Novo Nordisk, Eli Lilly fall after Trump comments on weight loss drug pricing

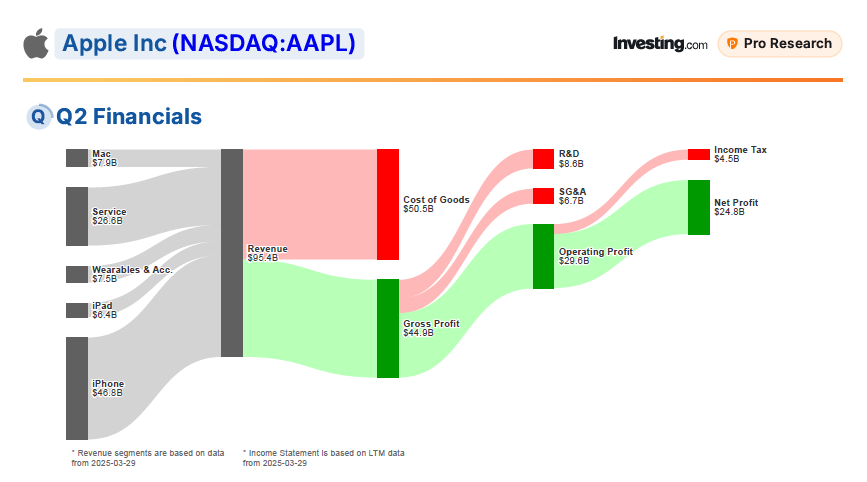

Apple (NASDAQ:AAPL)’s Services segment remains a key driver of growth, reaching a record $25 billion in revenue with a 12% year-over-year rise, highlighting the success of its diversification strategy beyond hardware. However, the company faces significant challenges, including heavy reliance on iPhone sales and increasing regulatory pressures impacting its App Store model. Additionally, delays in rolling out certain AI features compared to competitors pose a competitive risk, especially in markets like China where local manufacturers are rapidly advancing their AI technologies.

Apple’s growth prospects are bolstered by opportunities such as expanding AI capabilities across its product lineup, notably with the upcoming Apple Intelligence launch. Integrating AI into Apple’s ecosystem could unlock new revenue opportunities and boost user engagement.

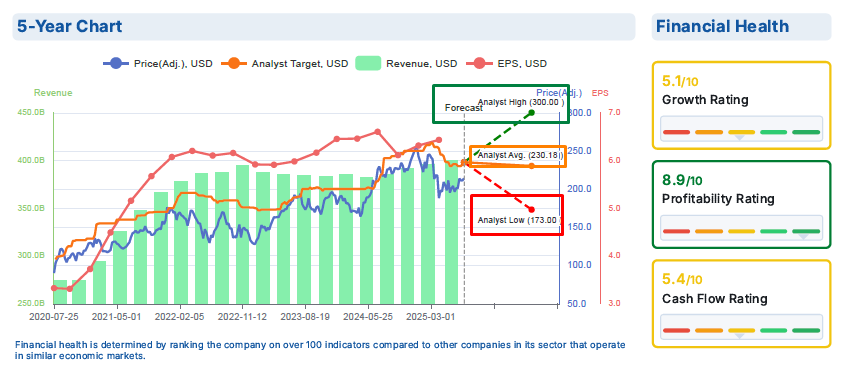

In a research note on Thursday, Evercore ISI analyst Amit Daryanani stated that Apple is confronting multiple headwinds that have contributed to its underperformance this year. He maintains an Outperform rating and a $250 price target for the stock.

The company’s robust brand and customer loyalty create a strong platform for launching innovative financial services or growing its Apple Pay ecosystem.

Hightened Regulatory Scrutiny, Tariff Impact in Focus

Heightened regulatory scrutiny could substantially affect Apple’s App Store revenue, as future rulings may mandate support for third-party payment options. Studies suggest that up to 28% of US iPhone users might bypass the App Store’s In-App Purchase system if given the choice, potentially reducing Apple’s earnings per share by approximately 2%.

The spotlight is now on how Apple intends to navigate a changing global landscape—one where its once-reliable supply chain has become a potential vulnerability. Former U.S. President Donald Trump criticized the company’s dependence on overseas manufacturing and proposed a 25% tariff on iPhones produced abroad. In response, Apple began moving production of iPhones bound for the U.S. to India, further drawing Trump’s ire.

Additionally, the Department of Justice’s lawsuit against Google poses a threat to the significant payments Apple earns for setting Google as the default search engine, which are estimated to total $20-$24 billion annually.

