Oil prices rebound sharply on smaller-than-feared OPEC+ output hike

- Shares of Cisco Systems are down more than 31.5% since the start of 2022

- New software and chip technology to be announced during Cisco Live event

- Long-term investors could consider investing now

- For tools, data, and content to help you make better investing decisions, try InvestingPro+.

Shareholders in the networking equipment leader Cisco Systems (NASDAQ:CSCO) have seen the value of their investments decline almost 20% over the past year and 31.8% so far this year. By comparison, the NASDAQ 100 and Dow Jones Technology index are down roughly 30.7% and 31.7%, respectively in 2022.

Source: Investing.com

On Dec. 29, shares in the San Jose, US-based global communications equipment behemoth went over $64 to hit a multi-year high. However, on May 19, shares saw a multi-year low of $41.02. The stock’s 52-week range has been $41.02-$64.28, while the market capitalization currently stands at $178.2 billion.

Cisco enjoys impressive levels of market share in different segments. For instance, in the enterprise network infrastructure market, it commands more than 55% of the market.

It also has a dominating position in the ethernet switch and enterprise WLAN markets. In 2021, Cisco Systems saw the “largest telco market share gain”.

As we write, management is holding the Cisco Live event, which typically features new software releases and chip technology enhancements.

Recent Metrics

Cisco Systems released Q3 figures on May 18. Revenue almost flat year-over-year, coming in at $12.8 billion. Adjusted net earnings of $3.6 billion translated into 87 cents per share, up 5%. The tech name ended the quarter with $7.7 billion in cash and equivalents.

On the metrics, CEO Chuck Robbins said:

"We continued to see solid demand for our technologies and our business transformation is progressing well. While COVID lockdowns in China and the war in Ukraine impacted our revenue in the quarter, the fundamental drivers across our business are strong and we remain confident in the long term.”

For Q4, the company expects its revenues to decline by 1% to 5.5% YoY and EPS to come between 76 cents and 84 cents. Supply-chain challenges, geopolitical concerns, and continued lockdowns in China are likely to mean headwinds for the company.

Prior to the release of the quarterly results, CSCO stock was around $50. Worse-than-expected Q3 top-line numbers and the Q4 guidance that was weaker than analysts’ forecast triggered another sell-off in CSCO stock.

At the time of writing, the stock is changing hands at $42.90, down more than 14%. However, potential investors may want to know that even at the low end of guidance, Cisco is still expected to deliver record EPS numbers. Lastly, the current share price also supports a dividend yield of 3.5%.

