Street Calls of the Week

President Trump’s latest announcement on tariffs is a reminder that macro uncertainty is high and will probably remain so for the near term.

“What we’re going to be doing is a 25% tariff on all cars not made in the US,” he said on Wednesday.

It wasn’t exactly a surprise, given the President’s preference for tariffs, but it’s another wake-up call that the White House intends to pursue its policies, which suggests a rough ride for making assumptions based on the standard playbook for the economy and financial markets.

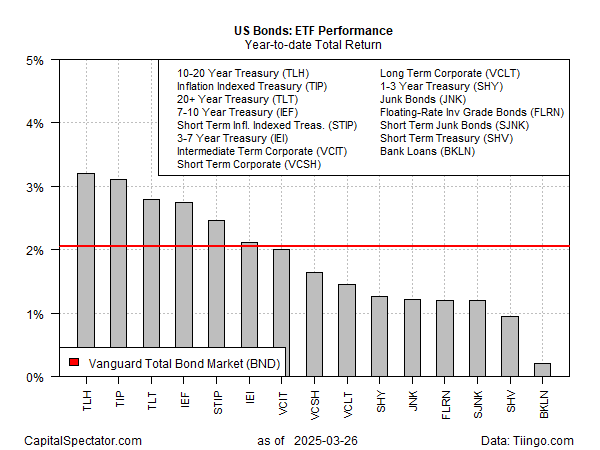

One exception is the case for holding bonds, which are often the go-to asset when the outlook turns challenging. Fixed-income securities overall are posting across-the-board gains this year, based on a set of ETFs through Wednesday’s close (Mar. 26).

The performance leaders in 2025 are 10-20-year Treasuries (NYSE:TLH) and inflation-indexed government bonds (TIP), each posting 3%-plus year-to-date advances. Those are welcome gains when the stock market (SPY) is nursing a 2.7% loss so far in 2025. The gains for TLH and TIP are also sizable return premiums over the benchmark for US investment-grade bonds via Vanguard Total (EPA:TTEF) Bond (NASDAQ:BND), which is up 2.1%.

But while bonds have provided a safe haven this year, there are several risk factors that could complicate the path ahead. The pressing question is whether inflation or slowing economic growth is the priority in terms of how the Federal Reserve adjusts its monetary policy.

For the moment, the central bank is in a wait-and-see mode. After leaving its target rate unchanged earlier this month, Fed funds futures are pricing high odds that a repeat performance will arrive at the next FOMC meeting on May 7. By contrast, the market sees a strong chance that the Fed will cut rates at the June meeting.

Softer economic activity, in other words, is the odds-on favorite for driving Fed policy in the near term. If correct, that will provide a tailwind for bonds.

Slower economic activity is usually associated with lower inflation, a combination that would smooth the path for rate cuts. However, the potential for sticky or higher inflation amid softer economic activity – stagflation — is a concern and threatens an outcome that could weigh on bond prices as investors demand a higher yield premium.

One strategist advises that stagflation risk is lurking. “The biggest question if you think about risk — I don’t think it’s a question of how much growth we will have or not — it’s stagflation,” says UBS Group AG’s Asia Pacific President Iqbal Khan at Bloomberg family office summit in Hong Kong on Thursday. “That’s the real risk out there and that’s what everybody wants to avoid. And I think most of the central banks including the Fed is clearly very, very focused on that.”

The implication: the Fed may be reluctant to cut rates. If so, bonds may have a tough time rallying further.

The Fed and the markets, in other words, are highly dependent on the drip, drip, drip of incoming economic data for deciding what comes next. The next major clue arrives tomorrow (Mar. 28), with the release of PCE inflation data for Feb—data that’s closely watched by Fed officials.

For good or ill, the numbers aren’t expected to change the calculus. The consensus forecast expects the monthly and year-over-year comparisons to basically hold steady vs. the January data. The odds for watching and waiting, in sum, still look like the best bet for now.