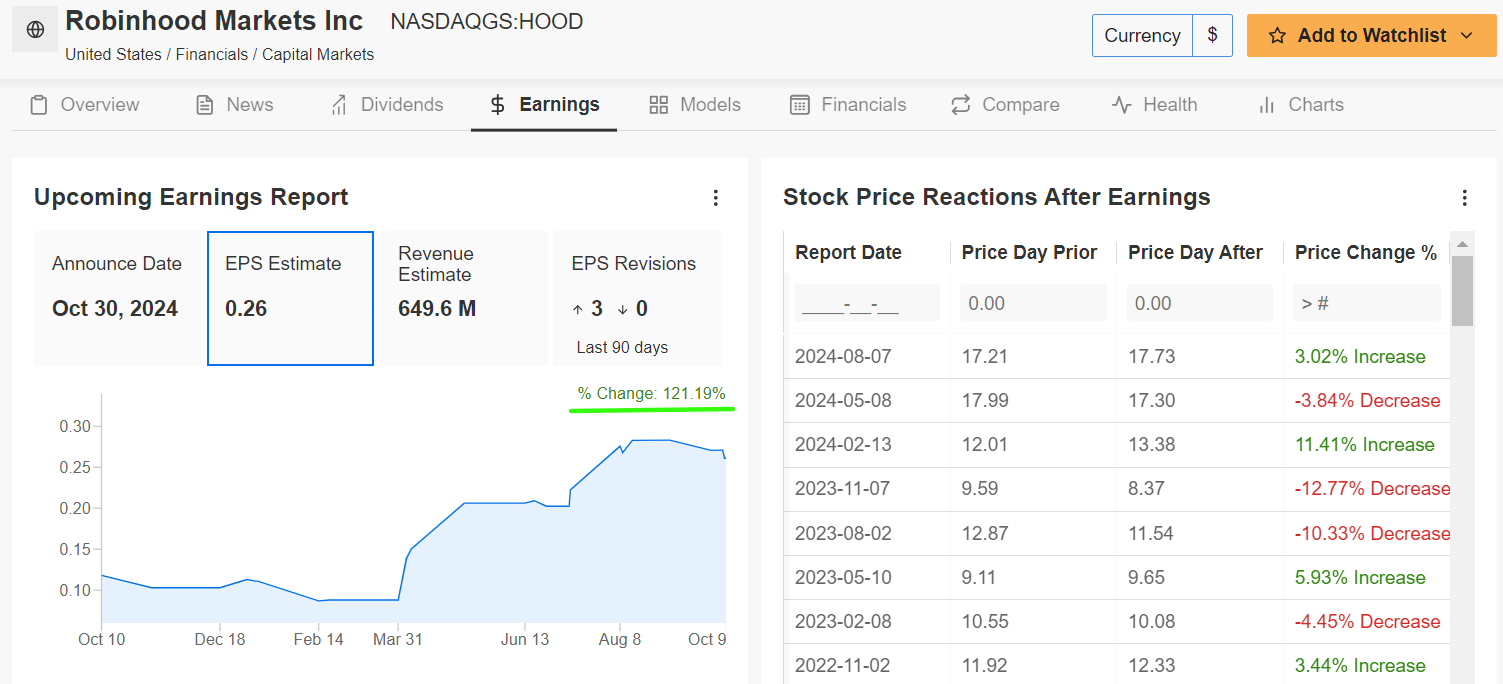

• Earnings Report Date: October 30

Robinhood, the popular commission-free trading platform, is on track for a stellar quarter. The company’s upcoming earnings report is expected to showcase triple-digit earnings growth as it continues to benefit from several key tailwinds.

HOOD stock was trading at a fresh 52-week high of $26.80 as of Wednesday morning, the strongest level since December 2021. At current levels, the Menlo Park, California-based retail brokerage firm has a market cap of $23.7 billion.

Shares have more than doubled this year, gaining 110%.

Source: Investing.com

Robinhood is seen earning $0.26 per share, surging 276% from a loss of -$0.09 per share in the challenging year-ago period. Meanwhile, revenue is forecast to jump 39.1% year-over-year to $649.6 million.

Increased customer engagement, rising interest income from uninvested cash balances, and expanding crypto trading activity are all contributing to the company’s strong financial performance.

Moreover, Robinhood has made strides in diversifying its revenue streams, particularly through its growing options trading and subscription-based products.

Source: InvestingPro

Exclusive data from InvestingPro highlights that analysts have been revising their EPS estimates sharply higher in recent weeks, further underscoring the optimism surrounding Robinhood’s upcoming results.

The stock-market trading platform operator also has an above-average InvestingPro Financial Health score, which reflects its solid balance sheet and operational efficiency.