Next Move In CSCO Stock

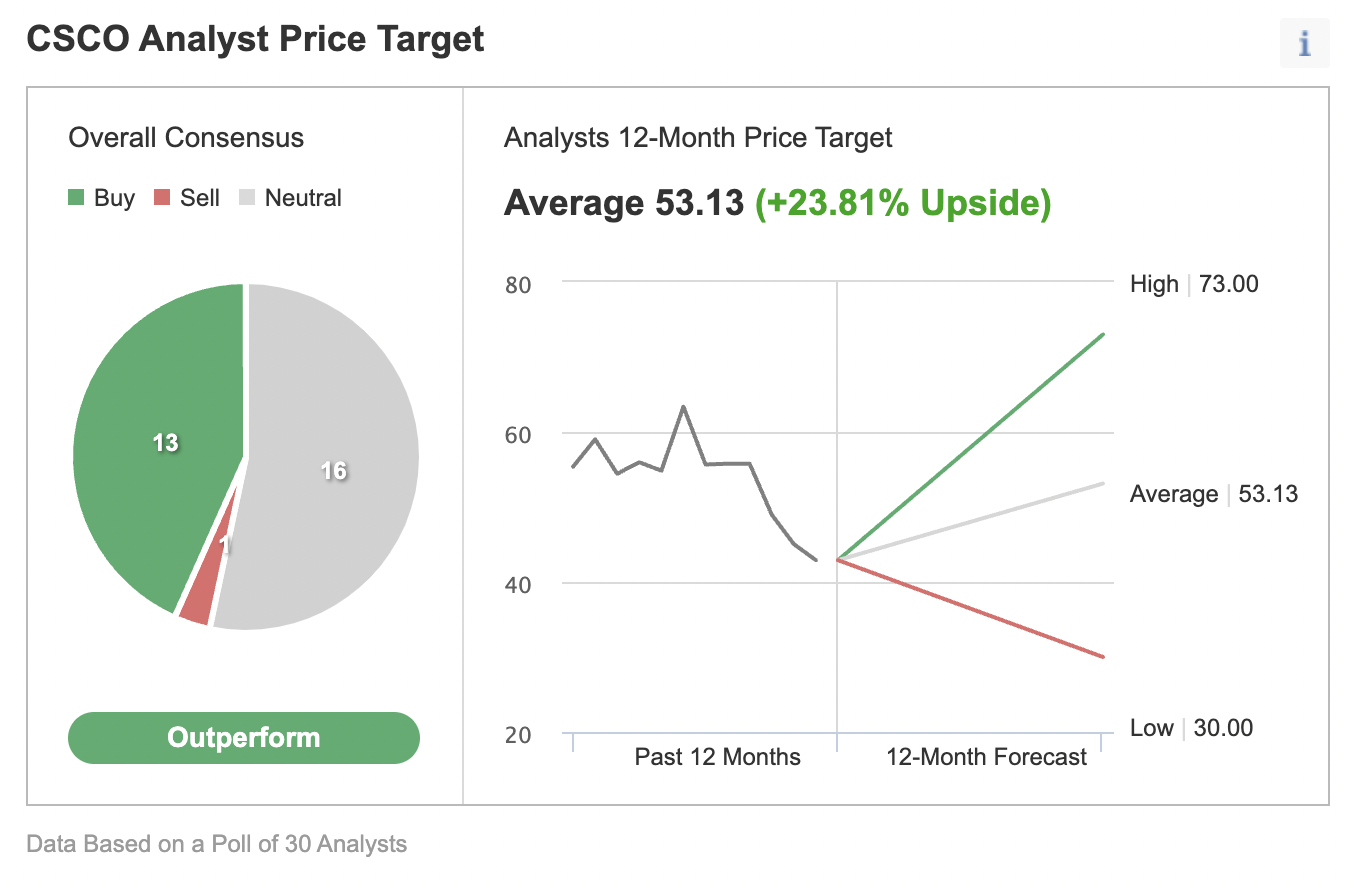

Among 30 analysts polled via Investing.com, CSCO stock has an "outperform" rating. Wall Street has a 12-month median price target of $53.13 for the stock, suggesting an increase of more than 23% from the current price. The 12-month price range currently stands between $30 and $73.

Source: Investing.com

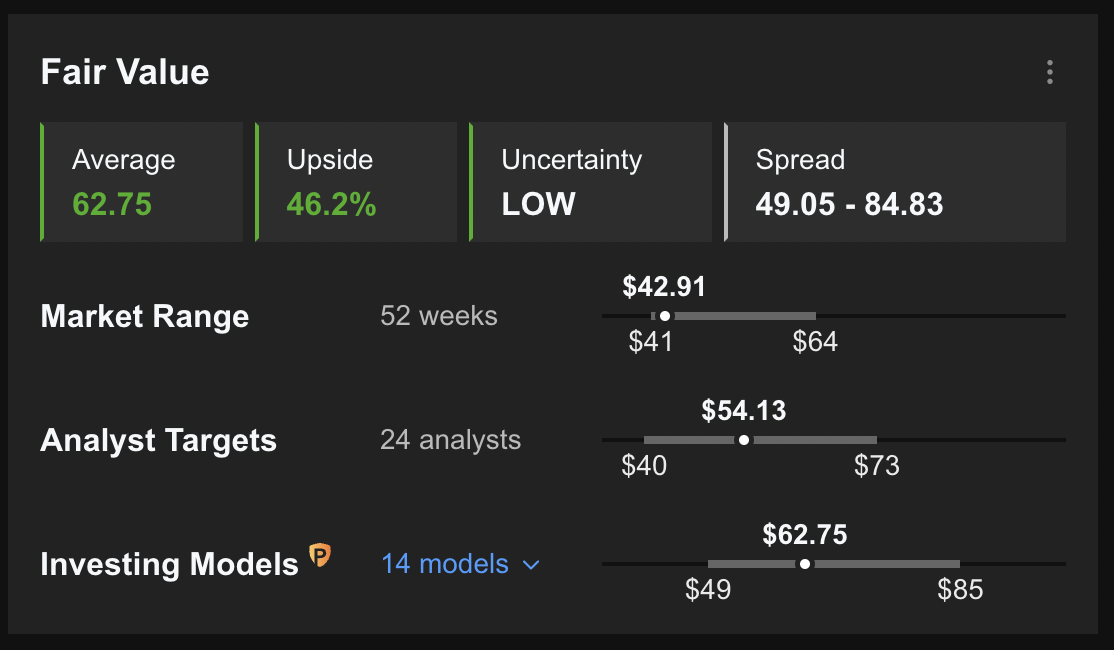

Similarly, according to a number of valuation models including P/E or P/S multiples or terminal values, the average fair value for CSCO stock on InvestingPro stands at $62.75.

