Sun Valley Gold sells Vista Gold (VGZ) shares worth $2.16 million

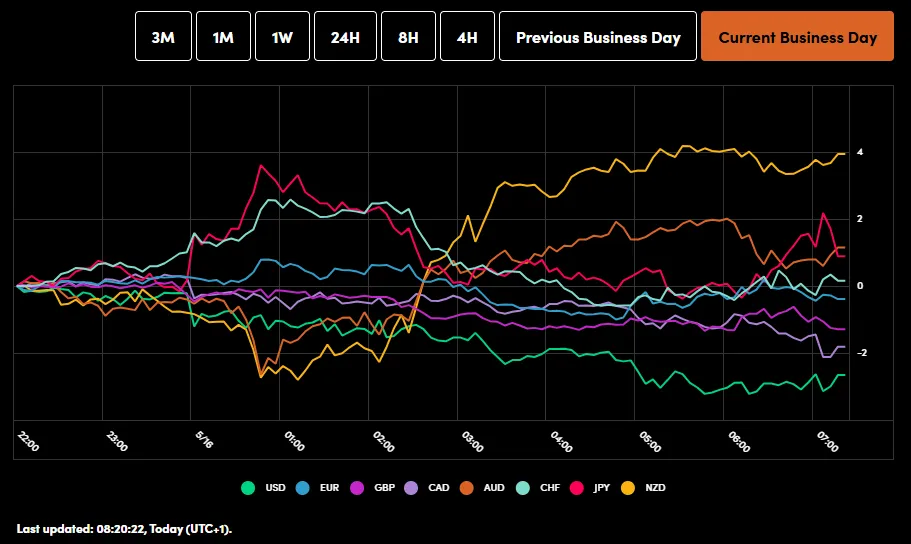

Asian Session Market Wrap

A mixed Asian session for stocks as US Futures struggled after the S&P 500 finished with gains of 0.4% on Thursday. It appears early-week optimism around the US-China trade deal may be fading. Will potential trade deal announcements reignite risk appetite?

For now, though, it appears concerns continue to linger with yesterday’s US data not doing much to allay fears that a global slowdown may still be in the offing. The picture around consumers and small businesses remains one of concern.

The NFIB Small Business Optimism Index declined 1.6 points in April, to 95.8, its lowest since October 2024. 6 of the 10 index components decreased, with expected business conditions having the most negative contribution. Over the last 4 months, the index has fallen 9.3 points, the sharpest drop since the 2020 pandemic.

At the same time, the share of small firms expecting better business conditions 6 months from now has plummeted 37 percentage points, to 15%, the lowest since October 2024.

In short, despite the 90-day pause between the US and China, businesses are becoming more pessimistic rather than optimistic about the US economy.

Stocks went up in Taiwan, Australia, and South Korea, while they were volatile in Japan and dropped in China. Alibaba (NYSE:BABA) Group shares fell as much as 6.7% in Hong Kong after quarterly revenue disappointed.

Adding to the concerns of a global slowdown, Japan’s economy shrank for the first time in a year, showing its weakness even before feeling the effects of US President Donald Trump’s tariffs. Finance Minister Katsunobu Kato said he plans to meet with Scott Bessent next week to discuss currency issues he had previously talked about with the US Treasury secretary.

All of the above appear to weigh on sentiment as we head into Friday’s European session.

Source: LSEG

The European Open

Heading into the European open, Eurozone government bond yields fell on Friday, moving further down from the multi-week highs reached earlier this week.

The DAX continues to advance with modest gains heading into the open. The Index is up 0.2% following yesterday’s gains of around 0.9%.

European shares on the whole are bracing for a subdued open, though with little data or events scheduled later in the day to provide a clear catalyst.

Gold prices faltered once more, dropping 0.7% to $3,217 an ounce after jumping 2% the night before. Over the week, they’re down by 3.2%.

For a technical outlook on Gold, read Gold (XAU/USD) Surges Beyond $3200/oz on Weak US Data, DXY Slips

Oil prices leveled off after dropping over 2% overnight due to news of a possible U.S.-Iran nuclear deal. However, they’re still up 1% for the week thanks to an improved global economic outlook.

On the FX front, traders resumed selling the US dollar on Friday, causing it to drop 0.3% against the Japanese yen and 0.2% against the Swiss franc. Meanwhile, the Australian dollar went up 0.4%, and the New Zealand dollar rose 0.5% on the back of rising inflation expectations.

Currency Power Balance

Source: OANDA Labs

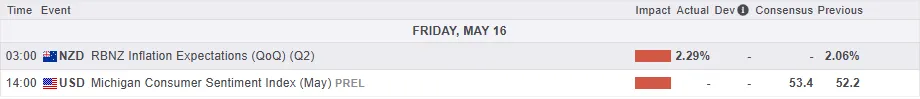

Economic Data Releases

Looking at the economic calendar, it is a quiet end to the week for European markets with a sparse calendar. The major market-moving event could come in the US session by means of the US Michigan Consumer Sentiment Preliminary release.

This could provide more insight into consumer expectations moving forward and depending on the numbers could either weigh or boost sentiment ahead of the weekend.

Chart of the Day - DAX

From a technical standpoint, the DAX held support yesterday and closed as a hammer candlestick on the daily timeframe.

Early European session gains position the index favorably for a retest of the 24000 handle and potentially a break higher.

The fading optimism around the US-China trade pause may halt the rally and is something worth monitoring.

The only concern from a technical aspect comes from the period-14 RSI, which is in overbought territory.

The Index does need a break and daily candle close beyond 24000 if bulls are to push on and print fresh all-time highs.

Definitely worth monitoring ahead of the weekend.

Immediate Resistance may be found at 24000, 24250, and potentially 24500.

Immediate support rests at 23750, 23471, and 23212, respectively.

DAX Daily Chart, May 16, 2025

Source: TradingView.com