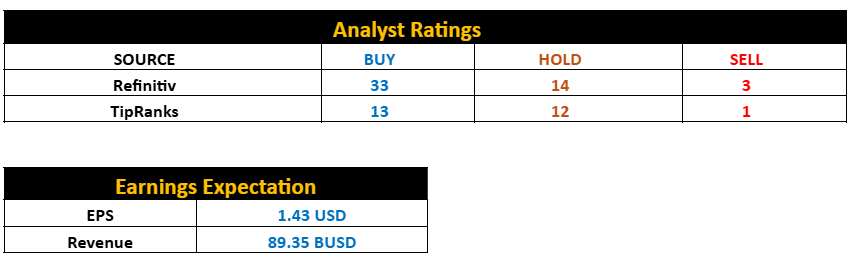

AAPL Q3 2025 earnings after-market Thursday July 31, 2025

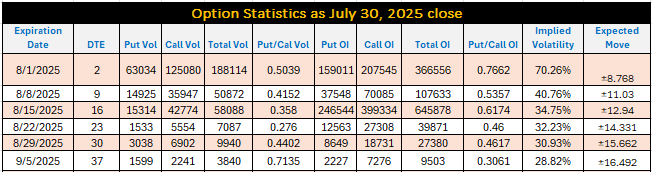

Option Statistics

Put/Call ratio suggests the following three scenarios:

- With Put/Call ratio between 0.7662 to 0.46 for the next four upcoming expiries suggest that the overall option traders are inclined to Calls.

- Lower earnings & guidance and higher capex could trigger a sharp sell-off as option traders would start selling their Calls.

- Better than expected earnings & guidance would trigger a sharp rally due to stock being under bearish influence.

- Option market is showing a large net positive Gamma at 220 strike versus a negative gamma exposure at 200 strike from July 2025 to December 2027.

