IonQ CRO Alameddine Rima sells $4.6m in shares

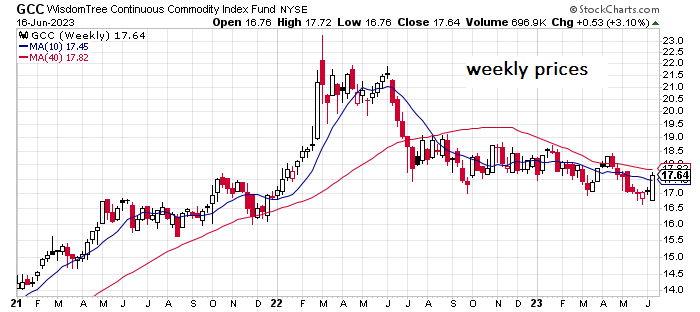

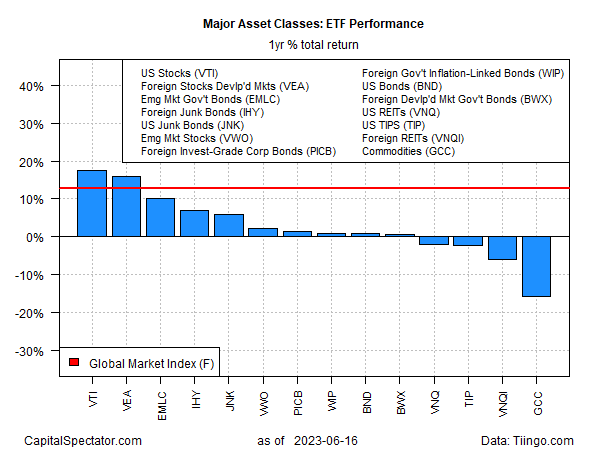

A broad measure of commodities led returns for the major asset classes last week, based on a set of ETFs through Friday’s close (June 16). But even after a strong rally, it’s still not clear that the trend for commodities is set to break out of a tight range that’s prevailed for the past year.

WisdomTree Enhanced Commodity Strategy Fund (NYSE:GCC) surged 3.1% last week, but that still left the ETF at a middling level relative to prices over the trailing 12-month window. In fact, a set of moving averages for the fund suggests GCC is still drifting lower despite the latest pop.

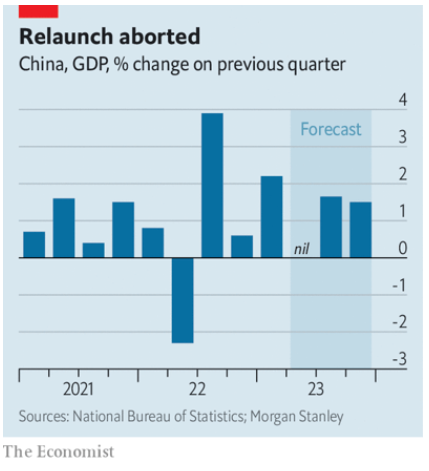

A new challenge for prices of some commodities, including energy: China’s disappointing results after reopening its economy from a COVID lockdown. As the world’s second-biggest economy, the ebb and flow of China’s economic activity are a key factor for commodity prices overall.

“(China’s) economy is navigating through powerful headwinds,” says PVM oil analyst Tamas Varga. “The property market has not healed from last year’s slump, and in May both retail sales and industrial output came in below expectation.”

The Economist reports:

“Some economists now think the economy might not grow at all in the second quarter, compared with the first. By China’s standards that would count as a ‘double dip’, says Ting Lu of Nomura, a bank.”

Commenting on today’s weakness in oil prices, Tina Teng, an analyst at CMC Markets, advises:

“China’s economic uncertainties may have caused the selloff after a two-day rebound in oil markets ahead of The People’s Bank of China’s decision on its loan prime rates this week.”

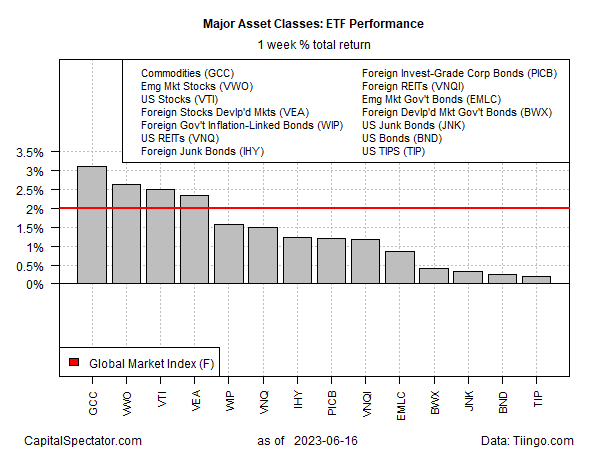

Markets overall rose last week, with every slice of the major asset classes posting gains, ranging from the 3.1% leading performance for commodities to a modest 0.2% rise for inflation-indexed US Treasuries (NYSE:TIP).

The Global Market Index (GMI.F) rose for a third week, rallying 2.0%. This unmanaged benchmark holds all the major asset classes (except cash) in market-value weights via ETFs and represents a competitive measure for multi-asset-class portfolio strategies.

US stocks have taken the lead for the one-year change after last week’s rally. Vanguard Total UUS Stock Market Index Fund (NYSE:VTI) is up nearly 18% for the past 12 months through Friday’s close on a total-return basis.

Commodities (GCC), by contrast, are still in the red for the trailing one-year window, despite last week’s gain.

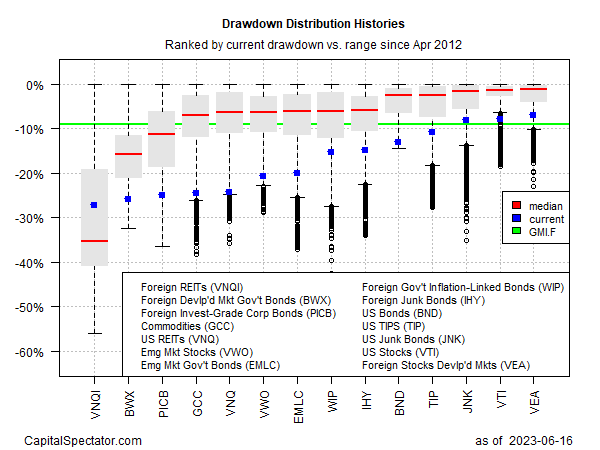

Despite recent strength, most of the major asset classes are still posting relatively deep drawdowns. All but three ended last week with peak-to-trough declines that are deeper than GMI.F’s 9.1% drawdown.