TSMC earnings; Oracle analyst meeting; Gold’s new high - what’s moving markets

Diamondback Energy (NASDAQ:FANG) is one of the largest crude oil and natural gas producers of the Permian Basin—the region that spans between western Texas and southeast New Mexico and accounts for approximately 30% of total domestic oil output. Its strategic positioning and consolidated market share make it a major player in the U.S. energy sector.

Powered by a favorable macro environment for its core business, which includes exploring, developing, and producing oil, gas, and natural gas liquids, the company gained around 59% over the last 12 months, reaching a market cap of $22.4 billion. After reaching an all-time high of $147.99 on Mar. 25, FANG closed Thursday at $127.04.

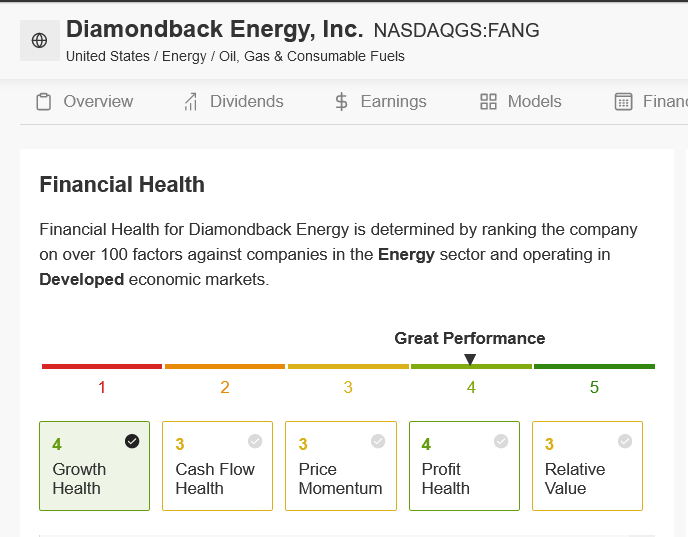

With a near-perfect InvestingPro financial health score of 4/5 and an extremely attractive valuation, Diamondback Energy fits the bill as a solid name to own amid the current environment.

Source: InvestingPro

Strong Fundamentals

Diamondback Energy's stock has a comparatively low price-to-earnings (P/E) ratio of 8.2, making it cheaper than other notable names in the thriving energy sector, such as EOG Resources (NYSE:EOG), Pioneer Natural Resources (NYSE:PXD), Devon Energy (NYSE:DVN), and Continental Resources (NYSE:CLR).

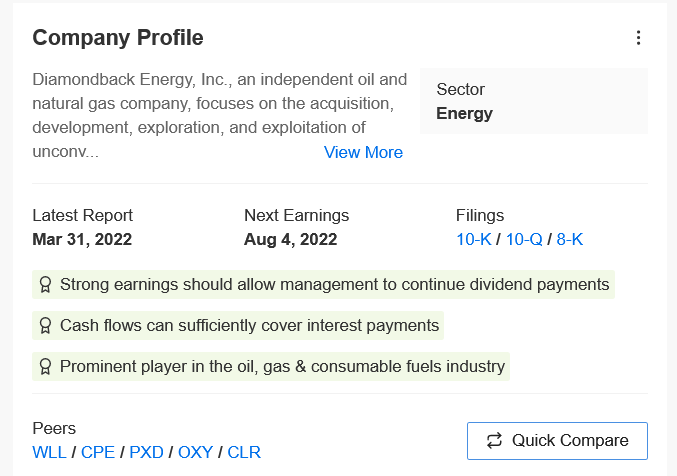

Pro also highlights several additional tailwinds the energy company currently has, including solid earnings and cash flow growth, allowing management to continue to return capital to shareholders in the form of higher dividend payouts and stock buybacks.

Indeed, the oil-and-gas company offers a relatively high annualized dividend of $2.80 per share at a yield of 2.24%, more than the implied yield for the S&P 500, currently at 1.55%.

Source: InvestingPro

Analyst Consensus

Shares of the Midland, Texas-based Diamondback have thrived in 2022, gaining about 16% year-to-date, vastly outpacing the comparable returns of both the Dow Jones Industrial Average and the S&P 500.

