Infosys, Wipro decline despite upbeat Q2 earnings; margin concerns weigh

- From Pelosi in Taiwan to plummeting dollar and yields, gold has reasons to rally

- Last week’s gain of 2.2% was gold’s best week in 4 months

- Notion of peaking Fed rate hikes could send gold to interim high of $1,830

Bloomberg cites the geopolitical turbulence associated with Nancy Pelosi’s trip to Taiwan as the reason for gold's strength on Tuesday. Others point to the incessant drone of US recession talk, the plummeting dollar and US bond yields.

Whatever the driver, gold is once again in the safe-haven seat as the yellow metal’s faithful—as well as those who’d ignored it for some time—hop on for the ride as the Dollar Index and the 10-Year Treasury note rapidly go down the tube.

Gold has shown encouraging strength in holding on to the higher end of $1,700 since the reading on second quarter US gross domestic product on Friday that technically placed the economy in a recession.

The yellow metal gained 2.2% last week for its best weekly performance in four months after Federal Reserve Chair Jerome Powell said the central bank couldn’t predict if it’ll hold on to the aggressive rate hikes it had conducted since March to beat inflation, as the US economy itself was sliding.

All charts by skcharting.com, with data powered by Investing.com

James Stanley, who blogs on precious metals at Daily FX, said gold was showing a distinctive “behavior change” since last week. He adds:

“Longer-dated Treasury yields are diving even as the Fed is hiking short-term rates. The big question at this point is one of continuation and this seems to tie in with the same macro questions that are pertinent in a variety of asset classes at the moment.”

Ed Moya, analyst at online trading platform OANDA, concurred, saying:

“Gold can’t stop climbing higher now that a peak in Treasury yields has been made. King dollar lost its mojo and that has been great news for the yellow metal.”

Moya said deteriorating macroeconomic data along with the weaker dollar had pulled bullion higher.

“Technical levels matter here and gold will need a fresh catalyst to break the $1,800 level. If the dollar pullback continues, that might be enough for gold’s rally to extend. The dollar days are not numbered, as the interest rate differential will widely remain in the greenback’s favor, as will US growth prospects, and safe-haven flows as Europe rushes towards a recession.”

In Tuesday’s Asian trade, gold was headed for a fifth straight day of gains.

By 1:45 PM in Singapore (1:45 AM in New York), gold’s benchmark futures on New York’s COMEX, December, was at $1,788.30, up 60 cents on the day. It earlier reached a session high of $1,797.20. On July 21, COMEX gold had plumbed an 11-month low of $1,678.40.

The spot price of bullion meanwhile, reached a near one-month high of $1,780.59.

Bloomberg cited Pelosi, who would arrive later Tuesday in Taiwan, as a reason for gold’s climb on Tuesday. The Speaker of the US House would be the most senior US politician to visit Taiwan in a quarter of a century. Beijing views Taiwan as its territory and has warned of consequences, including military action, if Pelosi’s trip goes ahead.

Gold is supposed to be a hedge against inflation but it has not been able to hold up to that billing for most of the past two years since hitting record highs above $2,100 in August 2020. One reason for that has been the rallying Dollar Index, which is up 11% this year after a 6% gain in 2021.

In recent days, however, the dollar, a contrarian trade to gold, has been doing the exact opposite to the yellow metal. The Dollar Index, which pits the greenback against six other major currencies, hit a near three-week low of 104.92 on Tuesday, after a two-decade high of 109.14 on July 14.

US bond yields also fell, with the benchmark 10-year Treasury note hitting a five-month low of 2.52%.

Gold’s climb this week was also aided by Chinese factory activity, which shrank in July amid a fresh round of COVID-related lockdowns.

China is the world’s No. 2 economy and a prolonged economic downturn there is likely to weigh on global growth. Beijing’s official purchasing manager’s index fell to 49.0 in July, indicating a contraction, from 50.2 in the previous month.

US manufacturing PMI released on Monday was a notch better at 52.8 versus 53 for June. The accompanying note from the Institute for Supply Management did not help sentiment. “Growing inflation is pushing a stronger narrative around pending recession concerns. Many customers appear to be pulling back on orders in an effort to reduce inventories,” the institute said.

Monday’s news out of the rest of Asia wasn’t any better, as South Korea's factory activity fell for the first time in almost two years and Japan saw its slowest growth in activity in 10 months.

Manufacturing is already in contraction in the Eurozone owing to the acute energy crisis and accompanying inflation problem, and those factors also appear to be hitting the consumers as German retail sales slumped to the biggest annual drop since the country started collecting pan-German data in 1994.

Despite all these factors aiding gold’s standing as a safe haven, bullion’s ability to break above $1,800 and progress from there might remain a greater challenge than thought, analysts who watch the space said.

″Bullion bulls are waiting to see if the coast is clear for another leg up, making sure expectations for a less-aggressive Fed are indeed rooted in reality,” Han Tan, chief market analyst at Exinity, said in remarks carried by Reuters.

“Like the Fed, gold’s next move may be data dependent."

