UnitedHealth tests AI system to streamline medical claims processing - Bloomberg

This week is jam-packed with several April economic indicators and a couple of May regional business surveys. On balance, they should show that the soft data turned even softer, mostly in response to Trump’s Tariff Turmoil. The hard data are likely to be mixed, though consumer-related indicators should show resilience.

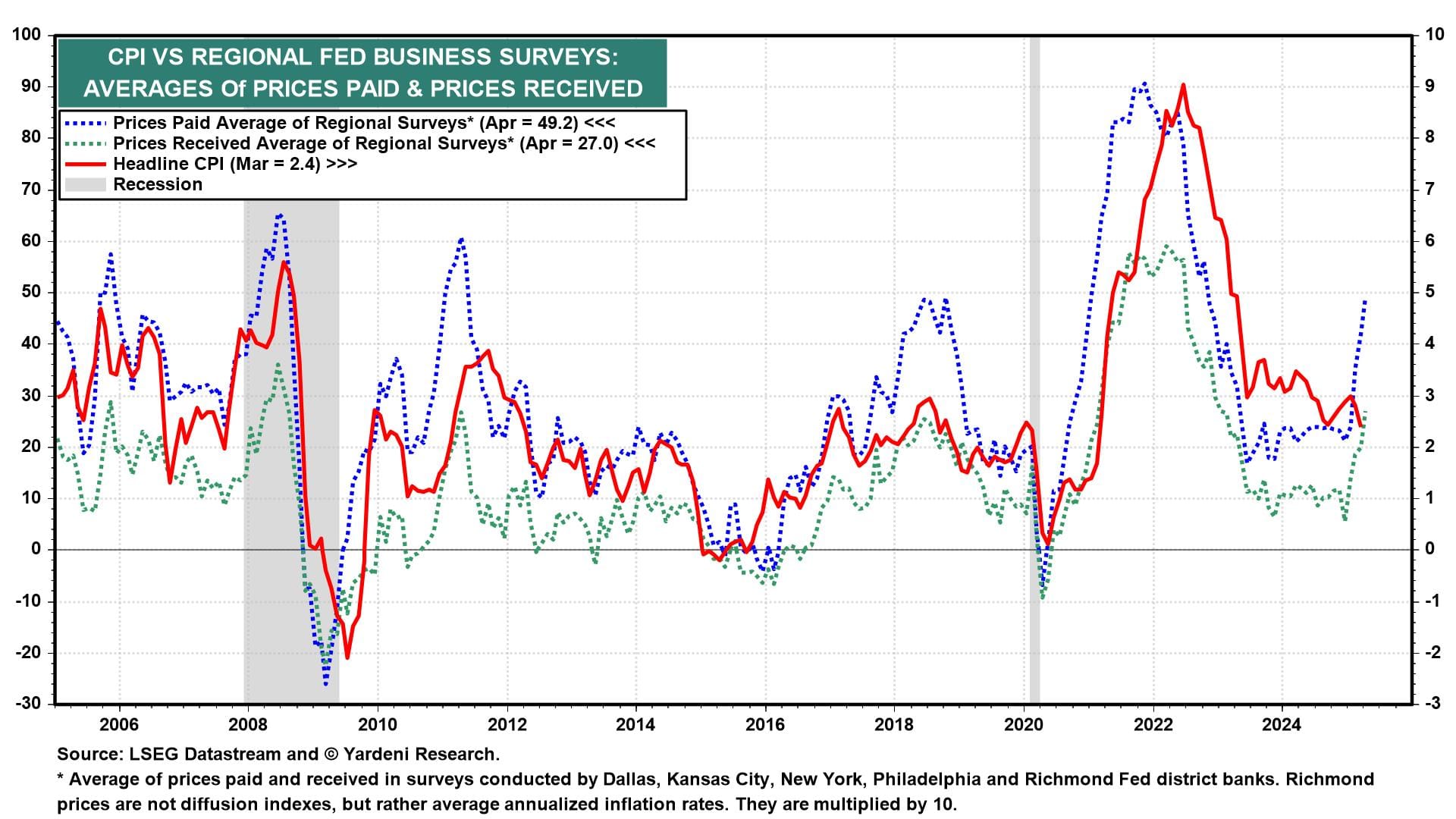

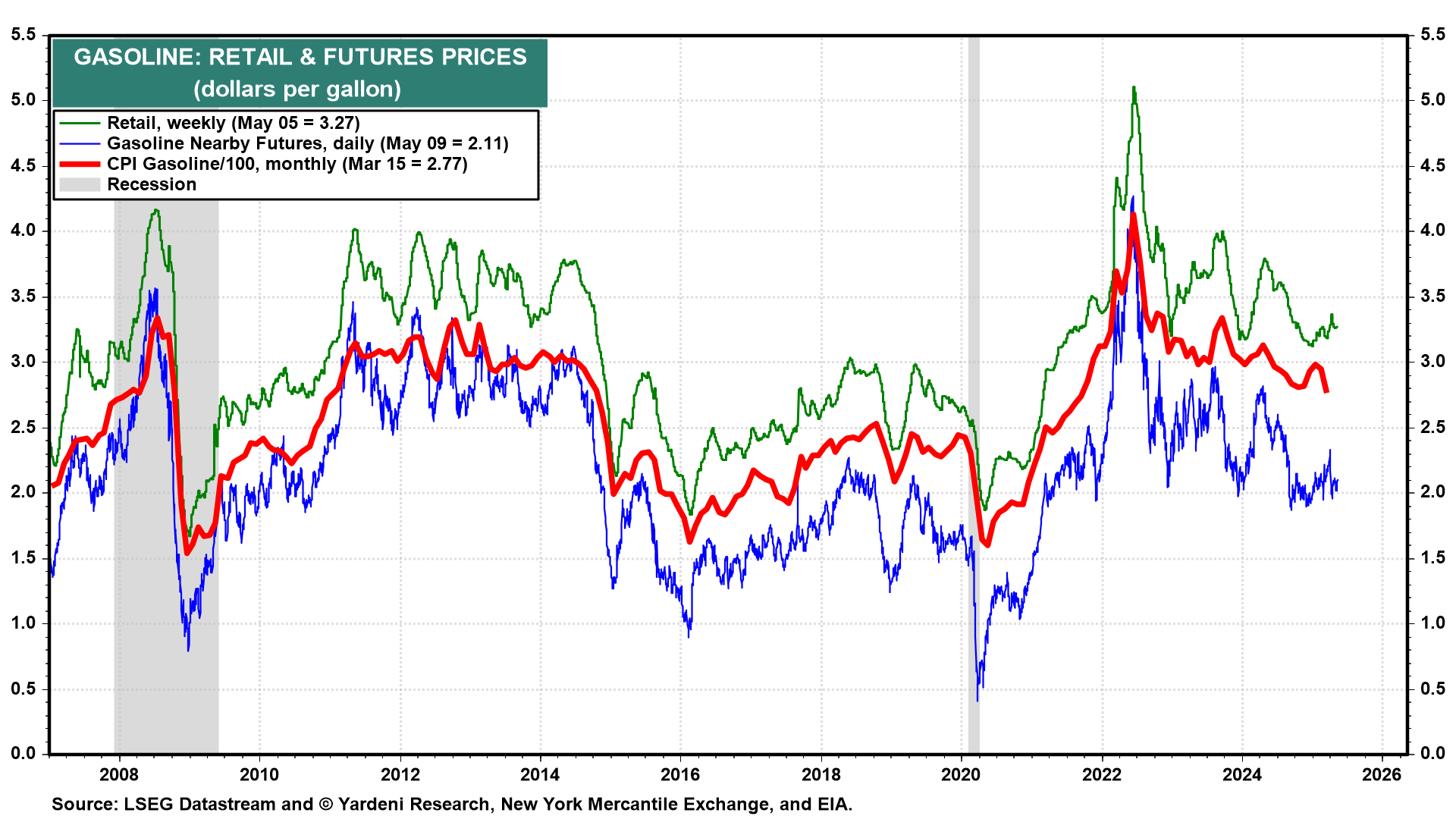

The week’s headline inflation indicators may be subdued by stable energy prices, while the core inflation rates are likely to show that Trump’s tariffs are starting to boost prices.

Let’s have a closer look:

(1) Inflation. The CPI inflation rate should ease a bit further in April, according to the Cleveland Fed’s Inflation Nowcasting. It has the headline CPI rising at a 2.3% year-on-year rate following March’s 2.4% gain. The core CPI is seen increasing 2.8%, the same as during March.

Overall, inflation still appears to be a more immediate threat than a sharp economic slowdown. Along with the tariffs, increases like the 2.7% m/m jump in the Manheim Used Vehicle Value Index in April from March bear watching.

Economic disconnects these days are almost too frequent to count. Let’s add one more to the list: how gasoline prices aren’t falling in line with crude oil prices. Oil prices, of course, have been surprisingly reasonable given the number of geopolitical dustups around the globe. But prices at the pump have yet to adjust accordingly (chart).

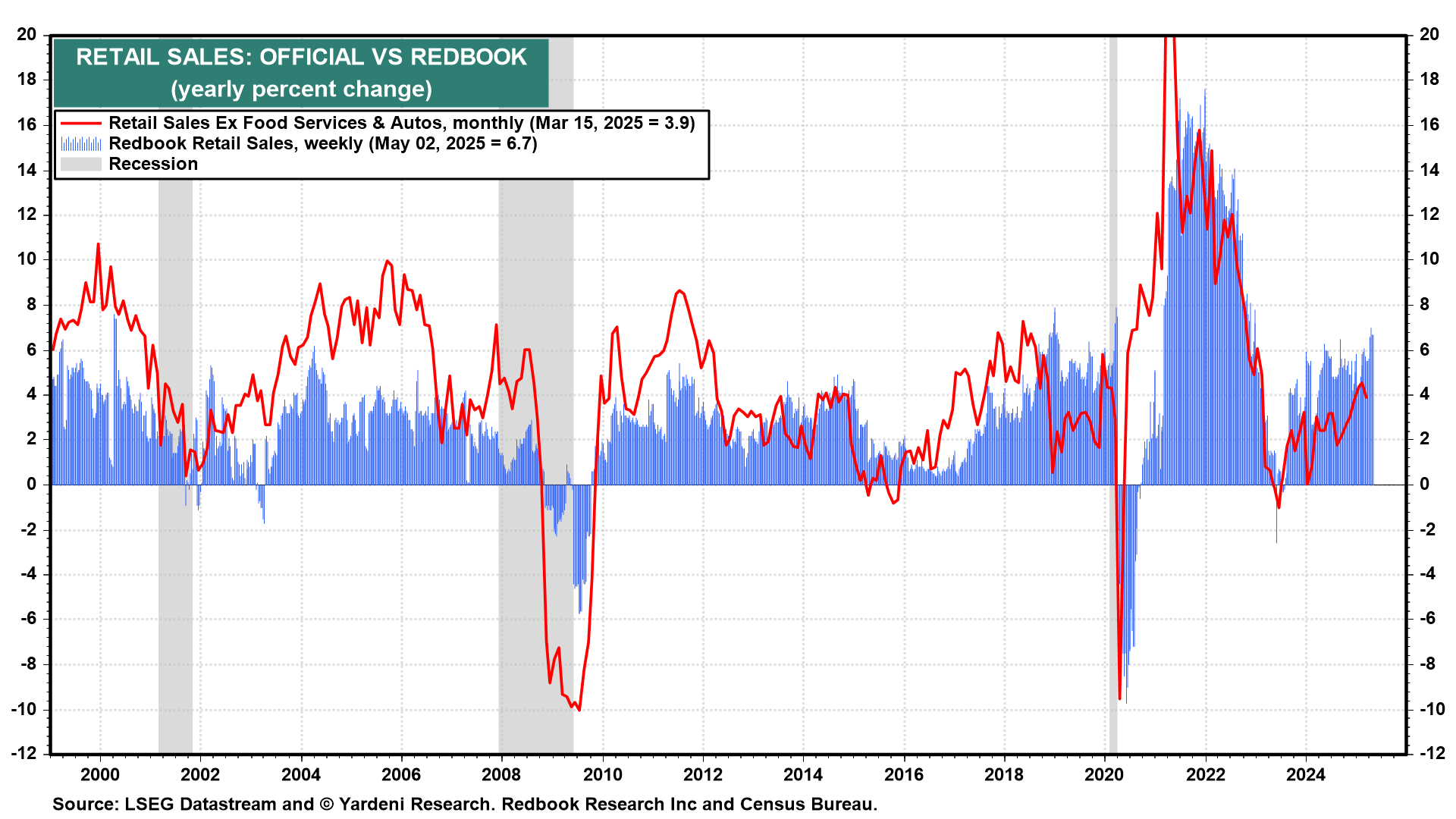

(2) Consumers. Reports of the demise of the US consumer have been greatly exaggerated, thanks largely to a robust labor market.