Source: InvestingPro

In other words, fundamental valuation suggests shares could increase by 46%.

Readers who watch technical charts might be interested to know that a number of Cisco’s short- and intermediate-term oscillators are oversold. Although they can stay extended for weeks—if not months—the decline in the CSCO share price could also be coming to an end.

Our expectation is for CSCO to find strong support around the $42.5 level. Although it might initially dip below it, shares are likely to bounce back before too long. Afterward, Cisco stock would likely trade sideways while it establishes a new base.

Cash-Secured Puts On Cisco Systems

Price Now: $42.90

Investors who are not concerned with daily moves in price and who believe in the long-term potential of the company could consider investing in CSCO stock now. They could expect the shares to make a move toward $53.13, or analysts’ estimate.

Those who are experienced with options could also consider selling a cash-secured put option in CSCO stock—a strategy we regularly cover. As it involves options, this setup will not be appropriate for all investors.

Such a bullish trade could especially appeal to those who want to receive premiums (from put selling) or to possibly own Cisco shares for less than their current market price of $42.90.

A put option contract on CSCO stock is the option to sell 100 shares. Cash-secured means the investor has enough money in his or her brokerage account to purchase the security if the stock price falls and the option is assigned. This cash reserve must remain in the account until the Cisco option position is closed, expires, or is assigned, which means ownership has been transferred.

Let's assume an investor wants to buy Cisco stock, but does not want to pay the full price of $42.90 per share. Instead, the investor would prefer to buy the shares at a discount within the next several months.

One possibility would be to wait for CSCO stock to fall further, which it might or might not do. The other possibility is to sell one contract of a cash-secured Cisco Systems put option.

So the trader would typically write an at-the-money (ATM) or an out-of-the-money (OTM) put option and simultaneously set aside enough cash to buy 100 shares of the stock.

Let's assume the trader is putting in this trade until the option expiry date of Aug. 19. As the stock is $42.90 at the time of writing, an OTM put option would have a strike of $40.

So the seller would have to buy 100 shares of Cisco at the strike of $40 if the option buyer were to exercise the option to assign it to the seller.

The CSCO Aug. 19 40-strike put option is currently offered at a price (or premium) of $1.45.

An option buyer would have to pay $1.45 X 100, or $145, in premium to the option seller. This premium amount belongs to the option seller no matter what happens in the future. The put option will stop trading on Friday, Aug. 19.

Assuming a trader would enter this cash-secured put option trade at $42.90 now, at expiration on Aug. 19, the maximum return for the seller would be $145, excluding trading commissions and costs.

The seller's maximum gain is this premium amount if CSCO stock closes above the strike price of $40. Should that happen, the option expires worthless.

If the put option is in the money (meaning the market price of Cisco stock is lower than the strike price of $40) any time before or at expiration on Aug. 19, this put option can be assigned. The seller would then be obligated to buy 100 shares of CSCO stock at the put option's strike price of $40 (i.e. at a total of $4,000).

The break-even point for our example is the strike price ($40) less the option premium received ($1.45), i.e., $38.55. This is the price at which the seller would start to incur a loss.

Cash-secured put selling is a moderately more conservative strategy than buying shares of a company outright at the current market price. This can be a way to capitalize on the choppiness in Cisco Systems stock in the coming weeks.

Investors who end up owning CSCO shares as a result of selling puts could further consider setting up covered calls to increase the potential returns on their shares. Thus, selling cash-secured puts could be regarded as the first step in stock ownership.

***

Looking to get up to speed on your next idea? With InvestingPro+ you can find

- Any company’s financials for the last 10 years

- Financial health scores for profitability, growth, and more

- A fair value calculated from dozens of financial models

- Quick comparison to the company’s peers

- Fundamental and performance charts

And a lot more. Get all the key data fast so you can make an informed decision, with InvestingPro+. Learn More »