TSX lower as gold rally takes a breather

This post was written exclusively for Investing.com

It didn’t take long for the S&P 500 to suffer a swift 3% decline, with the index touching technical support around the 3,250 level, as we noted last week.

However, now that the index has held that critical level of technical support on a number of occasions, we are left wondering if the pullback may already be over, despite mounting headlines of the spreading coronavirus.

Some are betting that the market will recover its losses. Recently, there has been options betting taking place in the iShares MSCI Emerging Markets ETF (NYSE:EEM) and the iShares China ETF (NYSE:FXI). The options activity for both ETFs seemed to have picked up in recent days suggesting that the two ETF’s rise in the weeks ahead, acting as a bet that is clearly against the grain.

Finding Strong Support

The S&P 500 fell sharply starting last Friday as headlines of the coronavirus first started to spread. It didn’t take long for the index to fall, dropping by just over 3% from the Jan. 22 highs to the Jan. 27 lows. But the S&P 500 has found a substantial level of technical support around the 3,245 level, which has been acting as a floor for the index. Investors have tested this level of support four times intraday since Jan. 27.

It would seem that the general uptrend in the market has not been damaged either. The S&P 500 has been steadily climbing in a tight trading channel since the beginning of October and has essentially been able to hold that trend line. Additionally, the relative strength index is trending higher off its December 2018 lows. It would indicate that long-term momentum favors markets rising.

Betting The Markets Recover

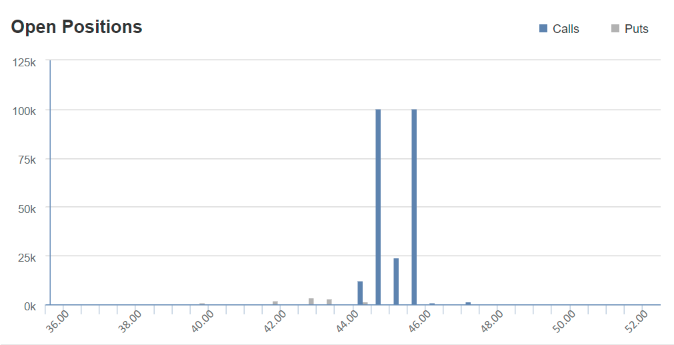

Additionally, it would seem that some traders are betting that the emerging markets and China markets are likely to rebound soon. On Jan. 29, the open interest for the EEM Feb. 28 $45 calls rose by almost 100,000 contracts. The data shows that contracts were bought, with the trader paying about $0.35.

This means that for the buyer of the calls to earn a profit, the EEM would need to rise to $45.35 or higher if holding the contracts until the expiration date. That would amount to a gain of about 5.5% from the EEM’s current price of approximately $43 on Jan. 30.

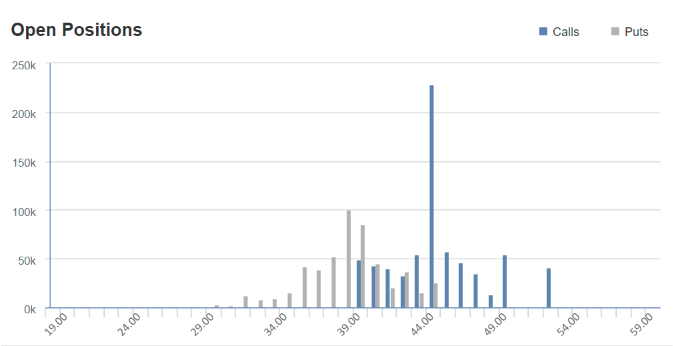

Additionally, the open interest for the FXI March 20, $45 calls saw their open interest levels rise by over 92,000 contracts on Jan. 27. The data also show that the contracts traded on the ASK for about $0.50.

In this case, the ETF would need to rise to $45.50 or higher to earn a profit if the buyer holds the contracts until expiration. The ETF would need to increase by around 12% from its current price of approximately $45.60.

The bets would seem to suggest that some see the market recovering much, if not all of its losses from the recent downdraft. It could even serve as further confirmation the U.S. equity markets are poised to bounce in the days ahead, resuming their current uptrends, in line with the technical charts.

Risks Remain

However, there seems to be a looming risk, which is always present in the equity market. However, should prices reverse and decline below the 3,245 level on the S&P 500, it would likely deal a crushing blow to the index, potentially pushing it lower towards 3,150.

But for now, it seems as if the short-term storm may have already blown over.