Berkshire Hathaway reveals $4.3 billion stake in Alphabet, cuts Apple

Last week was big for macro and markets.

Today’s piece is going to cover:

-

The Fed’s dovish announcement: a sizeable tapering of their Quantitative Tightening program;

-

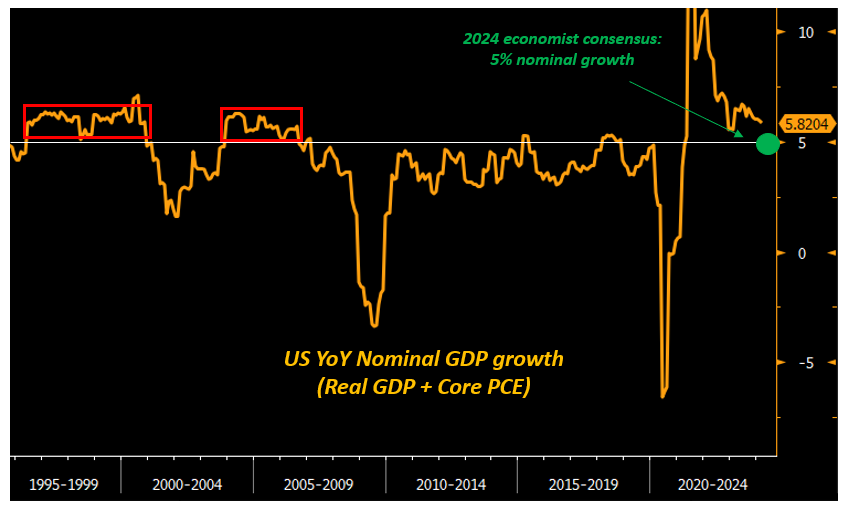

A potential upcoming shift in market dynamics: for the first time in a while the reflation thesis was challenged by a weaker suite of data clashing versus the very optimistic 5% economist expectation for 2024 US nominal GDP growth;

''Beginning in June, the Committee will slow the pace of decline of its securities holdings by reducing the monthly redemption cap on Treasury securities from $60 billion to $25 billion.''

With this sentence, the Fed announced the tapering of their QT program last week.

The Federal Reserve has been running QT (Quantitative Tightening) since mid-2022: this process is aimed at unwinding the multi-trillion Fed bond holdings accumulated during previous QE episodes.

The Fed doesn't sell bonds back to the market, but it merely allows them to roll over its balance sheet without reinvesting the full maturing notional.

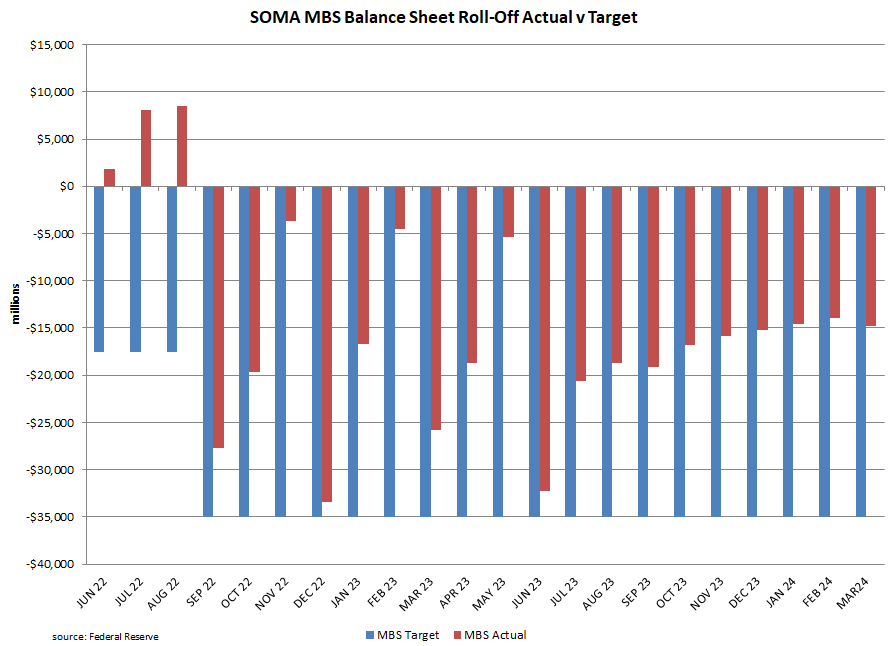

Summing up Treasuries and other bonds, the Fed was allowing $95 billion of bonds (60bn USTs + 35bn MBS) to roll-over its balance sheet each month.

