Tyson Foods to close major Nebraska beef plant amid cattle shortage - WSJ

First quarter earnings continued to come in better-than-expected last week, but it was the latest Federal Open Markets Committee (FOMC) meeting which led to a pop in markets in the second half of the week.

Federal Reserve Chairman Jerome Powell ruled out a rate hike at the next meeting, downplayed stagflation concerns and announced the central bank would slow the pace of balance sheet reductions, a move widely seen as a slight easing of monetary policy.

Rate cut hopes were raised even further on Friday when US jobs data for April came in weaker-than-expected. Nonfarm Payrolls totaled 175,000, well below the Dow Jones consensus of 240,000. Unemployment, which has stayed consistently low, rose to 3.9%. All major US indices ended the day up 1 - 2% on the news.

On the earnings front, all eyes were on two more of the Magnificent 7 names, Amazon (NASDAQ:AMZN) and Apple (NASDAQ:AAPL). Amazon surpassed both top and bottom-line expectations, driven by strength in ad revenue which increased 24% YoY, and Amazon Web Services (AWS) which grew 17%.

Apple was able to beat on earnings estimates, but missed on revenues as iPhone sales sunk 10% during the quarter. Despite that disappointing result, which CEO Tim Cook blamed on difficult YoY comparisons, the tech behemoth showed there is no shortage of cash when they announced a $110B buyback, the largest-ever in history. The stock shot up 6% in after-hours trading.

On the flipside, there were some consumer-centric names that didn’t fare well when they reported Q1 results last week. Results from Starbucks (NASDAQ:SBUX), McDonald’s (NYSE:MCD), and Yum! Brands (NYSE:YUM) all showed that US consumers were starting to hold back on dining out. All three missed on bottom-line expectations, while only McDonald’s squeaked by on the top-line. Consumers have remained resilient in the face of higher prices in the last two years, but inflation may finally be taking its toll.

With 80% of S&P 500 names reporting thus far, YoY earnings growth stands at 5.0% according to data from FactSet. That’s with 77% of companies surpassing analyst expectations, above the 10-year average, on par with the 5-year average and just a little lighter than the 1-year average of 78%. Revenues are still light, with only 61% of companies beating on the top-line, showing that many names are continuing to cost-cut their way to profitability.

