Japanese Bitcoin treasury Metaplanet surges on $620 mln buy

Sunday's Commentary touched on the divergence between robust economic growth in the U.S. and near-recessionary conditions in Canada. We highlighted the importance of this to U.S. investors because of the historically strong correlation between the two economies. Unfortunately, Canada is not a one-off instance.

Britain, Europe, and China also exhibit poor economic growth. Given the U.S. operates in a global economy, it’s hard to imagine that economic stagnation in Britain, Europe, China, and Canada will not, at the minimum, provide a strong headwind to U.S. economic growth. Throw in tariffs, and that gust could prove too much for what has been a good run of post-pandemic above-economic growth in the U.S.

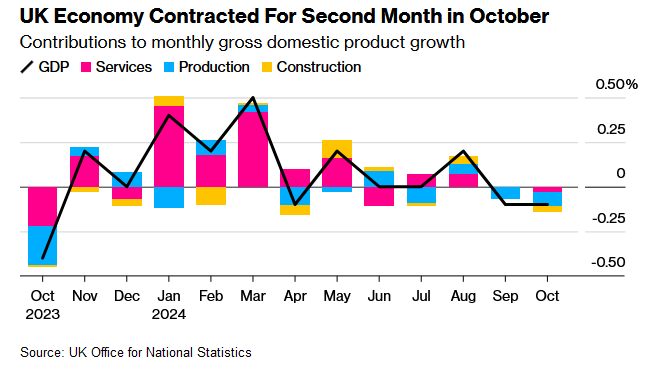

We bring up this topic again because Britain reported last Friday that its GDP fell by 0.1% for the month. Moreover, as shown in the graph below, courtesy of Bloomberg, Britain has had zero economic growth since July. As a result, the Bank of England is likely to cut rates at a faster pace than the Fed. Europe faces similar struggles, and its central bank is also likely to be more aggressive than the Fed.

In a coming blog article, we will discuss the slump in global economic growth and why U.S. investors should pay attention.

What To Watch Today

Earnings

- No earnings releases today

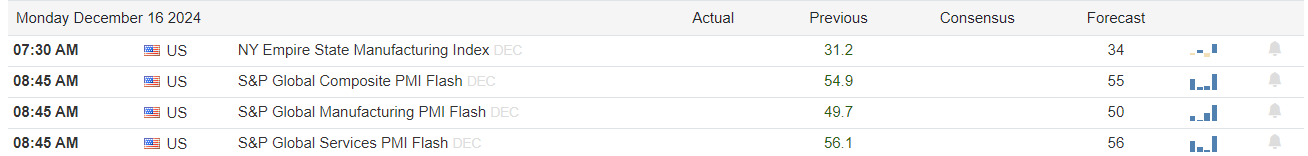

Economy

Market Trading Update

Last week, we discussed that the risk to the markets was the annual portfolio rebalancing process. To wit:

“With the year-end approaching, portfolio managers need to rebalance their holdings due to tax considerations, distributions, and annual reporting. For example, as of this writing, the S&P 500 is currently up about 28% year-to-date, while investment-grade bonds (as measured by iShares US Aggregate Bond ETF (AGG) are up 3.2%. That differential in performance would cause a 60/40 stock/bond allocation to shift to a 65/35 allocation. To rebalance that portfolio back to 60/40, portfolio managers must reduce equity exposure by 5% and increase bond exposure by 5%. Depending on the magnitude of the rebalancing process, it could exert downward pressure on risk assets, leading to a short-term market correction or consolidation.”

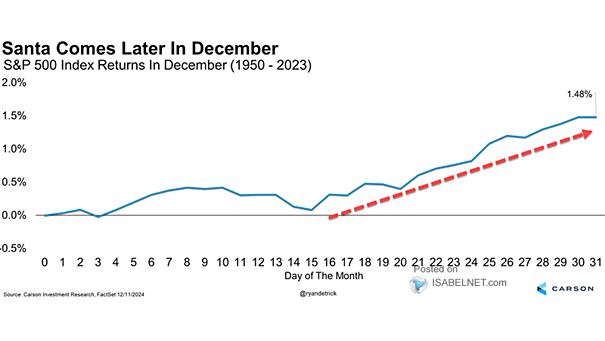

That certainly seemed the case this past week, with the market trading being fairly sloppy. Attempts to push the market higher were repeatedly met with sellers, and we saw a rotation from over-owned to under-owned assets. Notably, that selling pressure arrived as expected, and while such could persist until early next week, we should be getting close to the end of the distribution and rebalancing process. The good news is that the recent consolidation paves the way for “Santa Claus to visit Broad and Wall.”

