HSBC downgrades Bloom Energy after significant rally

- Mondelez stock is down about 5.5% in 2022

- Management expects high-single-digit earnings this year

- Long-term investors could consider buying MDLZ stock at current levels

- Looking for more top-rated stock ideas to add to your portfolio? Members of InvestingPro+ get exclusive access to our research tools, data, and pre-selected screeners. Learn More »

Chicago-based snack food giant Mondelez International (NASDAQ:MDLZ) is well-known for its wide range of high-profile brands, including Cadbury and Toblerone chocolates, Oreo cookies and Trident gum. Shareholders of MDLZ have seen the value of their investment drop 1.5% over the past 52 weeks, and 5.6% so far year-to-date.

By comparison, another major player in the snack food space, Hershey (NYSE:HSY), has gained more than 10% so far in 2022. Meanwhile, the Invesco Dynamic Food & Beverage ETF (NYSE:PBJ), which holds both MDLZ and HSY shares, is flat so far this year, losing only 0.4% in 2022.

On Jan. 21, MDLZ stock went over $69, hitting a record high. However, since then it has come under pressure. The stock’s 52-week range has been $57.63-$69.47, while the market capitalization currently stands at $86.5 billion.

Recent Metrics

Mondelez is one of the most important names in the global confectionery market. Around a third of its revenue comes from chocolate. It employs more than 10,000 people in the US and about 80,000 worldwide.

The company released Q1 figures on Apr. 26. Net revenue grew 7.3% year-over-year to reach $7.76 billion. Of that figure, $4 billion came from developed markets, with the rest was generated by emerging markets.

Adjusted earnings per share (EPS) was 84 cents, up 13.9% YoY on a constant-currency basis. During the quarter, Mondelez returned $1.2 billion to shareholders in share buyback and dividends.

On these results, CEO Dirk Van de Put, said:

“Building on our category leadership, favorable geographic footprint and the power of our iconic brands, we are well positioned for stronger growth in the decade ahead.”

For the year, the food giant forecasts 4+% organic net revenue growth, up from previous guidance of 3%-plus. Management also expect adjusted EPS growth in high single digits.

Prior to the release of the Q1 results, MDLZ stock was around $65. But at the time of writing, it was trading at $62.20, down around 4%. The current price supports a dividend yield of 2.25%.

