Buy tech sell-off, Wedbush’s Ives says: ’this is a 1996 moment, not 1999’

The area of mineral exploration has long been cast aside. Whether precious (Gold, Silver) or more economically strategic (Rare Earth, Platinum/Palladium, Uranium, Copper and Nickel, etc.). This area has long been ignored in favor of sexier stuff over any given period during those 18 years. You know, Cloud/SaaS, Solar/EV and most recently, AI. The sexy stuff driven to over-valuation by rolling emotional hysterias. In other words, the stock market.

Gold stocks had been such a cast aside area. Producers, royalties, maturing developers of mines. The whole world appears to be getting in on the play now. But it’s got a lot further to go pending the next real correction. Now, the cat (the price of the HUI Gold Bugs Index) is out of the bag. My long-held target of 500 is history, at least so far on this move.

Now HUI is in a vertical upside move, targeting well beyond all-time highs. That will either happen before or after the coming correction. And it will come, folks. This is not an article about gold miners or royalties. But I’ll slip in a reminder that the fundamentals are much better today than they were prior to the crash of 2008, or the long correction that began in 2016. This is an impulse move, a launch.

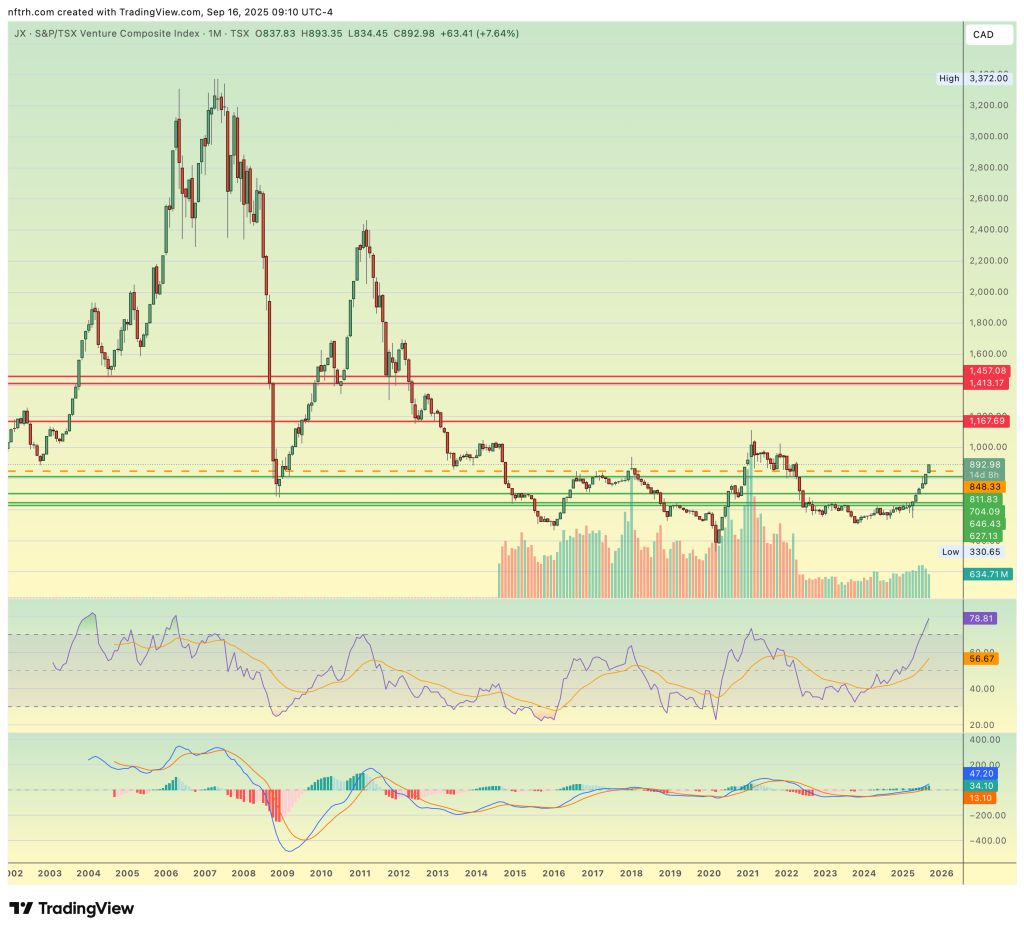

Today we are talking mineral exploration. Moving on. 18 years. Much like HUI above spent 12 years in the wilderness of a bear market turned bull market that felt like a bear market until 2024, the Canadian Venture index (TSX-V) had it rough as well. Rougher actually, as it’s been 18 damn years in the wilderness. TSX-V was cast aside.

What does that mean? It means utter hatred. Contempt. Disgust. What do those words mean? Opportunity. Contrarian opportunity.

Fundamentally, what it means is that with mining and royalty stocks in boom mode, the future has to come from somewhere. With gold, silver and many globally strategic metals/minerals in relentless demand, that somewhere is mineral exploration. Here I’ll lay out a couple disclaimers:

- TSX-V components have been re-balanced over the years, so it’s not entirely apples to apples. But materially, there are enough apples in the basket to make a reliable comp to the past.

- Among the prospective mineral exploration operations, there are many cow pastures where the only product that will ever be produced will be cow droppings. In other words, scams, promoted vigorously by people who do that for a living. So, eyes wide open.

Look for situations in which major mining companies have taken interest. When we get the Pod going, I expect much more wisdom to be forthcoming.

Personally, I have developed a basket of TSX-V listed stocks that have characteristics greatly improving the odds of future success. For me that means the aforementioned large miner sponsorship (investment) and/or drilling results that are expanding a company’s resource. My basket holdings explore/drill for Au, Ag, Cu, Pt, Pd, Ni, u3o8, among other minerals.