To be more accurate though, QT was actually running at about ~75bn/month.

That’s because the loans underneath the Mortgage-Backed Securities (MBS) sitting on the Fed balance sheet are being repaid slowly due to high-interest rates hampering mortgage refinancing activities, and so MBS maturities are only ~15bn/month.

See this excellent chart from Michael Gray:

In any case, after Wednesday’s announcement QT will be running at roughly half (!) its previous pace: from ~75bn/month to about ~40/bn month.

Why does it matter?

This is a positive surprise for markets because it means the Fed will be doing more work to absorb the Treasury bond issuance planned over the next quarters to match the approved deficit spending.

It means pension funds, asset managers, banks and other institutions are required to absorb this heavy-duration bond issuance to a much more limited extent.

And the portfolio rebalancing theory suggests that private investors with more balance sheet and risk-taking capacity will reallocate some of that towards riskier assets like credit or stock markets.

Also, a more measured QT pace implies an even slower drainage of reserves (aka ''liquidity'') from the interbank system.

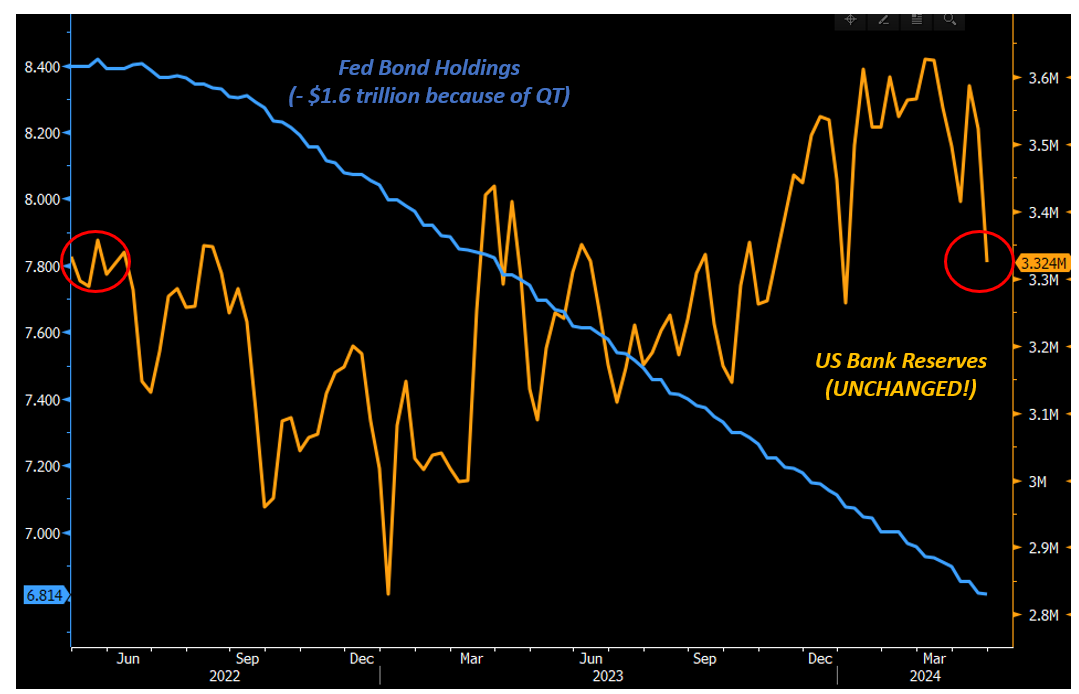

But since mid-2022, despite QT shrinking the Fed’s bond holdings by $1.6 trillion and counting the amount of bank reserves (‘‘liquidity’’) is literally unchanged:

This is because we are witnessing QT Sterilization.

The $1.6trn of bank reserves (''liquidity'') QT was supposed to drain were sterilized by a liquidity injection elsewhere.

That elsewhere is due to Money Market Funds (MMF) draining down the Reverse Repo (RRP) Facility to buy the avalanche of T-Bills issued by the US government.

