Flutter Entertainment beats Q3 earnings estimate despite sports results impact

- U.S. stocks ended November on a high note as cooling inflation boosted hopes the Fed is done hiking.

- December is expected to be another strong month as per recent history.

- Looking for a helping hand in the market? Members of InvestingPro get exclusive ideas and guidance to navigate any climate. Learn More »

- Missed out on Black Friday? Secure your up to 60% discount on InvestingPro subscriptions with our extended Cyber Monday sale.

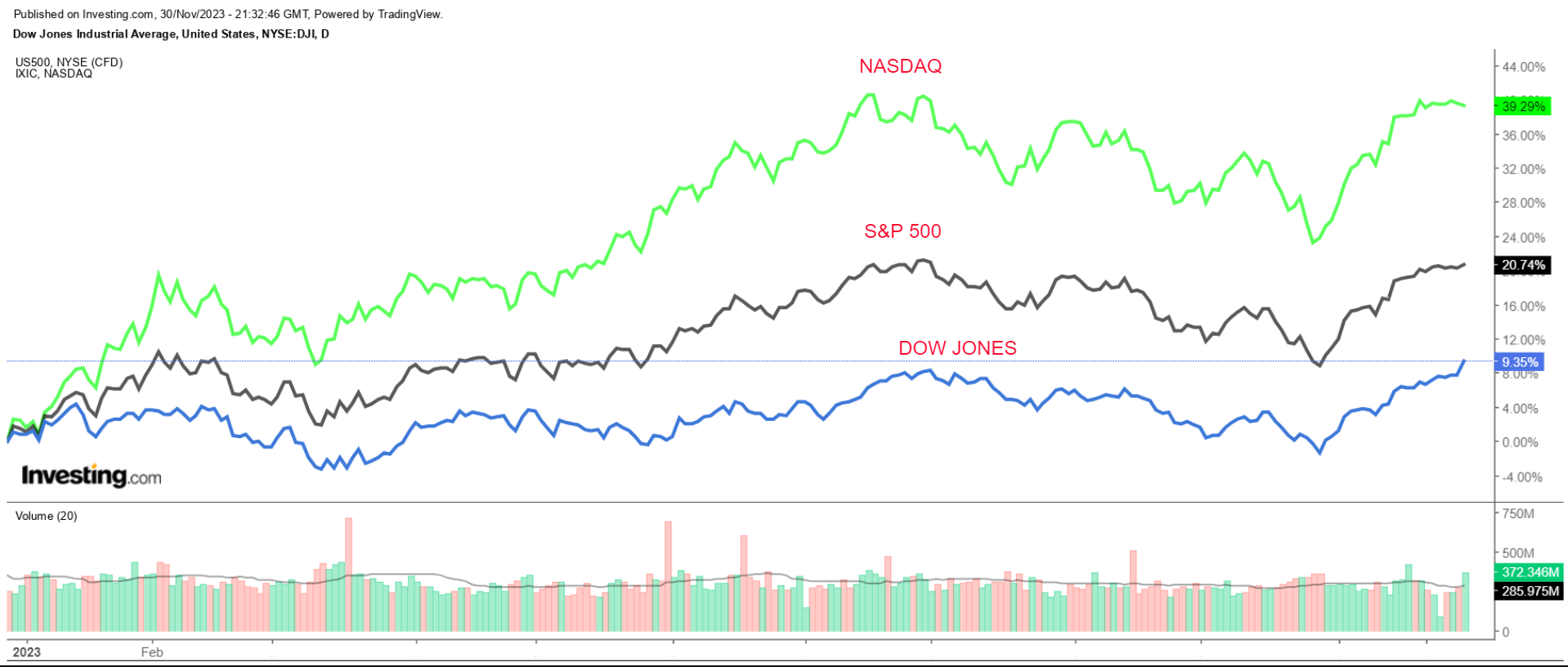

November was a terrific month for the stock market - easily the strongest month of the year and the best month since mid-2022. The major averages rallied on growing expectations that the Federal Reserve is done with raising interest rates and could start cutting them next year.

The Nasdaq Composite was the top performer, surging 10.7% during the month, boosted by the ‘Magnificent 7’ group of mega-cap tech stocks. The tech-heavy index is now up 36% on the year, a big rebound from the 2022 slump.

Meanwhile, the benchmark S&P 500 and the blue-chip Dow Jones Industrial Average jumped 8.4% and 8.8%, respectively. That brings their year-to-date gains to 19% and 8.5% respectively.

The moves come as Treasury yields, whose steady rise over the last few months has weighed on stocks, slumped to multi-week lows.

