InvestingPro’s Fair Value model captures 63% gain in Steelcase ahead of acquisition

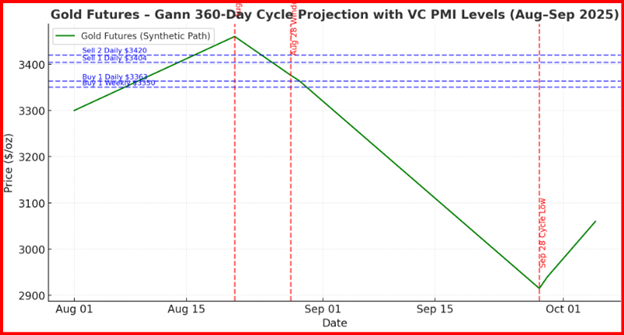

Gold’s reversal this afternoon is not happening in isolation — it is unfolding against the backdrop of a much larger time cycle that has been governing market rhythm since the September 28, 2024 pivot low. That cycle, lasting 360 calendar days, has carried price action through alternating phases of expansion, contraction, and retracement.

Where We Are in the Cycle

Here’s the Gann 360-day cycle projection with VC PMI daily/weekly levels mapped in:

Blue dashed lines (VC PMI Levels):

- Buy 1 Weekly: $3,350

- Buy 1 Daily: $3,363

- Sell 1 Daily: $3,404

- Sell 2 Daily: $3,420

Red dashed lines (Cycle Dates):

- Aug 21 Crest – last major high of this cycle.

- Aug 28 Window – minor pivot window, often a distribution/reversal zone.

- Sep 28 Cycle Low – projected major cycle bottom.

Interpretation

- The VC PMI buy levels ($3,350–$3,363) align tightly with the cycle low base, reinforcing them as accumulation zones.

- The sell levels ($3,404–$3,420) overlap with the Aug 21–28 cresting window, marking them as prime distribution zones before the final decline into the September low.

- This confluence shows that price, probability, and time are in harmony, with the September 28 cycle date standing as the true accumulation opportunity.

- The last major crest was printed on August 21, 2025, a near-perfect 330° harmonic from the September 28, 2024 anchor.

- According to Gann geometry, that crest is often the final high before the cycle completes into its ultimate low due September 28, 2025.

- This places today’s surge into the category of a counter-trend rally inside a declining cycle phase — a type of “last gasp” before the gravitational pull of time pushes the market lower again.

Cycle Windows

- Aug 20–22 (330° cycle harmonic): A cresting window that aligns almost perfectly with today’s test of $3,392–$3,404.

- Aug 28–29 (345° cycle harmonic): Historically, this is the final minor pivot window before the terminal decline begins into the 360-day completion. A strong reversal here would be consistent with cycle theory.

- Sep 28, 2025 (360° completion): The high-probability major low of the cycle. From this date forward, Gann’s law of alternation suggests a powerful new up-leg should begin.

Price–Time Confluence

Today’s bounce off $3,353.4 (weekly Buy 1 / Fibonacci base) creates a short-term bullish wave, but the time factor warns it may be a rally into resistance rather than the start of a sustainable uptrend.

- If gold extends above $3,404, it can squeeze shorts into $3,420–$3,425, where both VC PMI resistance and the 330°–345° Gann harmonics converge.

- A reversal from that band would align with the Aug 28–29 window, confirming the setup for a final cycle washout into September 28.

- That low — if it materializes — could form the launch pad for a long-duration bull phase, possibly retesting and exceeding the $3,500–$3,600 zone in Q4 2025.

Narrative Conclusion

This afternoon’s reversal is more than a tactical bounce — it’s part of the endgame sequence of the 360-day cycle. Gold has likely printed its last meaningful crest of this cycle and now oscillates within its final window of distribution. The market’s behavior into the Aug 28–29 cluster will reveal whether today’s strength is a trap for late buyers or the last leg of a springboard rally into the September low.

In Gann’s terms: time is running out for the bears to press their advantage — and for the bulls, the true opportunity may not be today’s rally, but the major accumulation window opening at the cycle’s conclusion on September 28.

***

TRADING DERIVATIVES, FINANCIAL INSTRUMENTS AND PRECIOUS METALS INVOLVES SIGNIFICANT RISK OF LOSS AND IS NOT SUITABLE FOR EVERYONE. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.