Fermi America stock tumbles after tenant terminates $150M agreement

The outlook for Bitcoin and Ethereum remains supportive from a sentiment and flow perspective - see the key levels to watch from here!

Bitcoin, Ethereum Key Points

- The outlook for Bitcoin and Ethereum remains supportive from a sentiment and flow perspective.

- BTC/USD remains within a bullish channel off the early-April lows, suggesting that the path of least resistance remains to the topside.

- ETH/USD has shown relative strength in recent weeks and is currently threatening a near-term bullish breakout.

Between the constant flood of trade headlines, geopolitical flare-ups, fiscal spending bills, and central bank pronouncements, cryptoassets like Bitcoin and Ethereum have dropped off many traders’ radars this year. As experienced crypto traders will tell you though, that tends to be the best environment for cryptoassets to thrive; indeed, it’s when Bitcoin is being heralded as the “future reserve currency” on the evening news or Ethereum is lauded as the “base layer of Web 3.0” that sentiment (and price) is usually nearing a peak.

As we break down below, the current outlook for Bitcoin and Ethereum remains supportive from a sentiment and flow perspective:

Crypto Sentiment Steady Amidst Positive Flows

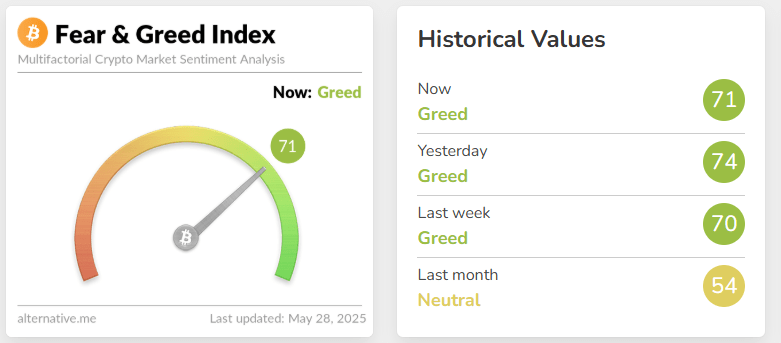

The sentiment gauge I watch most closely, the “Crypto Fear and Greed Index,” has held steady in the low 70s for three weeks now, solidly in the middle of the range that characterizes a healthy, balanced uptrend. If the index were to tick up toward 90 in the coming weeks, it could hint at an elevated risk for a pullback, but the current reading does not provide a strong contrarian signal:

Source: Alternative.me

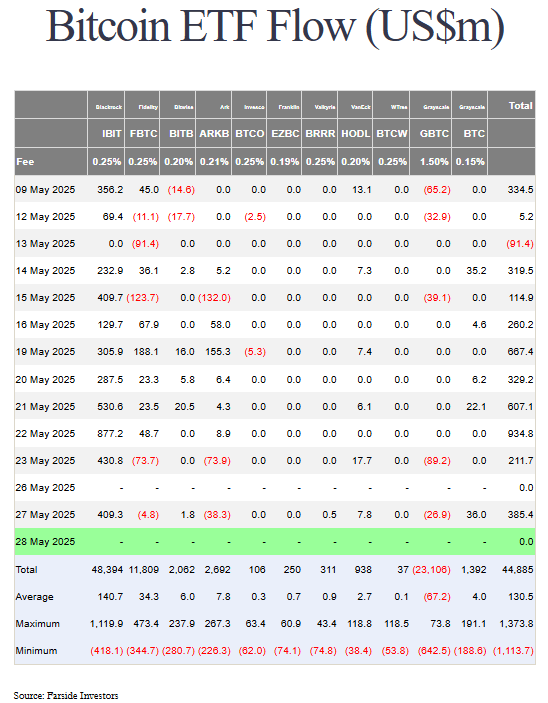

Another way of gauging sentiment, flows into exchange-based cryptoasset investment vehicles have remained strong over the last few weeks. As the chart below shows, Bitcoin ETFs have seen inflows in all but one day over the last three weeks, including a few days over $500M in inflows. Over the long term, inflows from “tradfi” investors provide incremental demand for Bitcoin and could help support the price, as we’ve seen in recent weeks.

