Top U.S. Defense Stocks to Watch According to Jefferies Analysis

- LLY, one of the best-performing pharma stocks in 2021, was down over 6% in the first week of the new year.

- Wall Street concurs that innovation across its core therapeutic areas has meant increased revenue and EPS numbers for Eli Lilly.

- Long-term investors could consider buying the dips in Lilly shares, especially if they decline toward $250 or below.

Shares of pharma giant Eli Lilly and Company (NYSE:LLY) returned almost 56% in the past year. Yet, LLY stock has declined over 6% since the beginning of the year.

On Jan. 7, shares ended the week at $259.50. For comparison, the Dow Jones U.S. Pharmaceuticals Index is up 18.2% over the past 12 months but lost close to 2% in the first week of 2022.

On Dec. 16, LLY shares came close to $284, and hit a record high. The stock’s 52-week range has been $161.78 - $283.80, while the market capitalization (cap) stands at $248.2 billion.

Eli Lily focuses on four therapeutic areas: diabetes and obesity, immunology, oncology and neuroscience. It also has an antibody treatment against COVID-19, to which the U.S. Food and Drug Administration (FDA) has granted Emergency Use Authorization (EUA).

Management released its Q3 figures on Oct. 26. Revenue of $6.78 billion increased 18% year-over-year. When excluding revenue from COVID-19 therapies, the top line increase was 11% during the same period. On a non-GAAP basis, net income increased 37% YOY to $1.764 billion, while adjusted EPS increased 38% YOY and came in at $1.94. A year ago, comparable metrics had been $1.29 billion and $1.41.

On the results, CEO David A. Ricks said:

”Lilly demonstrated strong performance again this quarter. Revenue attributable to our newer medicines grew more than 35% and represented nearly 60% of our core business, an important indicator of our long-term growth potential.”

Meanwhile, on Dec. 15, the Indianapolis, Indiana-based company said it expected 2021 revenue to be between $28.0-$28.3 billion and adjusted EPS to come in the range of $8.15-$8.20. For this year, on the other hand, Lilly expects 2022 top line to be between $27.8-$28.3 billion and EPS to be $8.50-$8.65.

Prior to the release of the quarterly results in late October, Lilly shares were trading around $248. Then, on Dec.16, it saw a record high of $283.90. But shares finished the first trading week of 2022 at $259.50. At the current price, the stock has a dividend yield of 1.51%.

What To Expect From Eli Lilly Stock

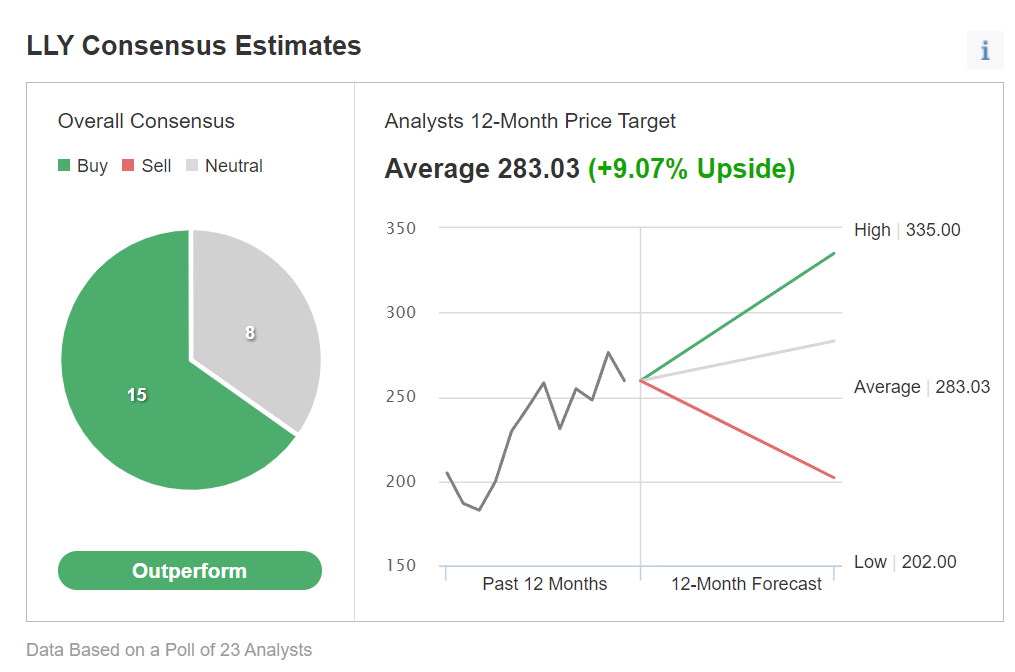

Among 23 analysts polled via Investing.com, LLY stock has an “outperform" rating.