Technical Analysis Perspective

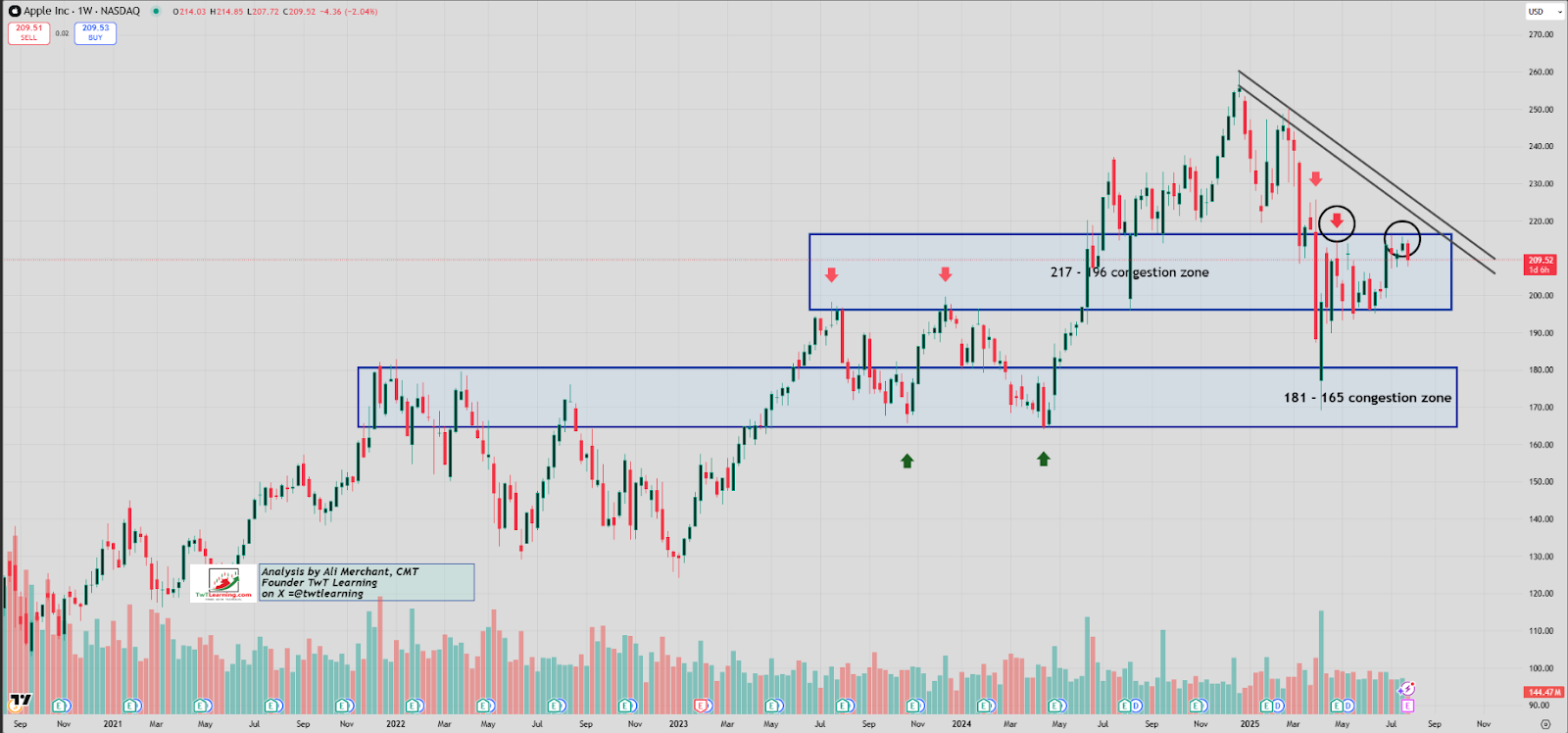

- Since April 2025, Apple has been trading within a range, fluctuating between $217 and $196.

- The stock has struggled to break through the $215-$216 resistance level over the past four weeks.

- A decisive move in either direction could establish the upcoming trend.

- From a technical standpoint, earnings serve as a strong catalyst for a breakout and can help determine the stock’s direction.

- A sustained break above 217 resistance could propel the stock toward the 222–225 zone, confronting the falling trendline obstacle, with further potential to reach the 232–234 region.

- A break below 196 could open the way toward the 185–181 support zone.

Weekly Candlestick Chart

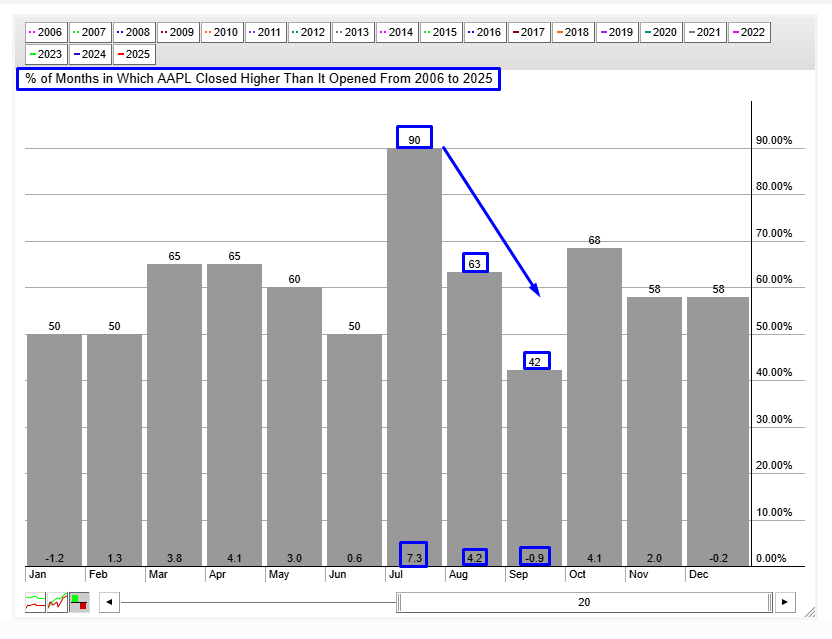

AAPL Seasonality Chart

Since 2006, Apple has closed July with a 7.3% gain and August with a 4.2% gain in 90% and 63% of the years, respectively.

Since 2006, Apple has closed July with a 7.3% gain and August with a 4.2% gain in 90% and 63% of the years, respectively.

***

Be sure to check out all the market-beating features InvestingPro offers.

InvestingPro members can unlock a powerful suite of tools designed to support smarter, faster investing decisions, like the following:

- ProPicks AI

Built on 25+ years of financial data, ProPicks AI uses a machine-learning model to spot high-potential stocks using every industry-recognized metric known to the big funds and professional investors. Updated monthly, each pick includes a clear rationale.

- Fair Value Score

The InvestingPro Fair Value model gives you a clear, data-backed answer. By combining insights from up to 15 industry-recognized valuation models, it delivers a professional-grade estimate of what any stock is truly worth.

- WarrenAI

WarrenAI is our generative AI trained specifically for the financial markets. As a Pro user, you get 500 prompts each month. Free users get 10 prompts.

- Financial Health Score

The Financial Health Score is a single, data-driven number that reflects a company’s overall financial strength.

- Market’s Top Stock Screener

The advanced stock screener features 167 customized metrics to find precisely what you’re looking for, plus pre-defined screens like Dividend Champions and Blue-Chip Bargains.

Each of these tools is designed to save you time and improve your investing edge.

Not a Pro member yet? Check out our plans here or by clicking on the banner below. InvestingPro is currently available at up to 50% off amid the limited-time summer sale.

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk is at the investor’s own risk. We also do not provide any investment advisory services.