Stock market today: S&P 500 ends lower as Fed rate cut, outlook meet expectations

- The EUR/USD pair shows consolidation, with a head-and-shoulders pattern signaling a potential correction.

- The Fed’s statement tone, not just interest rates, will heavily influence the US dollar’s direction.

- A possible ECB pause could boost the euro, limiting any EUR/USD correction with key support.

- Looking for actionable trade ideas to navigate the current market volatility? Subscribe here to unlock access to InvestingPro’s AI-selected stock winners.

The currency markets are currently in a holiday mood, causing consolidation in the EUR/USD pair. Within this sideways movement, a head-and-shoulders pattern is formed, indicating a possible deeper correction. The key factor for a potential discount will not be the Federal Reserve’s decision itself (which is likely to remain unchanged) but the tone of the accompanying statement, which will provide clues on future US monetary policy.

If the market views the statement as hawkish, a downward move is likely. Additionally, President Donald Trump recently stated that he does not plan to push for Fed Chairman Jerome Powell’s removal, which may boost the US Dollar.

Solid Data Increases Chances of Hawkish Outcome

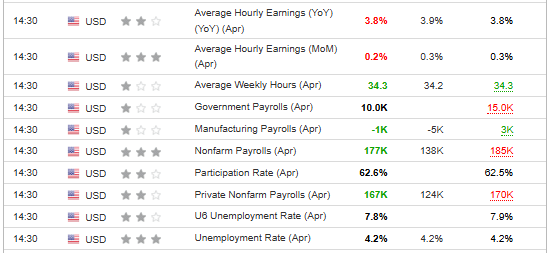

Recently, we have seen the usual set of data from the US economy at the start of the month, with labor market readings and ISM indicators taking the lead. While the industry and services sectors showed slightly weaker results, the labor market remains strong.

This suggests that the likelihood of a slightly more hawkish message, which could strengthen the US dollar, is increasing. The market is still pricing in three interest rate cuts this year, but expectations have shifted for the first cut, moving from June to July, with a 75% probability of a 25 bps reduction.

However, we must also consider April’s PCE inflation data, which dropped to 2.3% y/y, and GDP growth, which showed a negative quarter-to-quarter change for the first time since November 2022. The Fed will take these factors into account, and the market will likely look for clues on these macroeconomic elements in the upcoming Federal Reserve announcement. The European economy, meanwhile, continues to face its own set of challenges.

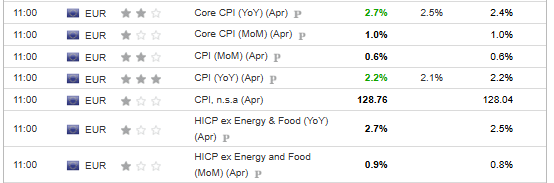

ECB’s Inflationary Problem

The ECB has been on a full-fledged interest rate cut cycle for many months. With the latest inflation readings, another cut in June is now in question. This is due to an increase in key price measures in the eurozone, driven by core inflation, which exceeded market expectations and came in at 2.7% y/y.

If signals from the ECB in the coming weeks suggest a possible pause in the rate cut cycle, the euro could see further appreciation, limiting the potential for a correction on EUR/USD.

Currently, the key technical factor is the formation of a head-and-shoulders pattern, with the neckline around the $1.13 per euro price area, confirmed by the upward trend line.

If we see a breakout of this area, the path will be open for a downward scenario, with the first target at the 1.1150 level. The negation of this scenario will occur if the right shoulder breaks above the round level of $1.14 per euro.

****

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. Whether you’re a novice investor or a seasoned trader, leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging market backdrop.

Subscribe now and instantly unlock access to several market-beating features, including:

- ProPicks AI: AI-selected stock winners with a proven track record.

- InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

- Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters and criteria.

- Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.