Chart: Investing.com

Analysts also have a 12-month median price target of $283.03 on the stock, implying an increase of about 9% from current levels. The 12-month price range currently stands between $202 and $335.

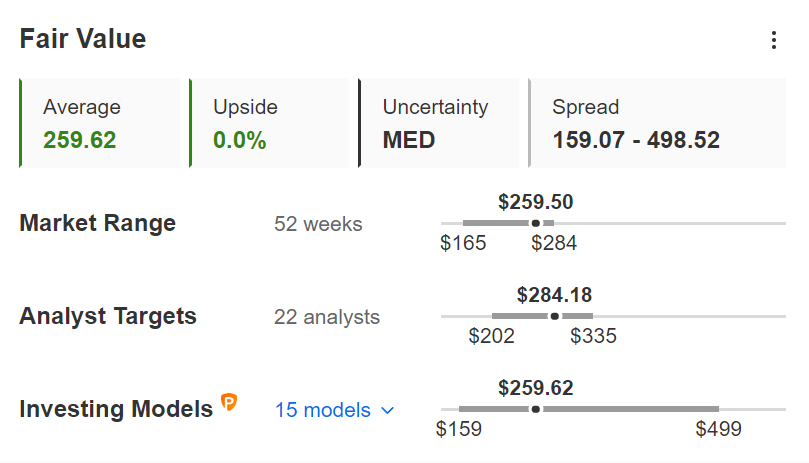

Source: InvestingPro

However, according to a number of valuation models, like those that might consider P/E or P/S multiples, dividends or terminal values, the average fair value for LLY stock via InvestingPro stands at $259.62. In other words, most of the potential good news has likely already been baked into the Eli Lilly share price.

Meanwhile, we can look at the company’s financial health as determined by ranking more than 100 factors against peers in the healthcare sector. In terms of profit and price momentum health, Eli Lilly scores 4 out of 5 (top score). But growth and cash flow stand at 3. Its overall performance is rated “great.”

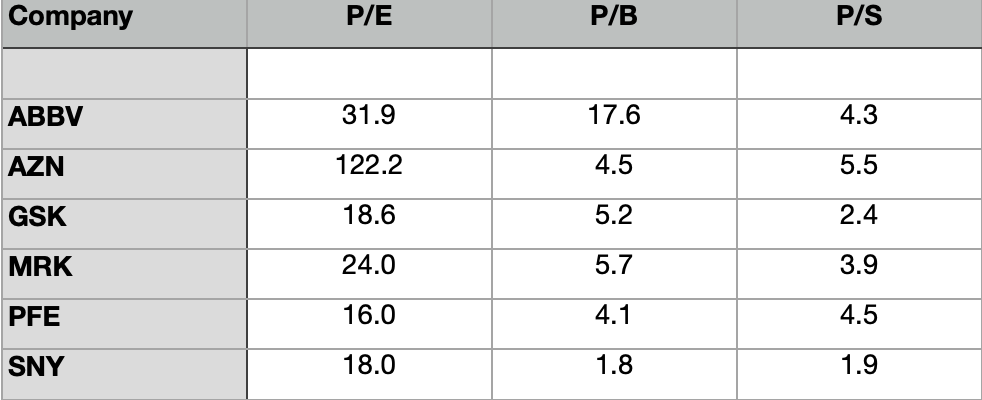

At present, P/E, P/B and P/S ratios for LLY stock are 39.4x, 30.3x and 8.5x. By comparison, those metrics for the peers stand at 16.6x, 4.7x and 4.0x. Put another way, Eli Lilly stock looks frothy compared to the average metrics in the healthcare sector.

We can also look at comparable ratios for several other pharma names via the chart above, such as AbbVie (NYSE:ABBV), AstraZeneca (NASDAQ:AZN), GlaxoSmithKline (NYSE:GSK), Merck (NYSE:MRK), Pfizer (NYSE:PFE) and Sanofi (NASDAQ:SNY).

