United Homes Group stock plunges after Nikki Haley, directors resign

GBP/USD Key Points

- This morning’s UofM Consumer Sentiment survey fell to 50.8, the second-lowest on record, driven in large part by a rise in 1-year (to 7.3%) and 5-year (4.6%) inflation expectations.

- Current backward-looking inflation measures are tame, but elevated expectations of rising inflation are still weighing on sentiment.

- A bullish break above this week’s high near 1.3360 would confirm a breakout and set the stage for a rally to 3+ year highs into at least the mid-1.3400s in GBP/USD.

Conflicting US inflation readings were the big story of the week:

- Both the US CPI and PPI reports came in below expectations (2.3% and 3.1% y/y, respectively)…

- …But, the CFO of Walmart, the nation’s largest retailer, stated that 30% tariffs on China were “still too high” and that “the magnitude of these increases is more than any retailer can absorb. It’s more than any supplier can absorb. And so I’m concerned that the consumer is going to start seeing higher prices. You’ll begin to see that, likely towards the tail end of this month, and then certainly much more in June."

- Then, this morning’s UofM Consumer Sentiment survey fell to 50.8, the second-lowest on record, driven in large part by a rise in 1-year (to 7.3%) and 5-year (4.6%) inflation expectations.

So, traders and policymakers – including the Fed – remain in a situation where current backward-looking inflation measures are tame, but elevated expectations of rising inflation in the coming weeks and months are still weighing on sentiment. By the middle of this summer, we should know whether near-term expectations of surging inflation are on point or not.

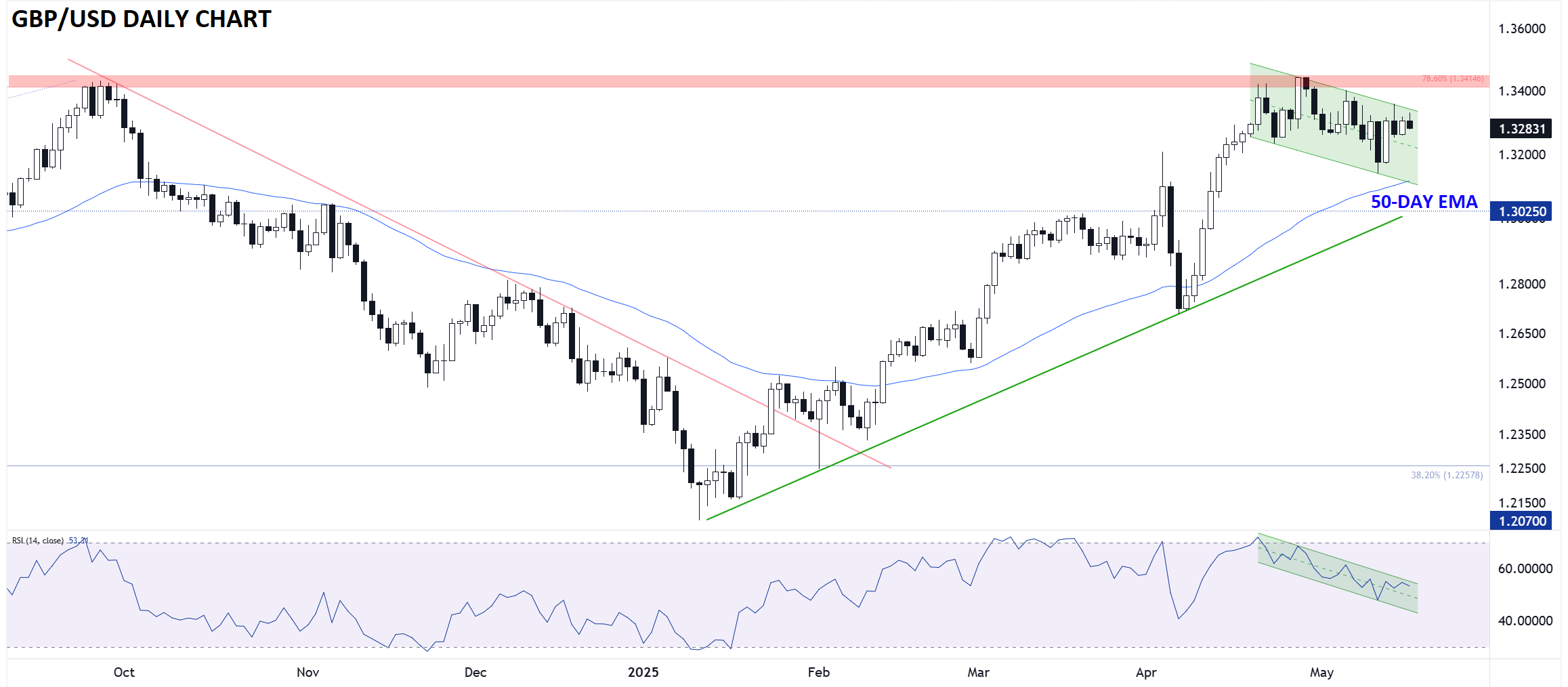

British Pound Technical Analysis: GBP/USD Daily Chart

Source: TradingView, StoneX

Turning our attention to cable, GBP/USD continues to consolidate within a well-defined bullish flag pattern just below key resistance in the 1.3225-40 range. The exchange rate remains above both its upward-trending 50-day EMA and rising trendline, signaling a healthy medium-term bullish trend as long as the pair remains above 1.3100 or so.

At this point, a bullish break above this week’s high near 1.3360 would confirm a breakout and set the stage for a rally to 3+ year highs into at least the mid-1.3400s.

As a final note, readers may want to monitor the equivalent channel in the 14-day RSI indicator. A breakout in the indicator would serve as a clear leading/confirmatory signal of a bullish breakout in GBP/USD itself.