Fed independence crucial for U.S. and global economy, says Williams

This will be a huge week for markets, with an FOMC meeting, a slew of economic data points, and a big week in earnings. The show stopper will be the FOMC meeting, where the Fed is expected to slow the rate hikes down to 25 bps.

I think the Fed has allowed financial conditions to ease too much, and you are seeing commodity prices move up too fast. This could reignite inflationary impulses across the global economy. So unless the Fed wants to repeat the mistakes of the 1970s, they need to figure out how to get financial conditions to begin to tighten again. That will take a very hawkish message from the Fed.

There will also be a slew of economic data points starting on Tuesday, with the employment cost and house price indexes. Then on Wednesday, we will get our first inflation reading for January with the ISM manufacturing report, along with JOLTS and the FOMC Meeting in the afternoon. The data will finish Friday with the job report and the ISM services index.

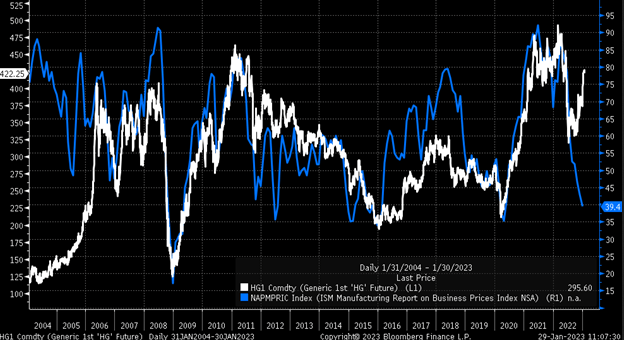

Based on the current increase in copper prices, we could begin to see the ISM manufacturing prices paid begin to surge higher again in the next couple of ISM reports.

Thursday afternoon will feature earnings from Alphabet (NASDAQ:GOOGL), Amazon (NASDAQ:AMZN), and Apple (NASDAQ:AAPL) and mark the peak of earnings season. This quarter’s results have seen the fewest sales and earnings surprises in two years.

Source: Bloomberg

This explains why we are seeing earnings estimates for 2023 fall so dramatically. It isn’t so much that earnings are coming bad; it is just that they are no longer surprising to the upside like they had been, which tells us that expectations for 2023 need to be moderated.

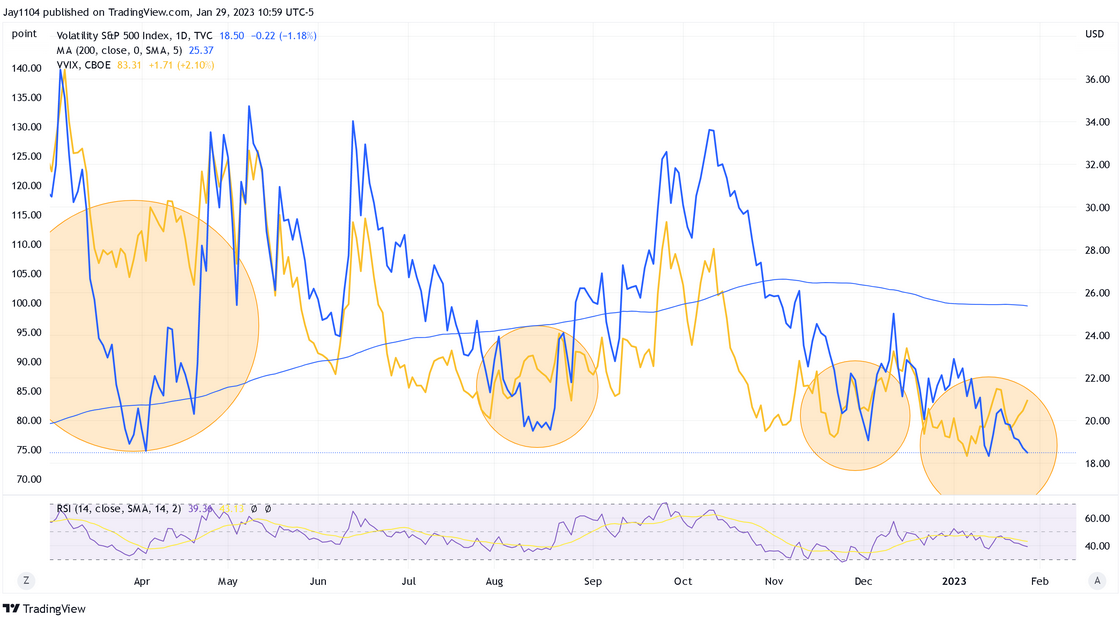

Stocks are mainly rising, I think, because of the impacts of the options market, more than anything else, with what appears to be a gamma squeeze occurring in the major indexes. The implied volatility of a 50-delta S&P 500 one-week option has been rising along with the S&P 500, and they usually move opposite one another. Typically, when they both increase together, it indicates a gamma squeeze, as frantic call buying leads to higher implied volatility.

S&P 500

Typically, these gamma squeezes end when buying a call becomes too expensive and is no longer profitable to trade. That may have happened on Friday when the market sold off pretty hard into the end of the trading session. The pattern on the S&P 500 looks like an ending diagonal with a throw-over pattern. If this is the correct pattern, the index should continue to drop this week and head back towards 4,000 as the rally has exhausted itself.

VIX/VVIX

Additionally, we are seeing the VVIX begin to move higher, which measures the implied volatility of the VIX. When the VVIX starts to move higher ahead of the VIX, it can be a leading indicator of the VIX moving higher.

Dow

Additionally, we still have a diamond reversal pattern that has formed in the Dow Jones, suggesting a lower move is likely to happen as it struggles to move beyond 34,200.

Rates

Also, if the Fed does what it should, pushing back against the easing of financial conditions, we should begin to see higher rates. The 10-Year has successfully bounced off its 200-day moving average and appears to be forming a bullish pennant, which could lead to rates breaking out and moving back above 3.7%.

Apple

Apple isn’t expected to have a stellar first quarter, with analysts forecasting earnings falling 7.3% y/y and revenue dropping by 1.9%. On top of that, the stock appears to be overextended as the RSI approaches 70. The past couple of times this has happened, it has marked a short-term top in the shares.

Amazon

The big thing for Amazon results will be AWS, given Microsoft’s (NASDAQ:MSFT) soft Azure guidance. AWS is expected to have revenue of $21.7 billion in the fourth quarter, with a growth of 23.8%. For the first quarter overall company revenue guidance, analysts estimate revenue of $116.4 billion. The big problem for Amazon right now is that it is also approaching overbought levels, with resistance around $103.50.

Have a good week!