Case in point: a drop in new applications for unemployment insurance for the week ending May 3 to 228,000. Continuing jobless claims, meanwhile, were down 29,000 to reach 1.879 million.

Though risks abound, there’s little evidence that an untimely decline of retail spending is either afoot or coming. On the contrary, the Redbook Retail Sales Index has been growing at a solid pace recently (chart)

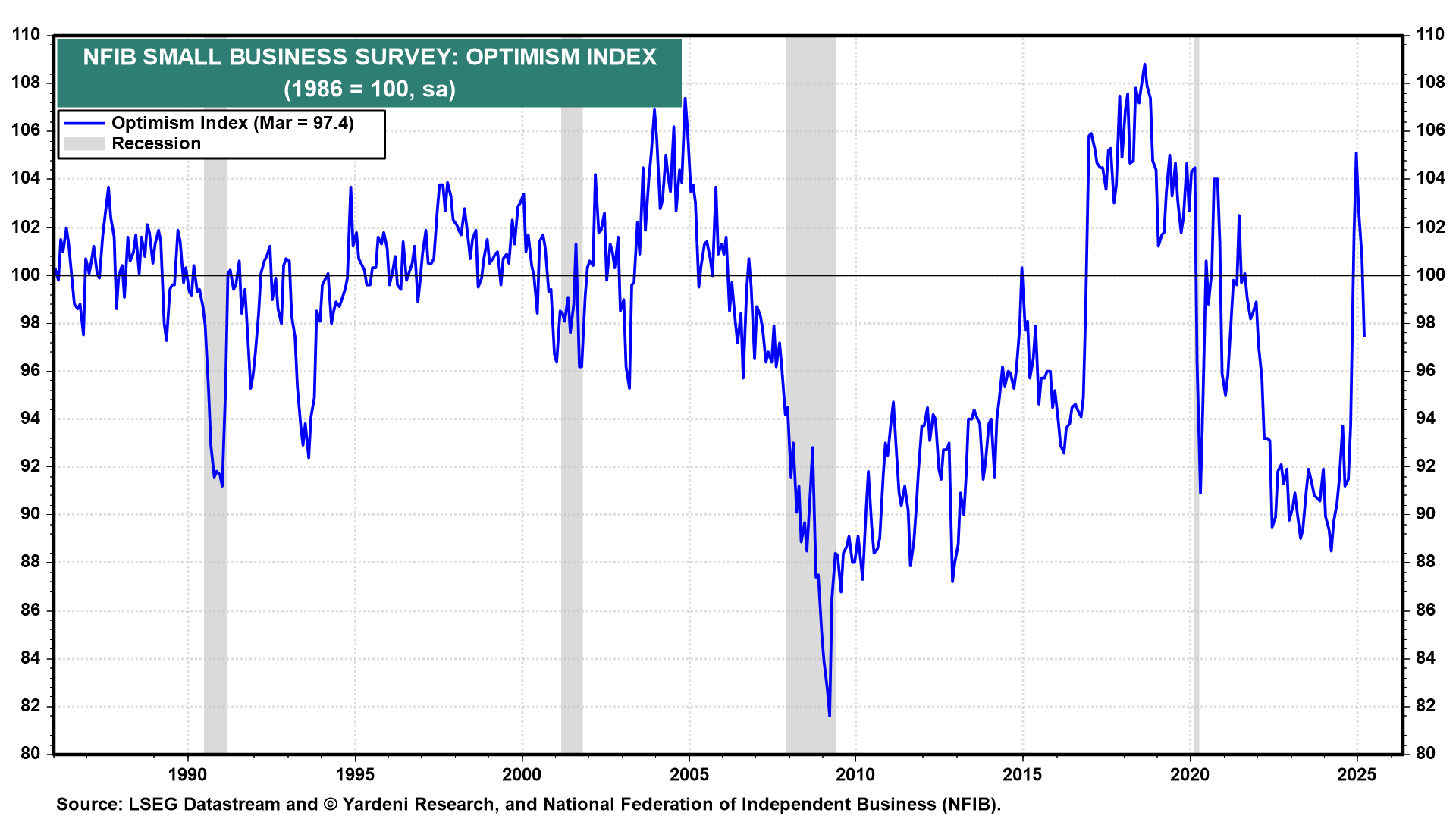

(3) Business surveys. Downside risks will almost surely be on display in the April confidence index from the National Federation of Independent (LON:IOG) Business (NFIB). Muddying the latest reading, of course, is confusion over President Donald Trump’s abrupt postponement of Liberation Day tariffs. In March, NFIB’s optimism index slid to 97.4, just below the 51-year average of 98.