As these numbers highlight, fundamental values differ significantly across the sector. Therefore, readers who want to invest in individual healthcare names should do further due diligence before hitting the ‘buy’ button.

During the rest of January, we expect LLY stock to slide toward $250, after which it should trade sideways, possibly between $240 and $260. As a reminder, the company is set to announce its Q4 financials on Thursday, Feb. 3, before the opening bell. Therefore, volatility could increase in the first week of February as Wall Street digests the quarterly metrics.

Adding Eli Lilly Stock To Portfolios

LLY bulls with a two- to three-year horizon who are not concerned about short-term volatility could consider buying into the declines. The target would be $283.03, analysts' consensus expectation.

Alternatively, investors could consider buying an exchange traded fund (ETF) that has LLY as a holding. Examples would include:

- Invesco Dynamic Pharmaceuticals ETF (NYSE:PJP)

- Global X Aging Population ETF (NASDAQ:AGNG)

- iShares MSCI USA Momentum Factor ETF (NYSE:MTUM)

- ETC 6 Meridian Hedged Equity-Index Option Strategy ETF (NYSE:SIXH)

Finally, those who are experienced with options strategies and believe there could be further declines in Eli Lilly shares might prefer to do a bear put spread.

Most option strategies are not suitable for most retail investors. Therefore, the following discussion is offered for educational purposes and not as an actual strategy to be followed by the average retail investor.

Bear Put Spread On LLY Stock

Current Price: $259.50

In a bear put spread, a trader has a long put with a higher strike price as well as a short put with a lower strike price. Both legs of the trade have the same underlying stock (i.e. Eli Lilly here) and the same expiration date.

The trader wants LLY stock to decline in price. However, in a bear put spread, both the potential profit and the potential loss levels are limited.

Here's an example:

For the first leg of this strategy, the trader might buy an at-the-money (ATM) or slightly out-of-the-money (OTM) put option, like the LLY Feb. 18, 2022, 250-strike put option. This option is currently offered at $6.75. It would cost the trader $675 to own this put option, which expires in slightly over a month.

For the second leg of this strategy, the trader sells a put, like the LLY Feb. 18, 2022, 240-strike put option. This option’s current premium is $3.90. The option seller would receive $390, excluding trading commissions.

Maximum Risk

In our example, the maximum risk will be equal to the cost of the spread plus commissions. Here, the net cost of the spread is $2.85 ($6.75 – $3.90 = $2.85).

As each option contract represents 100 shares of the underlying stock, i.e. LLY, we’d need to multiply $2.85 by 100, which gives us $285 as the maximum risk.

The trader could easily lose this amount if the position is held to expiry and both legs expire worthless, i.e., if the Eli Lilly stock price at expiration is above the strike price of the long put (or $250.00 in our example).

Maximum Profit Potential

In a bear put spread, potential profit is limited to the difference between the two strike prices minus the net cost of the spread plus commissions.

So in our example, the difference between the strike prices is $10.00 ($250.00 – $240.00 = $10.00). And as we’ve seen above, the net cost of the spread is $2.85.

The maximum profit, therefore, is $7.15 ($10.00 – $2.85 = $7.15) per share less commissions. When we multiply $7.15 by 100 shares, the maximum profit for this option strategy comes to $715.

The trader will realize this maximum profit if the price of LLY stock is at or below the strike price of the short put (lower strike) at expiration (or $240.00 in our example).

Investors who have traded options before are likely to know that short put positions are typically assigned at expiration if the stock price is below the strike price (i.e., $240.00 here). However, there is also the possibility of early assignment. Therefore, the position would need monitoring up until expiration.

Break-Even LLY Price At Expiration

Finally, we should also calculate the break-even point for this trade. At that price, the trade will not gain or lose any money.

At expiration, the strike price of the long put (i.e., $250.00 in our example) minus the net premium paid (i.e., $2.85 here) would give us the break-even LLY price.

In our example: $250.00 − $2.85 = $247.15 (minus commissions).

Bottom Line

Long-term shareholders in Eli Lilly have seen excellent returns in the past several years. Wall Street credits innovation across its main therapeutic areas for the success of the group.

However, LLY stock started 2022 on a down note. We can possibly expect the volatility in the share price to continue for several more weeks as the company gets ready to report Q4 earnings. However, later in the year, shares of Eli Lilly should start a new leg higher.