Walmart halts H-1B visa offers amid Trump’s $100,000 fee increase - Bloomberg

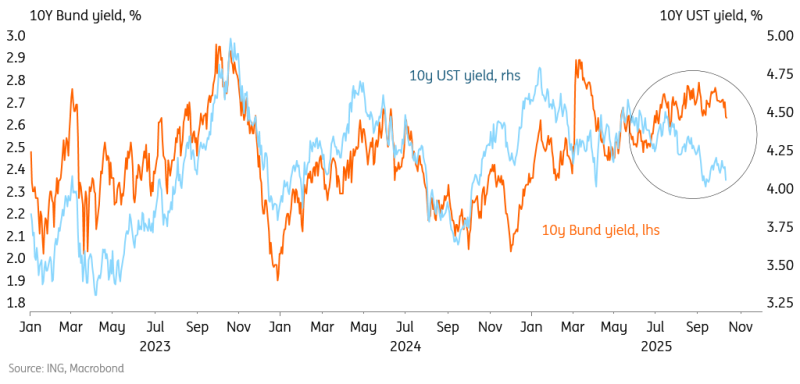

Trade tensions have forced 10Y US Treasury yields below 4% again. The spillovers to euro rates remain moderate, but a broader global risk-off episode would likely force 10Y rates to explore lower ranges. Bunds, especially, could see high demand in such scenarios as one of the last remaining AAA havens

Euro Rates Are Not Impervious to US-Incited Risk-Off Episodes

Trade tensions are benefiting US Treasuries, with the 10Y UST yield dipping below 4% intraday again as investors seek safety. Albeit not directly targeted by the tariff discussions, euro rates do get pushed around with US rates these days. One could say that most movements in euro rates recently have been US-driven, simply because the domestic drivers aren’t offering any novel insights. Yes, we have French headlines popping up now and again, but outside of French government bonds, the spillovers are negligible. Also, ZEW figures on Tuesday were weak again, but markets are already well aware that the (German) growth recovery is slow and fragile.

Even though euro rates have come down alongside the US, one could argue that the spillovers have been relatively mild so far. The 10Y swap rate is still trading broadly sideways between 2.6% and 2.7%, which has been the range ever since June. A common driver is global risk sentiment, which is being challenged by the revival of tariff threats. This also explains why the correlation of the front end of the euro curve with US rates is close to zero, while longer maturities are more sensitive.

A glide lower in US rates, as seen over the past months, would not alter our view that euro rates should remain around current levels or even drift higher. A sharp decline, however, would undoubtedly force Bunds and swaps to test lower levels too. The past few days have already seen the Bund outperforming swaps, reflecting demand for safe assets. With Bunds one of the last remaining AAA havens, we can expect these to see strong performance if risk sentiment were to deteriorate more sharply.

Bund Yields Can Resist a Drift Lower in UST Yields, but Not Sharper Sentiment-driven Moves

Wednesday’s Events and Market Views

The most-watched report of the day is the Fed’s Beige Book, which collects anecdotal evidence from contacts in the individual Fed districts. In August, it had suggested activity was stalling. Eleven out of 12 regions reported no change in employment, with the other region reporting a decline in jobs. Our economist is not expecting any material improvement in its assessment this time, which should help convince the Fed to cut rates by 25bp later this month.

Central bankers will also take the spotlight again. From the ECB, de Guidos, Rehn and Villeroy are scheduled to speak. The Fed will field Miran, Waller and Schmid, while the BoE has Ramsden and Breeden speaking. After the final CPIs for France and Spain, the eurozone industrial production data is the only other macro data release of note for the day.

In primary markets, Germany taps two bonds in the 30y area for a total of €2.5bn. The UK will auction £1.50bn in 6y inflation-linked gilts.

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user’s means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more