Here’s why Citi says crypto prices have been weak recently

- Dow-30 member Johnson & Johnson is up 3.4% so far in 2021, but down about 9.2% in the past three months.

- JNJ recently announced it will spin off the consumer health division

- Despite potential further volatility in the stock, long-term investors could consider buying Johnson & Johnson shares now

On Nov. 12, healthcare giant Johnson & Johnson (NYSE:JNJ), a member of the 30-component, mega cap Dow Jones index, announced that it planned to spin off its consumer health division. That segment is known for numerous high-profile brands such as Aveeno, JNJ Baby Powder, Band-Aid, Listerine and Neutrogena. Management expects the separation to finalize within two years.

So far, the reaction by investors to the group’s upcoming pharma-driven future has been subdued, and Johnson & Johnson shares have lost about 3% in the past week. Meanwhile, JNJ stock is up close to 3.5% in 2021. By comparison, the Dow Jones US Pharmaceuticals index has returned 20.5% year-to-date.

JNJ stock’s 52-week range has been $142.86 - $179.92. The current price of $162.89 supports a dividend yield of 2.60%.

The announcement by JNJ follows a similar press release by General Electric (NYSE:GE), which recently said it would “Form Three Public Companies Focused on Growth Sectors of Aviation, Healthcare, and Energy.” Understandably, investors wonder whether now would be a good time to invest in JNJ or even GE stock.

Research led by John J. McConnell of Purdue University, West Lafayette, Indiana, points out:

“based on prior evidence, the best investment advice is to buy shares of the spun-off subsidiaries as soon as they become available and hold them for 22 months. At the same time, buy shares in the parent companies and hold them for 15 months.”

With that information, let’s take a closer look at how JNJ shares could fare in the coming months.

What To Expect From Johnson & Johnson Stock

Johnson & Johnson’s corporate history goes back to 1886. The company's shares were listed on the Big Board in September 1944. Management issued Q3 results on Oct. 19. Total sales came in at $23.3 billion, up 10.7% year-over-year (YoY). Adjusted earnings per share (EPS) was $2.60, growing 18.2% over the past year.

On the results, CEO Alex Gorsky said:

“Our third-quarter results demonstrate solid performance across Johnson & Johnson, driven by robust above-market results in Pharmaceuticals, ongoing recovery in Medical Devices, and strong growth in Consumer Health.”

