Microsoft sued by Australia competition regulator over Copilot, 365 pricing

Gold futures have entered a rare window of time–price alignment, where multiple analytical frameworks point to the same conclusion: the market is preparing for a decisive move higher. The VC PMI AI model, combined with Gann’s 30-day and 90-day cycles and Square of 9 projections, places gold at the center of a harmonic convergence that traders cannot afford to ignore.

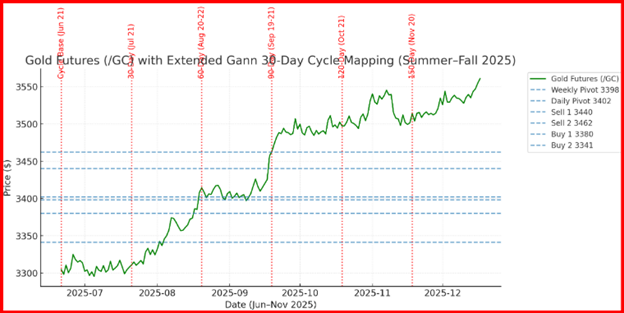

The story begins with the June 21, 2025 low at $3,298, which established the foundation of the current cycle. From that base, the VC PMI projected Buy 2 levels at $3,341, where gold tested and reversed in textbook fashion. The recovery reclaimed the critical pivot axis at $3,398–$3,402, signaling a mean reversion back toward equilibrium.

In the language of probability, once the pivot is restored, the odds of advancing toward the Sell 1 and Sell 2 zones—$3,440 and $3,462 respectively—rise to over 90%.

Gann’s 30-day cycle divisions reinforce this trajectory. The July 21 cycle produced a secondary low at $3,352, validating the rhythm of the 30-day vibration. The August 20–22 window represents the 60-day crest, coinciding with the current rally. Looking ahead, the 90-day cycle falls on September 19–21, and this is where probabilities concentrate: a cycle crest aligning with the VC PMI Sell 2 level at $3,462–$3,468. Time and price are harmonizing into mid-September.

The Square of 9 spiral strengthens this conclusion. Projecting forward from the $3,341 low, the 360° rotation lands at $3,462, the same resistance cluster projected by VC PMI. Extended harmonics at 540° and 720° mark $3,502 and $3,562, setting ambitious but achievable targets if momentum extends into Q4 2025. On the downside, the 180° symmetry anchors support near $3,280–$3,298, reinforcing the Buy 2 weekly level as the natural reversion zone.

Momentum indicators confirm the technical setup. The MACD, deeply oversold in early August, has reversed sharply, reflecting capitulation by weak hands and absorption by institutional buyers. This shift marks the transition from consolidation to expansion, with probabilities skewed to the upside as long as the market holds above the $3,398 pivot.

In summary, gold is advancing through a cycle of acceleration. The September 19–21 crest window is projected to be the next decisive turning point, with $3,462–$3,468 as the prime target zone. Traders are advised to ride the bullish wave while preparing for potential profit-taking as cycle time and price spiral into alignment.

TRADING DERIVATIVES, FINANCIAL INSTRUMENTS AND PRECIOUS METALS INVOLVES SIGNIFICANT RISK OF LOSS AND IS NOT SUITABLE FOR EVERYONE. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.