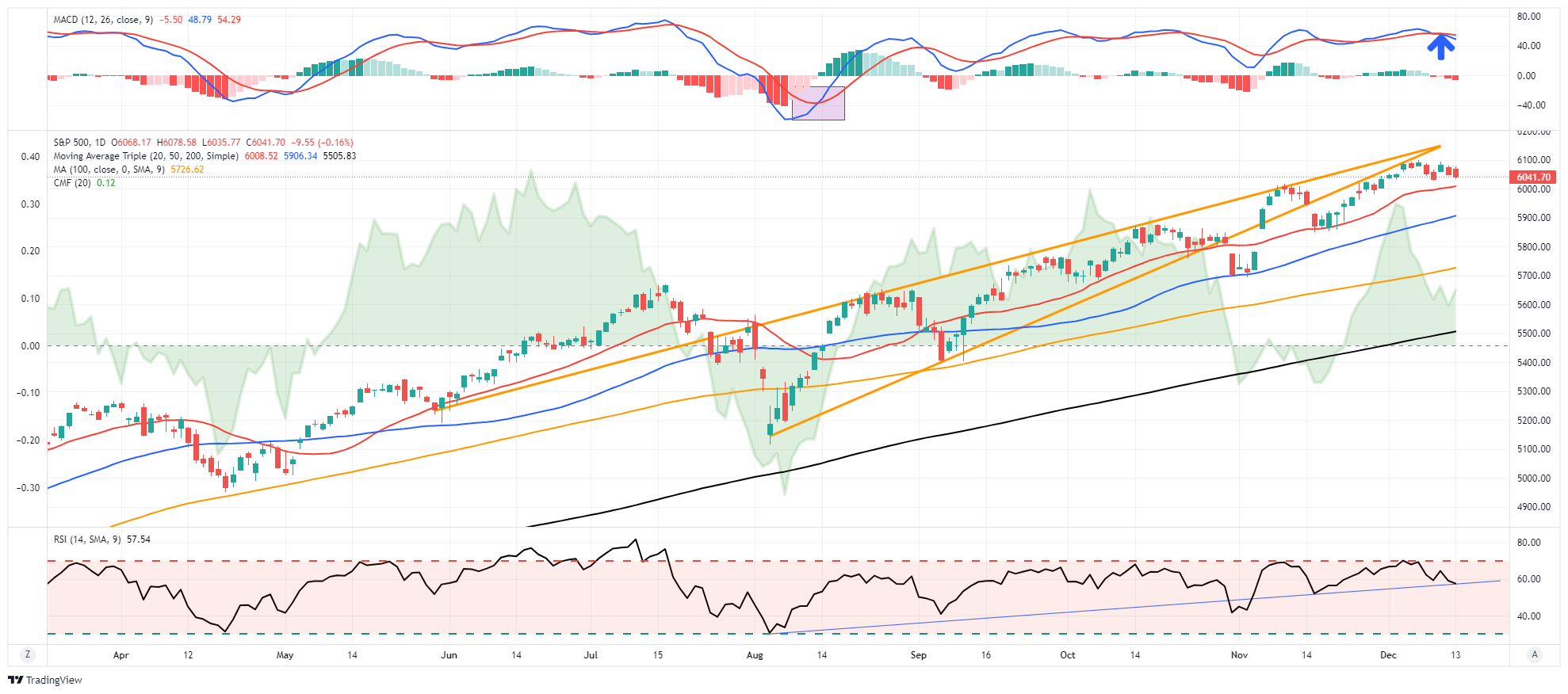

Technically speaking, the market did register a short-term MACD sell signal last week, which could exert further downward pressure on stocks into next week. With relative strength not oversold, there is some risk of the market declining toward the 20-DMA by the time the Fed announces its next rate cut on Wednesday. However, barring any unexpected events, the market should be able to rally into year-end with a target of 6100 to 6150.

Short-term forecasts always have risks, so we suggest managing risk accordingly. However, the seasonal tendencies, current bullish sentiment, and share buybacks continue to favor higher prices into the first week of 2025. After that, all bets are off as a new administration, executive actions, and the first 100 days of policymaking will set the stage for market expectations next year. As noted last week, optimism is exceptionally high. Still, a radical transformation of Government, which will be great in the long term, does not come without short-term economic and financial. risks.

The Week Ahead

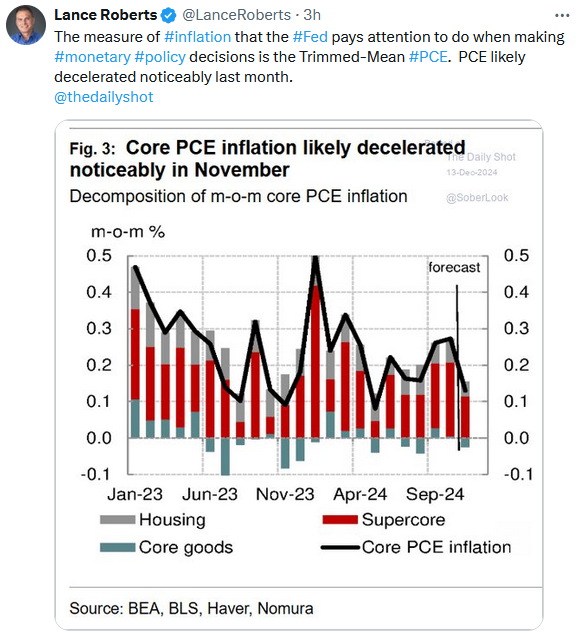

The FOMC meets on Wednesday. In addition to making its interest rate decision, the FOMC will release its fourth-quarter economic projections. Investors will focus on their Fed Funds expectations, along with its CPI and employment forecasts. The market puts the odds of a 25bps rate cut at nearly 100%.

