Vivek Ramaswamy buys Strive Inc (ASST) stock worth $1.25 million

Where there was little to say about Monday's trading, there was much more to the recent action. For starters, we saw a significant loss and moving average undercut earlier this week and a continuation of the selling. The volume also rose in confirmed distribution.

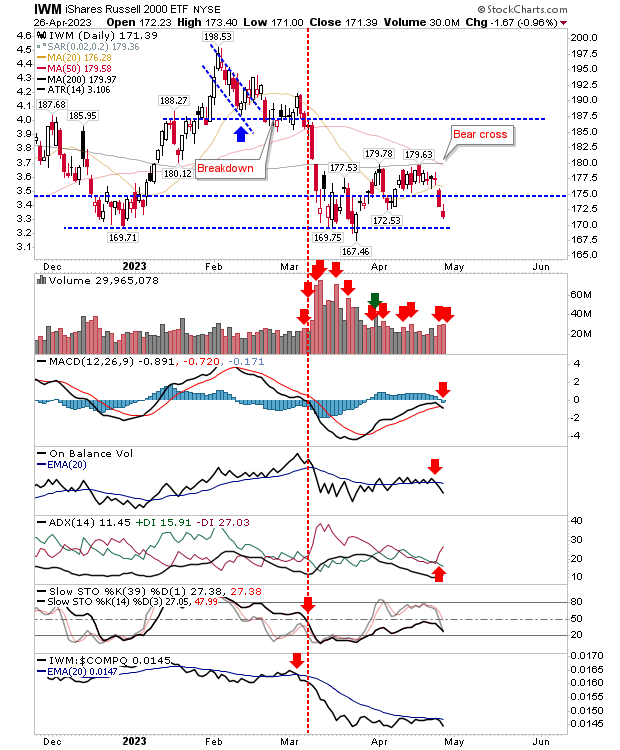

The Russell 2000 gave up two down gap days as it cleanly undercut the 20-day MA support. Adding to that was a "Death Cross" between 50-day and 200-day MAs - although, in reality, we are looking more at a trading range. Adding to the malaise were new 'sell' triggers in the MACD, On-Balance-Volume, and ADX.

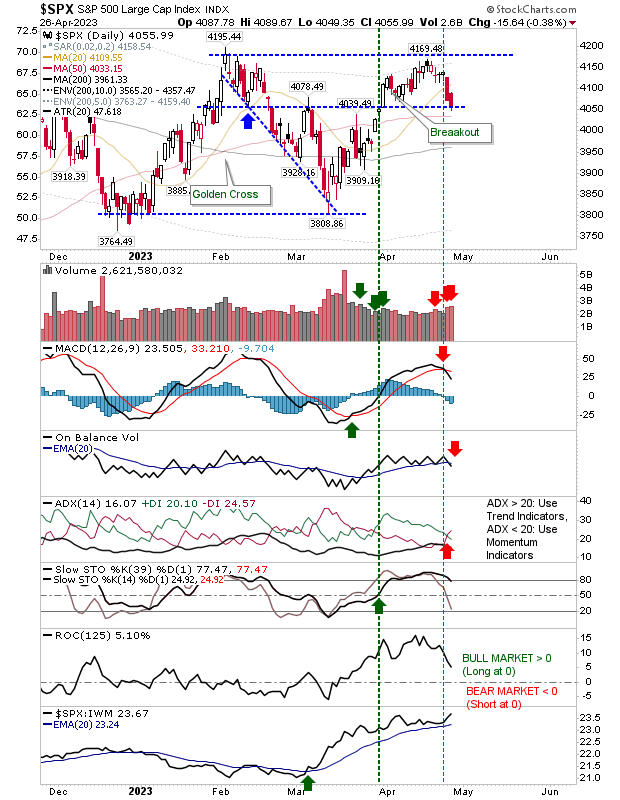

The S&P 500 has edged back to support of the last swing high in March but hasn't yet touched on 50-day MA support. The mini-range breakout is still in play, but it has been offset by the 'sell' triggers in On-Balance-Volume, MACD, and ADX, as occurred in the Russell 2000. The key lead for bulls is the relative performance advantage of the S&P 500 over peer indexes.

