SoftBank Group Q2 profit blows past expectations; sells Nvidia stake for $5.8 bln

While momentum and value are often seen as opposing strategies, the highest-yielding opportunities tend to emerge where the two converge — in undervalued assets showcasing significant momentum.

With markets hovering near record highs and uncertainty looming large, chasing overpriced names can be risky. When corrections occur, it’s often the most overvalued stocks—those trading far above their intrinsic value—that undergo a pullback first.

In this article, we aim to identify US stocks that fit this profile, utilizing the Investing.com screener. Specifically, we will take advantage of the predefined "High-beta stocks" screen to find stocks that meet these criteria.

How To Access the Predefined "High-Beta Stocks" Screen?

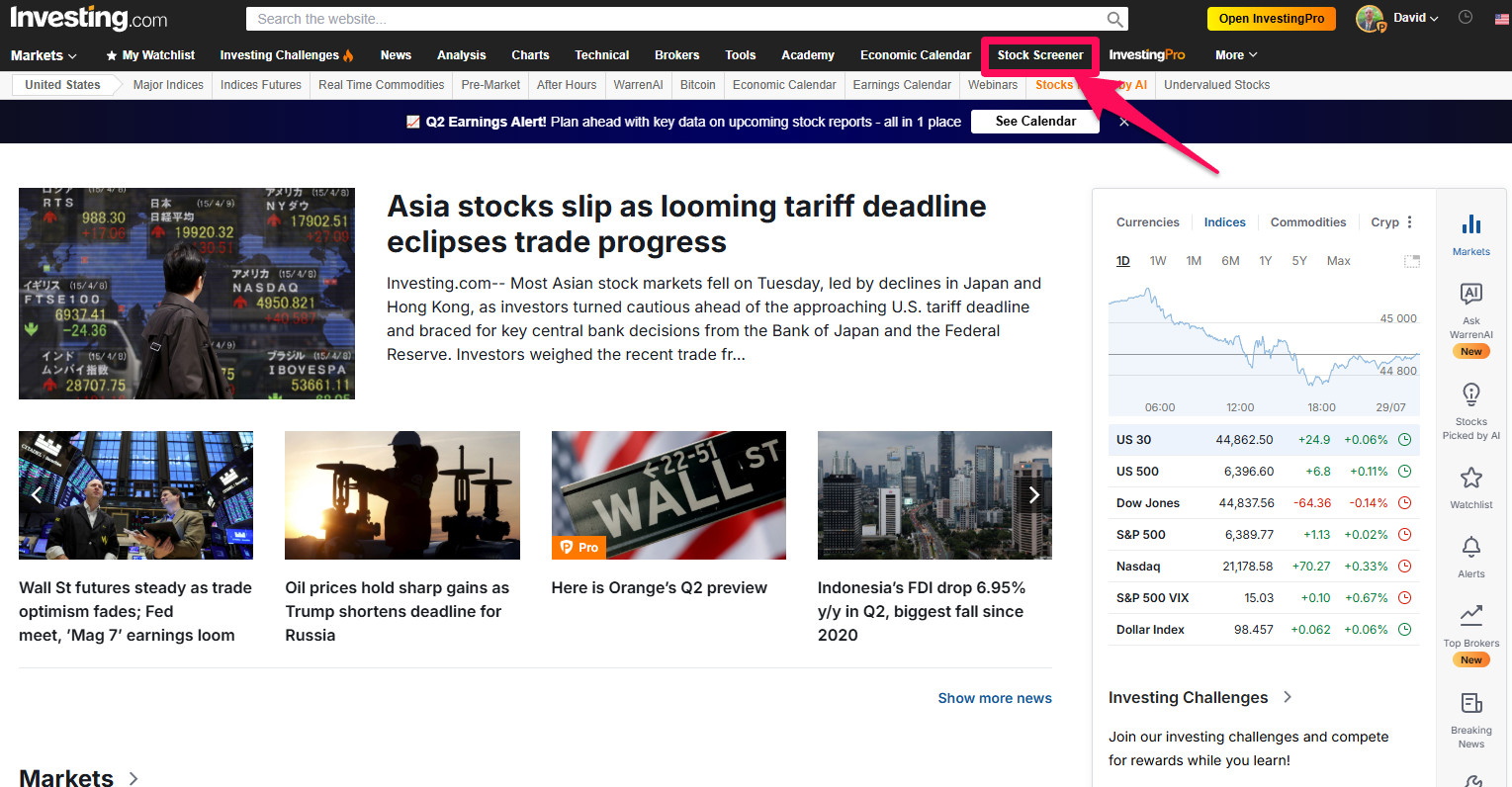

To access the screener, navigate to the Investing.com home page and click the stock screener button located at the top of the page.

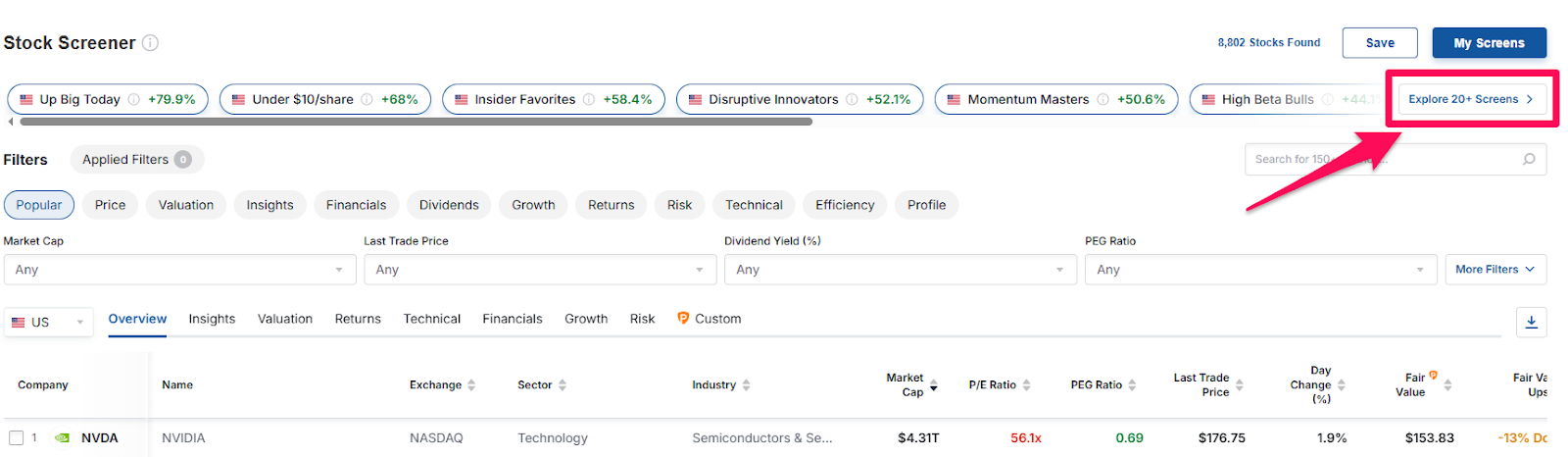

The Investing.com screener offers over 20 pre-configured searches. These searches can be used as they are, but can also be customized and modified as required.

Beginners can get their feet wet, while experts can use these preconfigured searches as a time-saving basis.

