AlphaTON stock soars 200% after pioneering digital asset oncology initiative

In 2024, central banks bought gold futures in a bullish tone amid growing concerns over the surge in geopolitical volatility at the global level if Donald Trump comes back to power.

Central banks sped their buying spree after the joining of US President Donal Trump while gold futures were sliding since Nov. 5, 2024, after the outcome of the Nov. 2024 presidential election, after facing stiff resistance at $2750, and continue to hold above the significant support at the 50 DMA in a daily chart.

Undoubtedly, gold futures continued to trade in a narrow range from Nov. 5, 2024, to Jan. 20, 2025, under bearish pressure before starting the next phase of this uptrend when US President Donald Trump joined the office.

Once again, gold futures started to move upward and hit a fresh high at $2955 on Feb. 20, 2025, after Donald Trump confirmed the steps he committed before the election.

But now, the global economic scenario could be shifting focus to stagflation amid growing developments on imposing tariffs and retaliatory tariffs.

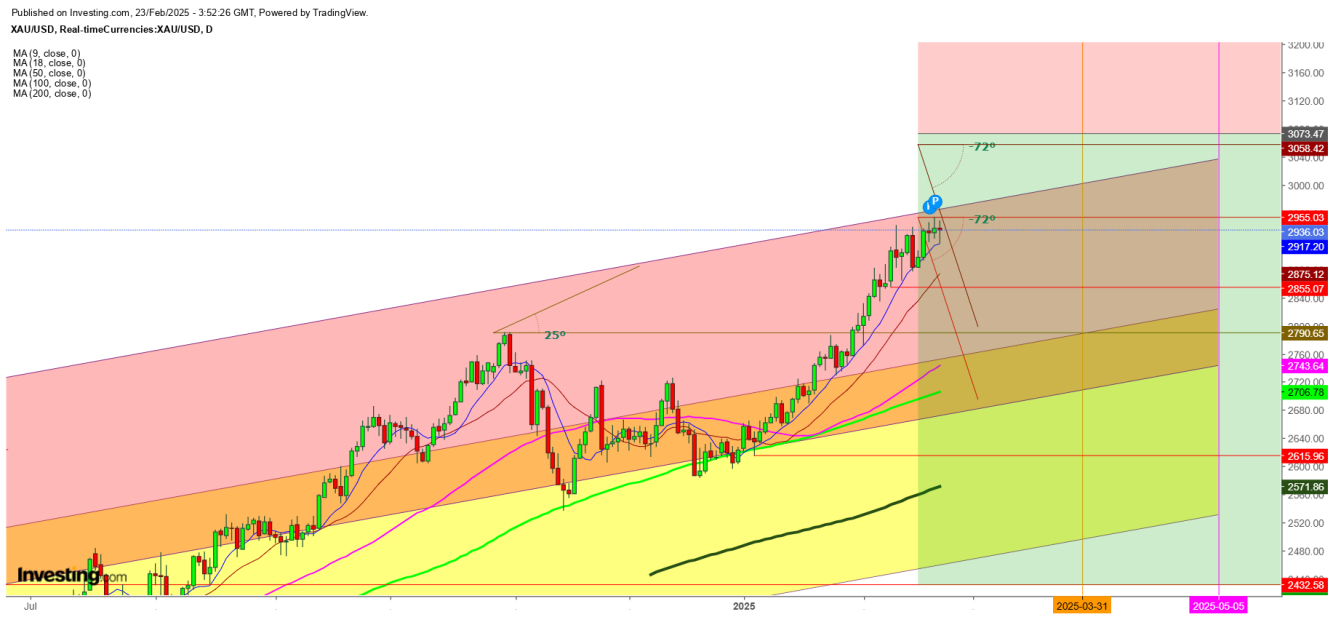

Upon analyzing the movements of the gold futures from Nov. 21, 2024, to Feb. 21, 2025, I anticipate that the gold futures have already defined territory for both the bulls and bears between $2706 - $2950. Only a step out of this territory will define the next direction for the gold bugs.

Technical Levels to Watch

on the weekly chart, if the gold futures are not able to find a breakout above the significant resistance at $2955, a selling spree could push the gold futures to test the first support at 9 DMA at $2766, and the next support level likely to be at 20 DMA at $2716.

But, a breakdown below this could turn the current trend to remain bearish for some time, and the gold futures could retest the next significant support at 50 DMA at $2524 till the end of Mar. 2025.

Inversely, if the gold futures find a sustainable move above the immediate resistance at $2955, then only the bulls could dare to test the next resistance at $3058.

I anticipate that if the gold futures find one more up leg to test this next resistance, could provide a good opportunity to create a short position at $3073 with a stop loss at $3235 for a target at $2525 up to May 5, 2025.

On the daily chart, gold futures are teetering in a narrow range, trying to hold above $3058 with a 5% stop loss level for a target at the 200 DMA at $2571 for Mar. 2025.

For a short-term directional move, lets have a look at the movements of gold futures in the 4 Hr. chart as the gold futures are trying to hold at the 50 DMA at $2918 but facing stiff resistance at 2940 due to the formation of a bearish crossover by the 9 DMA and 20 DMA as the 9 DMA has moved below the 20 DMA as the gold futures were trying to hold the 9 DMA at $2934 last Friday.

Further directional moves could be mapped after next week’s opening levels which will provide a definite clue for the day traders.

Takeaway for the Traders

I conclude that traders should remain cautious before a breakout or breakdown out of the trading range explained in this article as I anticipate that the surging inflation hardly provides any definite clue if the economic growth remains stagnant due to surging uncertainty over the impact of tariff trade tussle.

Disclaimer: Readers are advised to take any position in gold as this analysis is only based on the observations.