BitMine stock falls after CEO change and board appointments

- November is set to end with a 10% rise for Amazon

- Shares are back above the $200 barrier, and look likely to sustain there.

- Should we expect further gains in the coming months?

- Looking for more actionable trade ideas? Subscribe here for up to 55% off as part of our Bird Black Friday sale!

Amazon (NASDAQ:AMZN) has reached a major milestone this November, surging past the $200 mark to hit an all-time high of $215.90 on November 14.

This impressive rally caps a month that began with a bang, as shares gained 6.19% on November 1, following the release of quarterly results that topped expectations.

Amazon, like many other stocks, also benefited from the surge of optimism following Donald Trump’s election.

By the close of trading on the Wednesday before Thanksgiving, Amazon shares were sitting at $205.74—up more than 35% year-to-date, including a 10.3% jump in November alone.

But with the stock soaring, investors are beginning to question how much further it can climb.

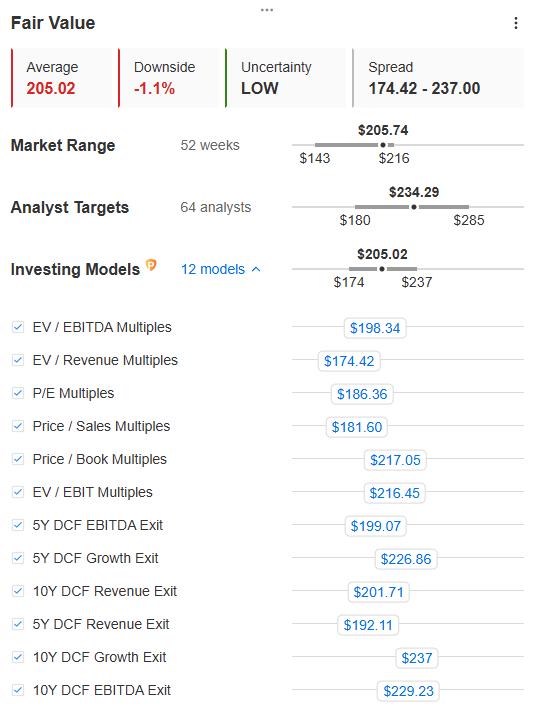

The stock’s valuation is starting to look lofty, and Amazon’s InvestingPro Fair Value, based on 12 recognized financial models, is pegged at $205.02—just below its current price. So, how much more upside potential does Amazon have left?

Source : InvestingPro

The 64 analysts who follow the stock have a target price of $234.29, which translates into a modest upside potential of just over 14%.

What's Next (LON:NXT) in 2025?

However, this does not consider the positive surprises the company could offer in 2025.

Amazon is indeed taking full advantage of the AI craze, which it is using across its entire business, from determining the fastest and cheapest delivery routes in e-commerce to identifying target audiences for advertisers.

More importantly, the generative AI platform it offers its Amazon Web Services (AWS) cloud computing customers is proving to be a massive business with underestimated potential.

This helped AWS sales to grow by 19% year-on-year in the third quarter and should continue to boost growth in this business over the coming quarters.

In this regard, it's worth noting that analysts estimate that spending on cloud computing will grow by 22% annually between 2024 and 2030, boosted by AI.

Assuming AWS can maintain its profit margins and market share, six years of 22% profit growth would mean AWS generating over $100 billion in profits by 2030.

Nor should we forget Amazon's historical business, with a huge gap to its competitors in e-commerce, a gap it maintains by constantly innovating.

In this regard, analysts at BofA hailed some of Amazon's strategic developments in a recent note, including the expansion of warehousing facilities, the growth of same-day delivery services, and the increased use of robotics, all of which are expected to drive efficiencies in the company's operations.

Conclusion

Amazon's AWS business positions the company ideally to continue to benefit from the AI rally and looks indestructible as an e-commerce leader.

Added to this is a particularly profitable advertising business, not to mention that Amazon is also part of the streaming industry landscape.

So there are plenty of reasons to be interested in Amazon shares, and to expect the stock to continue rising over the coming months.

***

Ever wondered how top investors consistently outperform the market? With InvestingPro, you’ll unlock access to their strategies and portfolio insights, giving you the tools to elevate your own investing game.

But that’s not all—our AI-powered analysis delivers 100+ stock recommendations every month, tailored to help you make smarter, faster decisions.

Ready to take your portfolio to the next level? Click here to start today!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.