Uber stock surges after Nvidia partnership announcement

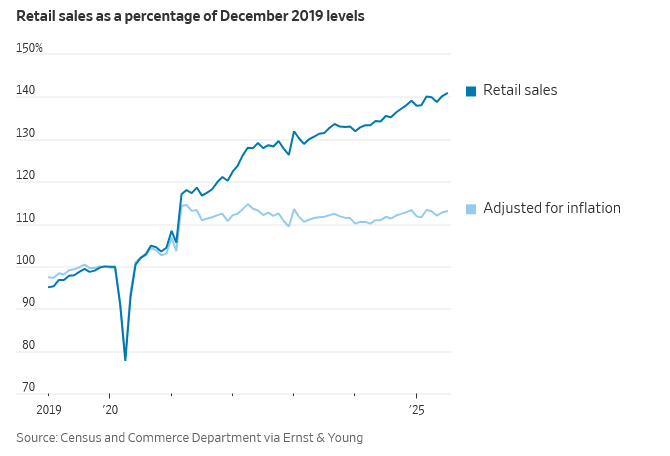

Another round of quarterly earnings reports has come and gone, and once again, many companies beat profit expectations. Yet a glance at the graph below from The Wall Street Journal, showing that retail sales have been flat excluding inflation, suggests that the ways in which companies are growing their earnings must be changing.

The Wall Street Journal provided details on a “transformation” of earnings sources in Behind This Season’s Bumper Earnings. The bottom line of the article is that companies have had to increase productivity instead of relying on increasing revenues to drive earnings. Per the article:

The outcome of those transformations means less headcount, more productivity.-Damon Lee, CFO C.H. Robinson Worldwide

Some of these “transformations” include new technologies and cost-cutting measures, such as employee layoffs. While profit growth has benefited, the downside has been increased anxiety among the workforce, resulting in poor consumer sentiment and reduced spending, as recent data suggests. However, the expense cuts and layoffs have not been severe enough to trigger a recession. Gregory Daco, Chief Economist at EY-Parthenon, worries that this may still be on the horizon. Per the article:

My fear is that the longer this lasts, the more likely we are to enter something akin to a downturn

To his point, as companies run out of areas in which they can cut expenses and or add new technologies, they will become more reliant on layoffs to boost profit margins. A trend higher in the unemployment rate would likely confirm this is the case.

The article ends with another tool used by large companies to boost earnings, financial engineering. According to the article, share buybacks contributed to at least 4% of earnings (EPS) growth for one out of every six S&P 500 companies.

