European stocks mixed on Friday after volatile week; U.K. economic woes

- The tech-heavy Nasdaq enters the second half of 2025 near record highs.

- While mega-cap tech stocks have dominated the market, lesser-known companies with strong fundamentals and favorable tailwinds are emerging as compelling buys.

- Consequently, mentioned in this article are five standout Nasdaq-listed gems poised for further upside in the latter half of 2025.

- Looking for more actionable trade ideas? Subscribe now to unlock access to InvestingPro’s AI-selected stock winners for up to 50% off amid the summer sale.

As the Nasdaq Composite enters the second half of 2025 near record highs, investors looking beyond the mainstream mega-cap names have a wealth of opportunities to diversify their portfolios with high-potential tech stocks.

Source: Investing.com

As such, here are five standout Nasdaq-listed gems—Cisco (NASDAQ:CSCO), Fortinet (NASDAQ:FTNT), Shopify (NASDAQ:SHOP), Monolithic Power (NASDAQ:MPWR) Systems, and Jabil Circuit (NYSE:JBL)—poised for further upside in the latter half of 2025. These companies offer a mix of innovation, undervaluation, and exposure to high-growth sectors like cybersecurity, e-commerce, AI, and networking.

Below, we explore why these stocks are strong buys and the tailwinds driving their potential as the back half of the year begins.

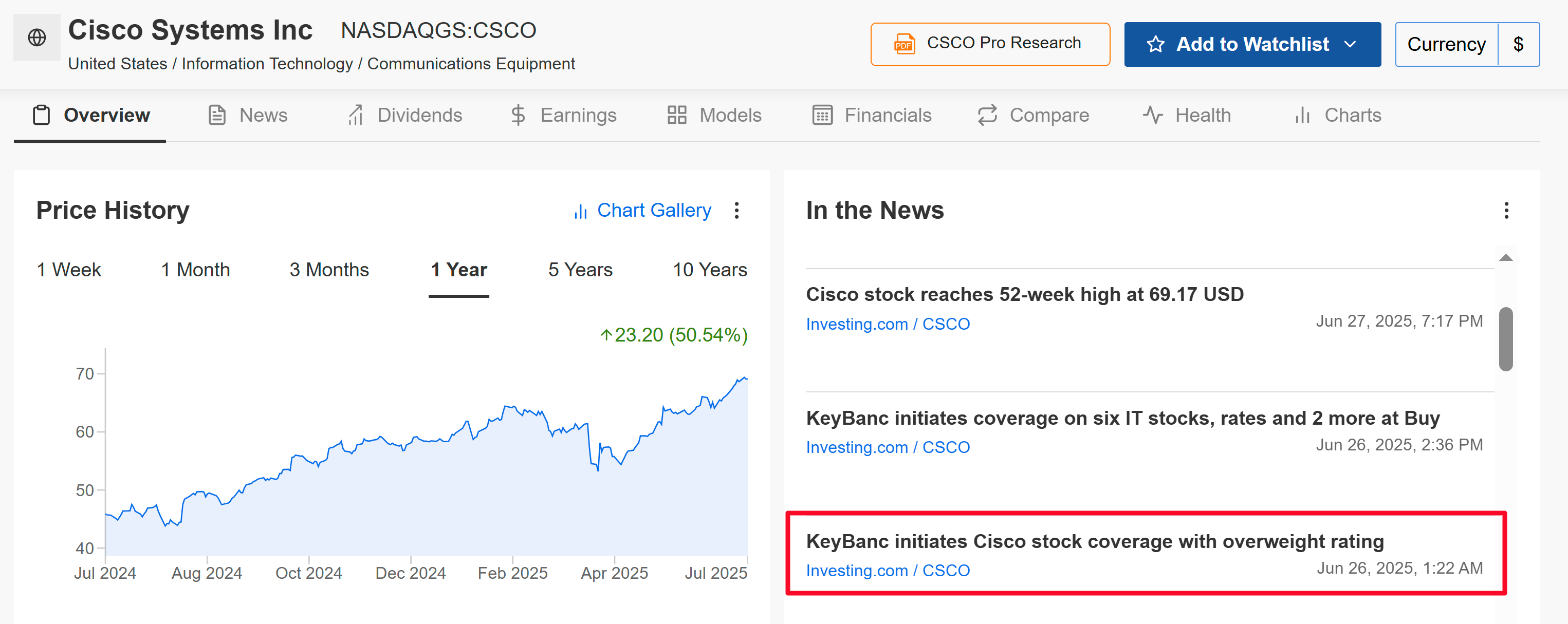

1. Cisco: Networking Giant on the Edge of Transformation

Cisco Systems may not be the flashiest, but its 50% year-on-year gain proves its staying power as it pivots toward software and recurring revenue. The tech giant is reinventing itself as a leader in AI-driven networking and security, drawing praise from analysts.