As a result, US banks were not asked to step in and buy bond issuance amidst QT - the standard mechanics by which QT reduces reserves.

Instead, QT has been effectively sterilized via T-Bill issuance absorbed by MMF draining the RRP.

The Fed is being very prudent and risk-adverse with this early and aggressive move in reducing the pace of QT as they are scared of a 2019 repeat when a low amount of reserves in the system caused a blow-up of repo markets.

But interbank liquidity isn’t low, and reserves aren’t nearly getting scarce.

The Fed just went ahead with a proactively dovish monetary policy announcement.

This begs the following question.

Will they also replicate such a proactively dovish stance regarding interest rate cuts and start their cutting cycle in summer despite the inflation comeback we witnessed in the first quarter?

Basically: is the Fed Put back?

A Fed Put refers to the setup where Powell virtually sells put options on the S&P 500 – effectively putting a floor under risky assets.

The Fed would achieve that by signaling a very dovishly skewed Forward Guidance: ready to proactively ease at the first signs of weakness, while not tightening if growth or inflation pick up.

This dovish reaction function was prevailing for most of the 2013-2019 period.

The Fed would ''have the markets' back'' and investors would know that at any sign of economic weakness, a big easing would be around the corner.

But when the economy or inflation accelerated, the Fed won't react hawkishly but rather ''let the economy run hot''.

Now, picture the US economy running at a 5.8% nominal GDP growth with economists expecting growth to remain at or above 5% for quarters ahead.

The last time this happened was in 1996-1998 and 2004-2006:

And now picture Powell refusing to talk about hikes at the press conference, but only focusing on potential downsides ahead to discuss when (not if) the Fed is going to cut.

Doesn’t that look like a Fed Put?

And why would the Fed risk such a proactively dovish reaction function - are they not afraid growth and inflation might pick up further as a result?

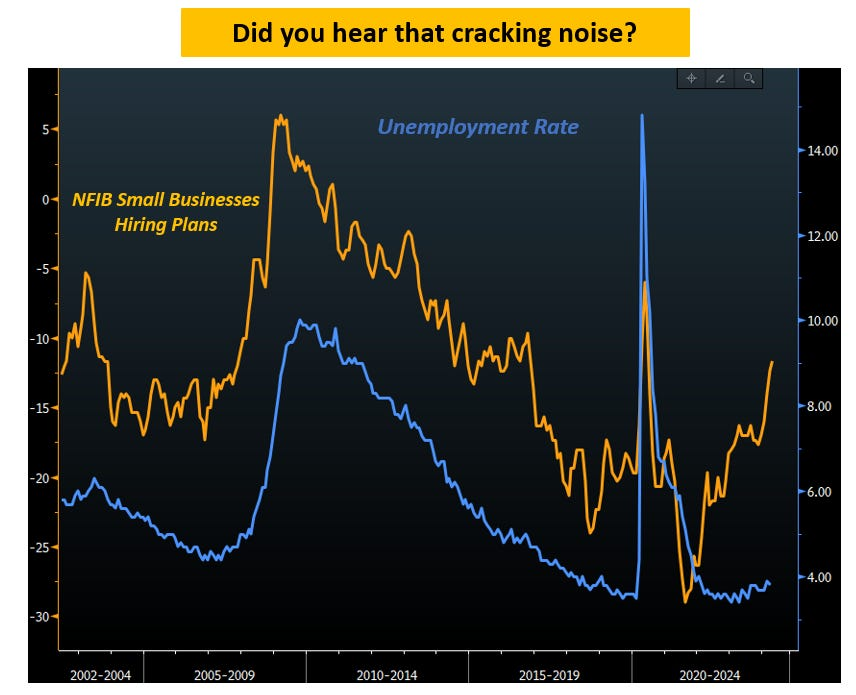

Well: maybe it’s because they are hearing a few cracking noises

The labor market is still doing ok, but a few cracks are showing up under the surface.

The unemployment rate is gently picking up, cyclical industries like construction and manufacturing are seeing fewer and fewer job openings, and small businesses (orange) hiring plans are disappearing - which historically correlates with a broadly weaker US job market.

The reflation narrative is being challenged hard.

And the Fed is listening.

Disclaimer: This article was originally published on The Macro Compass. Come join this vibrant community of macro investors, asset allocators and hedge funds - check out which subscription tier suits you the most using this link.