Bitcoin price today: steady near $92k after sharp losses; Fed caution weighs

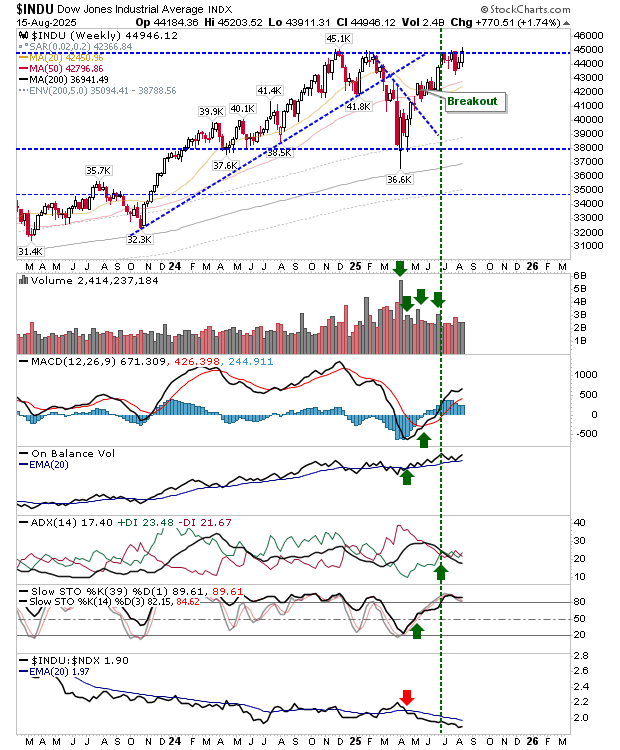

There hasn’t been a whole lot of change on the daily time frame across indices. The Dow Jones Industrial Average ($INDU/$DJIA/$DIA) has been indicating a possible breakout on the daily time frame, but it’s now looking so on the weekly time frame; this week is as good as any to see this happen.

There was a fresh ’buy’ trigger for On-Balance-Volume on this time frame to go with a recent ’buy’ trigger in the MACD. Higher volume accumulation is a bonus.

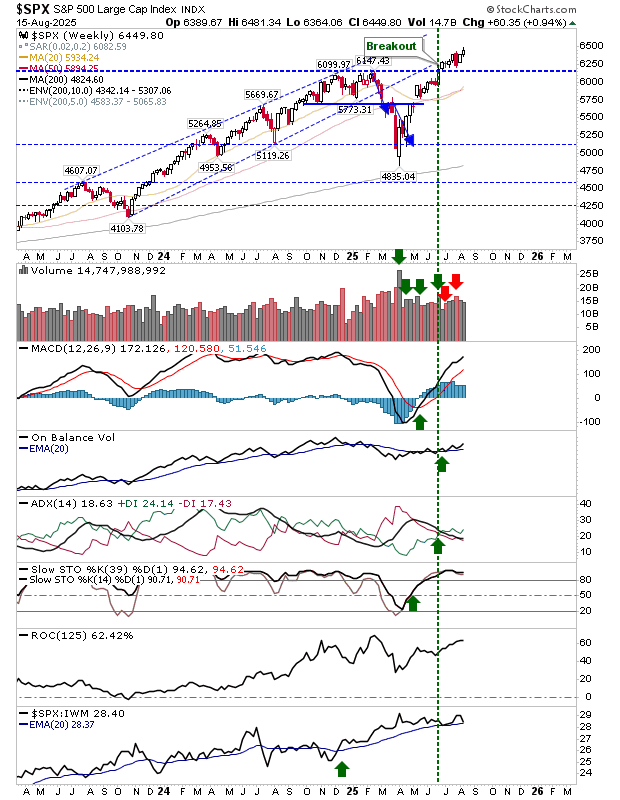

I would be expecting the Dow Industrial Average to follow the lead of the S&P 500 which has already cleared the early 2025 high after having broken out earlier this summer. Technicals for this index are net positive, including a relative outperformance to its peers.

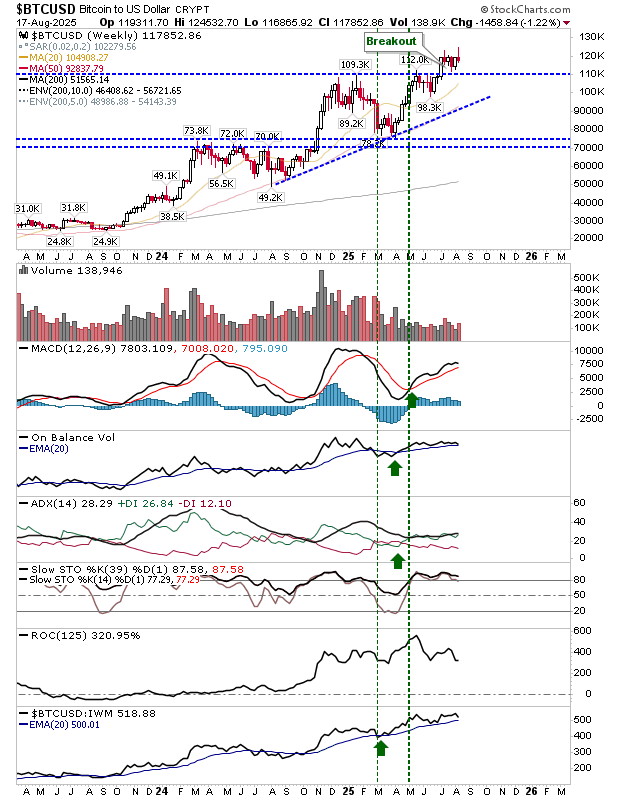

Bitcoin is pointing a little in the other direction. It managed a clear breakout on the weekly timeframe five weeks ago, but it has failed to push on and is now looking vulnerable to a reversal. Technicals are net positive, although trading volume has dropped off dramatically since the latter part of 2024.

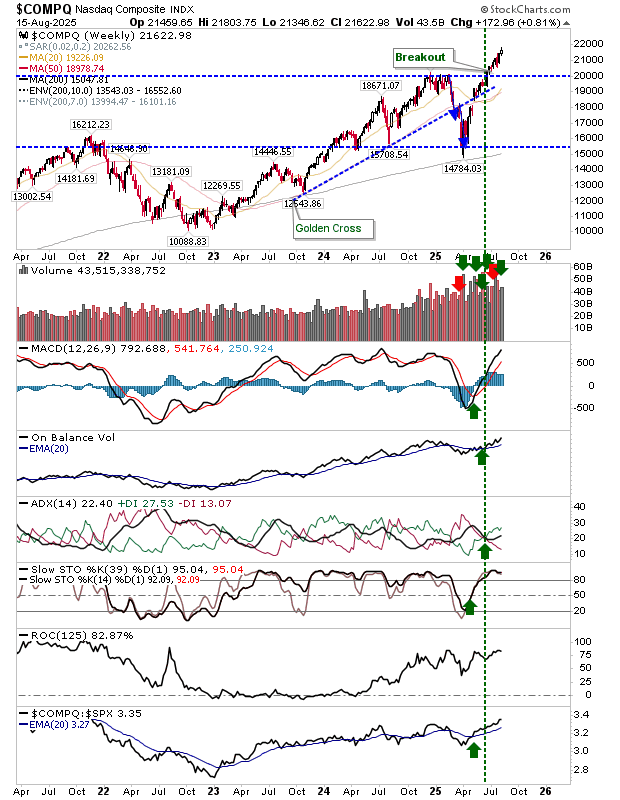

While Bitcoin has struggled a little on the weekly timeframe, the Nasdaq has been moving consistently higher on net bullish technicals. The index has also been outperforming peer indices on the weekly timeframe. I would be looking to Bitcoin to benefit from the gains in this index.

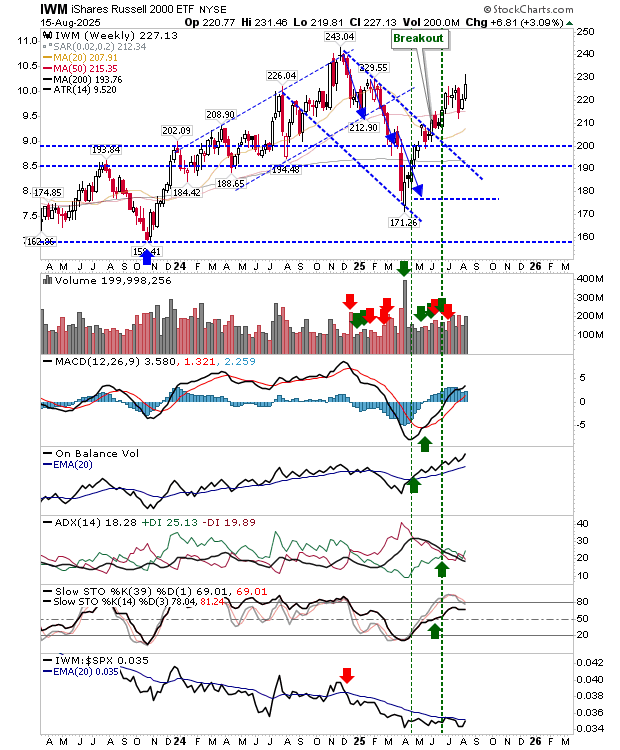

The Russell 2000 (IWM) remains the laggard on the weekly timeframe. However, it does now enjoy a net bullish technical picture.

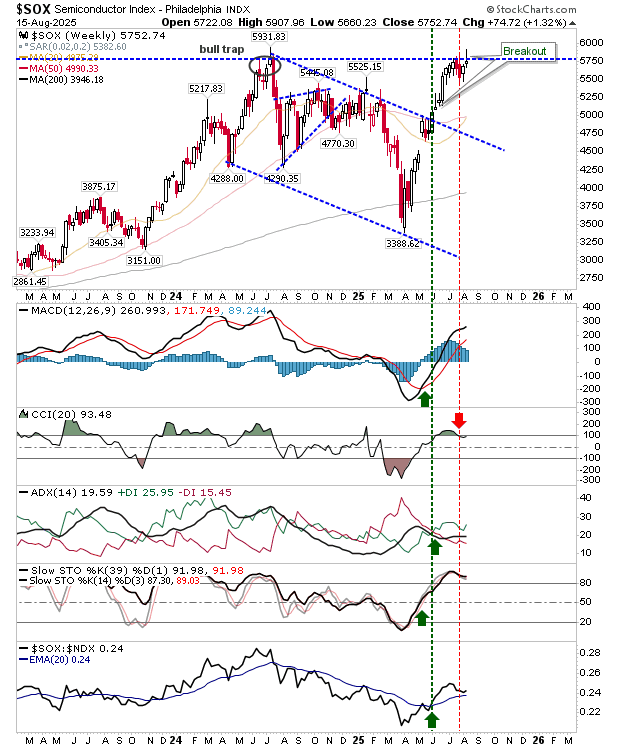

Finally, the Semiconductor Index ($SOX) managed to poke its head above breakout resistance, but finished the week below it. Second time lucky for this index?

For this week, I would probably stick with the Dow Industrial Average. The Semiconductor Index might provide a solid alternative, and if it does, then Bitcoin could be the ancillary benefit.