The Week Ahead And Employment

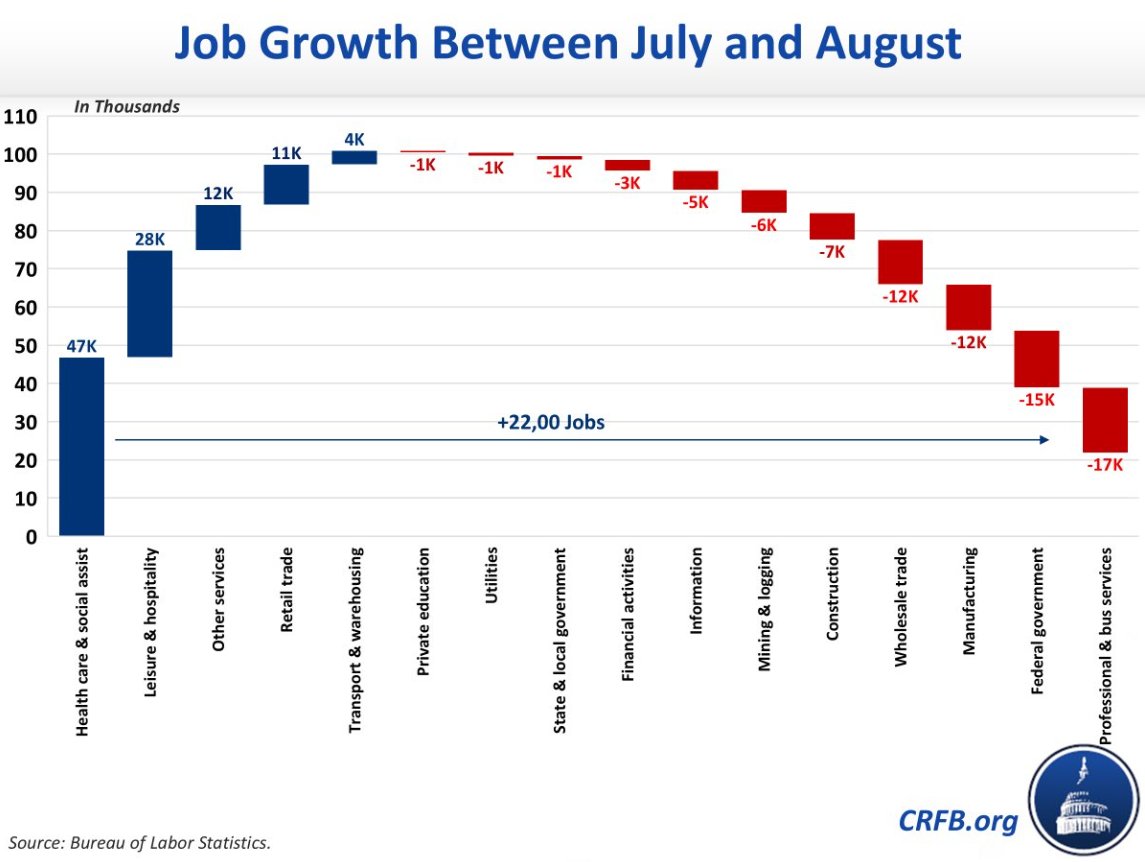

The BLS employment report once again shows very weak payroll growth. Last month, the economy added 22k jobs. Furthermore, the unemployment rate ticked up by 0.1% to 4.3%. Of concern, full-time jobs fell by 357k while part-time jobs rose by nearly 600k. As shown in the first graph below, 11 of the 16 employment sectors experienced job losses last month.

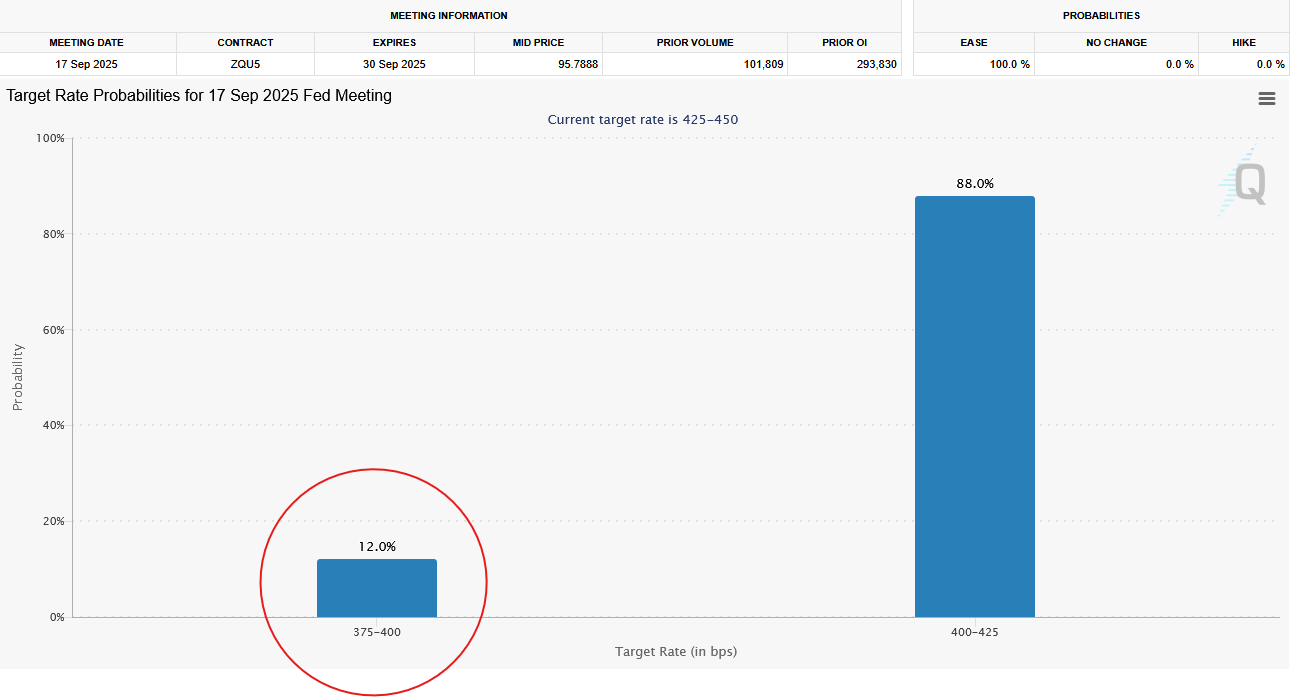

Following the data release, the Fed Funds futures market assigned a 12% probability to a 50-basis-point rate cut at next week’s meeting. Weaker-than-expected PPI and CPI this week could further increase those odds.

With the FOMC meeting next Wednesday, this week’s inflation data will be the last piece of inflation information the Fed has to consider when making its decision. Following last month’s stunningly high PPI print, Wall Street estimates that it will rise by 0.6% this month. While below last month’s +0.9%, if Wall Street’s forecast comes to fruition, Powell may not be supportive of a rate cut. Even if the Fed does cut with a second high PPI number, talk of future rate cuts is likely to be limited.

CPI expectations are more tame at +0.3%. If PPI remains high while CPI sticks around current levels, corporate profit margins are at risk. Given that consumer sentiment is poor and recent spending has been weak, it should not be surprising that some companies are having to absorb much of the tariffs.

Federal Reserve members will be in a media blackout this week, heading into the September 17th FOMC meeting.

Tweet of the Day