The benchmark 10-year Treasury yield stood at 4.32% early Friday, compared to a 16-year high of just above 5% in mid-October, as investors largely believe the Fed has finished hiking rates and have started to price in a series of rate cuts beginning next spring.

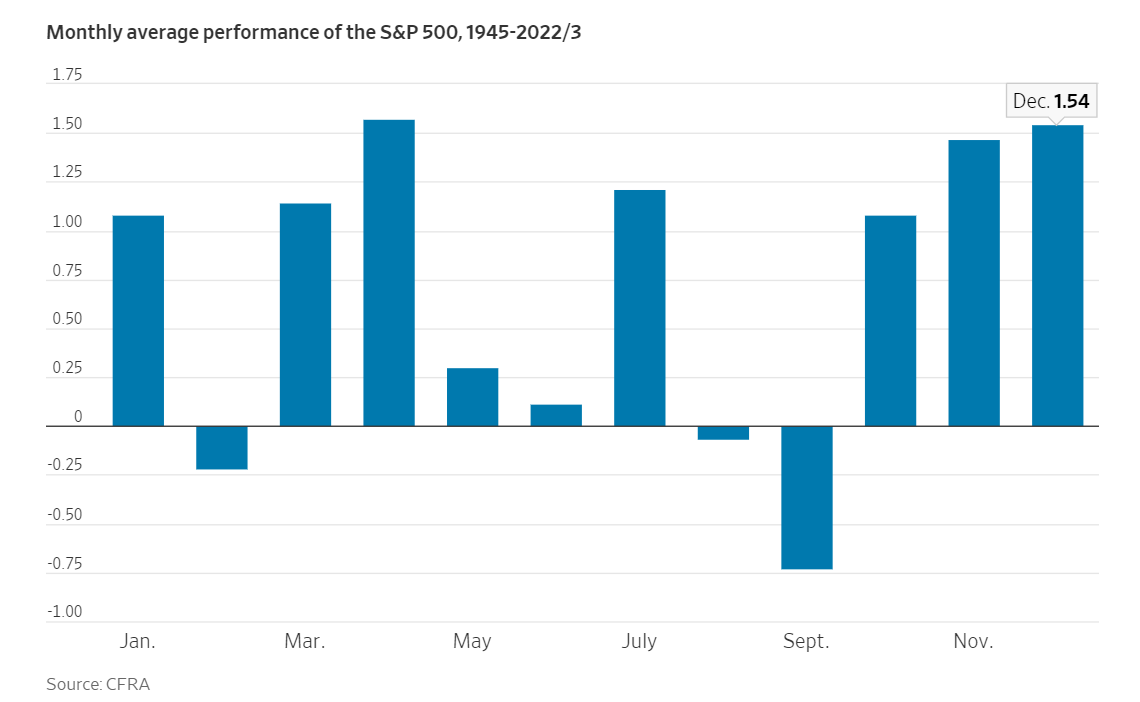

As a cheerful November comes to an end, history says investors should expect further gains in December, which historically tends to be a strong month for the stock market. Since 1945, the benchmark S&P 500 index has averaged a gain of around 1.5% in December. That compares to an average gain of roughly 0.8% for the other months of the calendar.

With investors continuing to gauge the outlook for interest rates, inflation, and the economy, a lot will be on the line in the month ahead. The stock market rally faces its final obstacle of the year when the Federal Reserve delivers its latest policy decision on Wednesday, December 14.

While the U.S. central bank is all but certain to keep rates steady, the risk is that Fed Chair Jerome Powell could strike a more hawkish tone than markets currently anticipate and leave the door open to another rate hike as the economy holds up better than expected.

Many investors believe that the Fed is unlikely to raise rates any further, bringing an end to the central bank's most aggressive tightening cycle in decades. Meanwhile, financial markets are pricing in an almost 80% chance of a rate cut as early as the Fed's May 2024 meeting.

The Fed is at risk of committing a major policy error if it begins to loosen monetary conditions too soon, which could see inflationary pressures begin to pick up again. If anything, the Fed has more room to raise interest rates than to cut them, presuming it follows the numbers.