Source: InvestingPro

Investors are increasingly attracted to Cisco’s stability, consistent dividends, and ability to adapt—making it a “Buy” call for those seeking both growth and resilience as tech markets evolve.

Trading at a forward P/E of around 17, Cisco is substantially undervalued compared to tech peers, offering both growth and value. Its stable dividend yield (~2.5%) adds appeal for income-focused investors.

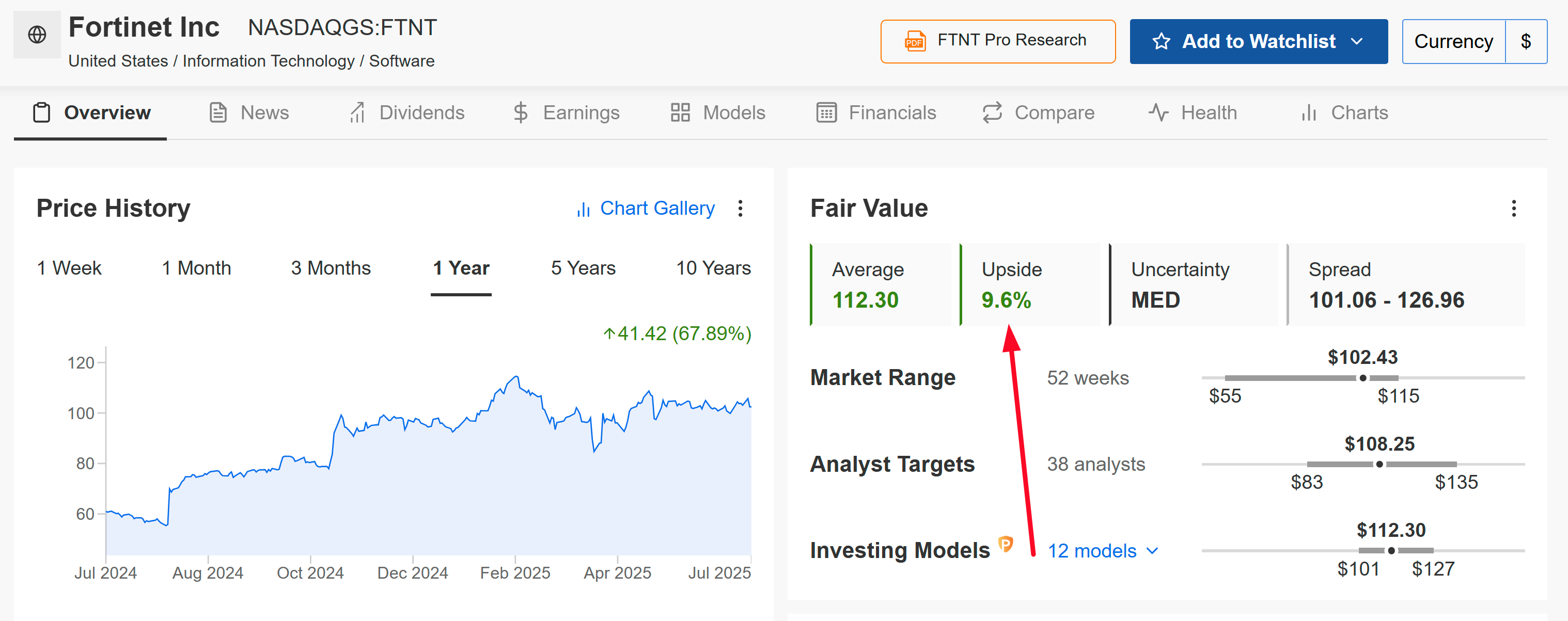

2. Fortinet: Cybersecurity Standout with Robust Growth

Fortinet, a leading cybersecurity solutions provider, is a standout due to its undervaluation and robust growth prospects. The company’s stock hit a record high of $114.82 in February, with an impressive 67.9% gain in the past year, yet Investing.com’s AI-backed models suggest it remains undervalued with a ‘Fair Value’ of $112.30, implying a 9.6% upside from recent levels.

