Stifel maintains Buy rating on Contineum Therapeutics stock despite MS trial failure

- The Nasdaq could continue rallying

- InvestingPro's 'Technology Gems' strategy is for those looking to gain from it

- Using the strategy, I identified three stocks poised to rally along with the index

The Nasdaq has had a brilliant 2023 so far, rallying almost 27% since the start of the year. But, if the rally continues, there are better ways to gain from it than buying ETFs or index funds.

This is where InvestingPro comes in. The tool allows users to explore various investment strategies that filter out companies based on specific criteria. Readers can do the same research for every hot market topic by clicking on the following link: Sign up and start your free trial today!

For example, those looking to identify stocks likely to soar with the index can use the 'Technology Gems' strategy.

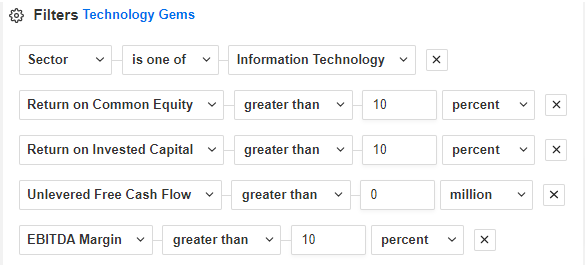

This strategy aims to identify opportunities using the following criteria:

Source: InvestingPro

The selection process has identified over 200 US stock market companies that meet the criteria as potential investment opportunities.

But three companies stand out and are worth considering for your portfolio. Let's take a deeper dive into these companies' current status and prospects.

1. Broadcom

With about 75% of its revenue coming from the semiconductor sector, Broadcom (NASDAQ:AVGO) is poised to capitalize on the ongoing semiconductor boom.

Last month, the Silicon Valley-based company's stock surged, reaching new record highs around $915. This surge is a reflection of the current upward trend in the market.

After a strong rebound, Broadcom stock is currently undergoing a consolidation phase, as expected.

This may result in a corrective pattern, with a potential price range of $680-700 per share. The key support level, confirmed by the upward trend line, falls within this range.

From a fundamental perspective, the company has demonstrated robust performance, with consistent revenue and net profit growth since 2020.

This provides a solid foundation for the continuation of the upward trend, following the recent correction in the stock price.

Source: InvestingPro

2. KLA Corporation

KLA Corporation (NASDAQ:KLAC), a semiconductor company, specializes in developing control systems and performance management tools for manufacturing processes.

It collaborates closely with NVIDIA (NASDAQ:NVDA), benefiting from the chipmaker's rally in May after publishing optimistic forecasts for the next quarter.

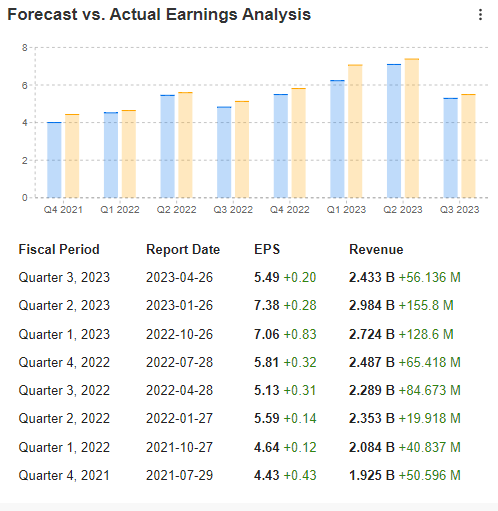

The company stands out for consistently exceeding quarterly earnings forecasts and its stock's upward momentum.

Source: InvestingPro

It is worth keeping these in the back of your mind ahead of the earnings release next month.

3. Adobe

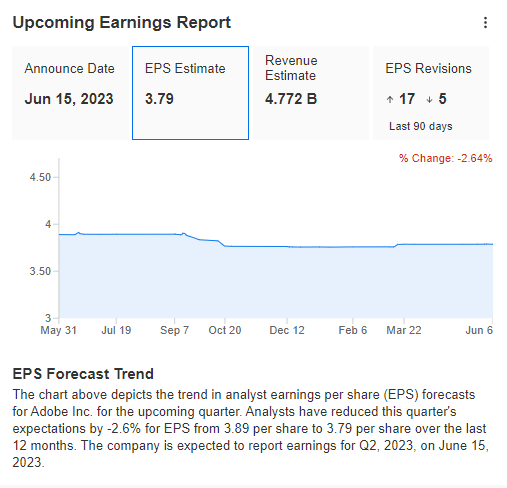

Adobe (NASDAQ:ADBE) is scheduled to release its Q1 2023 results next week on Thursday. Analysts' forecasts indicate an expected EPS (earnings per share) of $3.79 and revenues of $4.772 billion.

Source: InvestingPro

The company's stock price is currently at a critical juncture as it tests a key resistance near $440.

The successful breakthrough and continuation of an upward move will depend on the Federal Reserve's decision at the upcoming meeting and the absence of any negative surprises in the upcoming financial report.

Considering the dynamics of the demand impulse, the most probable scenario from a technical perspective is a breakout followed by a continuation toward $530.

InvestingPro tools assist savvy investors in analyzing stocks. By combining Wall Street analyst insights with comprehensive valuation models, investors can make informed decisions while maximizing their returns.

Start your InvestingPro free 7-day trial now!

***

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling, or investment recommendation. As such, it is not intended to incentivize the purchase of assets in any way. I want to remind you that any asset is highly risky and evaluated from multiple points of view; therefore, any investment decision and the associated risk remain with the investor.