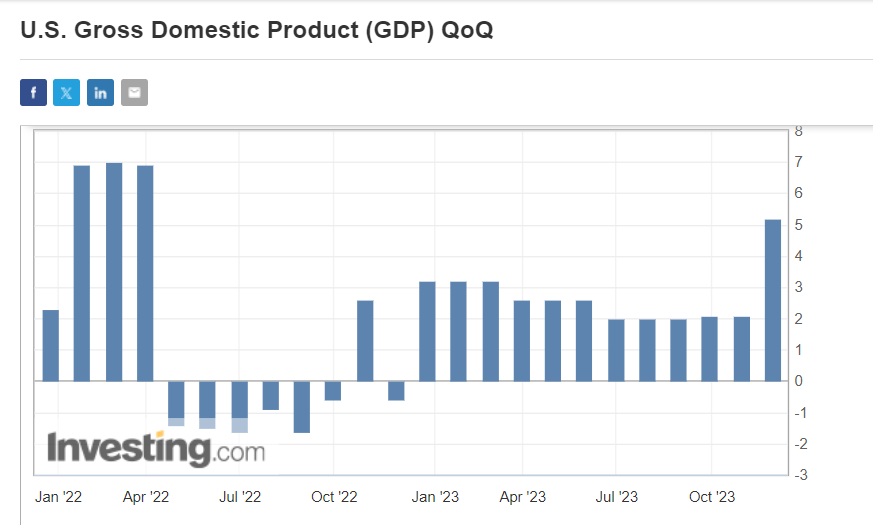

Indeed, U.S. government data released Thursday showed that the U.S. economy grew at a faster-than-expected 5.2% annual rate in the third quarter amid surprisingly robust consumer spending.

Despite widespread expectations of a looming downturn, the economy has proven considerably more resilient than anticipated by many on Wall Street and economic growth has held up better than expected in the face of higher rates.

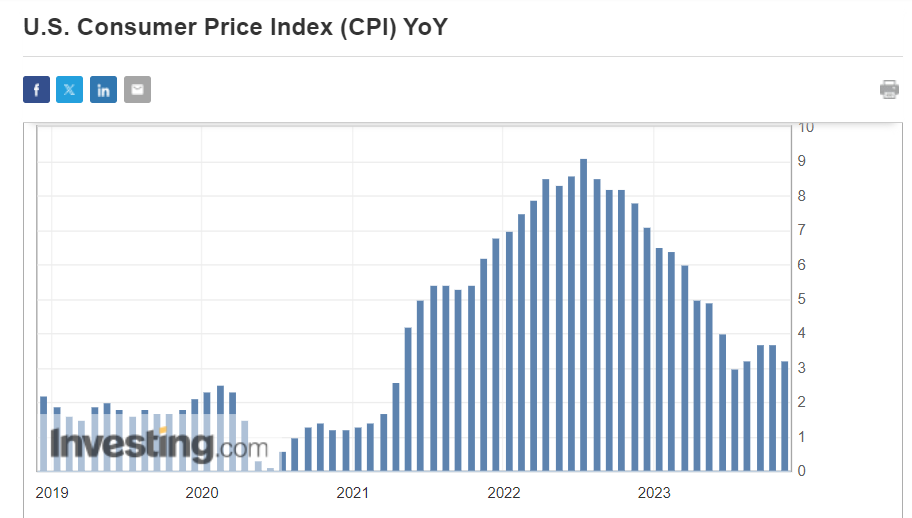

At the same time, inflation, as measured by the Consumer Price Index, has come down substantially since the summer of 2022, when it peaked at a four-decade high of 9.1%. By October 2023, it was down to 3.2% on an annualized basis.

With that being said, CPI is still rising far more quickly than the 2% rate the Fed considers healthy, a development that could keep pressure on policymakers to maintain their fight against inflation.

Inflation may be cooling - just not fast enough for the Federal Reserve.

What To Do Now

While I am currently long on the Dow Jones Industrial Average, S&P 500, and the Nasdaq 100 via the Dow Jones Industrial Average ETF (NYSE:DIA), S&P 500 ETF (NYSE:SPY), and the Invesco QQQ Trust (NASDAQ:QQQ), I have been cautious about making new purchases due to signals the market is getting overbought.

Perhaps my biggest concern is the absolute lack of market fear. The CBOE Volatility Index, or VIX, fell sharply in November to notch its biggest monthly decline since March. The market fear gauge stood not far from its lowest level since January 2020 as of Friday morning.

Overall, it’s important to remain patient, and alert to opportunity. Adding exposure gradually, not buying extended stocks, and not getting too concentrated in a particular company or sector are all still important. It's definitely a weekend to be running screens and building up a broad watchlist of interesting stocks amid the ongoing equity rally.

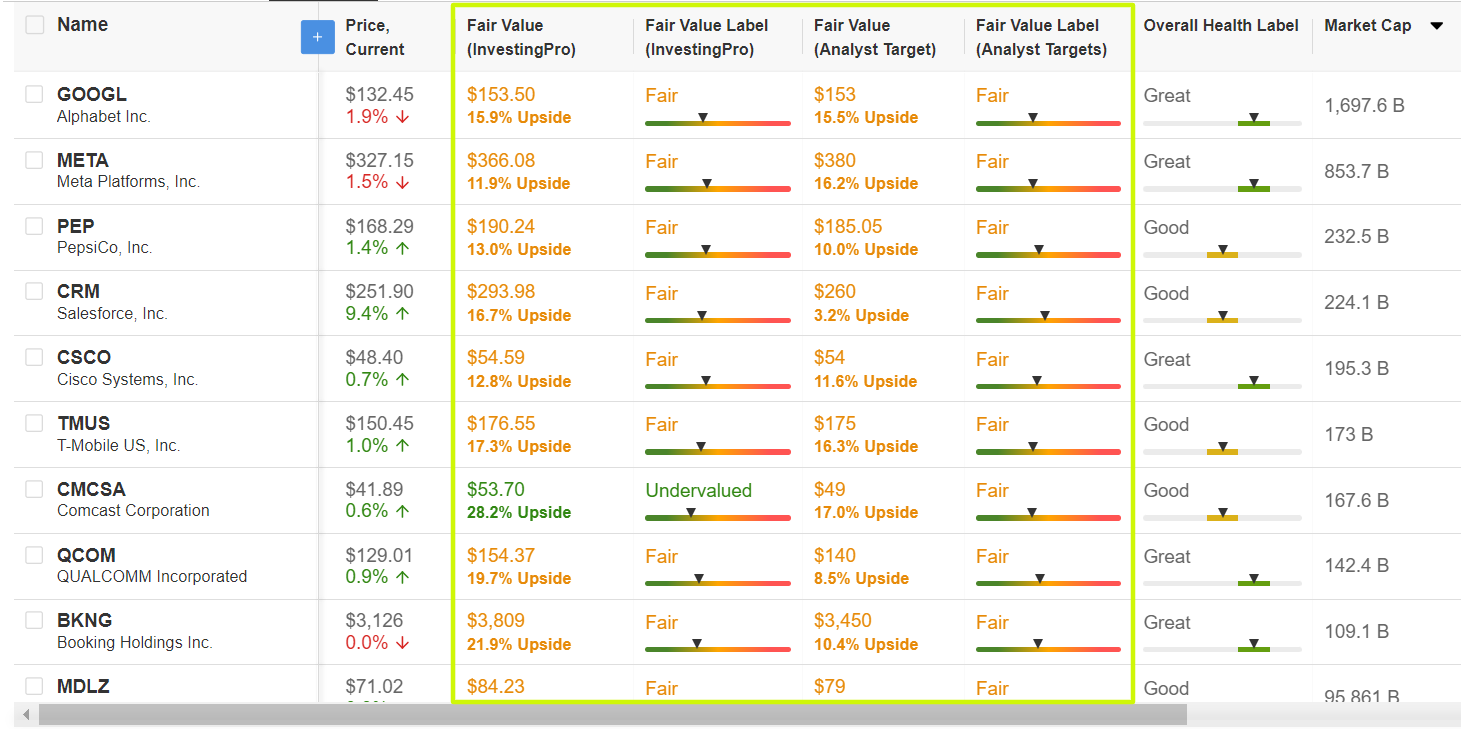

As such, I used the InvestingPro stock screener to identify high-quality stocks with more upside ahead based on the Pro models. Not surprisingly some of the names to make the list include Google-parent Alphabet (NASDAQ:GOOGL), Meta Platforms (NASDAQ:META), Pepsico (NASDAQ:PEP), Salesforce (NYSE:CRM), Cisco (NASDAQ:CSCO), T-Mobile (NASDAQ:TMUS), Comcast (NASDAQ:CMCSA), Qualcomm (NASDAQ:QCOM), Booking Holdings (NASDAQ:BKNG), and Mondelez (NASDAQ:MDLZ) to name a few.

Source: InvestingPro

With InvestingPro's stock screener, investors can filter through a vast universe of stocks based on specific criteria and parameters to identify cheap stocks with strong potential upside.

You can easily determine whether a company suits your risk profile by conducting a detailed fundamental analysis on InvestingPro according to your own criteria. This way, you will get highly professional help in shaping your portfolio.

In addition, you can sign up for InvestingPro, one of the most comprehensive platforms in the market for portfolio management and fundamental analysis, much cheaper with the biggest discount of the year (up to 60%), by taking advantage of our extended Cyber Monday deal.

Disclosure: I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials. The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.