Source: InvestingPro

This cybersecurity powerhouse remains a favorite as enterprises ramp up their digital defenses amid a surge in AI-driven threats and regulatory demands. With its broad product suite and expanding service margins, Fortinet’s steady revenue growth and healthy free cash flow keep it firmly in “Strong Buy” territory.

The rest of the year looks promising as organizations worldwide prioritize network security, a tailwind that isn’t fading anytime soon.

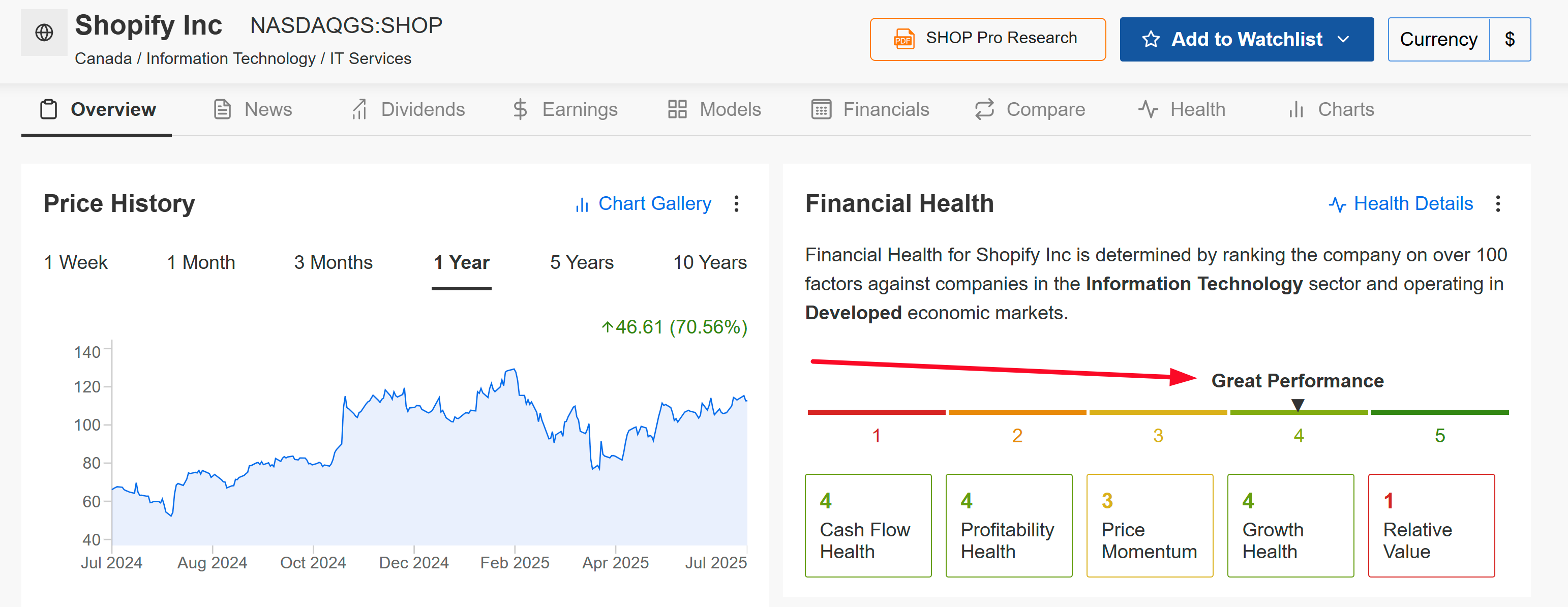

3. Shopify: E-Commerce Ecosystem Leader

Shopify is up a robust 70.5% over the last 12 months, riding the wave of e-commerce expansion and global merchant adoption.

Source: InvestingPro

Investors are drawn to the company’s great financial health, double-digit revenue growth and its ability to monetize AI-powered tools for merchants. Shopify’s international strength, robust free cash flow margins, and a “Buy” analyst consensus highlight its leadership in the e-commerce infrastructure space.

As digital retail continues to evolve, Shopify’s platform upgrades and strategic partnerships position it for further upside in the second half. Trading at a forward P/E ratio lower than its historical average, Shopify offers a compelling entry point for growth investors.