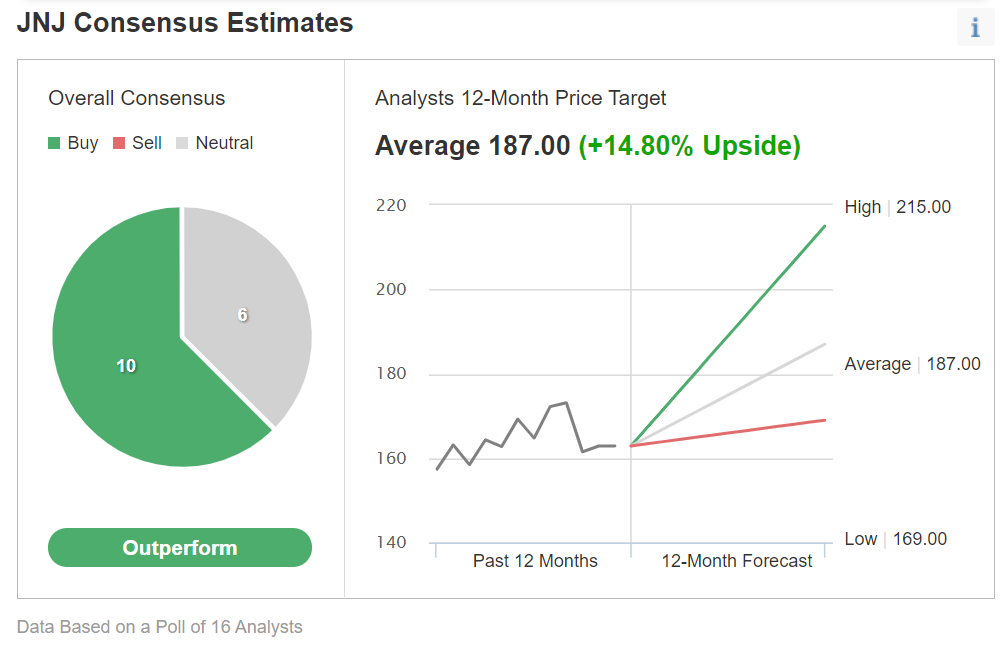

Among 16 analysts polled via Investing.com, JNJ stock has an “outperform” rating.

Chart: Investing.com

Analysts also have a 12-month median price target of $187.00, implying an increase of close to 15% from current levels. The 12-month price range currently stands between $169.00 and $215.00.

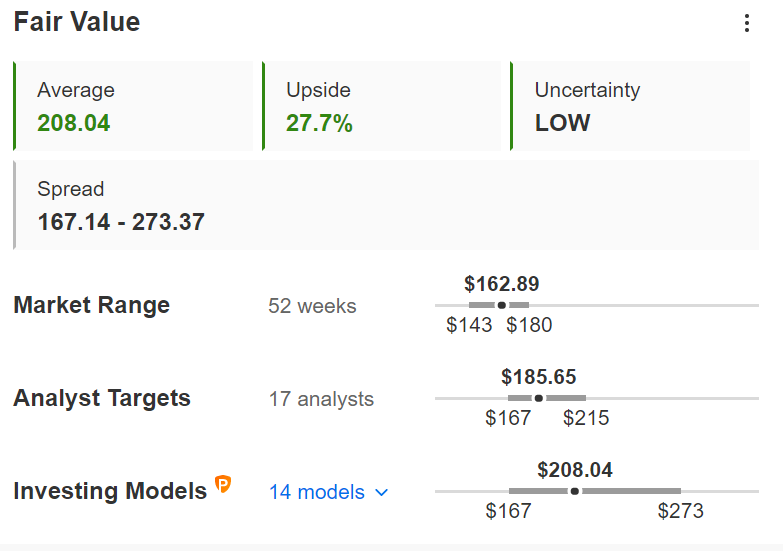

Chart: InvestingPro

Similarly, according to a number of investing models, such as those that might consider dividends, P/E multiples or the 10-year Discounted Cash Flow (DCF) model growth exit method, the average fair value for JNJ stock stands at $208.04.

Trailing P/E, P/B and P/S (based on Last Twelve Months or LTM) ratios for JNJ stock stand at 24.0x, 6.1x and 4.7x, respectively. By comparison, average ratios for its peers are 15.4x, 3.9x and 3,7x.

Readers who watch technical charts might be interested to know that, despite the price decline in the past several weeks, a number of JNJ’s short- and intermediate-term indicators are still cautioning investors. However, long-term charts remain bullish.

As part of the short-term sentiment analysis, it would be important to look at the implied volatility level (IV) for JNJ stock options, which typically shows traders the market's opinion of potential moves in a security. However it does not forecast the direction of the move.

JNJ’s current implied volatility is 16.6, which is slightly higher than the 20-day moving average of 16.1. In other words, IV is trending slightly higher, which might mean that options markets are not expecting any extreme moves in the coming days.

Our first expectation is for Johnson & Johnson stock to trade sideways between $160 and $165 and establish a new base. Then, a new bullish move is likely to start.

3 Possible Trades On Johnson & Johnson Stock

1. Buy JNJ Shares At Current Levels

Investors who are not concerned with daily moves in price and who believe in the long-term potential of the company could consider investing in JNJ stock now.

