ION expands ETF trading capabilities with Tradeweb integration

A breakout or reversal looms for BTC/USD, with dollar dynamics quietly shaping the backdrop.

- BTC/USD stalls at known resistance

- Break above opens path to $99,000 and October trendline

- Failure to clear invites shorts targeting $90,000 and beyond

- Dollar direction and risk appetite remain critical drivers

Summary

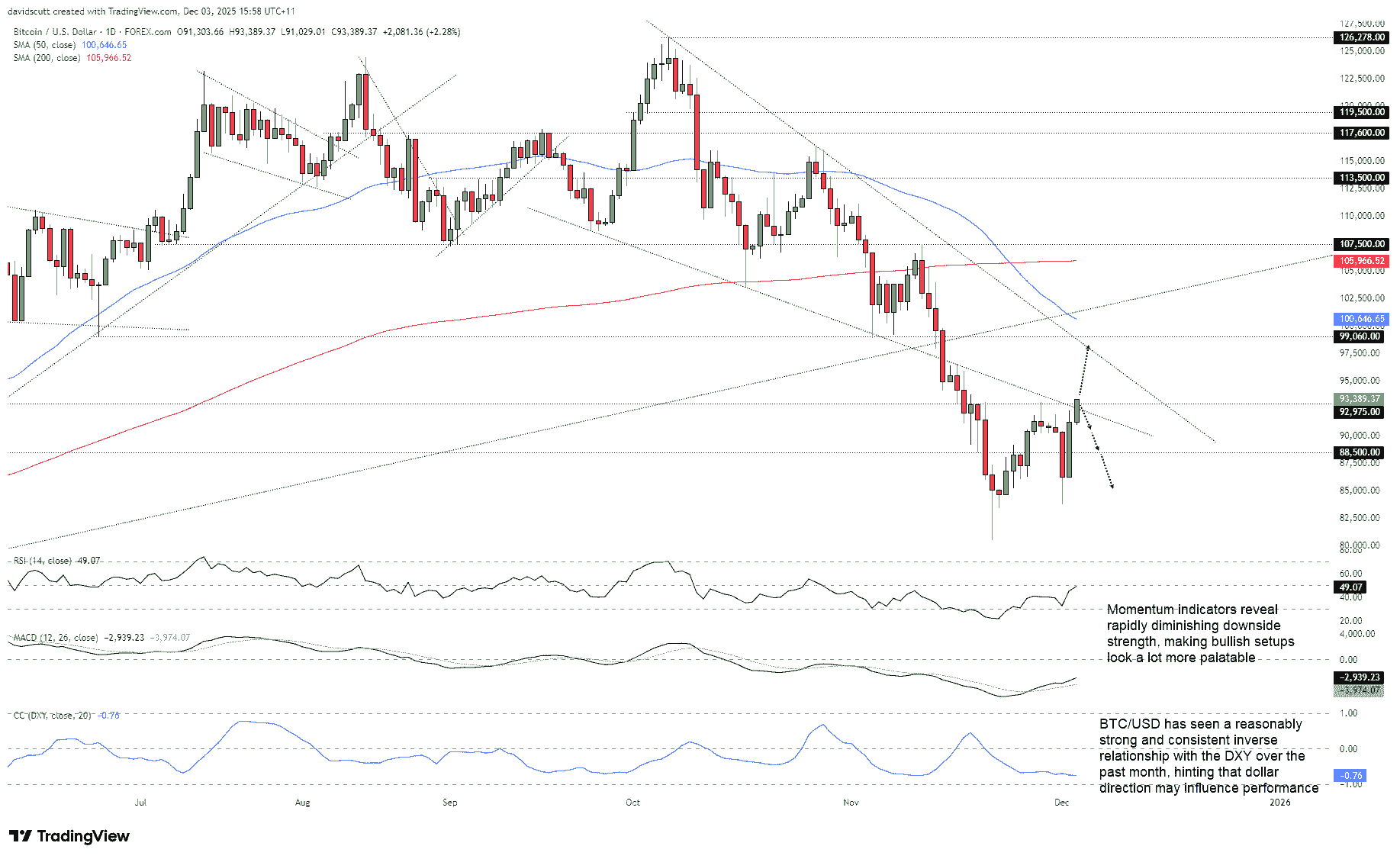

BTC/USD’s corrective rally has paused at a technical intersection, with $92,975 acting as the battleground between bulls and bears. A sustained break above favours longs toward $99,000, while rejection flips the bias to shorts targeting $90,000 and lower. Momentum indicators hint at fading downside pressure, but broader risk appetite and the US dollar’s trajectory may ultimately decide the next move.

Make-or-Break for Corrective Bounce

The bullish move in BTC/USD has stalled at an interesting level, coinciding with the intersection of former downtrend support and horizontal resistance at $92,975. What happens next could make or break the corrective bounce from oversold conditions, providing a decent entry level for two-way directional setups depending on how near-term price action evolves.

Source: TradingView

Should the price push above $92,975 and hold there, longs could be considered above the level with a stop below for protection, targeting the intersection of former horizontal support just above $99,000 with the downtrend running from the October highs.

Alternatively, an inability to break above $92,975 would allow for the setup to be flipped, with shorts established below the level with a stop above. Bids were parked just above $90,000 prior to the abrupt slump-and-pump earlier this week, making it relevant for anyone considering bearish setups. If that were to be broken, the December 1 low looms as another target, with the November 21 nadir the ultimate target should price action oblige.

The momentum picture is one of shifting directional risks, with once rampant downside pressure diminishing rapidly. RSI (14) is back at neutral levels while MACD has crossed the signal line from below and is trending higher. It’s not a bullish signal by any means (yet), but it makes the idea of bullish setups look a lot more appealing relative to earlier in the week.

Dollar Dynamics in Focus

When it comes to broader market conditions when assessing setups, BTC/USD has retained a strong relationship with risk appetite proxies such as Nasdaq and VIX futures over the past week. Interestingly, while the same applies to the US Dollar Index (DXY), over the past month there’s also been a strong and consistent inverse relationship between the two, sitting at -0.75 on a daily timeframe. That differentiates the dollar from other risk proxies, which have seen nowhere near as strong a relationship over the same period.

The read-through is that while broader risk appetite looms as important for BTC/USD setups, arguably the more important factor for bitcoin is the direction of travel for the big dollar.