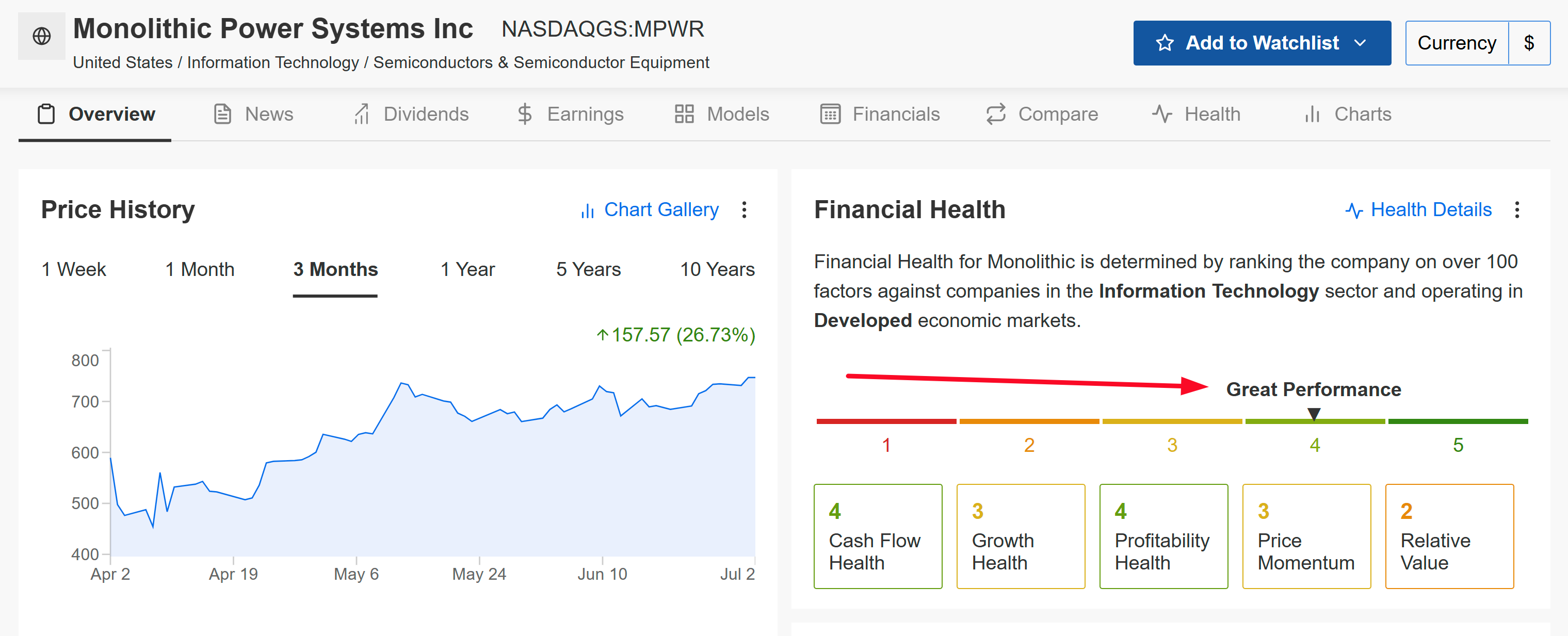

4. Monolithic Power Systems: Powering the AI and Data Center Boom

Monolithic Power Systems continues to outperform with a 26.7% return in the second quarter, fueled by its dominance in high-efficiency power solutions and optimism about its AI and automotive exposure.

Source: InvestingPro

Despite competition from Nvidia (NASDAQ:NVDA), Monolithic’s specialized chips for power-efficient systems are in high demand as data centers and electric vehicles scale. Its relentless innovation and margin expansion are drawing institutional interest, and with secular trends in electrification and AI infrastructure, Monolithic Power’s growth runway looks far from exhausted as H2 2025 begins.

Further, the company’s focus on R&D ensures it remains competitive in next-generation technologies.

