BigBear.ai appoints Sean Ricker as chief financial officer

For a government that has never shied away from taking an active role in markets, China’s ruling party has seemingly taken a laissez faire approach to its currency despite the Trump Administration’s crippling tariffs on the country.

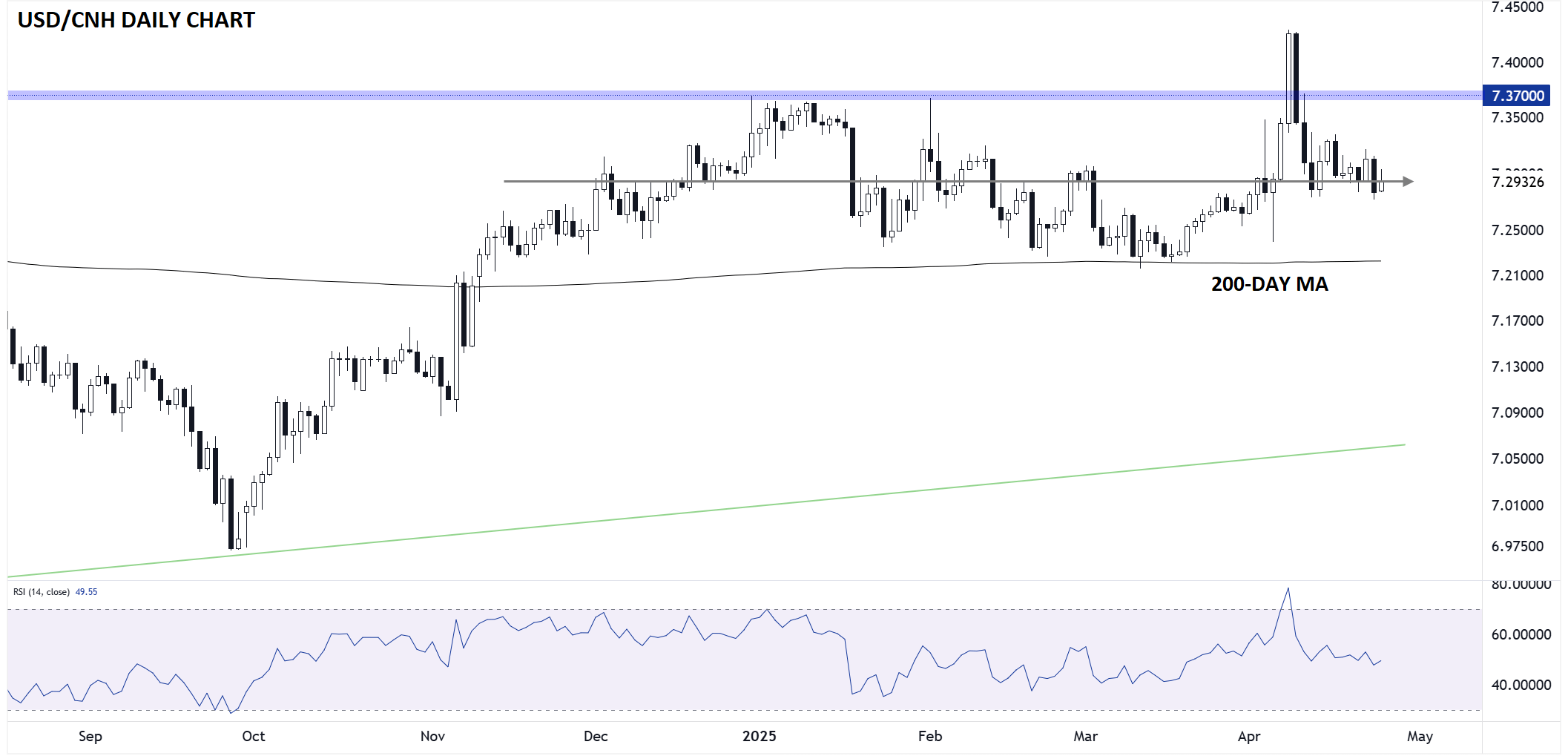

Using the “offshore” (Hong Kong) version of the currency pair, the USD/CNH chart below shows that the Chinese yuan is essentially unchanged at 7.30 against the US dollar since the week after the US election:

Source: StoneX, TradingView

Since then, USD/CNH has bounced around between about 7.20 and 7.40, and the 200-day MA remains flat near 7.22, confirming a (geopolitically surprising) lack of a clear trend.

With the US clearly acting as the aggressor in the current stage of the trade war between the world’s two largest economies, why WOULDN’T China devalue its currency to try to soften the blow from US tariffs?

The answer is that China has, unequivocally, allowed the yuan to depreciate… just not relative to the US dollar. With the US Dollar Index trading down nearly -10% in 2025 alone, holding steady against the greenback implies that the Chinese yuan has depreciated meaningfully against other major currencies, making its exports more competitive with everyone besides the US.

To wit, the yuan is trading at 10-year lows against the euro, 9-year lows against the British pound, 2-year lows against the Japanese yen, and just tested 3-year lows against the Australian dollar earlier this month.

By allowing the yuan to fall in value against other global currencies, China can seek to strike trade deals with non-US counterparts at more favorable terms. Ultimately, 100%+ tariffs between the US and China serve as an effective trade embargo between the two superpowers far beyond the scale of what a currency devaluation can offset, especially for a less volatile pair like USD/CNH, which has moved in a range of about 20% total since the start of the Great Financial Crisis in late 2007.

Moving forward, traders may be able to use USD/CNH as a potential signal into the CCP’s outlook toward the ongoing trade tensions. While the Chinese yuan has not significantly budged against the US dollar in recent months, that very stability may be the message.

Traders should view USD/CNH not just as a reflection of market forces, but as a barometer of Beijing’s tolerance for economic pressure. A sharp move lower in USD/CNH (i.e. yuan strength) could signal a willingness from Chinese authorities to stabilize external relationships or reduce import costs—perhaps ahead of a major diplomatic overture. Conversely, any sudden yuan weakness against the dollar might suggest China is preparing to absorb more pain in the trade war, opting to bolster competitiveness elsewhere as it battens down the hatches for a prolonged battle.

In a world where capital controls, state influence, and geopolitical posturing blur the usual rules of forex markets, USD/CNH remains one of the clearest windows into the Chinese Communist Party’s near-term strategic mindset. Keep a close eye on not just on the level, but on the velocity and direction of moves in the Chinese yuan to decode where the next shift in global trade dynamics may emerge.