2. DraftKings

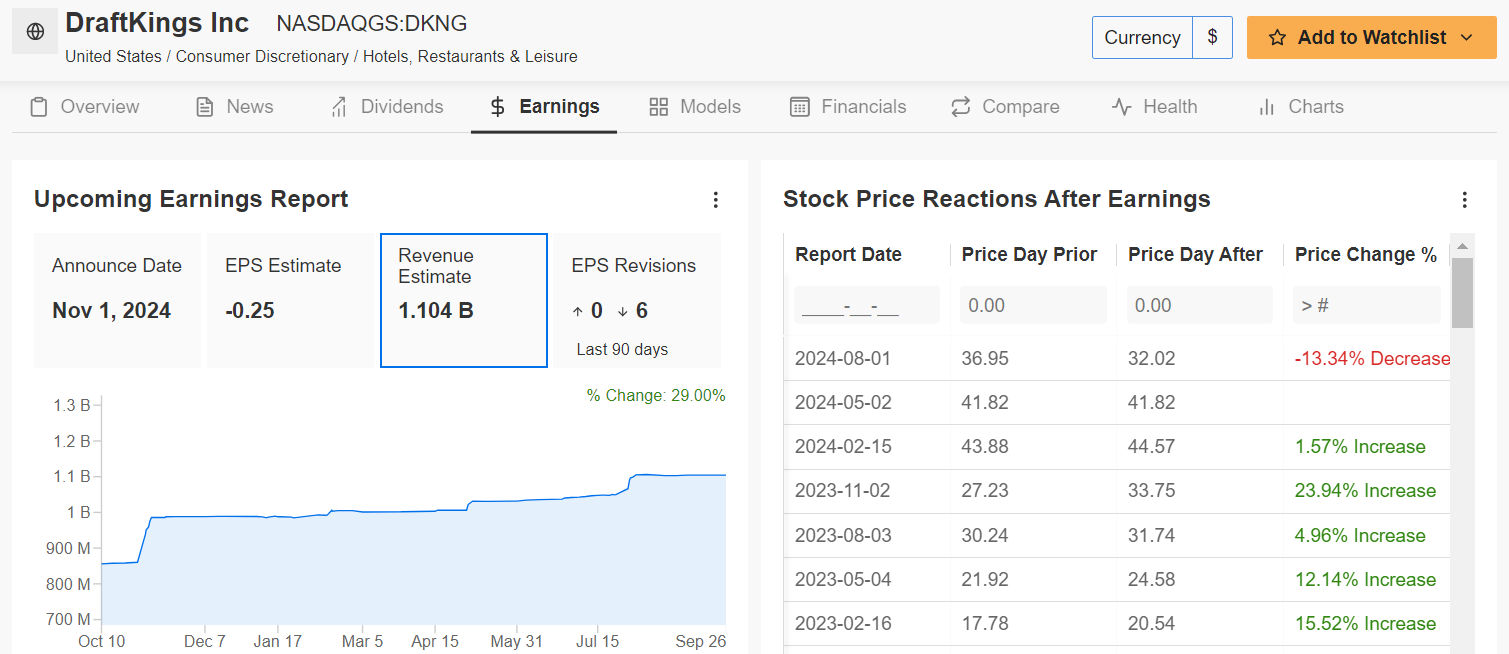

• Earnings Report Date: November 1

DraftKings, the online sports betting and fantasy sports giant is poised for a massive quarter, driven by favorable market dynamics and ongoing expansion into new states.

The continued legalization of sports betting across the U.S., combined with DraftKings’ growing market share, is expected to fuel triple-digit earnings growth in the upcoming report.

DKNG stock closed at $38.14 on Tuesday, earning the Boston, Massachusetts-based sportsbook operator a valuation of $18.5 billion.

Shares are up by 8.2% in 2024.

Source: Investing.com

Wall Street sees DraftKings losing -$0.25 per share, improving 137% from a loss per share of -$0.61 in the year-ago period. Meanwhile, revenue is expected to increase nearly 40% year-over-year to $1.1 billion.

The sports betting firm’s innovative product offerings, including its mobile betting platform and partnerships with major sports leagues, have helped DraftKings solidify its position as a market leader.

Additionally, the NFL and NBA seasons as well as other major sporting events are expected to provide a significant boost to the company’s top and bottom lines.

Source: InvestingPro

As per InvestingPro’s exclusive data, analysts have been consistently raising their EPS forecasts for DraftKings in the weeks leading up to its earnings announcement.

The online gambling specialist also boasts a strong InvestingPro Financial Health score, with a growing user base and increasing profitability working in its favor.

