European stocks retreat on tech valuation concerns; U.K. economic woes

Gold’s tightening range could soon snap as trend support and resistance converge. With momentum slowly improving, bulls may have the edge—if they can finally break through.

- Gold trading in tightening range between key levels

- Uptrend support tested and held six times

- Resistance at $3360 remains a stubborn cap

- Break above $3360 puts $3400 and $3451 in play

Summary

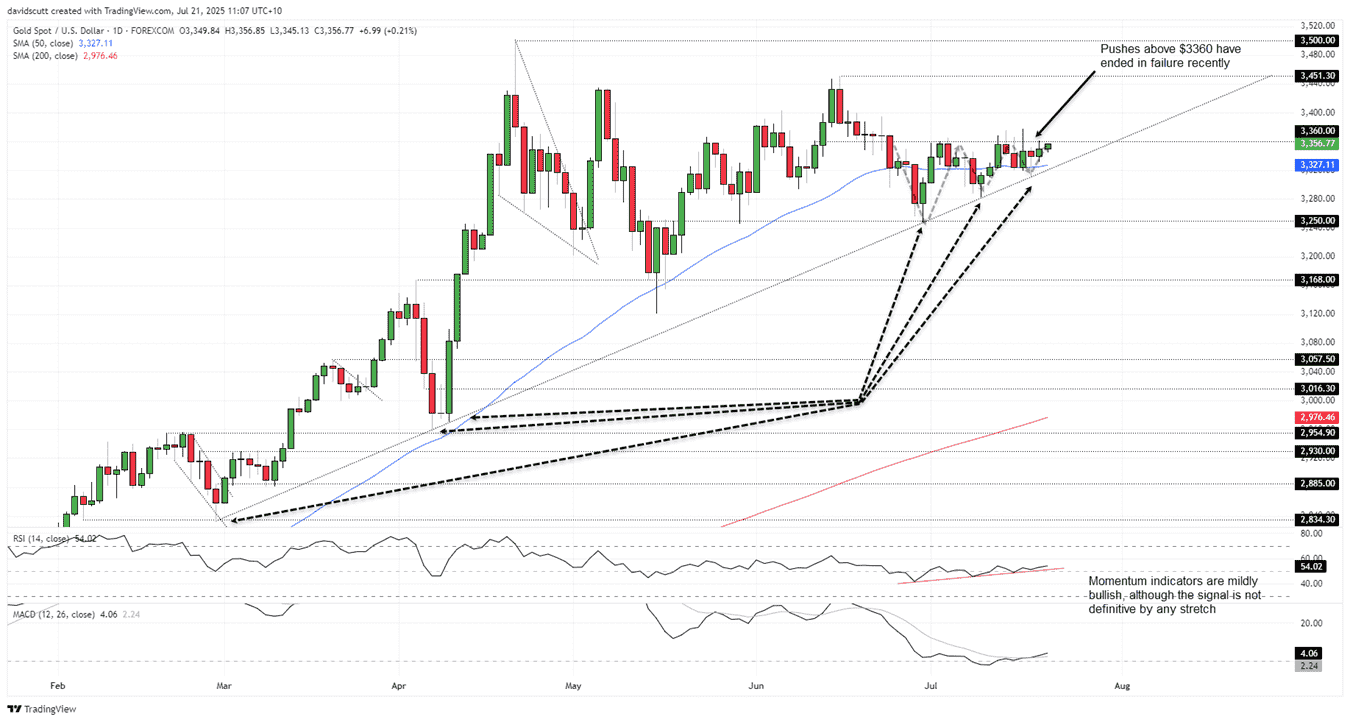

Gold traders have a choice to make this week, with the price continuing to coil within a narrowing range between uptrend support and horizontal resistance. While a bullish bias is marginally favoured based on recent price and momentum signals, it’s hardly a slam dunk case.

Gold Nears Technical Crossroad

After an incredibly strong start to the year, gold has gone comparatively nowhere in recent months. As seen in the daily chart below, the price continues to attract buyers on dips towards uptrend support running from the low set on February 28. We’ve now seen six bounces from this level, including one on Thursday. However, bears have been making their presence felt, selling into rallies above $3360 on multiple occasions, including several times last week.

Source: TradingView

The net result has been a gradually narrowing range, akin to a stalemate. That may be resolved later this week as the two levels converge, pointing to the potential for a decent directional move depending on which way the price breaks—if that eventuates.

Sitting in an ascending triangle pattern, the setup suggests a topside break may be more likely than a breach of uptrend support. From a momentum perspective, RSI (14) and MACD also favour a mildly bullish bias, trending slowly higher into positive territory. However, neither the price action nor momentum picture is definitive, suggesting traders should keep an open mind as to what happens next.

If the price manages to break and close above horizontal resistance at $3360, the July 16 high of $3377 looms as the first test for bulls, with a successful move above that level putting $3400 on the radar. Beyond that, the June 16 peak of $3451.30 is the last major level before a potential retest of the record highs at $3500.

On the downside, the confluence of the 50-day moving average and uptrend support looms as a tough test for bears, creating a significant technical hurdle based on recent price action. If the price breaks and closes beneath this zone, the July 17 low around $3310 and the July 9 low at $3283 are levels of note, before a more pronounced support zone at $3250.