European stocks mixed on Friday after volatile week; U.K. economic woes

US markets are closed for President’s Day on Monday and will reopen on Tuesday.

There will be plenty of market news, mostly on Wednesday, with the 20-year Treasury Auction at 1 PM ET, The Fed minutes at 2 PM ET, and Nvidia’s results after the close. Then, on Thursday, we will get initial jobless claims at 8:30 AM ET and a 30-year TIPS auction at 1 PM ET. So a lot is taking place mid-week.

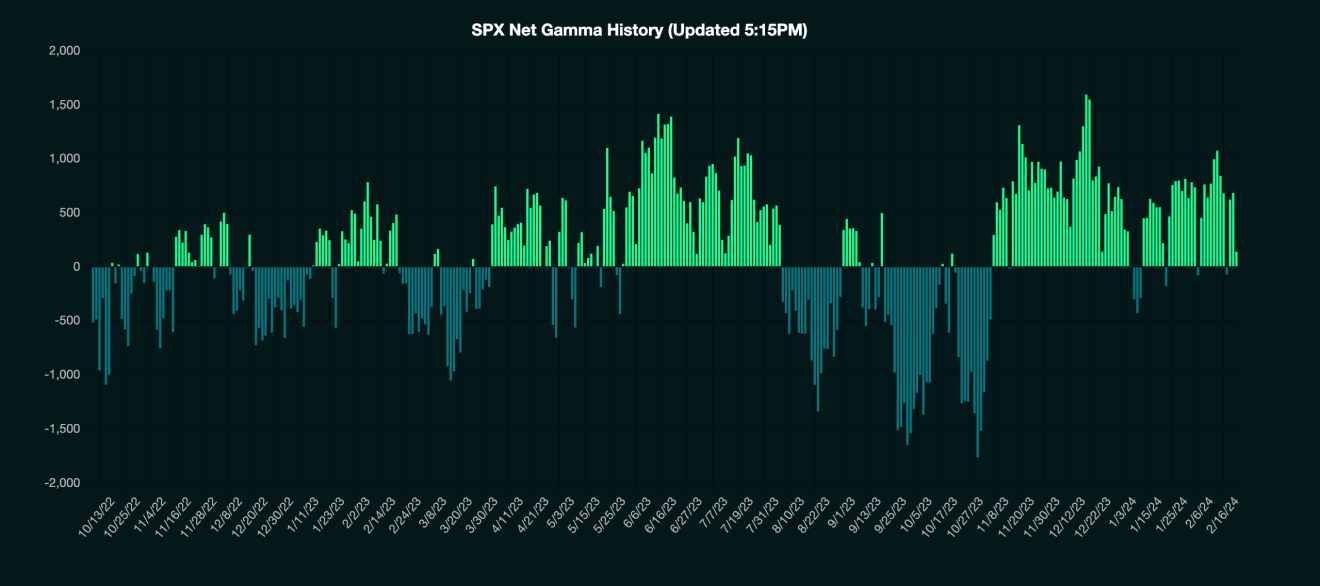

This week will also be a post-options expiration week, and that means that gamma levels will be greatly reduced in the S&P 500, which could make the market more unstable and more prone to big intraday swings.

Gammalabs shows that gamma levels have been reduced to just $140 billion in the S&P 500 as of Friday, down from $683 billion on Thursday. So, the market isn’t too far from that zero gamma level, and a slip into negative gamma can expand volatility.

Additionally, the S&P 500 appears to have formed a diamond reversal top, and if that is the case, the entire rally from the October lows could be at risk. But we have to take things one step at a time, with the first level of support at 4900, 4,850, 4785, and 4,690.

If the pattern is right, it has already broken, and the index should continue to drop from Friday’s close. If the pattern is wrong, we should be able to gap up to 5,040 and keep moving higher.

It is the same for the Nasdaq 100, with the diamond top and index sitting on support at 17,685. A gap lower on Tuesday potentially sets up an initial drop to 17,141, and then to a gap of 16,740, and then 16,260. But the entire rally off the October lows is at risk if the pattern is right. Typically, diamond reversals return to their origins, and this origin is at the October lows. If I’m wrong, we should be able to move higher, take out 17,855, and just keep moving higher from there.

