European stocks retreat on tech valuation concerns; U.K. economic woes

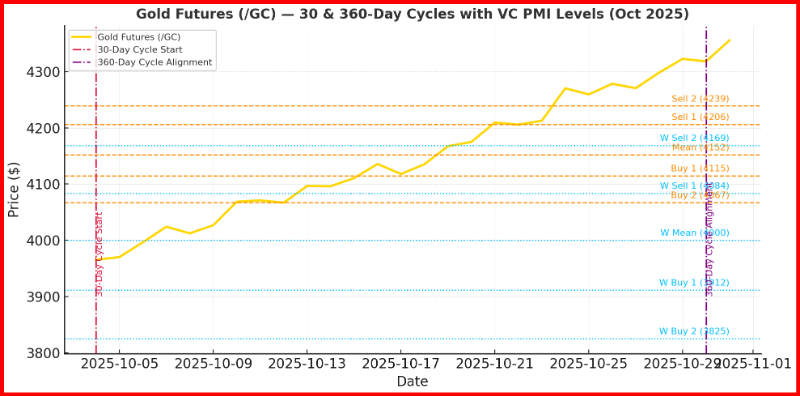

Gold futures have surged to $4,217.2, marking a powerful continuation of the 30-day and 360-day cyclical expansion now in full bloom. The current advance from the early October low at $3,957.9 confirms that the market has completed a full mean-reversion cycle from deep within the VC PMI Weekly Buy 2 zone ($3,825–$3,912) to well above the Weekly Sell 2 target ($4,169). This dramatic recovery—over +10% in less than two weeks—illustrates how the combination of time and price symmetry across the Gann and Square of 9 frameworks can define the rhythm of the market’s unfolding geometry.

The VC PMI model identified $4,000 as the weekly mean pivot and critical reversion threshold. Once gold decisively reclaimed this level with expanding volume and MACD momentum turning positive, the path of least resistance shifted to the upside. Each daily reversion zone has since been surpassed in succession: Buy 1 ($4,115), Sell 1 ($4,206), and now probing Sell 2 ($4,239). This breakout sequence suggests the probability distribution has entered its upper 95% confidence zone, where prices often pause or briefly revert before resuming the dominant cycle.

From a cyclical perspective, this move fits precisely into the Gann 30-day phase, which often produces an impulse extension in the direction of the primary 360-day trend. The broader cycle, initiated in late September 2024, is approaching its third harmonic of expansion, a phase historically associated with hyperbolic acceleration. On the Square of 9 spiral, the 4,200–4,240 price arc resonates directly opposite the 1,940 foundation low of the prior 360-day cycle, implying that both time and price have reached a harmonic junction of equilibrium and inversion.

Momentum studies reinforce this structural analysis. The MACD (14,3,3) has remained in positive territory, confirming sustained institutional momentum. Volume surges on breakouts above $4,152 (daily mean) indicate strong accumulation as weak hands capitulate and professional traders add to long positions on controlled retracements.

Looking ahead, the next resistance zone lies between $4,285 and $4,350, coinciding with the upper 1.618 Fibonacci extension of the prior range. Support remains firm at $4,115–$4,067, a region that should contain any technical pullback within the ongoing 30-day upcycle. Should the market maintain closes above $4,169 into the week’s end, gold may enter a vertical ascent window extending through late October, aligning with the 360-day Gann culmination phase—a period often marked by rapid price acceleration before the next consolidation wave.

In essence, gold has crossed a critical vibrational threshold. The 30-day pulse and the 360-day rhythm have synchronized through the Square of 9 grid, igniting a new leg in the long-term expansionary sequence that could redefine the upper range of the 2025 cycle.

***

TRADING DERIVATIVES, FINANCIAL INSTRUMENTS AND PRECIOUS METALS INVOLVES SIGNIFICANT RISK OF LOSS AND IS NOT SUITABLE FOR EVERYONE. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.