3. ON Holding

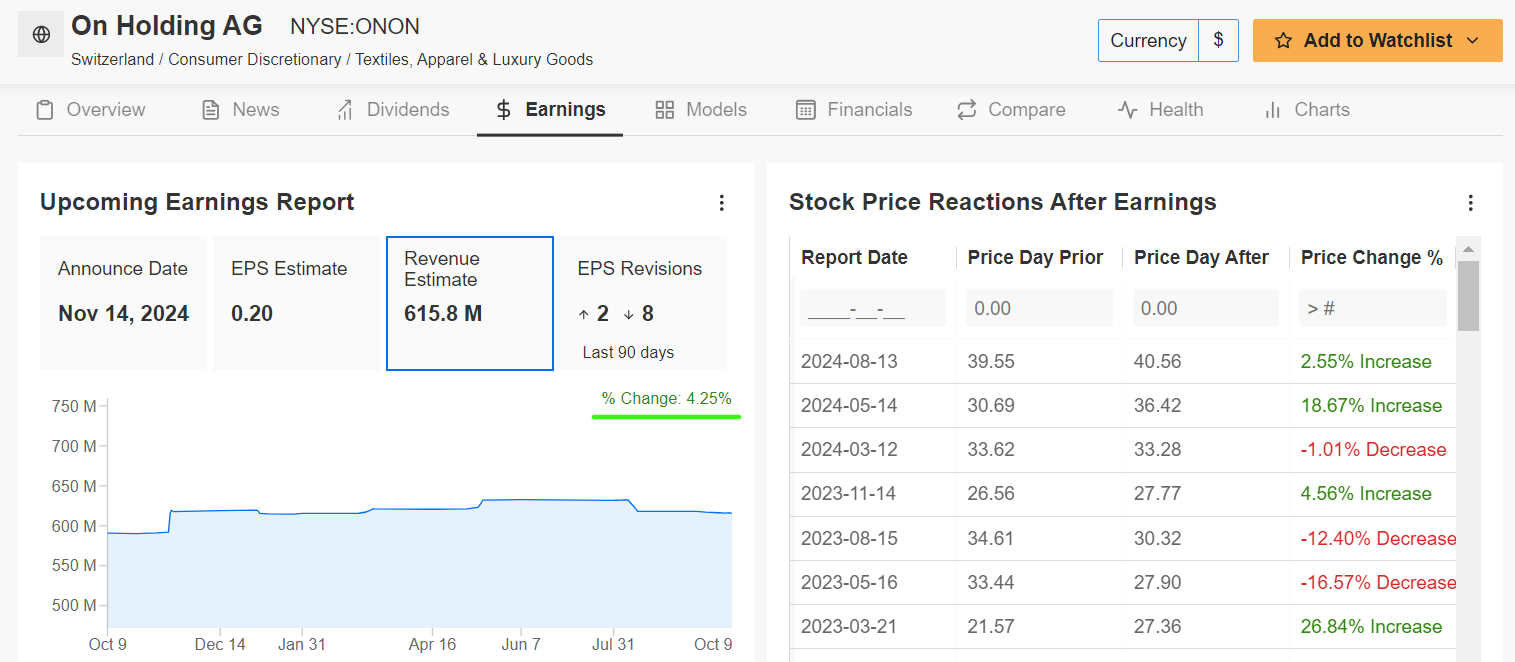

• Earnings Report Date: November 14

ON Holding, the fast-growing Swiss athletic footwear company is another name set to deliver outstanding earnings growth.

The brand, known for its high-performance running shoes and growing global footprint, has been riding a wave of strong consumer demand, particularly in North America and Europe.

ONON stock ended Wednesday’s session at $49.39, a tad below a recent 52-week peak of $52.80 reached on October 9. ON Holding has a market cap of $15.9 billion at its current valuation.

Shares have gained 83.1% in the year to date.

Source: Investing.com

Consensus estimates call for ON Holding to deliver earnings per share of $0.20, improving 400% from EPS of $0.04 in the year-ago period. Despite a difficult environment for retailers, revenue is forecast to soar 182.4% annually to $615.8 million.

ON Holding’s success has been fueled by its innovative product lineup, which has resonated well with athletes and casual consumers alike.

The company’s ability to balance premium pricing with strong brand loyalty has translated into impressive sales and profit growth.

Additionally, its partnership with tennis legend Roger Federer has added a significant boost to brand visibility, driving further demand.

Source: InvestingPro

InvestingPro data shows that analysts have been revising their EPS estimates upward as ON Holding continues to outperform expectations.

With a solid financial health score and a clear path to continued growth, ONON is well-positioned to deliver another quarter of triple-digit profit expansion.

Conclusion

Robinhood, ON Holding, and DraftKings are all set to deliver triple-digit earnings growth in the upcoming earnings season, driven by a combination of strong market demand, strategic growth initiatives, and favorable business conditions.

As per InvestingPro’s market data, all three companies have seen substantial upward revisions to their earnings forecasts, further solidifying their status as top picks for investors.

Additionally, each company’s robust financial health score highlights its solid foundation and potential for continued success in the months ahead.

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading.

Subscribe now to get an additional 10% off the final price and instantly unlock access to several market-beating features, including:

- AI ProPicks: AI-selected stock winners with proven track record.

- InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

- Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

- Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR® S&P 500 ETF, and the Invesco QQQ Trust ETF. I am also long on the Technology Select Sector SPDR ETF (NYSE:XLK).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Follow Jesse Cohen on X/Twitter @JesseCohenInv for more stock market analysis and insight.