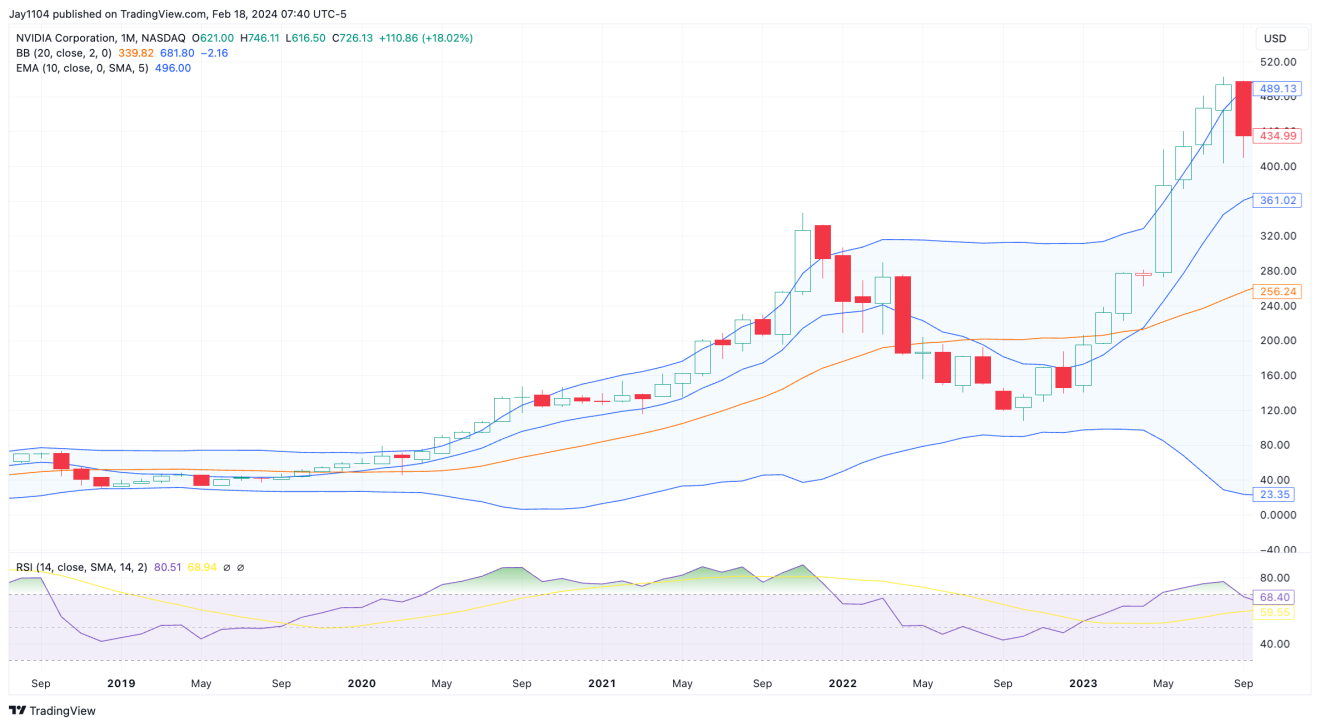

As for Nvidia (NASDAQ:NVDA), I have spent a lot of time this weekend going through, in fairly large amounts of detail, how important this earnings report is for Nvidia and the entire market. I can only say that this stock has risen a ridiculous 52% since January 4 and 84% since October 31.

That just isn’t normal. To demonstrate how crazy it has gotten, it would need to fall 45% to return to where it was on October 31.

It trades weekly above its upper Bollinger band, with an RSI of 84.

It is trading above its upper Bollinger Band with an RSI of 80.5 on its monthly chart. Being overbought may be an understatement.

The stock has a history of doing this type of stuff only to trade sharply lower in the following months, going back to 2001.

This is what the stock has done, with very similar patterns repeatedly. It has always been different this time, from gaming to crypto mining to data centers and now to AI.

I don’t know what the future holds for this stock, but if the past 20 years indicate the next, it will be a bumpy ride because, in the end, they make a product prone to supply and demand imbalances. Please remember that.

YouTube: