Asia stocks rise as Dec rate cut bets resurface; China lags on chipmaker losses

Trump’s landslide victory sparks a USD $50 million win for a French bettor, while the S&P 500 sees its biggest surge in two years! Each week, the Syz investment team takes you through the last seven days in seven charts.

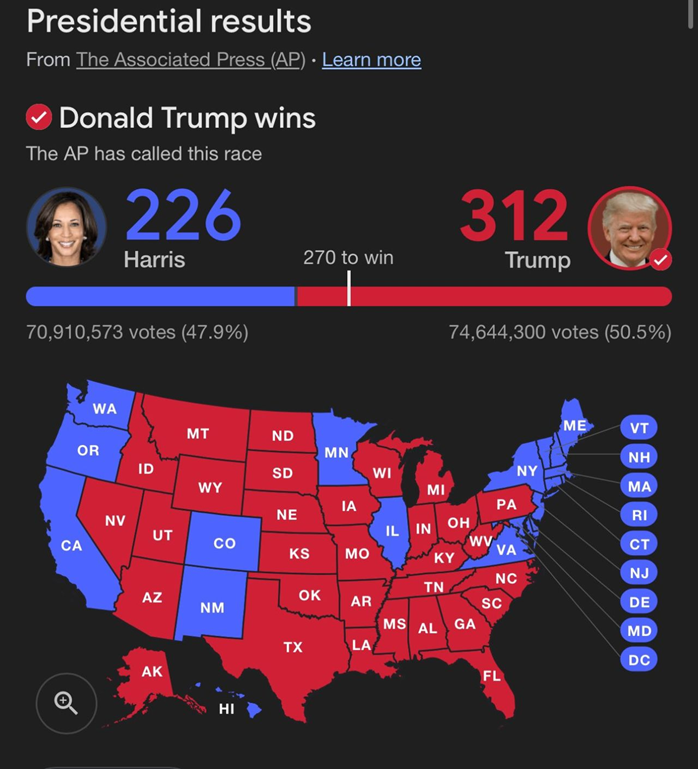

1. A Landslide Victory for Trump

Here is the final map of the states won by the two candidates and the number of electoral votes obtained.

- Trump won 312 delegates to Harris's 226. This is a very comfortable score, higher than Biden's in 2020 (306 delegates) and Trump's own in 2016 (304).

- Trump won 7 out of the 7 "Swing States" (Arizona / North Carolina / Georgia / Michigan / Nevada / Pennsylvania / Wisconsin).

- Trump easily won the popular vote with 4.650.000 more votes than Kamala Harris.

Another victory for Trump: the Republicans took control of the Senate, previously in Democratic hands. The final unknown is the House of Representatives, where Republicans seem likely to have a majority given the strong Republican momentum in the presidential and senatorial elections.

According to online betting site Polymarket, there is a 97% probability that Republicans will also win a majority in the House of Representatives.

2. A Frenchman Wins USD $50 Million Betting on Trump's Victory

Online betting site Polymarket made headlines last week: a Frenchman, who made his fortune in the financial markets, took advantage of the presidential election to try his luck by betting on Donald Trump's victory back in mid-October. The bet took place on the Polymarket platform. The former trader was convinced that the Republican candidate was underestimated in the polls. He therefore bet USD $30 million on the Republican, a good portion of his considerable fortune. The result: Trump won, and the Frenchman pocketed USD $80 million, a profit of USD $50 million.

The Wall Street Journal interviewed the “whale” after the election, and he explained the secret of the method that enabled him to bet such a large sum of money with a very high level of certainty regarding his winning odds. It's called “neighbor polls”.

“Traditional polls don't take into account the fact that many respondents prefer not to admit they're voting for Trump,” said Theo, an alias he gave to the WSJ. Either Trump supporters were reluctant to tell pollsters they supported the former president, or they didn't want to participate in polls, Theo wrote.

To solve this problem, Theo believes pollsters should use so-called neighborhood polls, which ask respondents which candidates they think their neighbors will support. The idea is that people don't want to reveal their own preferences, but reveal them indirectly when asked to guess who their neighbors intend to vote for.

Theo cited a handful of public polls conducted in September using the neighbor method alongside the traditional method. These polls showed that support for Harris was several percentage points lower when respondents were asked who their neighbors would vote for, compared to the result when they were asked directly which candidate they supported.

The former trader stated that he had made the bet purely from a financial perspective, without seeking to make a political statement

It is interesting to note that France's gambling regulator is considering banning cryptocurrency prediction platform Polymarket, which made headlines due to user demand around the 2024 US Presidential election.

The French National Gaming Authority (ANJ) is investigating Polymarket's operation and compliance with French gambling laws, Bloomberg reported on 7 November.

Source: Bloomberg

3. S&P 500 Records Most Spectacular Jump in 2 Years

While Trump's victory was already considered a foregone conclusion before the US markets opened, US equity markets saw substantial gains during Wednesday's session, with the S&P 500 up by almost 3%. The market is probably anticipating the possible consequences of Donald Trump's election and a possible triple victory for the Republicans, across the Presidency, Senate and Congress.

Note that this is only the fifth time since 1960 that the S&P 500 has recorded a gain in excess of 2.5% while hitting a new all-time high. The last time this occurred was on 21 March 2000.

Source: Bloomberg

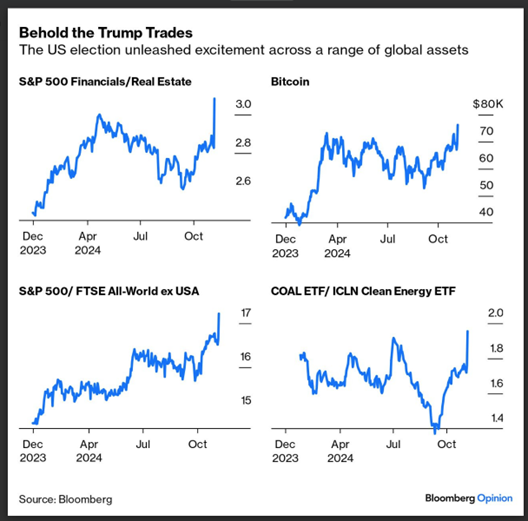

4. The Big Winners From Trump's Election: Banks, Cryptocurrencies, US Equities, Coal, etc.

During Wednesday's session, the assets that recorded the strongest gains were typically those directly and indirectly linked to its program. Some of these appear in the chart below.

Investors believe that Trump's election is particularly good for banks, thanks in large part to deregulation. On the other hand, it would be very bad for real estate (which is his domain); this sector could suffer from a rise in rates. His election benefits crypto-currencies, US equities (relative to the rest of the world), and coal stocks (to the detriment of clean energy).

Source: Bloomberg

5. Bitcoin Hits a New High and Outperforms Gold

Cryptocurrencies are also benefiting from the Trump effect, the 1st openly pro-cryptocurrency US President in history. Bitcoin reached a high of USD $76,000 in the 2nd half of the week. At the same time, gold suffered some profit-taking. As a result, Bitcoin's evolution relative to gold broke the downtrend that had been in place since March of this year. Note that Bitcoin's outperformance movements against gold tend to be relatively abrupt.

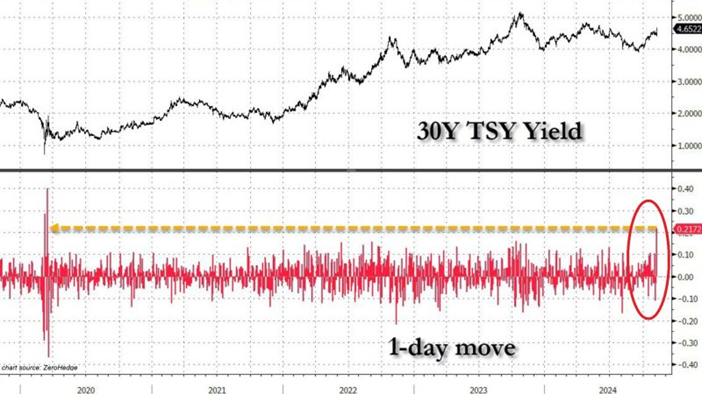

6. US 30-Year Treasury Yields Soar

On Wednesday, the yield on 30-year US Treasuries jumped 22 basis points, the highest since the Covid crisis. At the same time, the 10-year yield rose by 16 basis points, reaching its highest level since July.

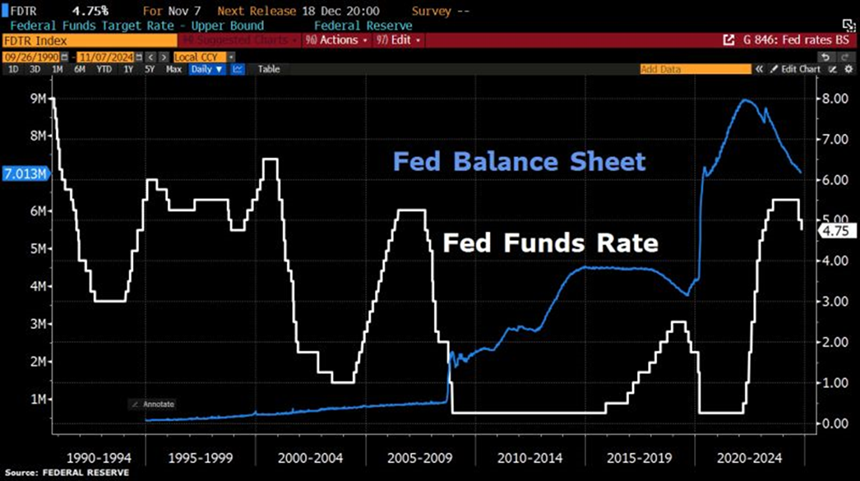

7. The Fed Cuts Its Rates, And Jay Powell Keeps His Job (for now…)

On Thursday, the U.S. Federal Reserve cut key interest rates by a quarter of a percentage point. This latest cut, which places rates in the 4.50% to 4.75% range, follows the half-point cut in September - the first since March 2020. During the press conference, the Fed chief noted that while headline inflation has moved closer to the central bank's target, core inflation is still “somewhat elevated”. Powell said economic activity “has continued to expand at a solid pace”, referring to strong GDP data and “robust” labour market reports.

“We don't think this is the right time to give a lot of guidance about the future. As the Fed moves closer to neutrality, it may be appropriate to slow the pace of recalibration,” he adds.

Questioned during the press conference, Jerome Powell also assured the audience that he would not resign before the end of his mandate, should the White House ask him to do so. He also pointed out that the law “does not allow” Fed governors to be fired. These comments come after Donald Trump signaled in July, after sowing doubt, that he would let Jerome Powell complete his term as Fed Chairman, which ends in May 2026.

Source: Bloomberg