So, where is gold going?

Most likely to $1,830, before a stop emerges, said Sunil Kumar Dixit, chief technical strategist at skcharting.com.

“The noise-free weekly chart for gold shows no significant resistance before the 100-week Simple Moving Average of $1830, which is in close proximity to 38.2% Fibonacci level.”

Dixit, who uses the spot price of gold for his outlook, said bullion’s weekly Relative Indicator has bounced from 32 to 43, while its stochastics at 40/29 continues with a bullish crossover for the third week in a row.

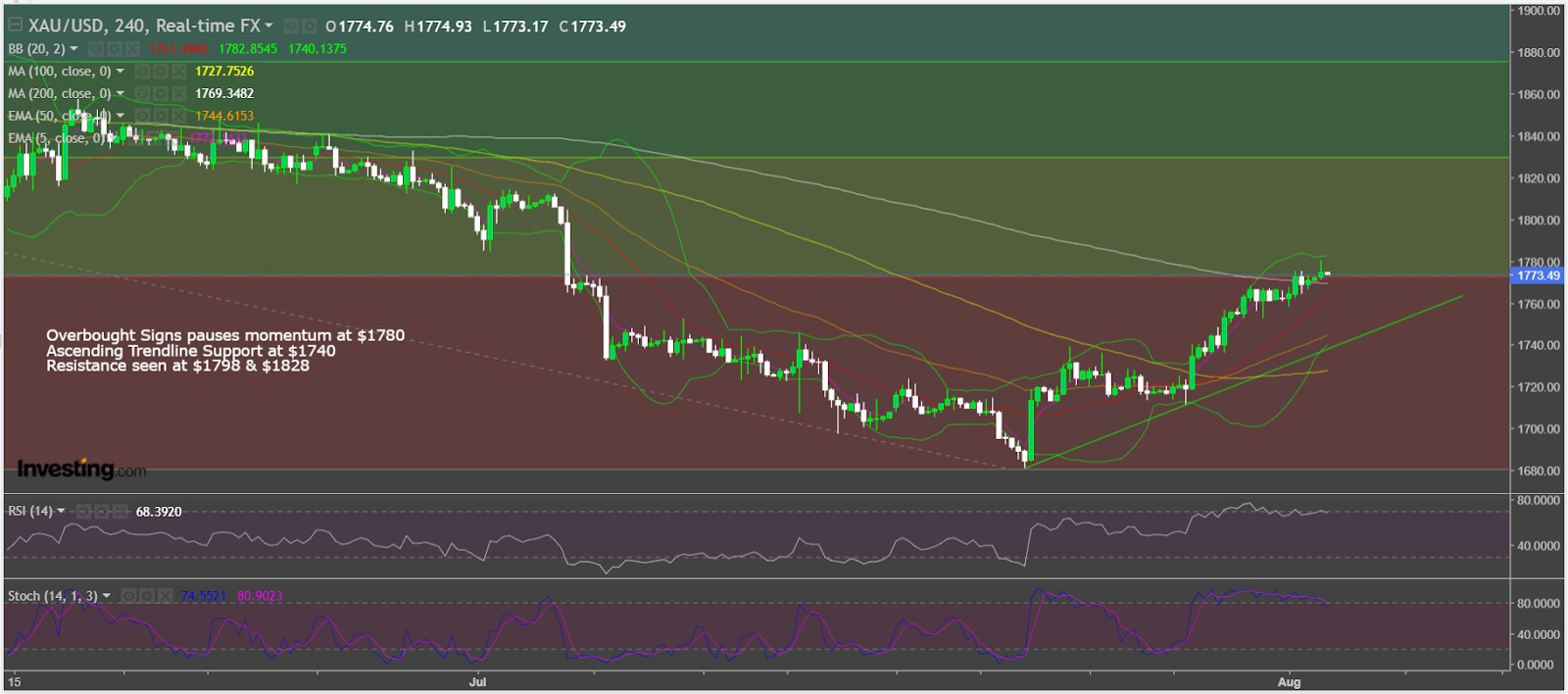

From a short-term perspective, gold’s momentum seems to have paused briefly, approaching the 50-Day Exponential Moving Average of $1,784 after breaching the above-200 Simple Moving Average of $1,769 on an intraday 4-hour chart, Dixit said. He added:

“Strong momentum can take a break if prices drop below $1,769, pushing towards the middle Bollinger Band of $1,762 and the 50-day EMA of $1745.”

“Failure to hold above $1,745 and the ascending trend line support of $1,740 can extend the decline to the critical 100-day Simple Moving Average of $1,728, which is a turning point of momentum with potential of a bearish reversal.”

“At the same time, if ongoing events (Pelosi visiting Taiwan) trigger safe haven appeal, a surge towards $1830-$1835 should not be a surprise.”

Disclaimer: Barani Krishnan uses a range of views outside his own to bring diversity to his analysis of any market. For neutrality, he sometimes presents contrarian views and market variables. He does not hold positions in the commodities and securities he writes about.