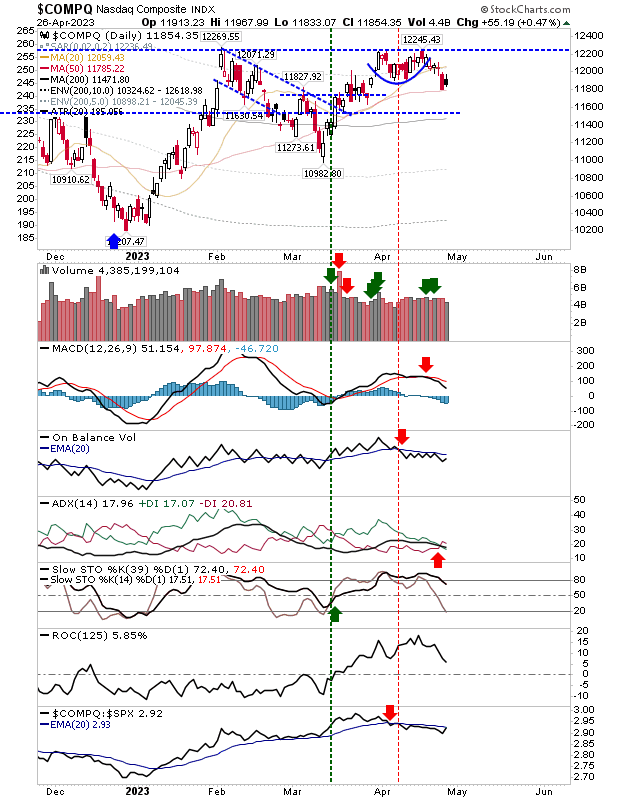

The Nasdaq was interesting because selling didn't register as distribution. However, it had already experienced 'sell' triggers in the MACD and On-Balance-Volume, with the ADX joining the 'sell' triggers. One thing to watch is the improvement of a relative performance advantage of the Nasdaq over the S&P 500.

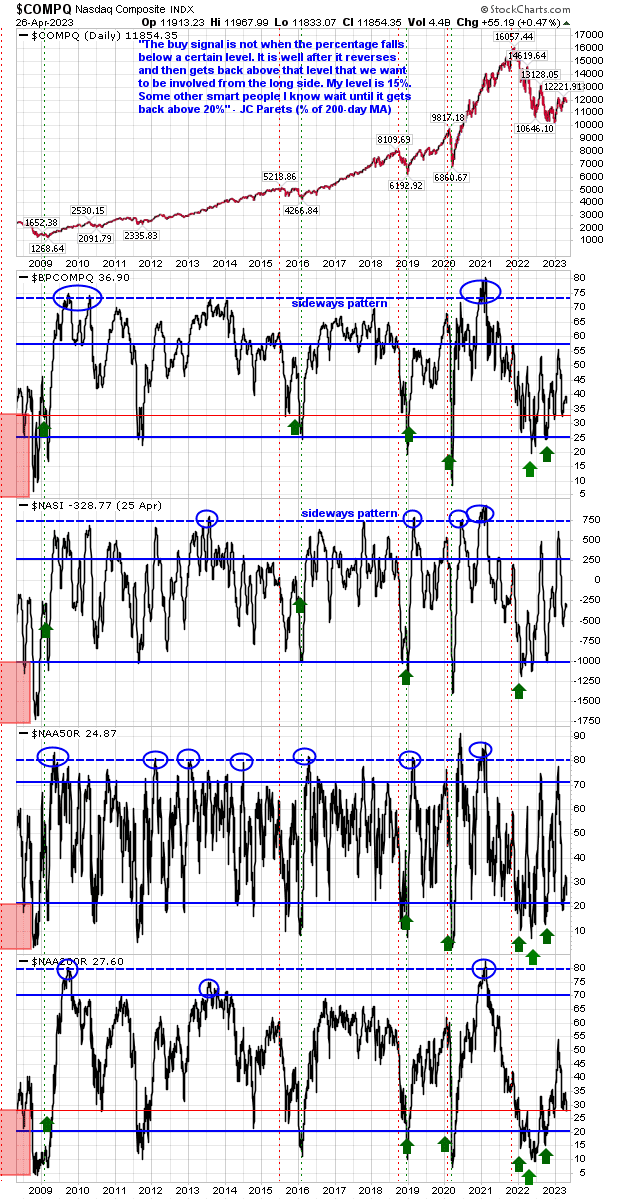

With the speed wobble in the indexes, we must look at breadth metrics to see where things may go. As I said last June, the then low *was* a low of key significance. While we saw new price lows later in the year, breadth had already started to recover.

Market breadth has continued to improve over this period, and while we may see new lows in price, we are unlikely to see new lows in breadth metrics - with more Nasdaq stocks above 50-day, 200-day MAs and on point-n-figure 'buy' signals than at the same point last year. I would argue bulls still have the edge and investors should be buying, but in the near term, prices are likely to continue lower.