Highway Holdings stock soars after signing LOI to acquire German firm

In wake of the latest events we have witnessed in the banking sector with several actors facing liquidity crunches as a result of rapid and large customer redemptions, financial markets have behaved surprisingly calmly over the last week.

This is happening at a time when the Federal Reserve sticks to its course and has increased the federal funds rate by 25 basis points to a total of roughly 5% now.

This is the reality of the waters we are treading in right now. On one hand, central banks are raising rates to battle widespread inflation that has proved stickier than most imagined. On the other hand, the rapid shift in the rate environment caused over just one year has started to cause severe damage to entities who’ve been blindsided by this changing context.

In the latest developments, Germany’s largest bank, Deutsche Bank (ETR:DBKGn) is the latest entity to have suffered from customers hoarding towards the fire exit and redeeming capital at large. This resulted in a massive stock sell-off of Deutsche Bank on Friday sending the stock downwards more than 8% last week.

And while the Federal Reserve’s chairman Jerome Powell has already said that their base case for rate increases have not changed, it is worth taking notice of the fact that the rhetoric has begun to soften with him stating that they are monitoring the impact of policy direction.

Crypto Lense

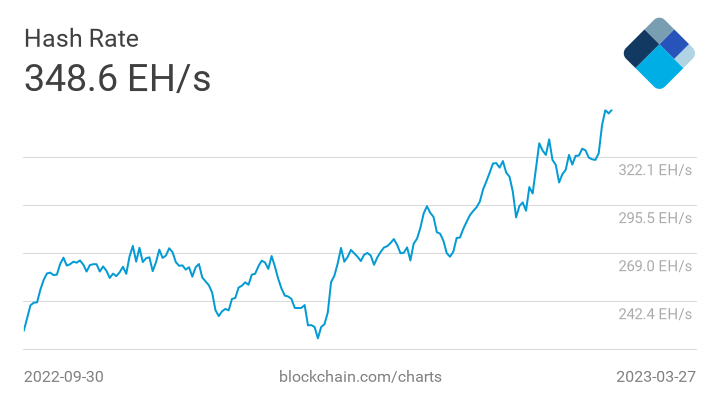

Hash Rate Climbing Comfortably

Bitcoin’s hash rate has been gradually making a comeback over the past few weeks and is currently at 348.6 EH/s, according to the latest data from blockchain.com. In the past, this has been a sign of the crypto market activity starting to breathe back to life.

What Investors Must Know This Week

- CZ Binance Sued by the CFTC & Do Kwon Arrested

CZ has since responded to the CFTC complaint, confirming that the exchange participates in trading to convert its revenues from crypto to fiat, but does not engage in trading for profit. Despite the assurance, the crypto market plunged on Monday, reversing what had started as a bullish momentum at the beginning of the week.

Meanwhile, Do Kwon, the founder of Luna, who has been on the run for some months, was arrested last week in Montenegro. Following the arrest, US authorities moved swiftly to charge the now disgraced crypto mogul with defrauding US citizens.

-

Several Tier-1 banks in France face over $1.1 billion in fines after PNF raids

On Tuesday, the offices of various Tier-1 banks, including HSBC, BNP Paribas (OTC:BNPQY), and Societe Generale (OTC:SCGLY), were raided by French authorities. As per a spokesperson from the PNF Financial Prosecution Office, there are currently five ongoing investigations associated with the 'cum-cum' practices, which involve intricate legal frameworks that affluent clients use to evade taxes on dividends. Given the recent insolvencies and ethical malpractices in the traditional banking system, it seems inevitable that Bitcoin will eventually emerge as the preferred form of currency in the modern-day financial ecosystem.

-

Microstrategy Repays $205 million Silvergate Loan, Buys $150 million worth of BTC

Business intelligence firm and one of the largest BTC holders, Microstrategy (NASDAQ:MSTR), has repaid a $205 million loan owed to Silvergate at a 22% discount. The firm’s CEO Michael Saylor shared the 8-K filing on Twitter, also revealing that Microstrategy added 6,455 BTC ($150 million) to its stash. As of writing, Microstrategy owns a total of 138,955 BTC, acquired at an average price of $29,817.

-

Layer 2 Hype Continues with Polygon’s zkEVM and zkSync Era Mainnet launches

The hype around Ethereum’s Layer-2 solutions continued to gain momentum last week as Polygon and zkSync launched their much-awaited zkEVM-compatible mainnets. Notably, the developments come barely a week after Arbitrum, one of the optimistic rollup solutions, launched its governance token, ARB. The war between optimistic and zk rollups will probably gain more steam as DeFi users get to experience these Layer-2 scaling infrastructures.

-

Fed Explains its decision to reject Custodia’s Bank membership application to the Federal Reserve system

The Federal Reserve has published a statement denying Custodia Bank's membership application to its system. The decision was based on concerns over the bank's management, financial condition, and limited focus on digital assets. The Fed emphasized its intention to prevent further integration of crypto into the conventional banking industry. The Board of Governors also expressed uncertainty regarding Custodia's potential profitability in the future.