What To Expect From Mondelez International Stock

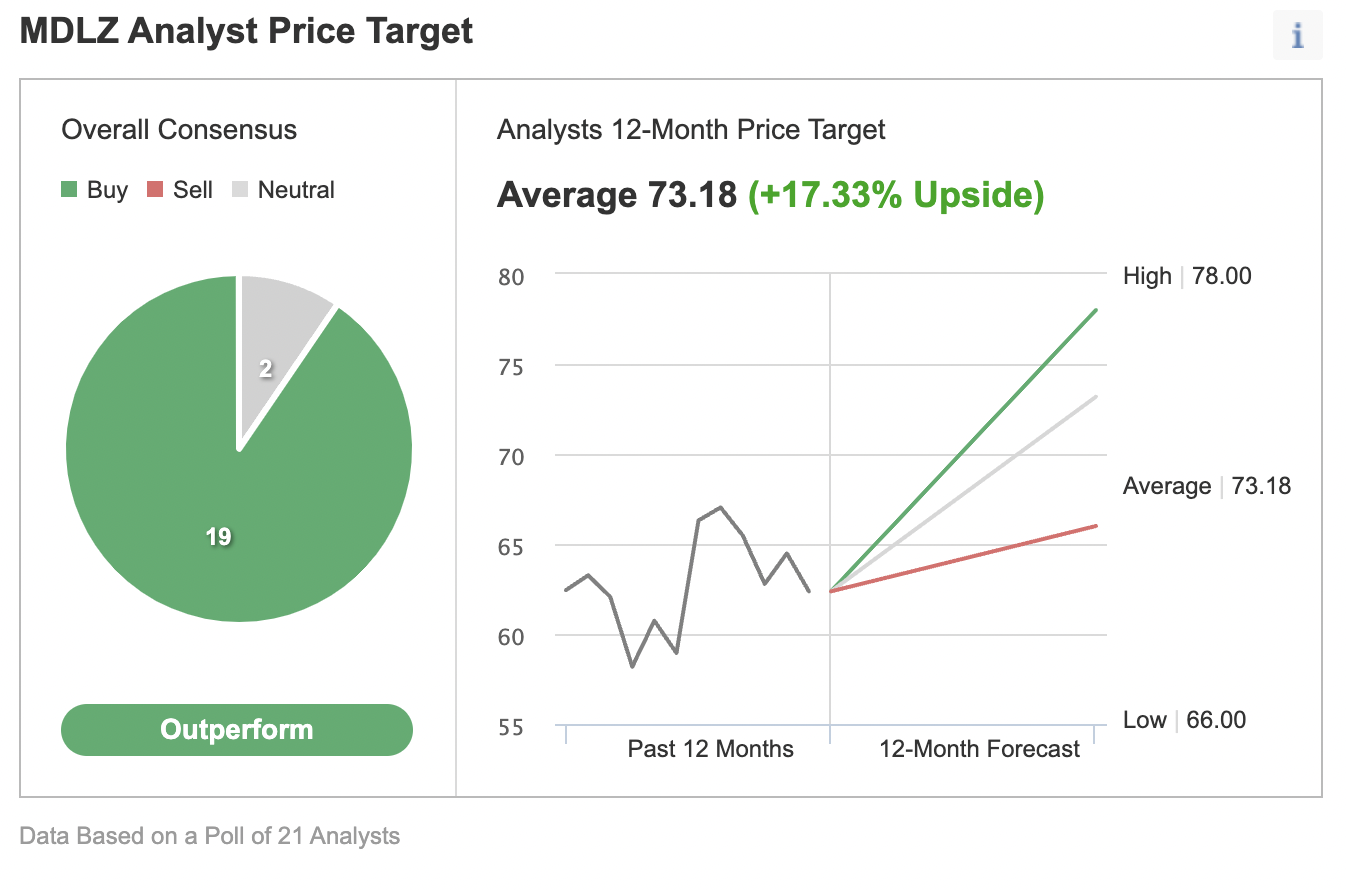

Among 21 analysts polled via Investing.com, MDLZ stock received an "outperform" rating.

Wall Street also has a 12-month median price target of $73.18 for the stock, implying an increase of more than 17% from current levels. The 12-month price range currently stands between $66 and $78.