Source: Farside Investors

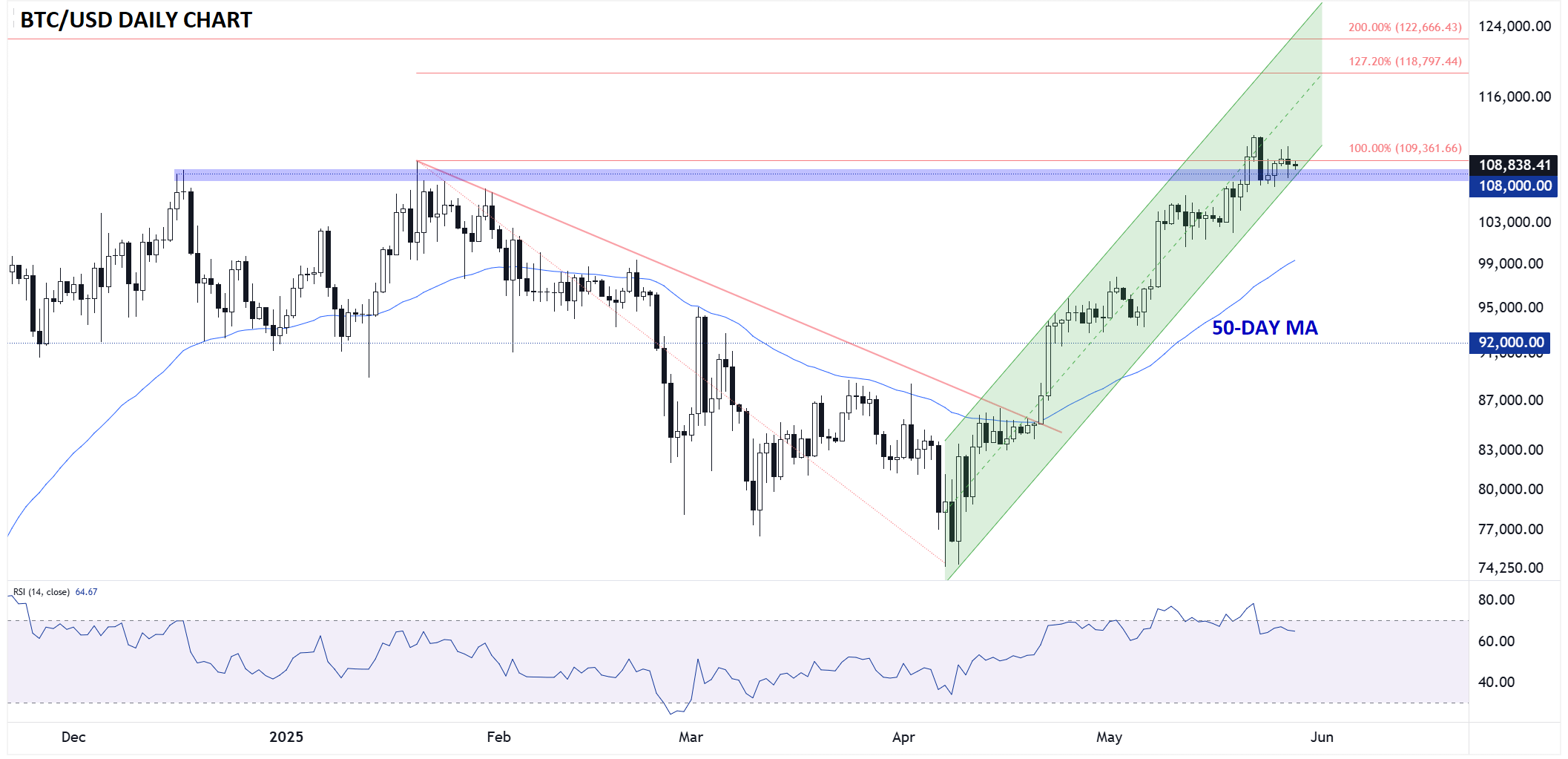

Bitcoin Technical Analysis: BTC/USD Daily Chart

Source: TradingView, StoneX

Turning our attention to the chart, Bitcoin is holding its ground near 2024’s all-time record highs in the $108-109K range. The cryptocurrency remains within a bullish channel off the early-April lows, suggesting that the path of least resistance remains to the topside for now, with potential for prices to extend toward horizontal resistance in the $118-120K range next.

That said, prices have seemingly lost some momentum in recent days, so readers should remain open-minded to a potential channel breakdown. If we see that scenario play out, a deeper pullback toward the 50-day EMA near $100K may be in the cards before the longer-term uptrend can reassert itself.

Ethereum Technical Analysis: ETH/USD Daily Chart

Source: TradingView, StoneX

As for the second-largest cryptoasset, Ethereum still remains far from its record highs or even the peak seen last year near $4K. That said, the cryptoasset has shown relative strength in recent weeks and is currently threatening a near-term bullish breakout above resistance in the $2700-2800 area, where the 50% Fibonacci retracement, 200-day MA and previous highs from February all converge. A clean breakout above that barrier could set the stage for a continuation toward $3000 or even $3500 next.