Even so, the trade war pivot over the last week means April’s findings might already be moot.

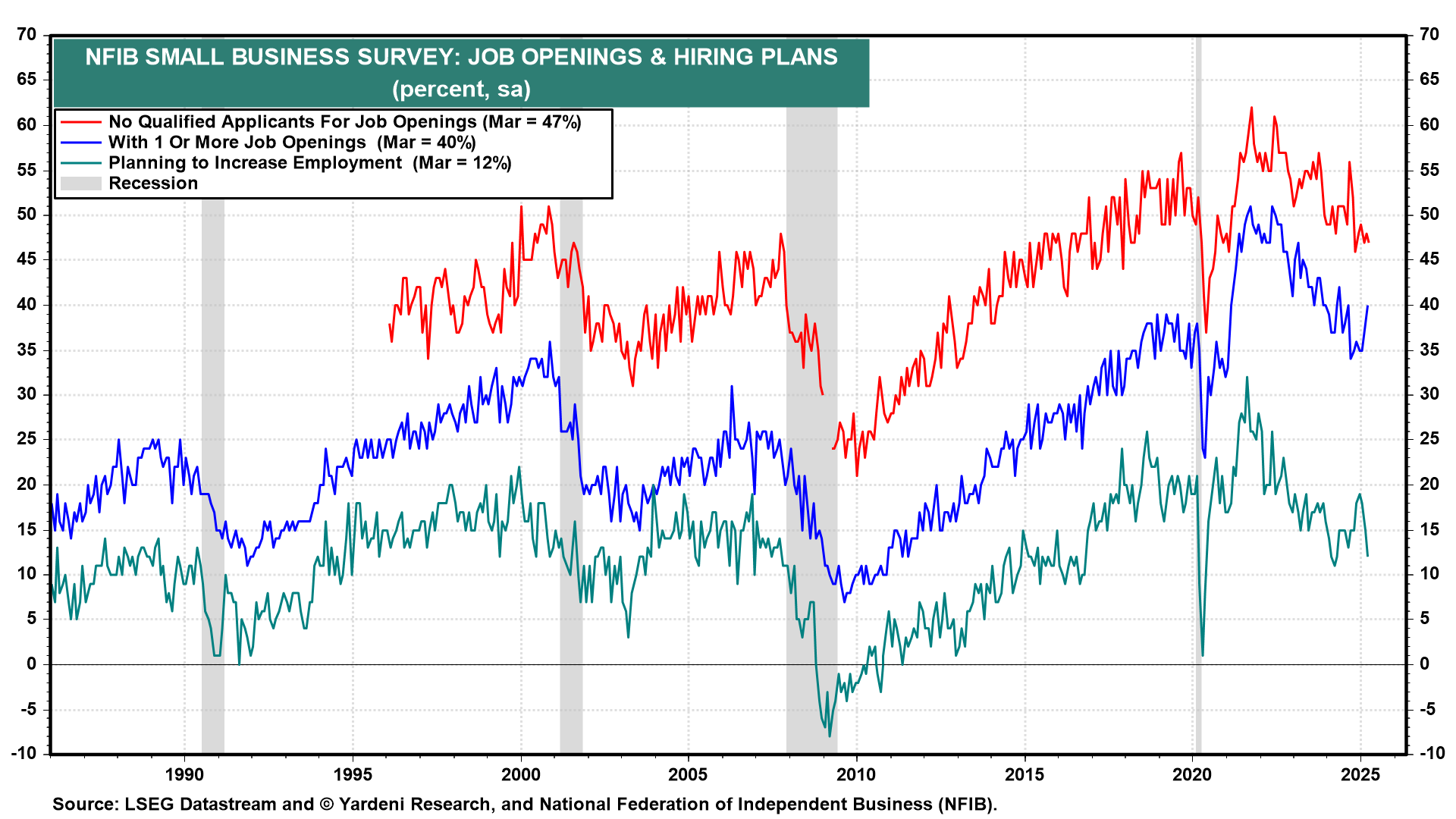

Still, NFIB’s reality check on labor market dynamics may offer timely insights. Given that the survey’s job openings are highly correlated with JOLTS’s job openings series and are more current, NFIB’s indicators might garner more attention than usual. Including Fed policymakers.