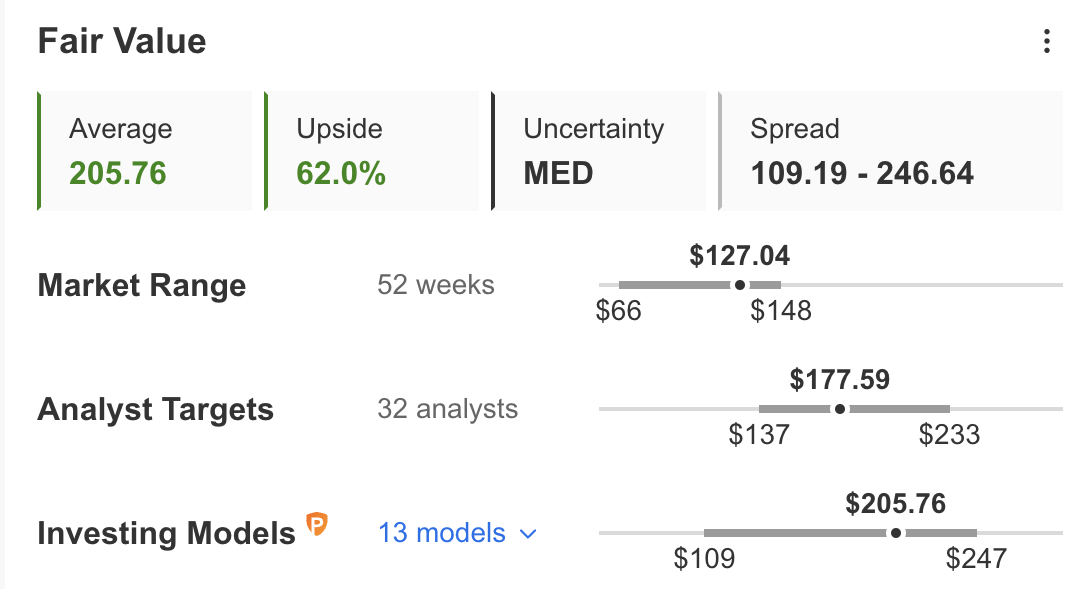

Not surprisingly, Diamondback's stock could see an additional upside of approximately 62% in the next 12 months, according to the Investing Pro model, bringing it closer to its fair value of $205.76 per share.

Source: InvestingPro

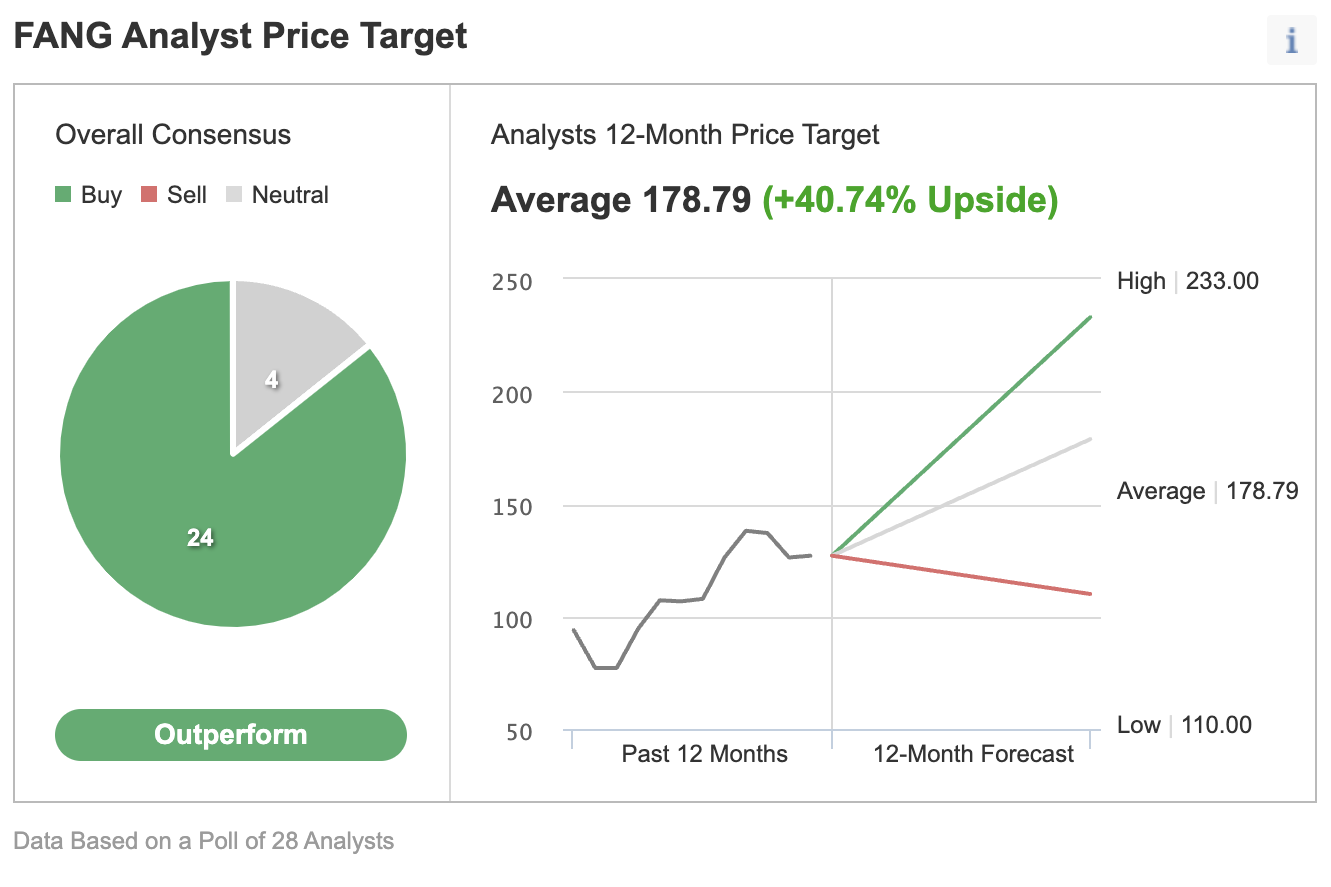

Analysts are also optimistic about the company's long-term perspectives, citing strong energy market fundamentals. The average analyst price target is $178.79, representing an upside of 40.7% from current levels.

Source: Investing.com

Bottom Line

Diamondback should continue to benefit from improving energy market fundamentals, especially as crude oil and natural gas prices hover near multi-year highs.

The current market makes it harder than ever to make the right decisions. Think about the challenges:

- Inflation

- Geopolitical turmoil

- Disruptive technologies

- Interest rate hikes

To handle them, you need good data, effective tools to sort through the data, and insights into what it all means. You need to take emotion out of investing and focus on the fundamentals.

For that, there’s InvestingPro+, with all the professional data and tools you need to make better investing decisions. Learn More »