BigBear.ai appoints Sean Ricker as chief financial officer

Gold futures movements during the last week indicate a wild price swing amid growing hopes that the Fed is likely to hold further rate hikes which could turn the momentum on the bearish side as the labor market is still too tight.

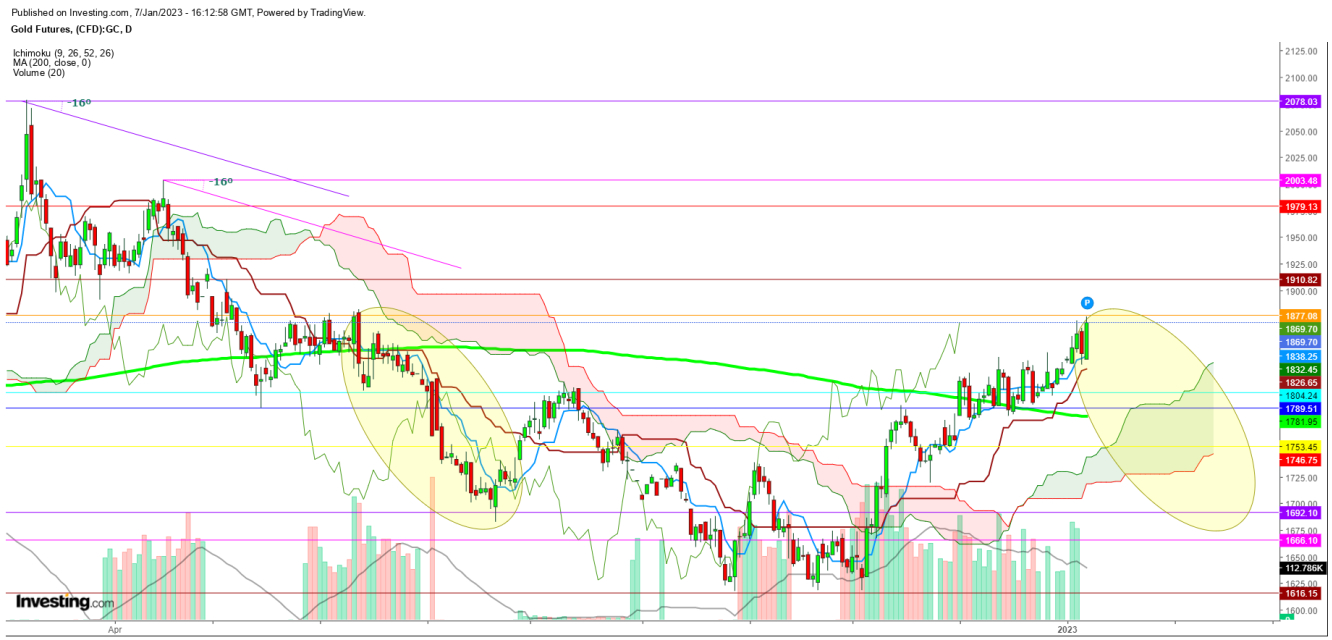

Despite a steep surge during the last week, that gold futures could not find a breakout above the significant resistance at $1877 indicates a steep slide ahead if gold futures start the upcoming week with a gap-down opening.

The Fed’s December meeting minutes indicate the interest rate is likely to be kept high all year, which could once again increase exhaustion in gold prices.

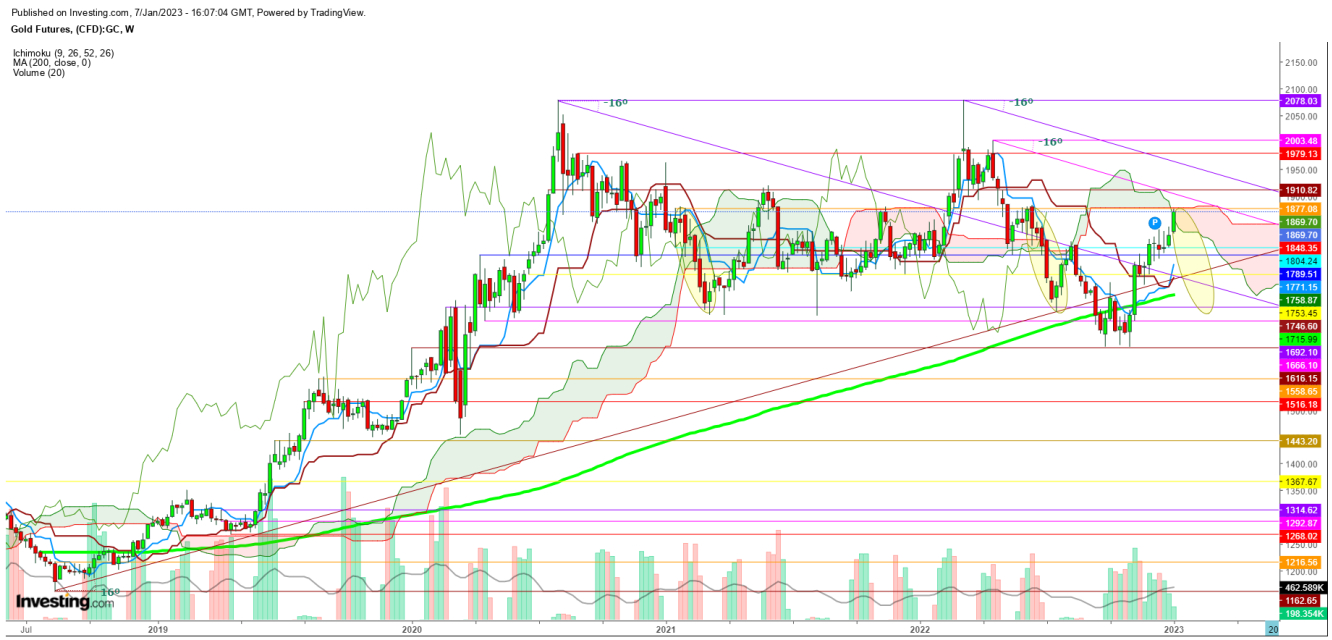

Technically in a weekly chart, gold futures could repeat the moves of Jan.-Feb. 2022 from Jan. 9 to Feb. 20, 2023, if they cannot find a sustainable move above the immediate resistance at $1877 during the upcoming week.

In a daily chart, a breakdown by gold futures below the significant support at 9 DMA, which is currently at $1838, during the upcoming week, will be the first confirmation of the advent of a downtrend in gold.

Undoubtedly, wild price swings are likely to continue during the upcoming weeks and could increase uncertainty, but rallies will attract sellers above the current levels.

I conclude that the weekly closing by gold futures ensures the advent of a downtrend, as gold futures faced stiff resistance at this level before a steep slide in Jun. 2022.

Disclaimer: The author of this analysis does not have any position in Gold futures. Readers are advised to take any position at their own risk in commodities of the world.