These pre-configured searches can be accessed by clicking on the "Explore 20+ screens" button at the top of the screener:

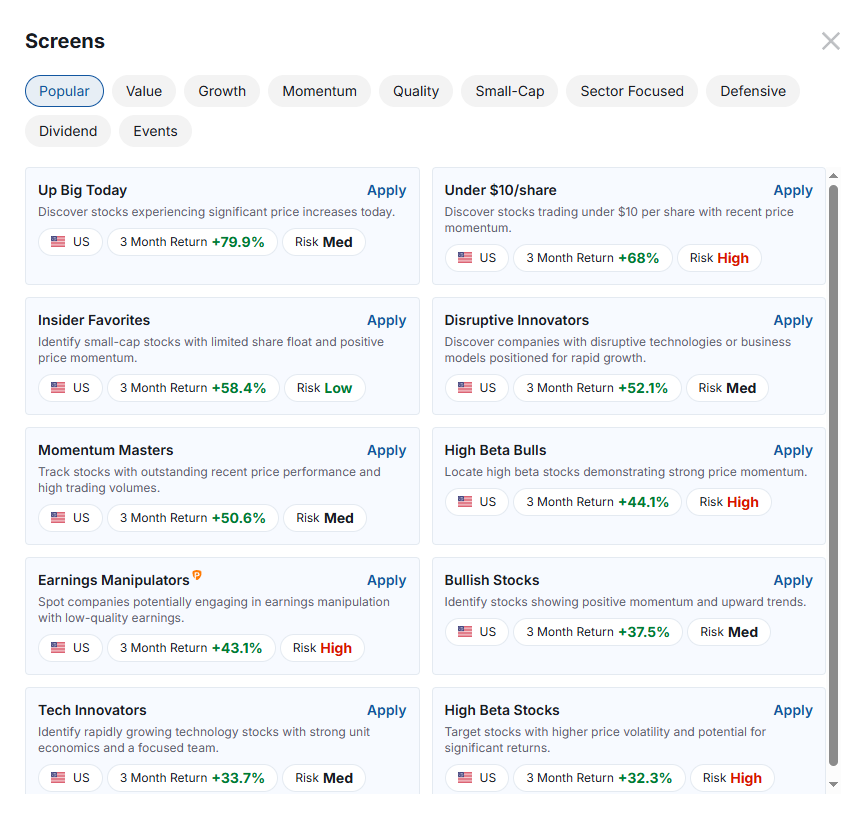

This will take you to the catalog of available screens:

Note: Some pre-configured searches are available free of charge, while others are reserved for InvestingPro, Pro+ plan subscribers.

10 High-Beta Undervalued Stocks

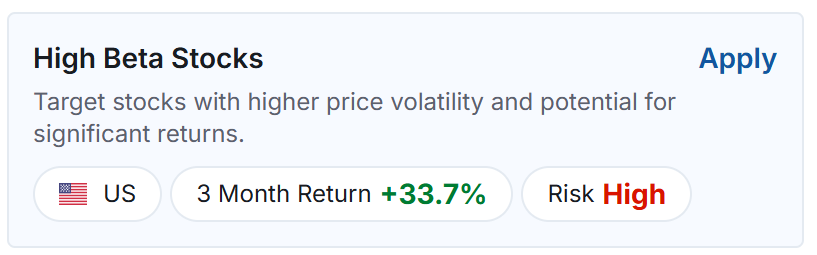

Returning to the predefined screen discussed in this article, we can report that the stocks it highlights have collectively risen by nearly 34% over the past three months.

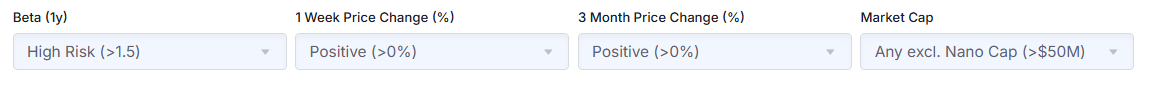

More precisely, here are the criteria that this search allows us to apply with a single click:

