TSX jumps amid Fed rate cut hopes, ongoing U.S. government shutdown

- The US dollar strengthens as trade tensions ease, but GBP/USD faces correction after April surge.

- Head-and-shoulders pattern suggests further declines for GBP/USD, with key support at $1.28-$1.27.

- UK GDP data and US inflation will be key factors influencing future central bank decisions.

- Looking for actionable trade ideas to navigate the current market volatility? Subscribe here to unlock access to InvestingPro’s AI-selected stock winners.

The trade war remains a major factor influencing currency markets, especially pairs involving the US dollar. Recent reports indicating a de-escalation in the trade conflict between Beijing and Washington are strengthening the US Dollar while putting pressure on the GBP/USD pair. This pressure is seen as a correction after a strong upward move in April, which slowed down near the 1.34 level for the pound.

From a technical standpoint, we now see a head-and-shoulders pattern formation. If the neckline is broken, it could signal further declines, especially with the current favorable geopolitical conditions.

US and China Engage in Trade Negotiations

According to information from both China and the U.S., an agreement has been made to reduce U.S. tariffs on China to 30%, while China will lower its retaliatory tariffs to 10%. Financial markets, especially stock indices, reacted positively to this announcement, viewing it as a sign that a permanent and long-term trade agreement might be possible. In the currency market, the US dollar has strengthened, with the potential for this positive trend to continue.

An updated trade agreement has also been signed with the UK, although its scope remains limited. Washington has removed tariffs on steel and aluminium, while reducing the rate on automobiles to 10%, with an annual cap of 100,000 units. In return, the UK has agreed to reduce tariffs on several products, bringing the effective overall tariff rate to 1.8%.

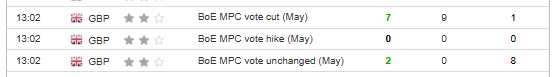

In addition to the new tariff agreements, another key event for the GBP/USD currency pair was the recent Bank of England meeting, where another 25 basis point interest rate cut was announced. The surprise came from the vote ratio, with 7 votes in favor of the cut and two votes to maintain current levels, while the market had expected a unanimous decision.

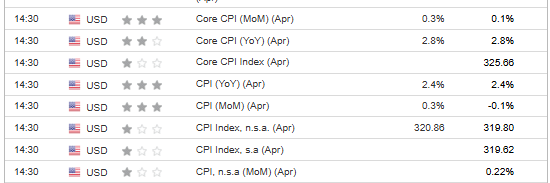

This week, we will see the release of several important macroeconomic data, with US inflation being the highlight. It is forecast to remain unchanged year-on-year.

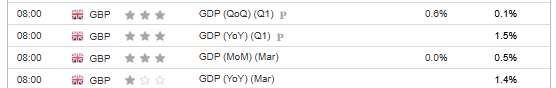

On Thursday, we will also receive GDP data from the UK, which is expected to play a significant role in the Bank of England’s future decisions. Weaker-than-expected data could lead to further rate cuts from those members who disagreed with the majority at the last meeting.

GBP/USD Technical Analysis

GBP/USD consolidation seen in late April and early May has formed a head-and-shoulders pattern, which typically signals a bearish outlook. Given the favorable conditions for a temporary strengthening of the US dollar due to the easing of the tariff conflict, and despite the relatively hawkish tone of the Bank of England’s meeting, a downward movement is likely to be the base scenario.

The main target areas will be the upward trend line and a cluster of support levels in the $1.28-$1.27 per pound range.

****

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. Whether you’re a novice investor or a seasoned trader, leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging market backdrop.

Subscribe now and instantly unlock access to several market-beating features, including:

- ProPicks AI: AI-selected stock winners with a proven track record.

- InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

- Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters and criteria.

- Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk belong to the investor. We also do not provide any investment advisory services.