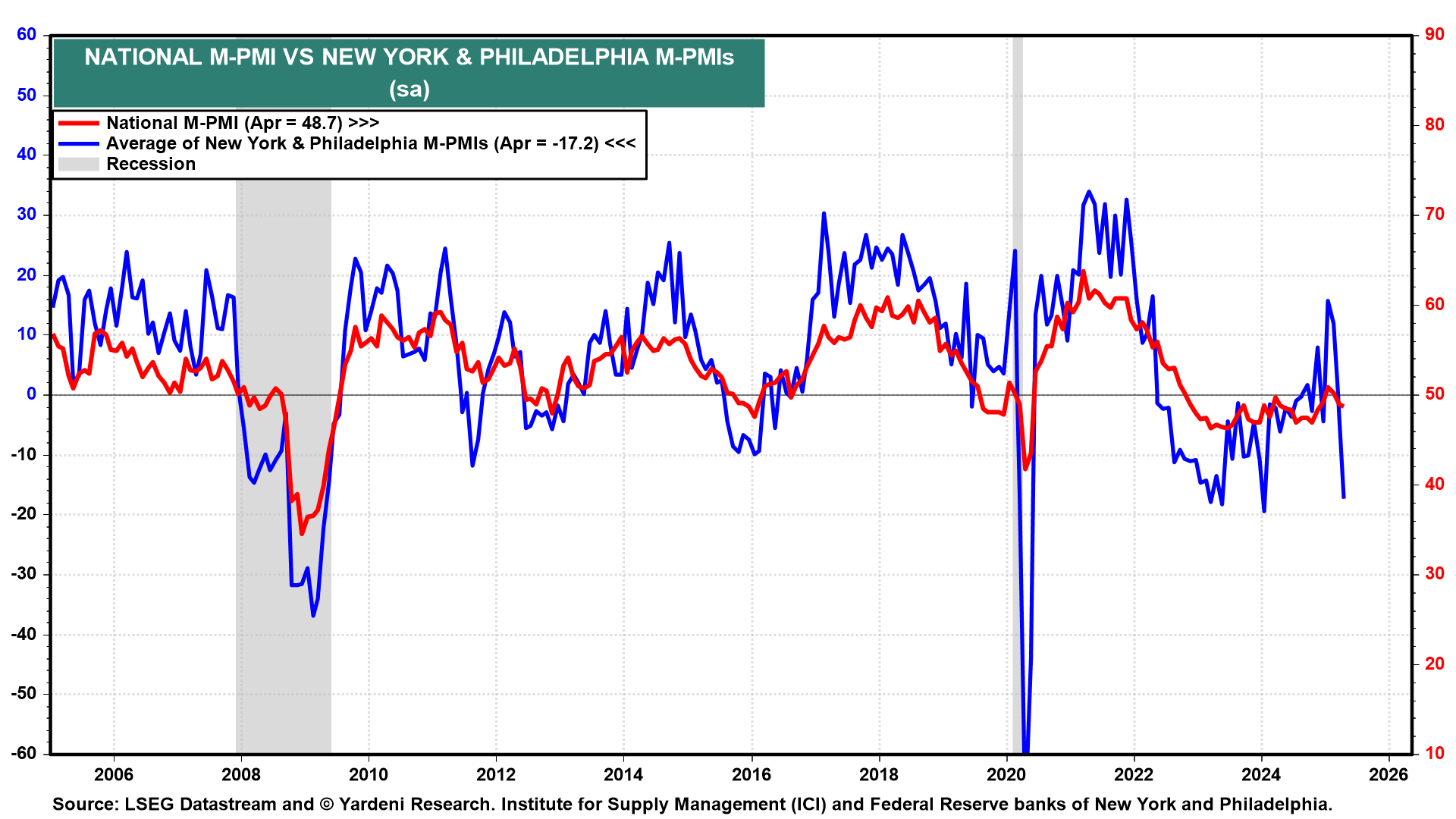

It also might be wise to take the May business surveys from both the New York Fed and Philly Fed with a grain of salt. Though perhaps not as much as April, both series are likely to remain depressed. Yet here too, much has changed in the intervening weeks, with Trump showing increased flexibility on tariffs. And with the labor market holding up well.

