Apple investigating outages affecting Apple TV+, Apple Music services

Leading US maker of memory semiconductors Micron Technology (NASDAQ:MU) was the latest chipmaker to warn shareholders that demand is weakening at an alarming rate and that revenue will not live up to forecasts.

Traders seemed more receptive to the dire outlook than previous chipmakers who painted a similar picture. MU opened yesterday 4% lower, extended the sell-off as much as 6%, and ended with a 3.74% loss.

AMD recently pointed out that PC demand is falling, which will adversely impact the company's revenue.

BMO Capital Markets analyst Ambrish Srivastava wrote to clients that "apart from inventory adjustments in the PC smartphone market, which have weakened more, Micron is experiencing inventory adjustments and lower demand in other end-markets ranging from the cloud to autos. We have not heard a chip company speak to the latter."

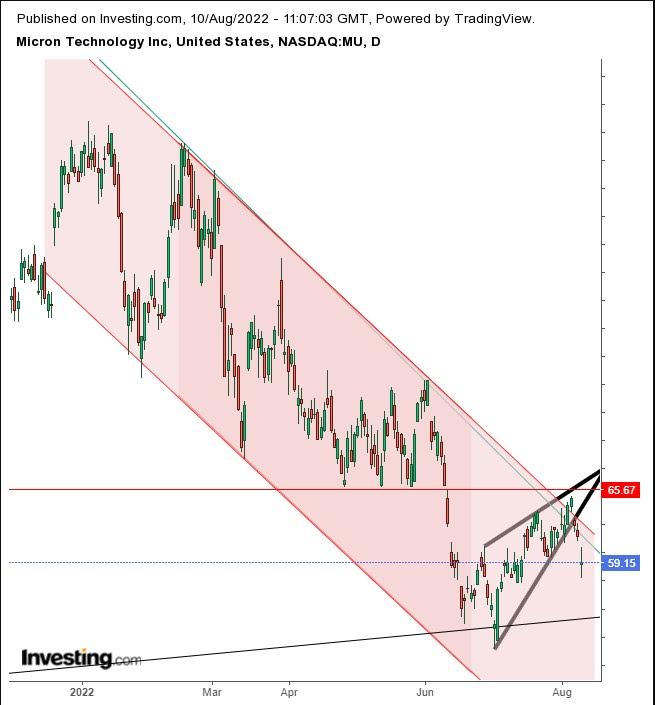

Now, to the chart.

The balance of supply and demand completed a rising wedge, a pattern that turns against the prevailing trend, a bull trap. The dynamics that dominate the climbing range are an eager appetite for the stock. However, as prices would not climb proportionate to bulls' hunger—as can be seen by the wedge's flatter upper line—buyers tired out.

Note that trading provided a downside breakout before earnings were published. This move may be surprising when traders tend to wait before a vital release. Therefore, I suspect 'informed money' is at play. Either way, the falling escape demonstrates that buyers frustrated by the lack of upward mobility gave up, paving the way for sellers to seek buyers at lower prices. The move is set to put the stock in a technical chain reaction that should push the price at least to the June 30 pattern low.

However, if that happens...

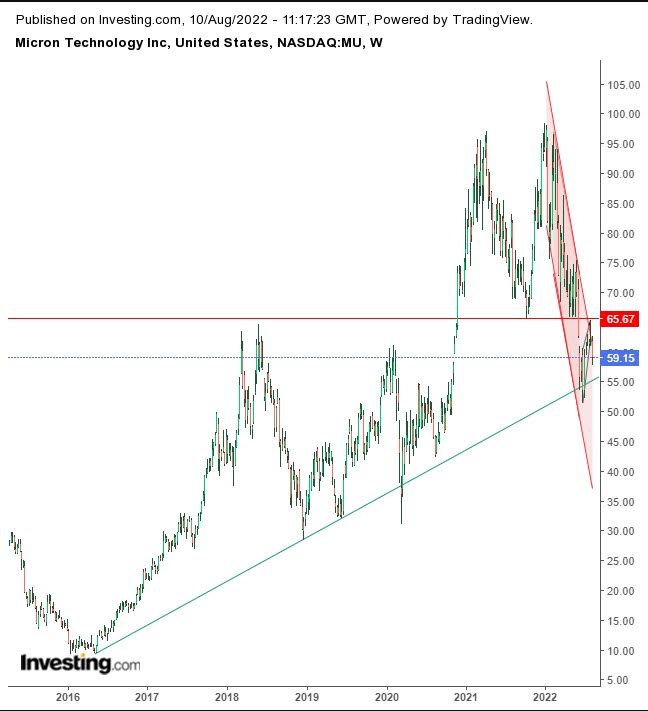

...the stock will have confirmed a massive double top between November 2020 and May 2022. Its implied target is $35, based on the assumption that all the interest wound up in the pattern will unwind downward. Therefore, the minimum target is derived from measuring the pattern's height at its lowest point.

Also, now we understand why the wedge may have formed, as buyers bought the bounce off an uptrend line from the May 2016 low. We can also appreciate the symmetrical beauty of the balance of supply and demand. The $65 level which has been resistant since 2018 then turned into a neckline for the double top, and finally, the resistance again for the rising wedge. We already mentioned how the wedge fits with the long-term uptrend line on the wedge's bottom side. Finally, the $35 implied target coincides with the 2018-2020 lows.

Trading Strategies

Conservative traders should wait for the price to trigger a return move to confirm the wedge's integrity before committing to a short position.

Moderate traders would wait for a corrective rally to reduce exposure by gaining a better entry.

Aggressive traders can be short at will, provided they can absorb potential follow-up whipsaws as traders unwind and even reverse positions, as they do after a breakout.

Trade Samples

Aggressive Short Position

- Entry: $60

- Stop-Loss: $62.50

- Risk: $2.50

- Target: $50

- Reward: $10

- Risk-Reward Ratio:1:4

Moderate Short Position

- Entry: $62.50

- Stop-Loss: $65.00

- Risk: $2.50

- Target: $55.00

- Reward: $7.50

- Risk-Reward Ratio: 1:3

Disclaimer: The author currently does not own any of the securities mentioned in this article.