On Nov. 19 shares closed at $162.89. Buy-and-hold investors should expect to keep this long position for several months while the stock makes an attempt toward $187.00, a level which matches analysts’ estimates. Such an up move would mean a return of over 14.5% from the current level.

Readers who plan to invest soon but are concerned about large declines might also consider placing a stop-loss at about 3-5% below their entry point.

2. Buy An ETF With JNJ As A Main Holding

Readers who do not want to commit capital to Johnson & Johnson stock but would still like to have exposure to the shares could consider researching a fund that holds the company as a leading holding.

Examples of such ETFs include:

- iShares U.S. Pharmaceuticals ETF (NYSE:IHE): This fund is up 7.1% YTD, and JNJ stock’s weighting is 21.43%;

- Health Care Select Sector SPDR Fund (NYSE:XLV): The fund is up 17.2%YTD, and JNJ stock’s weighting is 8.40%;

- Columbia Research Enhanced Value ETF (NYSE:REVS): The fund is up 24.7% YTD, and JNJ stock’s weighting is 4.52%;

- Amplify CWP Enhanced Dividend Income ETF (NYSE:DIVO): The fund is up 13.6% YTD, and JNJ stock’s weighting is 2.83%.

3. Diagonal Debit Spread On JNJ Stock

Our third trade is a diagonal debit spread on Johnson & Johnson using LEAPS options, where both the profit potential and the risk are limited. We have provided numerous examples (for example, for Apple and two semiconductor stocks) of this type of options strategy that is also know as a "poor person's covered call” or "poor man's covered call” on a given stock. Since the strategy involves options, it will not be appropriate for many of our readers. However, they could consider reading it for educational purposes.

In this set-up, a trader first buys a “longer-term” call with a lower strike price. At the same time, the trader sells a “shorter-term” call with a higher strike price, creating a long diagonal spread.

These call options for the underlying stock have different strikes and different expiration dates. The trader goes long one option and shorts the other to make a diagonal spread.

Most traders entering such a strategy would be mildly bullish on the underlying security. Instead of buying 100 shares of Johnson & Johnson, the trader would buy a deep-in-the-money LEAPS call option, where that LEAPS call acts as a “surrogate” for owning the stock.

On Nov. 19, JNJ stock closed at $162.89. For the first leg of this strategy, the trader might buy a deep in-the-money (ITM) LEAPS call, like the JNJ 19 January 2024, 130-strike call option. This option is currently offered at $35.50. It would cost the trader $3,550 to own this call option that expires in about two years and two months instead of $16,289 to buy the 100 shares outright.

The delta of this option is close to 80. Delta shows the amount an option’s price is expected to move based on a $1 change in the underlying security.

If JNJ stock goes up $1 to $163.89, the current option price of $35.50 would be expected to increase by approximately 80 cents, based on a delta of 80. However, the actual change might be slightly more or less depending on several other factors that are beyond the scope of this article.

For the second leg of this strategy, the trader sells a slightly out-of-the-money (OTM) short-term call, like the JNJ 18 February 2022 165-strike call option. This option’s current premium is $4.60. The option seller would receive $460, excluding trading commissions.

There are two expiration dates in the strategy, making it quite difficult to give an exact formula for a break-even point in this trade. Different brokers might offer “profit-and-loss calculators” for such a trade setup.

The maximum potential is realized if the stock price is equal to the strike price of the short call on its expiration date. So the trader wants the JNJ stock price to remain as close to the strike price of the short option (i.e., $460 here) as possible at expiration (on Feb. 18, 2022), without going above it.

Here, the maximum return, in theory, would be about $612 at a price of $165 at expiry, excluding trading commissions and costs. (We arrived at this value using an options profit-and-loss calculator).

Here, by not investing $16,289 initially in 100 shares of Johnson & Johnson, the trader’s potential return is leveraged.

Ideally, the trader hopes the short call will expire out-of-the money (worthless). Then, the trader can sell one call after the other, until the long LEAPS call expires in over two years.