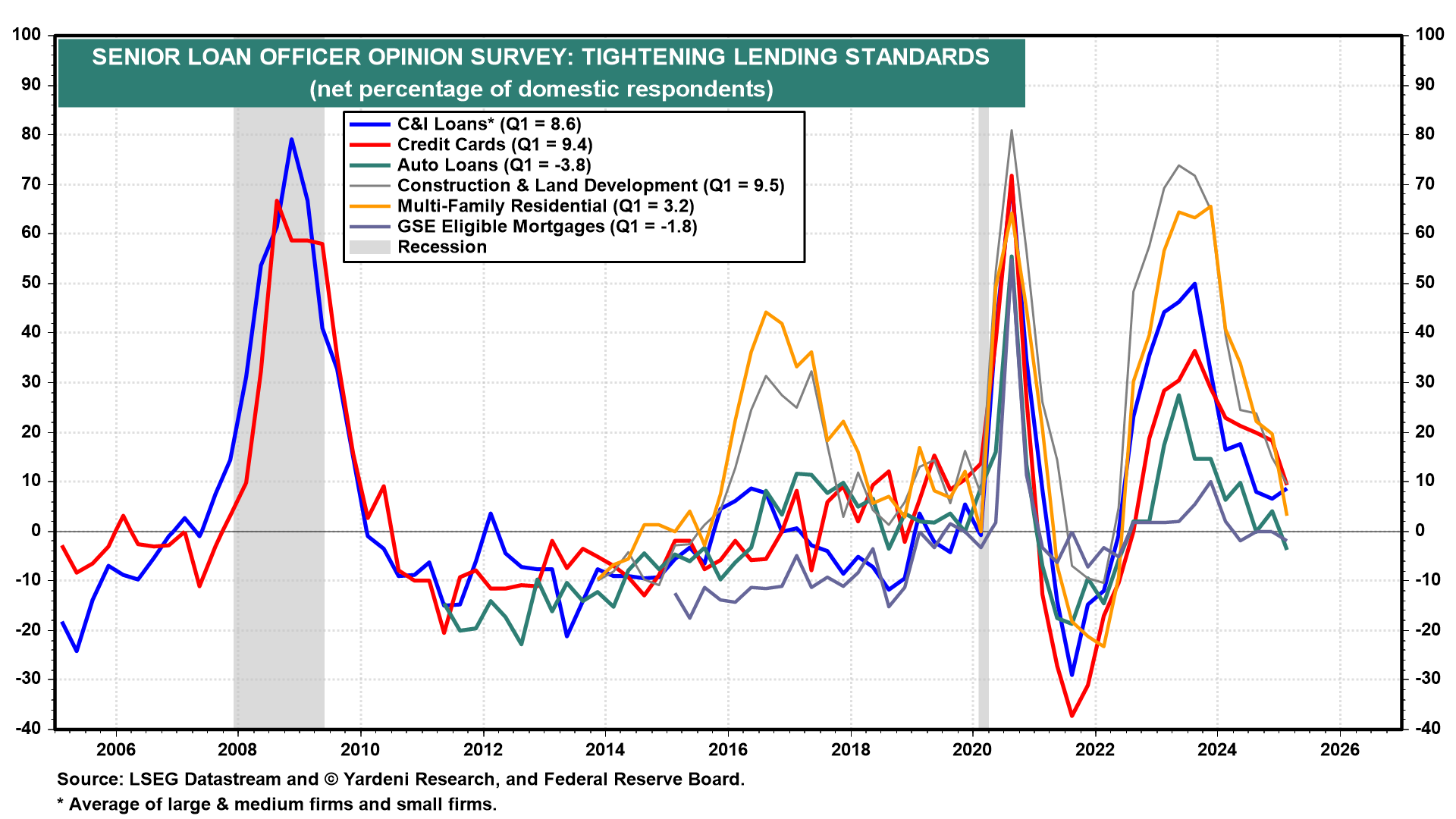

(4) Credit. Debates about the near-term direction of Fed policy might heat up again if credit conditions tighten more than markets expect. With loan officers turning more cautious, odds are good that the willingness to lend by banks might have declined a bit. Yet, with global headwinds appearing to be waning, there’s every reason to expect a bounce back in the months ahead. And for the Fed to take its time easing.