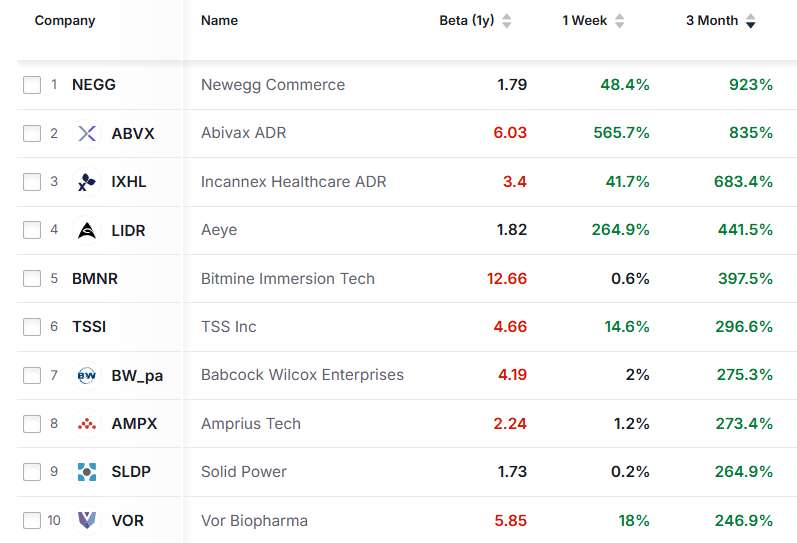

At the time of writing, the search resulted in 535 U.S.-listed stocks. Below, you’ll find the 10 stocks on this list with the strongest 3-month performance:

The performance of these stocks is indeed impressive, with gains ranging from +246.9% to +923% over the last three months. However, most of these stocks also display a risky profile and/or are highly overvalued according to valuation models and analysts.

What’s more, reviewing over 500 stocks for the best opportunities is practically impossible. We therefore wanted to refine this search to isolate the most undervalued stocks.

To do this, we added the following search criterion:

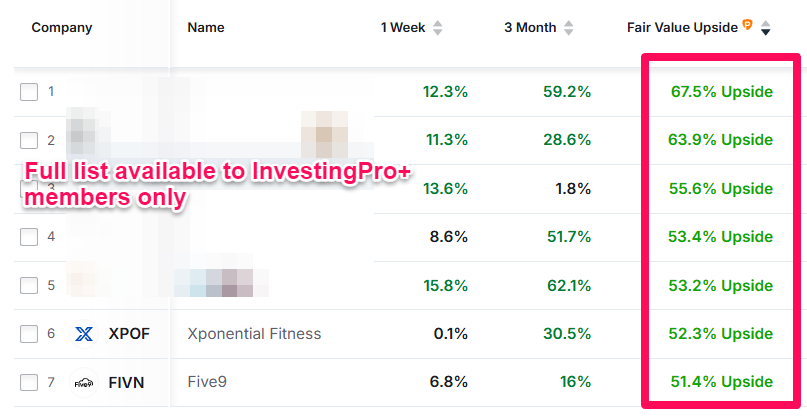

Bullish potential of +50% or more according to InvestingPro Fair Value (Note that adding this criterion to a screener search is reserved for InvestingPro members with the Pro+ plan).

Reminder: Fair Value calculates an intelligent average of several well-known valuation models to estimate a stock’s intrinsic worth.

By adding this parameter, the search narrows down to 7 stocks:

The bullish potential of these stocks ranges from +51.4% to +67.5%, according to InvestingPro Fair Value.

InvestingPro+ members can jump straight to the full list here.

Otherwise, take advantage of our summer sale and join InvestingPro now for less than $9 a month to get access to this and hundreds of other customizable screeners.

InvestingPro members can update to the Pro+ plan here.

Conclusion

The predefined "High Beta Stocks" screen is therefore just a click away from identifying the stocks with the best bullish momentum, making it an ideal starting point for investors adopting Momentum strategies.

Although many undervalued stocks can also be spotted among the identified stocks, as demonstrated in this article.

However, there are many other searches on the Investing.com screener, many of which are free. We therefore invite you to explore them now to identify those that best match your expectations and approach to investing.