The main point of this article, however, is 18 years in the wilderness + future demand and market attention. In other words, a potential career-maker. Okay, relax. That is hype until proven otherwise. But still, 18 years of pent up demand. Hmm, it’s worth considering.

We have been using the combo of the TSX-V/TSX ratio and the Silver/Gold ratio. This indicator combo is a general guide to the more speculative precious metals, commodity/resources areas. It is also a tailwind for many broader markets.

We began with the former and took it more seriously once the latter kicked in in May. These indicators are not just useful for managing the bull phase. They are ongoing tools NFTRH uses for other indications. You know, market correction ARE a thing too.

But for this article, the main point is that as long as these two are rising, so is the supportive environment for the commodity/resources space, and especially the TSX-V, nominally.

Here is a big picture (monthly chart) of ‘da V’, breaking through a resistance zone and getting overbought. However, does the monthly MACD at bottom look like it is finished? I don’t think so either. Of course, corrections can happen at any moment (e.g. FOMC may or may not be one of those flashpoint moments). But this surge appears to be just the start of an emergence from 18 years of ignominy.

[edit 2] FOMC has come and gone, but the general point remains the same.

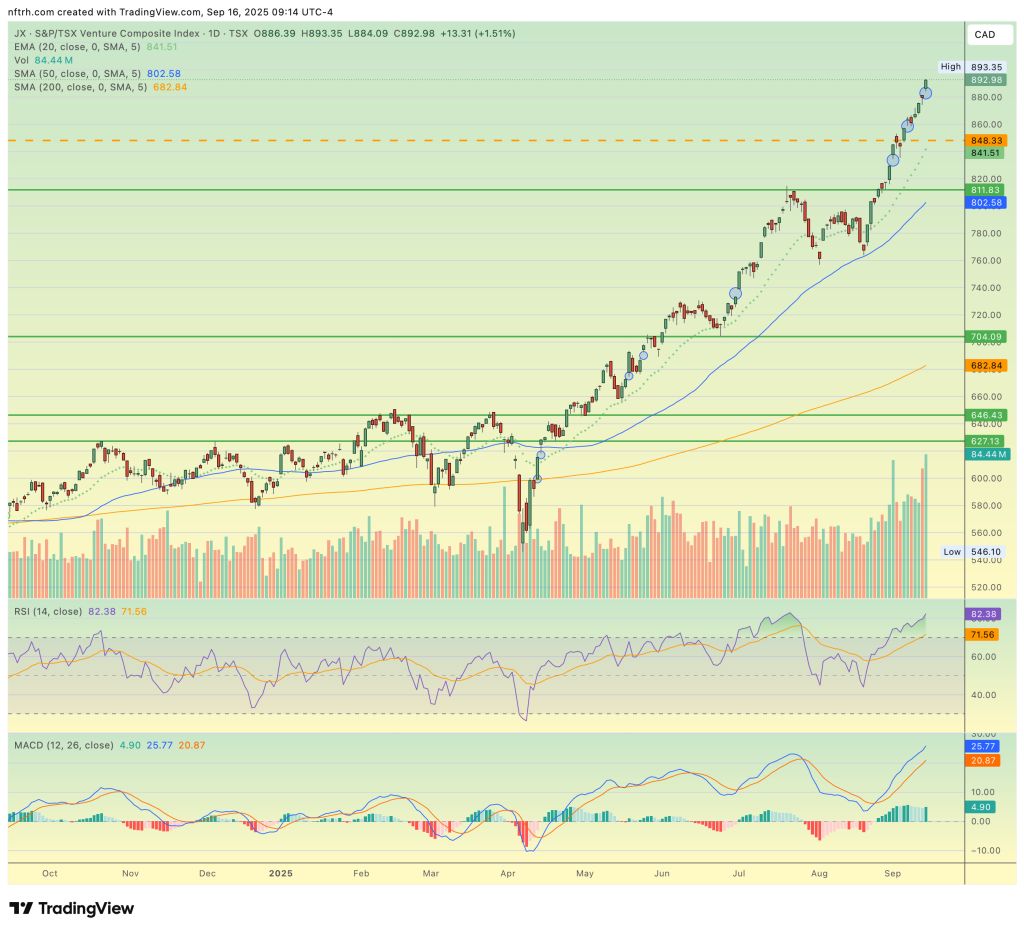

On a shorter-term basis, daily TSX-V has been leaving unfilled gaps galore and is also overbought. Volume appears to be gathering into some kind of blow off, which would precede a reversal. That is going to happen. It’s what markets do. But the big picture above and those 18 years of hell imply a contrarian opportunity.

On a shorter-term basis, daily TSX-V has been leaving unfilled gaps galore and is also overbought. Volume appears to be gathering into some kind of blow off, which would precede a reversal. That is going to happen. It’s what markets do. But the big picture above and those 18 years of hell imply a contrarian opportunity.

Again, this assumes one picks stocks of relative quality and legitimate potential.* Opportunity, the likes of which hardly ever come around.

Bottom Line

At this time the TSX-V and its relationship to the senior TSX is serving as both a macro indication and an investment in what could be (but has not been for 18 years). These markets are not easy and cartoon analysis (like an imagined chart patterns and upward arrows drawn on charts) is not going to change that. A combo of technical and fundamental (including supply/demand) is needed.

As things stand now, the macro is aligning in favor of said supply/demand fundamentals and the TA. While getting dangerously overbought, it is bullish on the bigger picture, both fundamentally and increasingly, technically.

* We will probably be at the end of the bull in the future when we see players jumping from Bitcoin & AI, paying up to buy cow pastures.