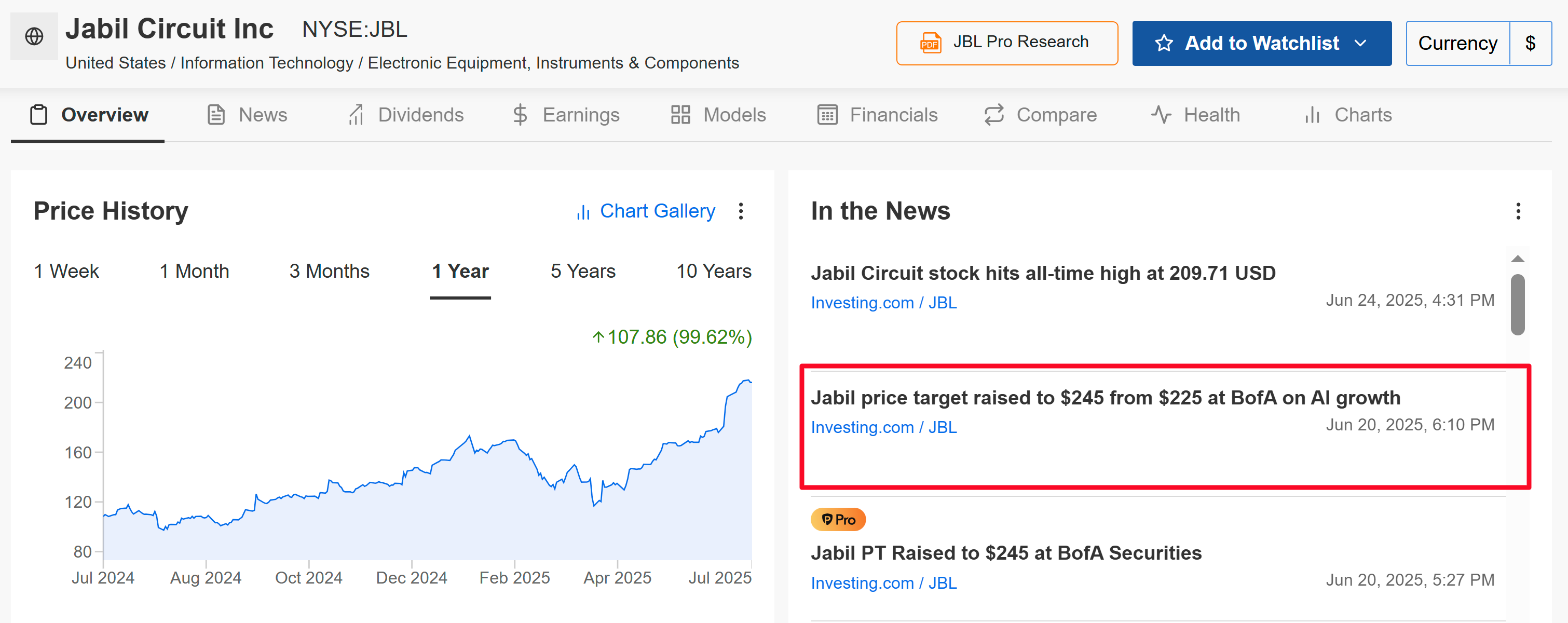

5. Jabil: Unsung Hero of Advanced Manufacturing

Jabil is quietly surging, up a massive 99.6% in the past year, as it leverages secular demand for advanced manufacturing and hardware across multiple industries. Jabil’s diversified client base, from electronics to healthcare, and its agility in adopting AI-driven automation have set it apart.

Source: InvestingPro

Analysts see more upside ahead as the company continues to win new contracts and expand its margin profile, making it a compelling “Strong Buy” as the second half of 2025 kicks off.

Trading at a forward P/E ratio of ~20, Jabil is cheap relative to its growth prospects, with analysts forecasting 15% EPS growth for 2025 amid strong demand for its manufacturing expertise in high-growth sectors like AI servers and electric vehicles.

Conclusion

Each of these five tech gems is well-positioned for continued momentum into late 2025, backed by secular growth trends in cybersecurity, e-commerce, AI infrastructure, networking, and global manufacturing.

For investors seeking tech exposure beyond the mega-caps, these stocks provide a compelling blend of innovation, financial strength, and clear catalysts for further upside.

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. Whether you’re a novice investor or a seasoned trader, leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the current market backdrop.

- ProPicks AI: AI-selected stock winners with proven track record.

- InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

- Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

- Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR® S&P 500 ETF (SPY), and the Invesco QQQ Trust ETF (QQQ). I am also long on the Invesco Top QQQ ETF (QBIG), and Invesco S&P 500 Equal Weight ETF (RSP).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies’ financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Follow Jesse Cohen on X/Twitter @JesseCohenInv for more stock market analysis and insight.