On Deck the Last Peak Week of the Q1 Season

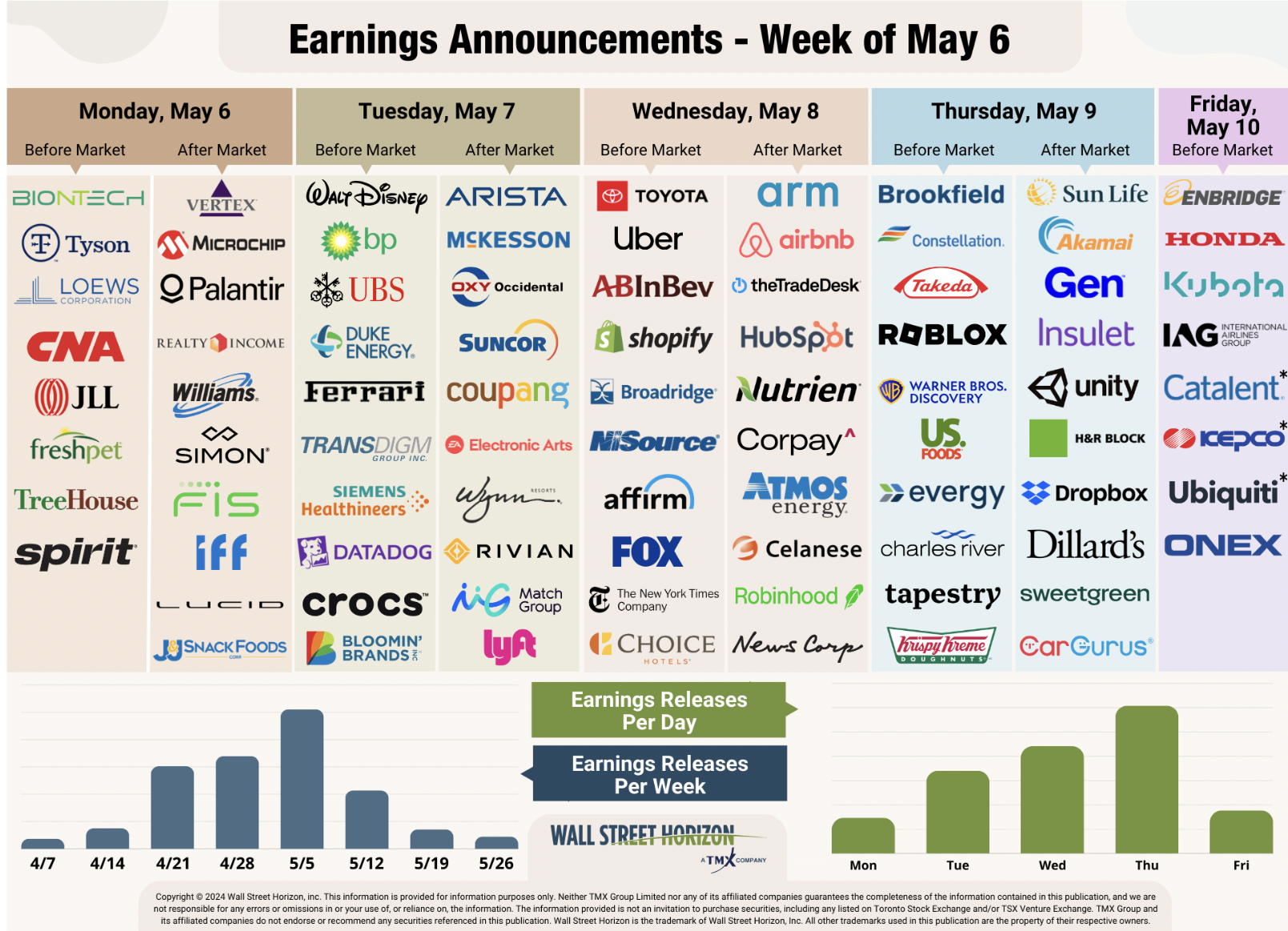

This week we get a smattering of results from different sectors, with 3,507 companies expected to report in total, the most of any week this season. Popular names to watch include Palantir (NYSE:PLTR) on Monday, Walt Disney (NYSE:DIS) and Lyft (NASDAQ:LYFT) on Tuesday, and Arm Holdings (NASDAQ:ARM), Uber (NYSE:UBER) and Airbnb (NASDAQ:ABNB) on Wednesday.

Source: Wall Street Horizon

Outlier Earnings Dates this Week

Academic research shows that when a company confirms a quarterly earnings date that is later than when they have historically reported, it’s typically a sign that the company will share bad news on their upcoming call, while moving a release date earlier suggests the opposite.

This week we get results from a number of large companies on major indexes that have pushed their Q1 2024 earnings dates outside of their historical norms. Nine companies within the S&P 500 confirmed outlier earnings dates for this week, all of which are later than usual and therefore have negative DateBreaks Factors*.

Those names are Loews Corp (NYSE:L), Williams Companies Inc (NYSE:WMB), Vertex Pharmaceuticals (NASDAQ:VRTX), Assurant Inc (NYSE:AIZ), Arista Networks (NYSE:ANET), Rockwell Automation (NYSE:ROK), Jack Henry & Associates (NASDAQ:JKHY), MarketAxess Holdings (MKTX) and NiSource Inc (NYSE:NI).

* Wall Street Horizon DateBreaks Factor: statistical measurement of how an earnings date (confirmed or revised) compares to the reporting company's 5-year trend for the same quarter. Negative means the earnings date is confirmed to be later than historical average while Positive is earlier.

Q1 Earnings Wave

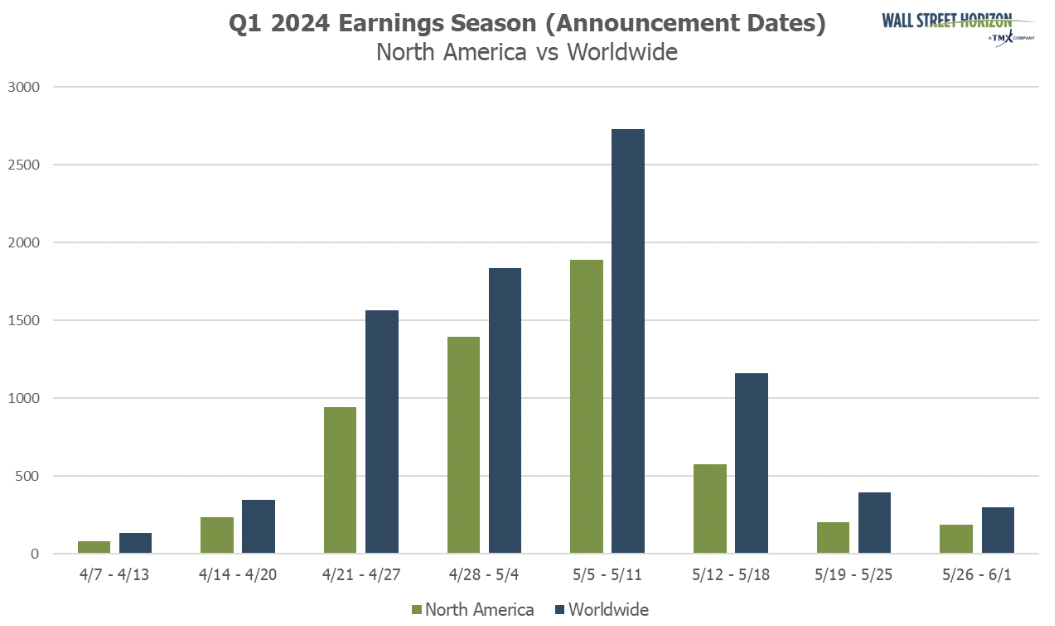

This week will mark the final “peak” week of the Q1 earnings season with 3,507 companies set to report. May 9 is predicted to be the most active day with 1,236 companies anticipated to report. Thus far 42% of companies have reported (out of our universe of 10,000+ global names).

Source: Wall Street Horizon

Source: Wall Street Horizon