Source: Investing.com

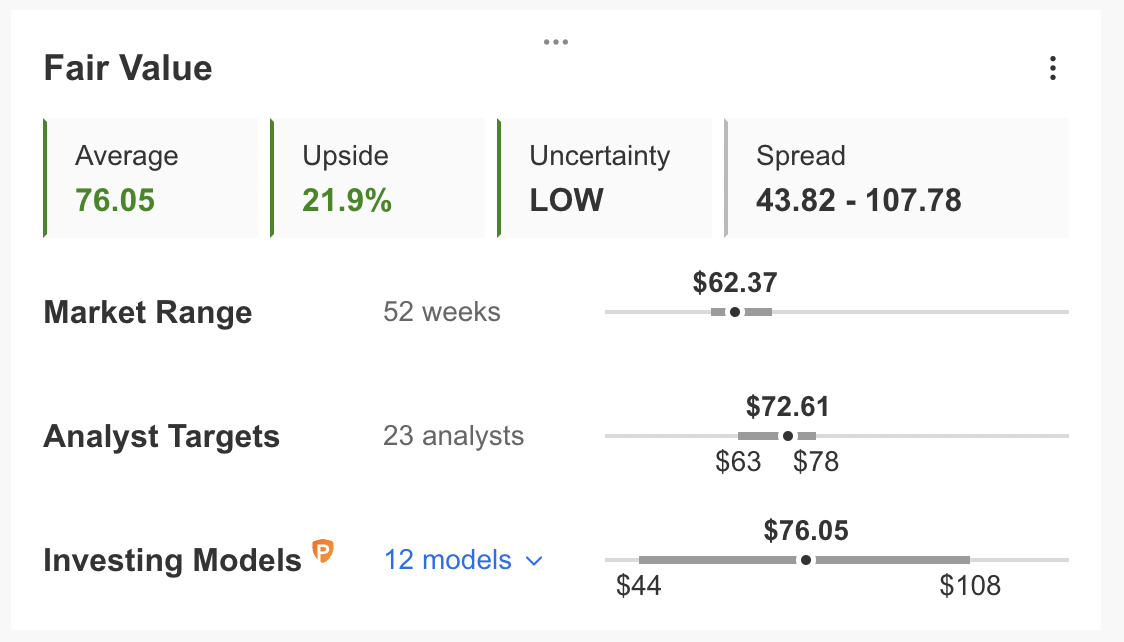

Similarly, according to a number of valuation models, like those that might consider P/E or P/S multiples or terminal values, the average fair value for MDLZ stock at InvestingPro stands at $76.05.

In other words, fundamental valuation suggests shares could increase about 22%.

Source: InvestingPro

We can also look at MDLZ’s financial health as determined by ranking more than 100 factors against peers in the consumer staples sector.

For instance, in terms of profit health, Mondelez International scores 4 out 5. Its overall score of 3 points is a good performance ranking.

At present, MDLZ’s P/E, P/B and P/S ratios are 20.6x, 3.1x and 2.9x. Comparable metrics for the sectors stand at 12.1x, 1.5x and 0.9x. These numbers show that despite the recent decline in price, the fundamental valuation for MDLZ stock is slightly on the frothy side.

Our expectation is for MDLZ stock to build a base between $60 and $65 in the coming weeks. Afterwards, shares could potentially start a new leg up.

Adding MDLZ Stock To Portfolios

Mondelez International bulls who are not concerned about short-term volatility could consider investing now. Their target price would be $73.18, or analysts’ forecast.

Alternatively, investors could consider buying an exchange-traded fund (ETF) that has MDLZ stock as a holding. Examples include:

- Consumer Staples Select Sector SPDR® Fund (NYSE:XLP)

- IQ Global Resources ETF (NYSE:GRES)

- Invesco S&P 500® Equal Weight Consumer Staples ETF (NYSE:RHS)

- Invesco S&P 500 Minimum Variance ETF (NYSE:SPMV)

Finally, investors who expect MDLZ stock to start a new leg up in the weeks ahead could consider setting up a bull call spread.

Most option strategies are not suitable for all retail investors. Therefore, the following discussion on MDLZ stock is offered for educational purposes and not as an actual strategy to be followed by the average retail investor.

Bull Call Spread On Mondelez International Stock

Intraday Price At Time Of Writing: $62.20

In a bull call spread, a trader has a long call with a lower strike price and a short call with a higher strike price. Both legs of the trade have the same underlying stock (i.e. Mondelez International) and the same expiration date.

The trader wants MDLZ stock to increase in price. In a bull call spread, both the potential profit and the potential loss levels are limited. The trade is established for a net cost (or net debit), which represents the maximum loss.

Today’s bull call spread trade involves buying the July 15 expiry 62.50 strike call for $1.95 and selling the 67.50 strike call for $0.35.

Buying this call spread costs the investor around $1.60, or $160 per contract, which is also the maximum risk for this trade.

We should note that the trader could easily lose this amount if the position is held to expiry and both legs expire worthless, i.e., if the MDLZ stock price at expiration is below the strike price of the long call (or $62.50 in our example).

To calculate the maximum potential gain, we can subtract the premium paid from the spread between the two strikes, and multiply the result by 100. In other words: ($5 – $1.60) x 100 = $340.

The trader will realize this maximum profit if the Mondelez International stock price is at or above the strike price of the short call (higher strike) at expiration (or $67.5 in our example).

Bottom Line

Since January, Mondalez stock has faced headwinds but the decline has improved the margin of safety for buy-and-hold investors who could consider investing in the snack giant soon.

Alternatively, experienced traders could also set up an options trade to benefit from a potential run-up in the price of MDLZ stock.

***

Interested in finding your next great stock or ETF idea? InvestingPro+ gives you the chance to screen through 135K+ stocks to find the fastest growing or most undervalued stocks in the world, with professional data, tools, and insights. Learn More »