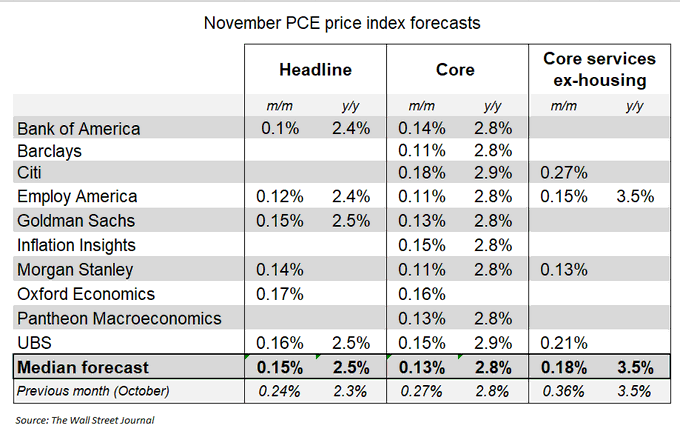

The PCE prices index on Friday will provide another look at inflation. Nick Timiraos of the Wall Street Journal notes that PCE is likely to come in slightly lower than initially expected based on the recent PPI data. As his table below shows, the Wall Street consensus for core CPI is now +0.13%, which annualizes to a low 1.6%. Also of note is retail sales on Tuesday. This will be an early look at holiday spending.

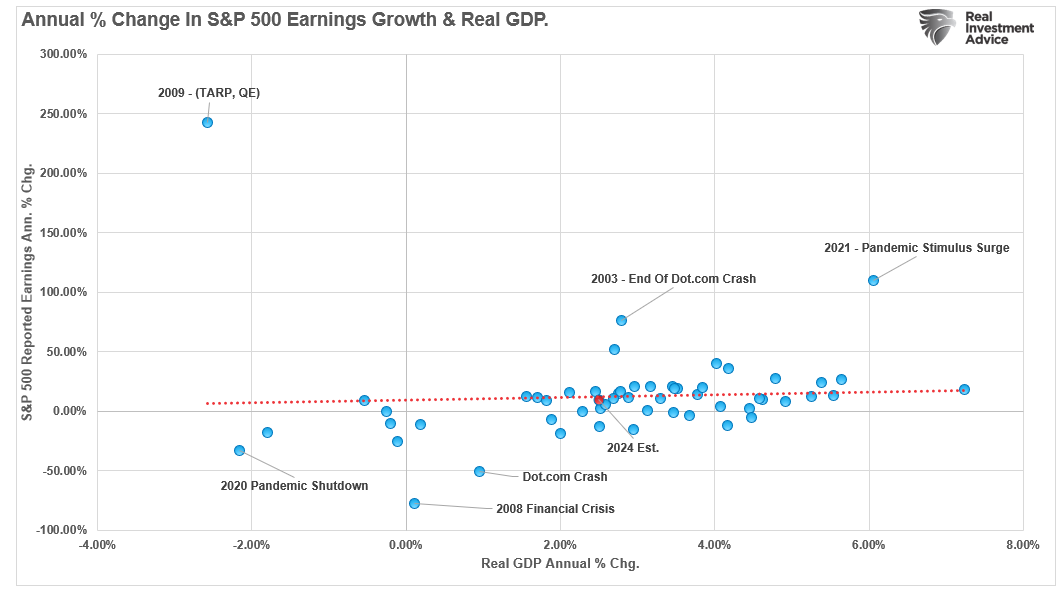

Economic Indicators And The Trajectory Of Earnings

Understanding the trajectory of corporate earnings is crucial for investors, as these earnings significantly influence stock valuations and market performance. Economic indicators such as Gross Domestic Product (GDP), the Institute for Supply Management (ISM) Manufacturing Index, and the Chicago Fed National Activity Index (CFNAI) provide valuable insights into the economic environment that shapes company profitability. These indicators can also help investors evaluate whether Wall Street’s earnings estimates are realistic.

During raging bull markets, exuberance about the market can detach from the underlying economic fundamentals. During these periods, it is not uncommon for Wall Street analysts to continually increase forward estimates on the hopes that the economy will catch up to reality. However, there is a symbiotic relationship between economic indicators and the trajectory of earnings that we will explore.

READ MORE…

Tweet of the Day

“Want to achieve better long-term success in managing your portfolio? Here are our 15-trading rules for managing market risks.”